The big R-word has been catching headlines recently. With inflation skyrocketing, interest rates catching up, and companies starting to cut hiring, everyone is starting to get worried about an impending recession. Despite all these concerns, the property market has been climbing still. Resale HDBs are making new highs and headlines. Rent is climbing further up at the risk of growing affordability concerns. But what about commercial real estate such as Shophouses?

In previous articles, we have discussed the possibility of a housing bubble, recession fears, and how the macroeconomic conditions (especially interest rates) might affect real estate market participants. With a sharp economic slowdown expected to hit Singapore soon, will there be any unexpected hiccups? Will housing, commercial, and investment properties all come crashing down?

In this article, we take a look at how Shophouses might fare when a recession hits. We look at the fundamentals behind Shophouse transactions and highlight key risks that you should consider. Taking a glimpse into past recessions might also give us a clue into how the market for Shophouses reacts.

The Fundamentals of Singapore Shophouses

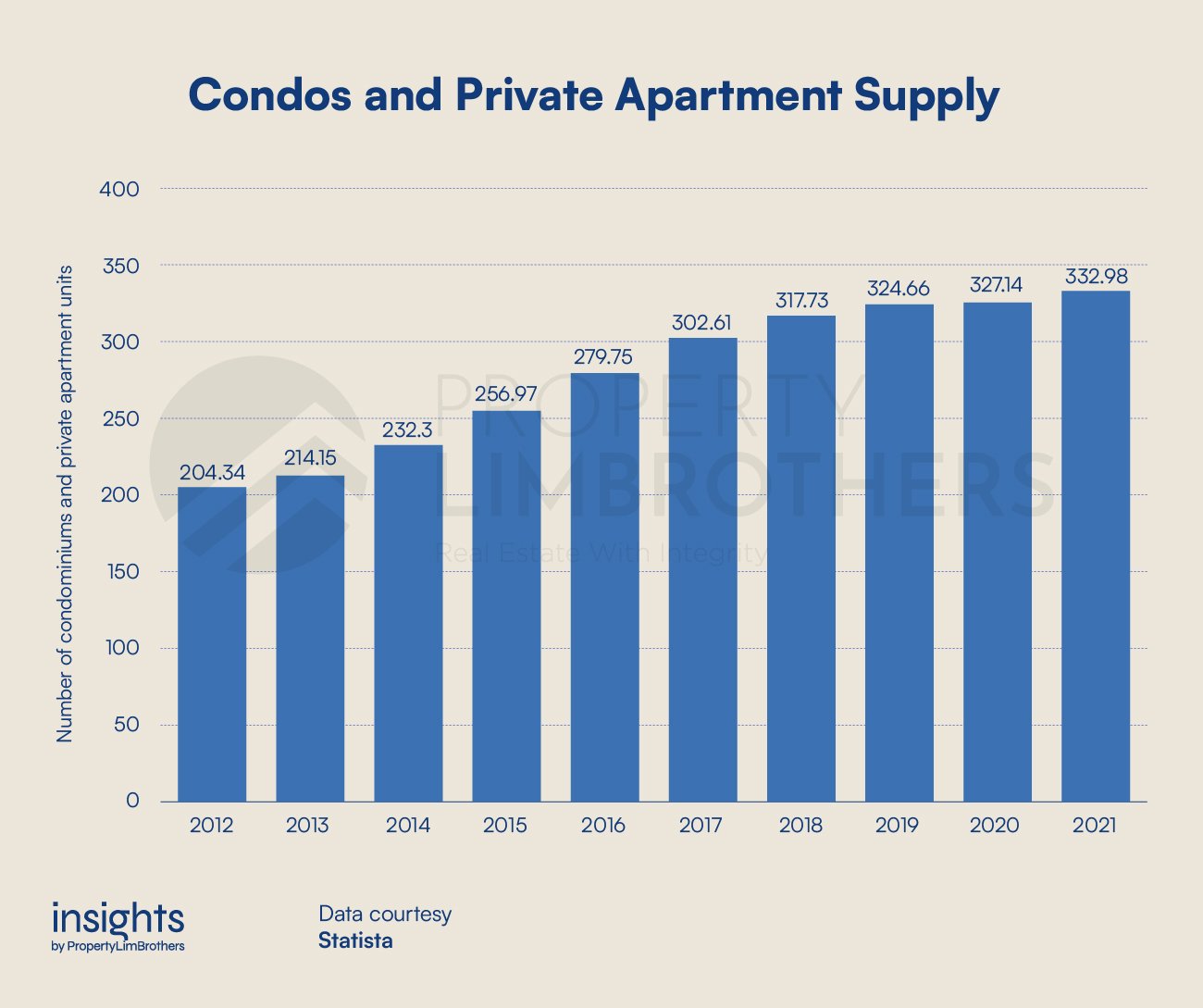

An important feature of Singapore Shophouses is its limited supply. This is especially true for conservation shophouses, which number around 6,500. In contrast, the supply of private housing is growing every year. A Statista survey shows that there will be 332,980 condominium and apartment units in 2021. Comparing the fundamentals between Shophouses and Condos, the supply-side story is extremely different.

Condos are residential properties. Most people buy Condos for their own stay or for investment purposes (rental income & capital gain). The government is on its path to increase housing supply in Singapore (both public and private), the policies surrounding the supply-side story for Condos suggest a gradual increase in Condo supply over the coming years.

On the other hand, Shophouses have a more interesting supply-side story. Unless we start conserving the newer HDB shophouses, the 6,500 conservation shophouses are highly unlikely to increase in number. Furthermore, the usage of shophouses is varied. Shophouses can be used for both residential and commercial purposes within the constraints given by the authorities. Depending on the designation of the shophouse, it is also possible that the shophouse can only be used for commercial purposes. This gives Shophouses a bigger slant to being used as an investment property (unless the owners plan to use the space for their own businesses).

Looking at inflationary forces, which is the primary driver of the impending recession, Condos are more likely to be impacted. Rising cost of materials and labour will affect the price and duration of new launches. With supply-chain lags, the development of new Condos would likely be delayed. In contrast, shophouses which are already constructed and conserved may only be affected by higher renovation costs and delays on that end. Nonetheless, renovations for conservation shophouses are an arguably simpler matter with the authorities setting specific regulations on how they are to be refurbished.

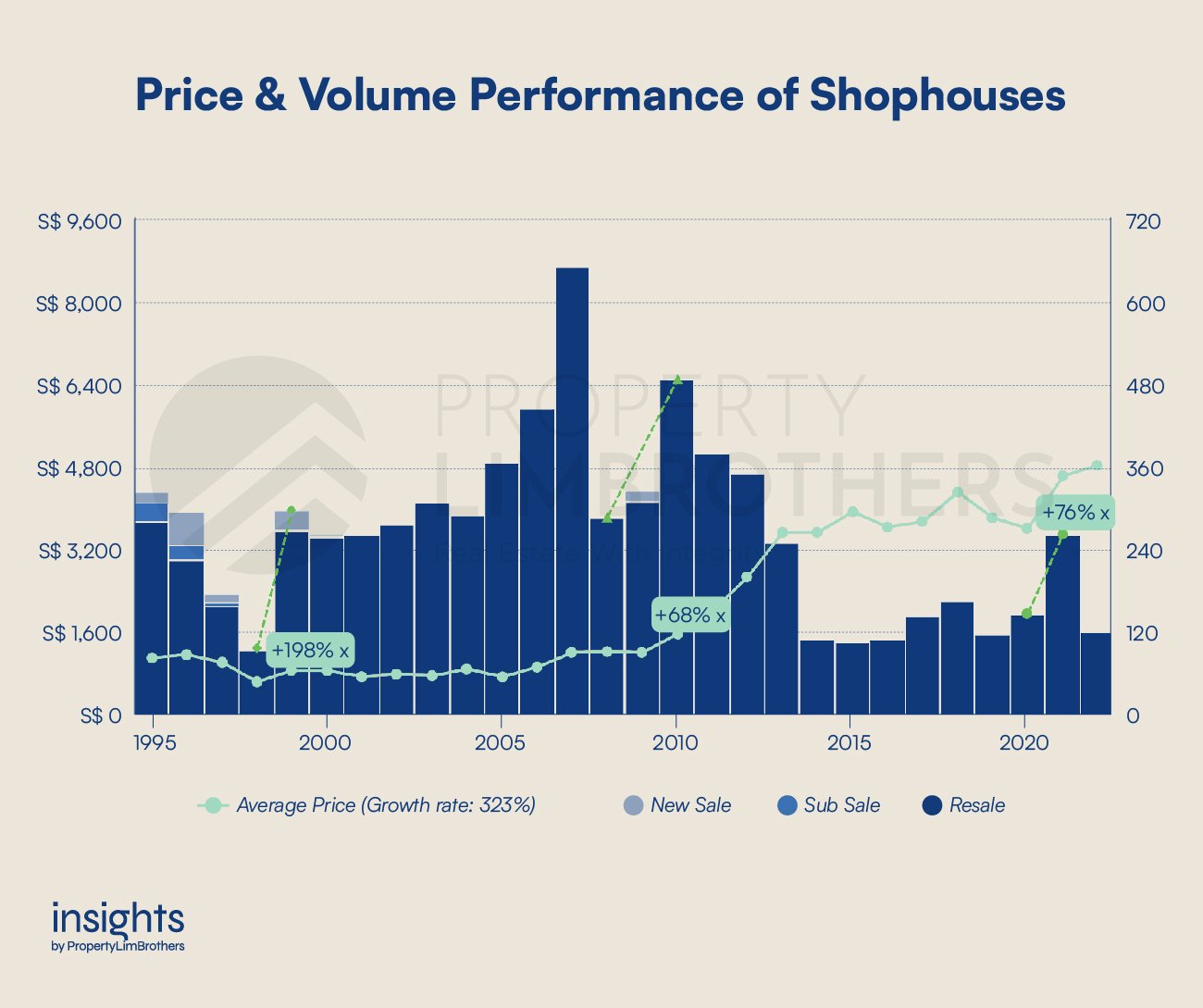

The current impending recession (if it happens at all), might not have a substantial influence on the supply mechanics of shophouses in Singapore. As a niche market with an already small supply of shophouses, incoming supply into the shophouse population would not be as greatly affected as mainstream real estate. The chart below shows the proportion of new sales (in orange) to resale (in blue) shophouses. Supply-side cost inflation will not be a huge influence on shophouse prices.

As economic uncertainty grows, investors and households tend to grow their cash reserves and behave more conservatively with big ticket purchases and investments. This prudence is expected and people should rightfully do so to preserve their own financial interests. In recessions, the unemployment rate typically rises, income levels taper or fall off. The earning and spending power is lowered. Coupled with high cost-push inflation this time round, this particular recession will see a steeper decline in the spending power of households. It is likely that demand for big ticket investments such as real estate would fall off a cliff. The high interest rate environment is looking to get worse and sustain even higher rates into the future.

Demand destruction for the real estate market, however, does not mean a slump in prices. As people start getting more cautious and take a pause on buying, it simply means a slowdown in deal flow. The number of transactions will be the first to decline. Price would only decline if the homeowners face a cash-crunch or have little to no holding power. As a result, we might continue to observe higher prices but shrinking transaction volume. This is what describes the Singaporean real estate market over the past few months.

This might affect the demand for commercial real estate as well, including shophouses. Although the supply of shophouses might not be as affected, will the shrink in transaction volumes also badly affect the shophouse market? This is definitely a possibility. The future price of shophouses will largely hinge on how demand for shophouses is impacted by the recession. The biggest demand concern would be the increasing interest rates. With the higher interest rates, some buyers may be put off by the obscene interest payments and mortgage. As of mid-July, the volume of transactions has already gone past 120, and is close to achieving the average number of transactions (over the past 8 years) in just half a year. Moving forward, it is likely that the number of transactions will slow down due to decreased demand.

To sum up, the fundamentals of Shophouses remain strong due to the limited supply of Shophouses and the fact that there is no new Shophouse supply being added. The existing population of Shophouses are already completed, thus the supply-chain and construction delays would hardly affect it. In addition, demand remained strong in the first half of 2022 despite a weaker macroeconomic environment and rising interest rates. Moving forward, we might see a slowdown in the number of transactions for Shophouses but probably not a drop in price.

Key Risks behind Shophouse Transactions

There are some key risks behind Shophouse transactions in a recessionary environment that you should be aware of. As an investor, you would need to be aware of your tolerance for leverage, liquidity, and cash flow risks. If either of these key risks manifest themselves while you are in need of capital, it could present a personal financial crisis. This list is not exhaustive, you should always do your own due diligence to make sure that the risks of investing in commercial real estate such as shophouses are within your risk tolerance and financial capability.

Shophouses are high-quantum commercial real estate investments. The median price of a transacted Shophouse from January 2014 to July 2022 is $4,750,000 (median psf is $3,284, median area is 1,445 sqft). Depending on the Loan-To-Valuation (LTV) agreement with banks, there could be significant leverage needed to purchase a shophouse. This presents a risk of overleveraging. In other words, you might be borrowing more than you can afford. If you (or your business) are already financially stretched, overleveraging for a shophouse investment might be a bad idea. Should there be a steep fall in the value of the shophouse due to a recession, the bank would ask for additional collateral to hold up the loan as the shophouse value is diminished.

Liquidity risks are another big concern. By liquidity, we mean the liquidity of the shophouse investment. Over the past 8 years, there has been only an average of 149 shophouse transactions a year (2014-2021). Because of the quantum and the commercial nature of this investment, it might take a longer period of time to find a willing buyer. It might be more difficult to exit considering a potential recession. For the subsequent buyer, they would likely face higher interest rates for their loans, a lower LTV, possibly higher prices, but in a more unfavourable market. This would mean that a shophouse investment now presents some elevated liquidity risks with the onset of a recession later (probably in 2023 if it does happen).

Liquidity concerns also apply to the investors themselves. Cash flow risks are an important consideration. A high amount of leverage or a high quantum loan would mean very high cash outflows in terms of the mortgage for the commercial property. Cash flow management will be key to prevent the investor from going insolvent. Similar to the previous point, recessionary environments are periods of negative growth. If businesses do not do well, it might be more difficult to find tenants for your shophouse. This presents an income cash flow problem. If the shophouse has a prolonged period of time without a tenant, this might present a strain on cash savings and reserves for the investor or company that purchased the property.

Again, these three key risks are not exhaustive but highlight how a recession might elevate risks concerning leverage, liquidity, and cash flow. Investors and companies looking to invest in shophouses need to go in with both eyes open, and all five senses active. A high-quantum investment such as this should not be taken lightly. Investors should also be aware of the buyer’s stamp duty and GST as additional costs for purchasing Shophouses. We have written a guide here for the highlights of transacting Shophouses.

Historical Price Behaviour during Recessions

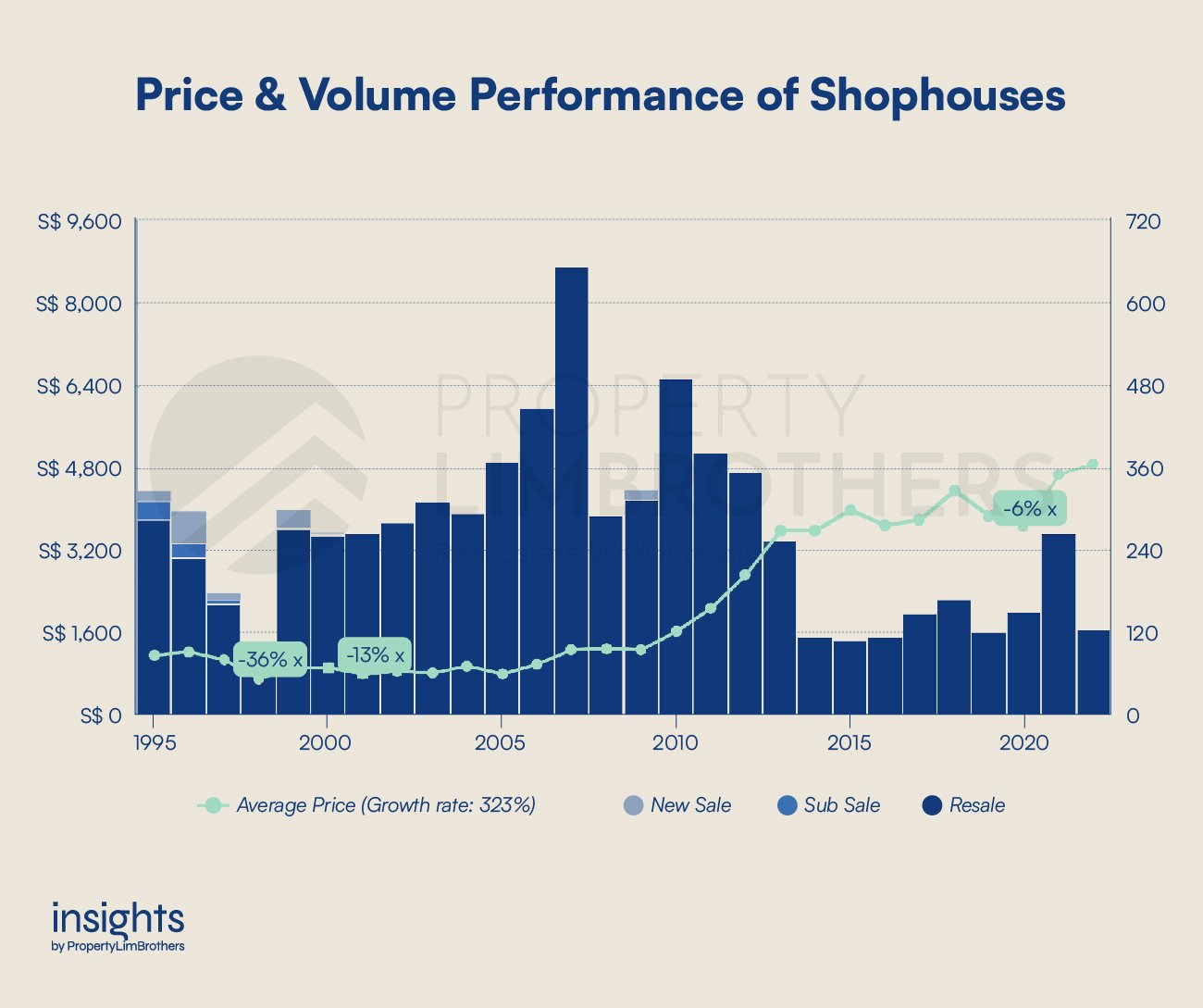

This section will look at how the price and transaction volume of shophouses have behaved in the past few recessions. We will look at the Covid-19 recession in 2020, the Global Financial Crisis in 2008, the Dot.com crash in 2001, and the Asian Financial Crisis in 1998. While each of these recessions has different contexts (and causes), they show the generic price and volume behaviour when economic outlook is poor. Every recession is different, and the one that we are expecting is also rather unique. We will discuss this issue further in the section.

Looking at the price movements over the past 27 years, we see very different price responses depending on the recession. The most recent recession due to Covid-19 saw a 6% dip in 2020 as compared to 2019. The Dot.com crash saw a 13% dip from 2000 to 2001. The most significant drop in prices was during the Asian Financial Crisis. From 1997 to 1998, shophouse prices dropped a whopping 36%. Interestingly, however, during the Global Financial Crisis price grew 1% from 2007 to 2008.

This presents a puzzle. Why did prices not fall during the Global Financial Crisis? It was a recession caused by the subprime mortgage crisis in the United States. Typically, real estate and finance related recessions tend to lead to very poor performance for real estate prices. We do not know the exact reason why prices remained stable for shophouses in 2008. Instead, we speculate that it is due to investors having strong holding power, learning from previous recessions to not overextend or overstretch their financial situation in light of an upcoming recession.

The Asian Financial Crisis in 1998 presents a different story. The real estate, finance, and currency markets of the region were experiencing a traumatic fight-or-die situation. Seeing the poor regional outlook on so many different markets (especially the currency markets) must have spooked investors holding their assets in Asia. Even if shophouse owners were local then, the dire economic situation might have convinced many investors to liquidate their assets and stay in cash or foreign currencies.

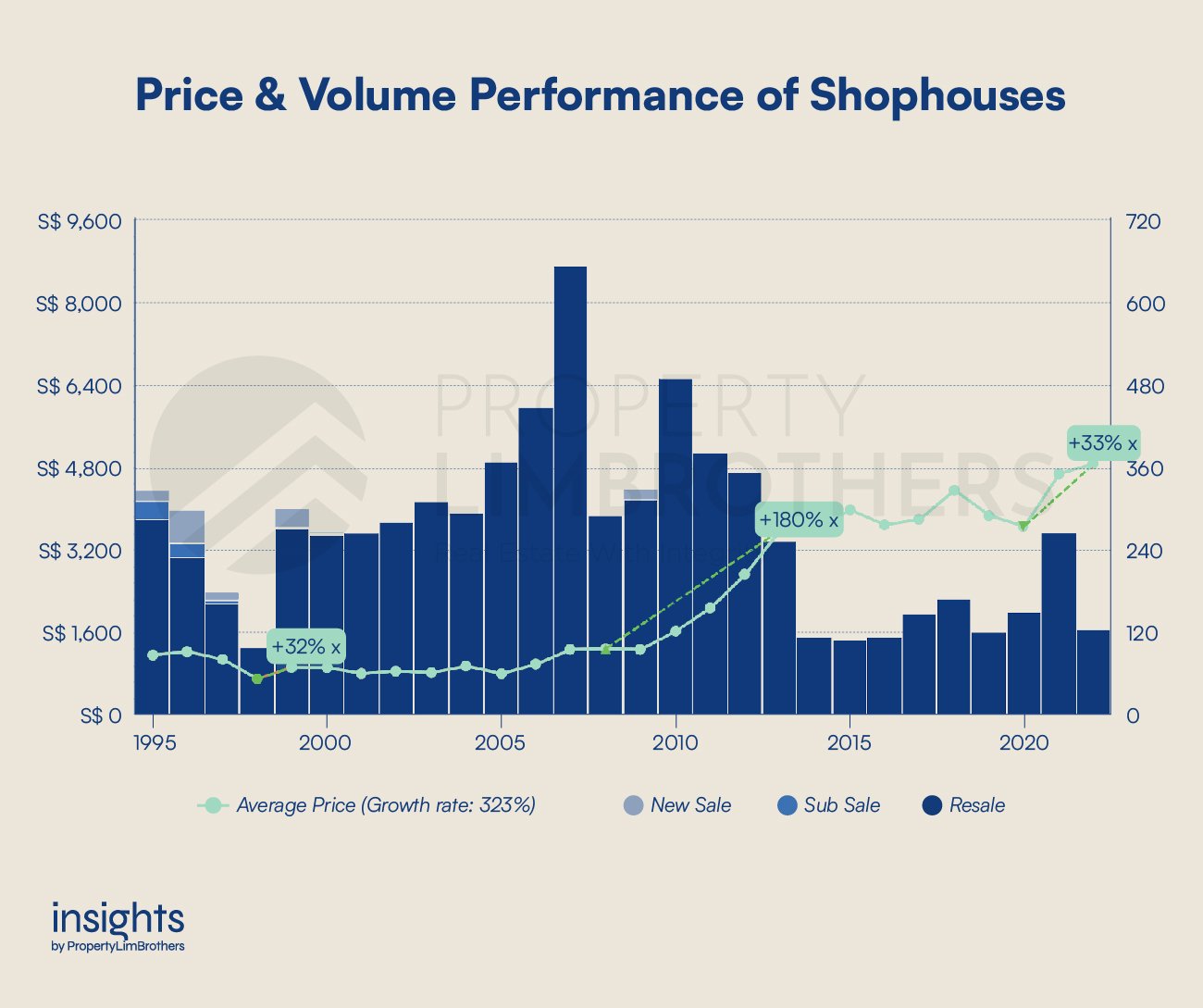

The bright side of history seems to suggest that price movements of shophouses due to recessions are less volatile now than in the past. The drawdowns are less intense, and shophouses were better able to hold their value through a recession. This is not to mention the spectacular recovery that the shophouse market was able to achieve after the recession.

After the Asian Financial Crisis in 1998, the price of shophouses increased by 32% in just one year (1999). The price performance of shophouses years after a recession has been strong. From 2008 to 2014, prices increased by 180% within 6 years of recovery from the Global Financial Crisis. This particular recovery saw one of the largest price movements in the shophouse market. More recently, shophouse prices increased by 33% from 2020 to 18 July 2022.

The shophouse price rebounded rather sharply after the past few recessions. For investors with large cash reserves or companies looking to grow their assets, shophouses are a prime property segment to pay attention to. With a high potential for good deals during the peak of the recession stress.

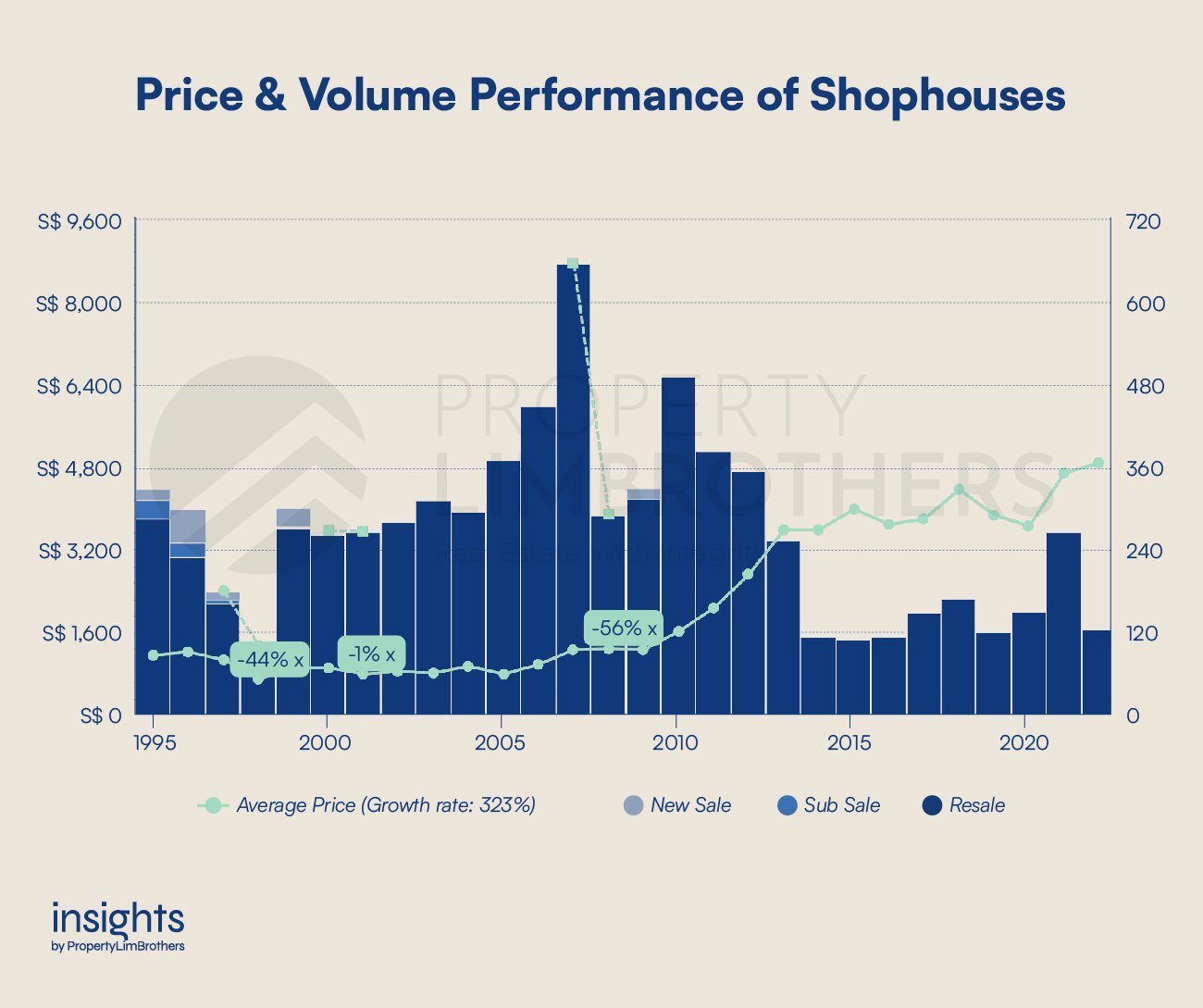

Volume movement typically correlates with price movement in the real estate market. However, sometimes this general trend does not apply. In the recent Covid-19 recession, transaction volume grew by 23% despite prices falling 6% (2019-2020). If anything, it might have meant that investors are getting savvier at “buying the dips”. In previous recessions, the Asian Financial Crisis in 1998 saw a reduction in transaction volume by 44%. The Dot.com crash saw a 1% reduction in transaction volume and the Global Financial Crisis saw a drop in volume by 56%.

The numbers make sense if we think about the increased difficulty in obtaining loans during the Asian and Global financial crises. However, as we have explained earlier, a considerable reduction in transaction volume might not exactly mean a huge drop in price. Rather, it hints at difficulty exiting or finding a willing buyer at your preferred price.

Similar to the price performance recovery after a recession, transaction volume recovers even more spectacularly. The year after the Asian Financial Crisis saw a 198% increase in transaction volume. The year after the covid recession saw a 76% increase in transaction volume. The transaction volume also increased by 68% within two years after the Global Financial Crisis. The sharp increase in transaction volume following a recession could mean that investor confidence in commercial properties with strong fundamentals is high. That translates into stronger demand, even if the prices get steeper.

An important quirk of the transaction volume data for shophouses is that resale transactions ever since 2014 have been relatively stable (with the exception of 2021). The transaction volume hovers around the 120 mark over the past 8 years, with some years showing higher price and volume movement synchronously. The substantially fewer transactions from 2014-2021 as compared to 1999-2013 is interesting, considering that this asset class does not have seller’s stamp duty and additional buyer’s stamp duty.

The shophouse segment is definitely one to pay attention to. Price drops during the recession have grown considerably weaker over time. While demand destruction and volume shrinkage might be a key liquidity concern for those investors who currently own a shophouse, these periods typically do not last more than a year. The time period after the recession is more fascinating, showing much higher increases in transaction volume and price appreciation.

Rather than focusing on fear, focus on opportunities. Over the next few years, it would be crucial to watch how the price movement corresponds with transaction volume. There is plenty of room for volume to spike up following the recovery from the upcoming recession. Pent up demand, cautious from the recessionary worries would hit the market running, pushing up price and volume. That being said, we are looking at 2-4 years into the future. What we have put forth in this article is still considered part speculation, part history.

Closing Thoughts

Shophouses, like other asset classes, do experience a dip in years of recession. However, the good news here is that the dips are getting smaller with each following recession. Interestingly, not every recession resulted in poor performance. In the year of the Global Financial Crisis, prices even increased by 1%.

Shophouses have been rather resilient in their recovery period following the recession, with strong moves upwards in both price and volume. Overall, prospective investors should focus on the growth opportunities following a recession (which seldom stretches beyond a year). Likewise, current owners of shophouses should also look for the better exit opportunities after the recovery rather than fear the collapse of the market.

Strong fundamentals support the continuation of growth in the Shophouse market. Investors would need to focus inwards on their own financial situation to make sure that key risks on leverage, liquidity and cash flows are properly managed in order to benefit from such a big investment decision.

If you like what we have discussed in this article, reach out to us to find out how a recession will impact your property investment journey. There are big implications in making the wrong decision when the market moves against you. So, contact us here to make sure you have your fingers on the pulse of the property markets.