Work is a large part of our lives. Whether you need it to put food on the table or to stay active, work is undeniably an integral part of our lives and human society. As much as people dream of the day they no longer work (a.k.a. retire), it is still somewhat of a necessary “chore”. People typically spend more time at work than at home (excluding the time you spend sleeping).

An amazing development in the nature of work recently was the entire work-from-home phenomenon spurred by the pandemic. People working from home now get to spend more time at home than ever before. Some love it, some hate it. Some want it to stay, some want to return to their workplace. The responses to the work-from-home phenomenon were mixed, but mostly positive. As companies move to get their employees back to the workplace, is the work from anywhere dream over?

The URA has put in deliberate thought as to how the workspace of the future should be organised. In this article, we cover how the future of work will be organised in Singapore. Specifically, we look at how the 2022 Long-Term Plan has designated specific regions for business activities, how the development of commercial properties might change, and finally how mixed-use concepts will take place in commercial real estate.

One City Centre, Four Business Districts

Over the past few decades, many first world cities have tried time and time again to develop a second Central Business District (CBD) to reduce the overcrowding of businesses, traffic, and people. Singapore was no exception. In the past, Singapore has tried to develop the Jurong and Changi areas into a secondary CBD. However, the lack of strong demand from the corporate sector in the form of job creation often stunts the plans from taking shape.

More noticeably, the plans to develop Jurong as a CBD were thwarted when bilateral negotiations with Malaysia fell through on the development of the shared rail system. The development of infrastructure for businesses requires way more hands to clap as compared to the development of residential spaces. There are far fewer businesses than there are residents, making each of their voices much louder and each of their actions much more impactful.

This is especially true not only for Multinational Corporations (MNCs) but also local Small & Medium Enterprises (SMEs). For the development plans to work, businesses must be deeply involved in the process of shaping physical infrastructure for commercial and industrial purposes.

Arguably, the agglomeration effect of a single CBD in town is too strong. Businesses might not prefer to conduct their business far away from the city centre. This lack of demand may partially be the reason why we do not have a second notable CBD in Singapore. And that is natural. Eventually, plans to create a second CBD got more mellow. It evolved into a much more gradual process of decentralising work from the city centre. The recent pandemic gave this decentralisation of work a huge push in the right direction.

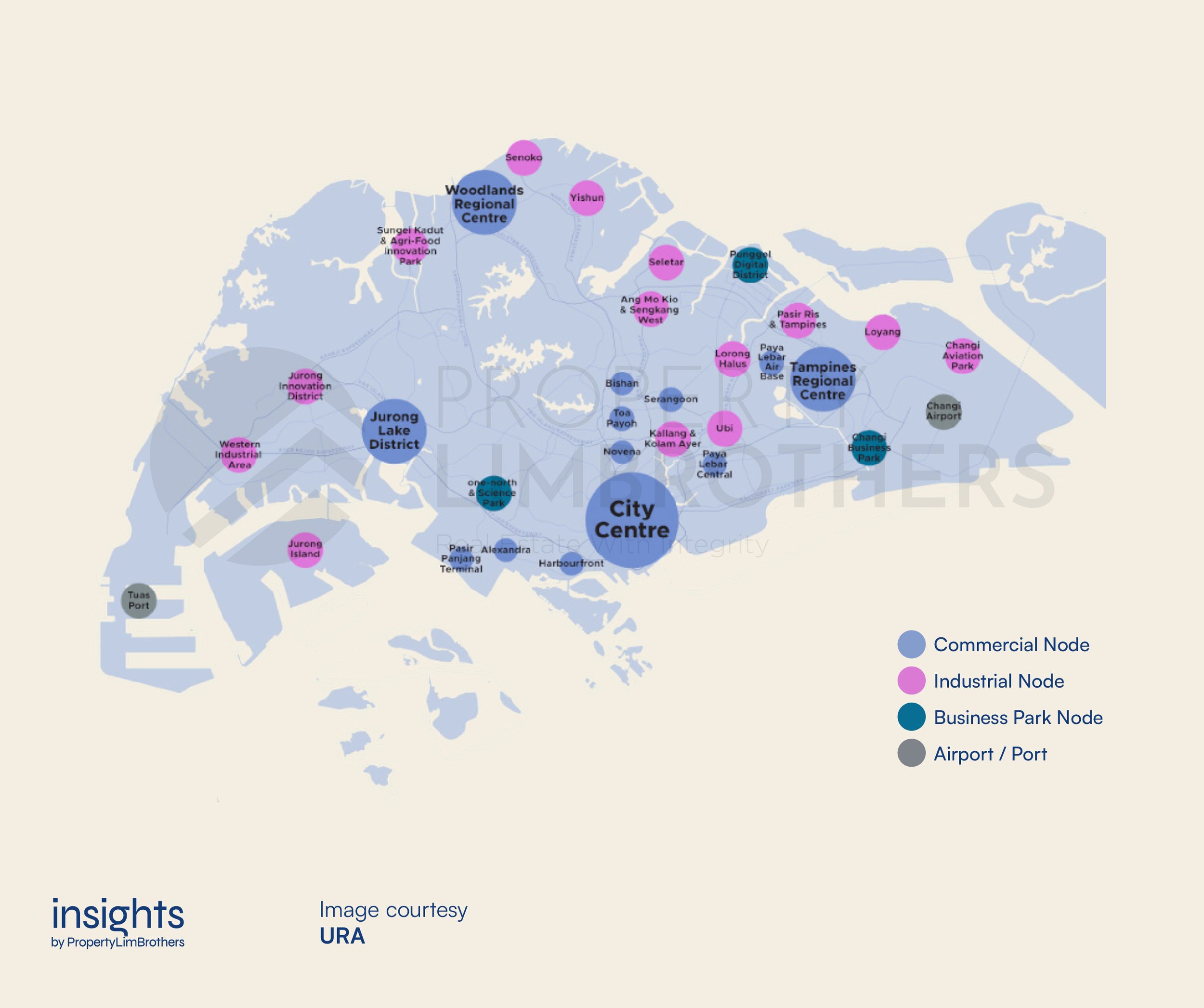

While we still have one City Centre, business activities will be segmented across four business districts. One in the traditional City Centre, another in the West Region, Changi Region, and Northern Gateway area. Rather than a vague idea of simply another “CBD”, each business district is set up for specific industries and lines of work. By setting aside these areas for specific industries, the URA hopes for businesses of the same industry to agglomerate within the same business district.

According to the Long-Term Plan, the current City Centre will act as an anchor for international business and finance. It will be a space for workers to meet and collaborate. Essentially, it retains its identity as the CBD, but will be spiced up by the complimentary focus on lifestyle, heritage, culture, nature, and residence. Having mixed-use spaces in areas like the CBD is the URA’s plan to keep the City Centre vibrant even after working hours.

If it works out as planned, having mixed-use developments in the CBD will not only keep business bustling, it would also be a more efficient use of built-up space in the country. If every district could be used for working, living, and playing, then there would be less of an overcrowding concern as everyone floods to a single district for a specific activity.

Just as how it would not be a good idea for all the businesses in Singapore to operate solely in the CBD, industries are being decentralised and segmented into different business districts across Singapore. In a way, it is to prevent overcrowding and simultaneously improve synergy. At the heart of each region would be a major commercial node, flanked by industrial nodes with (air)port facilities at the extremities of the island.

Starting with the Western Region, it is focused primarily on maritime port activities, logistics, e-commerce, and advanced manufacturing. The Jurong Lake District is the re-iterated second CBD, with a repurposed focus on sustainability and innovation. While no business is entirely focused on sustainability or innovation, the workspaces at Jurong Lake District will act as a “green-zone” of sorts for offices and companies to showcase their environmental efforts.

The Changi Region in the East will be the focus of the aviation industry, on both logistics and maintenance. Notably, the Tampines Regional Hub did not get much attention in the Long-Term Plan this round. It hosts one of the largest residential clusters in Singapore and is currently best known for its active heartland vibes. Generally, it is safe to say that the core principles and approach the URA has taken so far will not change even for those areas not yet mentioned in the most recent Long-Term Plan.

The Northern Gateway will focus on Agri-Tech (Lim Chu Kang), Cybersecurity (Punggol), and the Transit area to Johor Bahru (Woodlands). While not entirely synergistic, this region takes up a wide geographical area in the north. Each cluster plays its part in shaping specific industries in the Singaporean economy. Agri-Tech will definitely be a key industry moving forward as food security is quickly becoming each nation’s top priority following the increase in geopolitical instability in the world.

Even though this section of the Long-Term Plan is termed “Work Anywhere & Everywhere”, it doesn’t really mean that all individuals can just work wherever they please. Rather, that work will be decentralised from the CBD, with specific industries taking up different clusters around Singapore.

What does this mean for Residents?

Unless your job is entirely remote, it is very likely that you are still required to go back to a physical office space at least half of the time. Based on URA’s own survey, more than half of the surveyed residents wish to work within two MRT stations of where they live. That being said, residents should pay attention to how the industries are being organised across Singapore. If they wish to live near their current or future workplace, they would need to plan ahead.

An important caveat here is that some of the job nodes at the moment are more of a plan than a reality (such as Punggol Digital District & Paya Lebar Airbase). For families, this also assumes that both spouses work in the same industry or at least in the industries that are closely located to one another. If not, it will most likely be the case where only one half requires less travelling time to get to work. Career switches between industries may also be something to consider if you are relocating primarily due to work.

Either way, it is very likely that the implications of the future of work for residents are not as ideal as imagined. Perhaps only the more privileged few will get to enjoy work at their own doorsteps. Most residents would probably still need to travel more than they would like to reach their workplace. Residences closer to MRT stations and major job nodes are likely to be more expensive than the ones found in the periphery.

Furthermore, the presence of so many different job nodes from different industries is premised on the fact that there are many jobs created and available for residents to participate in. It is hard to imagine every Punggol resident as a cybersecurity specialist or every Changi resident to be an aviation expert. Even with flexible work arrangements and co-working spaces, residents can still expect to have a fair bit of travelling even with the “Working Anywhere & Everywhere” plan.

Mixed-use Integration of Workspaces

An interesting and mind-bending approach is adding mixed-use integration to segmented job nodes. Each job node will be focused on commercial, industrial, or specific business sectors. Yet, the buildings in these nodes might have mixed-uses. With this “vertical zoning” of space within buildings for different types of work activities, industrial job nodes might end up more varied and lively as compared to before.

The concept is an experimental but refreshing one. We can expect to see pilots in Geylang Bahru (Kolam Ayer in URA Long-Term Plan), Gul Circle, and Paya Lebar Airbase. These different nodes would demonstrate how mixed-use integration would play out in reality. Geylang Bahru will showcase how clean industrial workspaces can be integrated with co-living and micro residential units along with the necessary amenities for the community. Gul Circle would be an example of how worker dormitories and factory space can be integrated together with transport infrastructure.

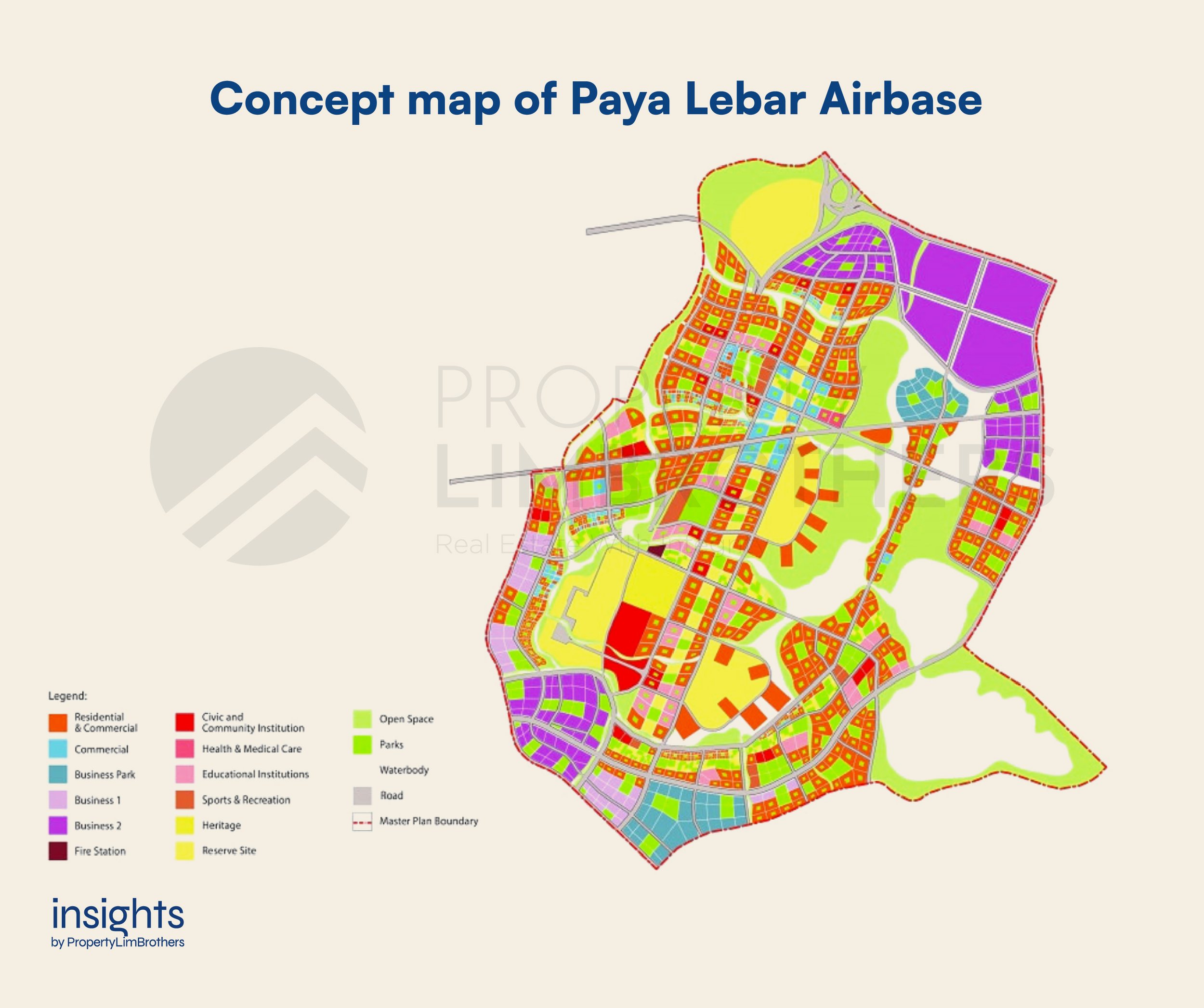

Paya Lebar Airbase on the other hand can be said to be a culmination of all the ideas presented in the 2022 Long-Term Plan. It would be the ultimate pilot for a mixed-use estate. With plans to integrate not only work, but also nature, heritage, commercial, and all necessary amenities together with residential spaces.

The concept map of Paya Lebar Airbase below is not finalised and is only one of many iterations of how the space might be used for varied purposes. No matter how it is organised in the end, mixed-use integration is going to be a cornerstone of the development of this estate. With Paya Lebar Airbase as sort of the “proof of concept” of mixed-use infrastructure, much of the future design of workplaces might be riding on how it performs in this pilot.

Should the mixed-use development prove to be a success, we might see a more lively Singapore in the OCR districts and city fringes. Mixed-use integration will help boost the value of residential estates and heartlands. With work venues located much nearer to these residential areas, we can expect higher demand for renting and buying properties in these more connected areas.

As compared to the past, OCR properties will have more to benefit from mixed-use developments than CCR properties. The marginal improvement is much higher for OCR properties, and hence we can expect some better appreciation in value for these locations. Mixed-use integration will allow less central properties and estates to catch up in value. This is, of course, built on the premise that there are that many jobs created to justify and support the mixed-use allocation for work, commercial, and industrial activities.

Development of Commercial & Industrial Real Estate

On top of the more varied usage of commercial and industrial real estate, the development cycle and pattern might also change quite radically. The typical lease of 99 years might be shortened drastically. Following the examples of other cities and companies, the lease might take the form of 30, 40, 50, or 60 years. This has not been confirmed as of yet. But what is likely to happen is the usage of multiple pilots to see which type of lease duration is best.

The key tradeoff in this shortening of the lease is between building quality and capital outlay. With a shorter lease, the capital required to buy the land would be significantly reduced but so will the incentive to develop the land. If the company only owns the land for 30 years, they might not be as inclined to spend as much on the quality of the building. This is a concern for the URA in terms of building safety as well as building quality for the eventual business tenants.

As raw materials and labour continue to inflate in price, developers might be tempted to take the shortcut with the building process. There is a serious possibility that inferior (or at least cheaper) materials would be used, with less focus on the rigour of the building and design process. This would be an important factor that may need some regulatory attention.

Even with some of these drawbacks, the benefits from the lower capital outlay might outweigh the cons. Developers and businesses will be able to be more agile with their decisions on location and physical infrastructure. The property owners of commercial and industrial real estate might also need to refocus their strategy of utilising the lower leases. With a steeper version of the existing Bala’s Curve, there’s less time to reap the rents of a new building, negatively affecting the total rental returns on the property. This would probably have the greatest impact on REITs and any other investors in the commercial and industrial real estate space.

While the focus has always been more on rental yield than on capital gains, a serious focus on cost efficiency will probably be the most important factor for profitability. There are a few theoretical speculations we can put out here based on what we have discussed thus far. First, the current newer 99-year lease commercial and industrial developments might be more attractive than their future counterparts due to the confidence in building quality. Second, subsequent landowners after the initial shorter-lease offer might stand more to gain if the existing infrastructure is not torn down. This will push subsequent land bids after the first 30 year lease much higher.

Third, subsequent development cycles after the lease expires might not be an incremental build-up. Rather, they might just rely on the leftover infrastructure. With a low lease, subsequent landowners might find it more profitable to rent out the existing infrastructure rather than rebuild or develop it further. Furthermore, add-on developments might not be physically possible unless the building was initially designed with future modular upgrades in mind.

Regardless of what the future might look like, commercial and industrial real estate will have some interesting changes to watch. Depending on the eventual regulatory rules regarding these new commercial developments, it might be a boom or bust. Too many regulations and requirements will stifle market forces, or distort prices. Only time will tell if these changes to the development and usage of work-related infrastructure will go well.

Closing Thoughts

The future of work is exciting. Although residents of Singapore might not be able to literally work from anywhere and everywhere, there are still exciting changes to look forward to. Work will become increasingly decentralised. With more commercial spaces looking to get a serious upgrade in the RCR and OCR, traffic jams to the CBD and peak hour squeezy public transportation might be less of a worry in the future.

For residents living in the RCR or OCR, work coming closer to the heartlands and the peripheries of Singapore might mean better price tags for property. The introduction of more mixed-use developments would also mean more lively workplaces and residential areas. Usage of space in Singapore would become more efficient across the day, and we might feel less of the squeeze and crowds if work and other activities are successfully decentralised.

The potential changes to the lease of commercial and industrial real estate would also create big waves in the market. The tradeoff between building quality and capital outlay may have serious implications for REITs, developers, and real estate investors. Most of these changes to lease are still up in the air and we can only speculate how it would turn out.

Moving forward into the future, key locales to look to for the future of work and how it impacts real estate would be Kolam Ayer, Gul Circle, and Paya Lebar Airbase in particular. These pilot estates would shine the spotlight on whether this model works and should be replicated across the rest of the island. If you’re interested to discuss how the URA Long-Term Plan 2022 might affect your property journey be it residential, commercial, or industrial, please reach out to us here to discuss more!