The November 2022 BTO ballot results were recently released. For those who were successful in your applications, a huge congratulations to you! For first-time homebuyers, this marks an exciting chapter in the next phase of your lives and the start of your property journey.

As the excitement settles, you might find yourself having many anxieties and questions regarding the process from here on. But fret not, we are here to help! In this article, we take you through the different stages from your first appointment to the key collection for your new flat.

Before The First Appointment To Select Your Flat

After you have received your BTO queue number, you will typically have to wait for a few months before you get another email to inform you of your appointment date to head down to HDB hub. This depends on your queue number – if your queue number is further back, you will have to wait for other couples to choose their flats first.

Apply for your HLE letter. The first appointment will be to select your unit and assess your grants and loan eligibility. Therefore, the first and most crucial step to take before your first appointment is to apply for your HDB Loan Eligibility (HLE) letter if you intend to take the HDB loan. Be thorough when applying for your HLE letter as this can drastically affect the maximum loan amount you can get from HDB.

If you are still studying full-time or in National Service (NS), you can defer the income assessment until the key collection appointment. The advantage of doing so is that you will qualify for higher grants since there is low to zero income at this time and a higher loan quantum later when your combined incomes are assessed in a few years’ time. However, the downside is that you will need to fork out more cash during the first downpayment since your CPF OAs will likely not have sufficient funds.

Shortlist your ideal flats. Depending on your queue number, there will likely be many applicants ahead of you. This means that the good units (high floors, corner units, units with unblocked views, units closer to certain amenities) will likely be taken up first.

In the days leading up to your first appointment, you can log into the HDB flat portal and go under Flat Applications to check on the flat details and availability. This way, you will be able to see which units are still unselected before heading down to HDB hub. Shortlist a few in the event that some of those that you have shortlisted get snapped up before your turn.

Discuss whether to opt in for OCS. Before your first appointment, you should have a discussion with your partner to decide whether you want to opt in for the Optional Component Scheme (OCS).

Under the OCS, the cost of necessary fixtures and fittings such as internal doors, flooring, and bathroom fixtures will be added to the final price of your BTO flat. As these finishes will be completed by HDB by the time you collect your keys, it will save you some time on renovation and you might be able to move in earlier. Additionally, since the cost of these fittings is included in the final price of your flat, you are able to pay for it using your CPF and mortgage loan.

Forfeiting your queue number is not recommended as additional chances that you have accumulated from previous unsuccessful applications (in non-mature estates) will be reset. If you really have to forfeit due to unforeseen circumstances, rest assured that you will still be considered a first-timer in your next application. However, if you reject a second chance to select a flat after getting a queue number, your first-timer priority will be suspended for a year and will be considered a second-timer if you apply during the same year.

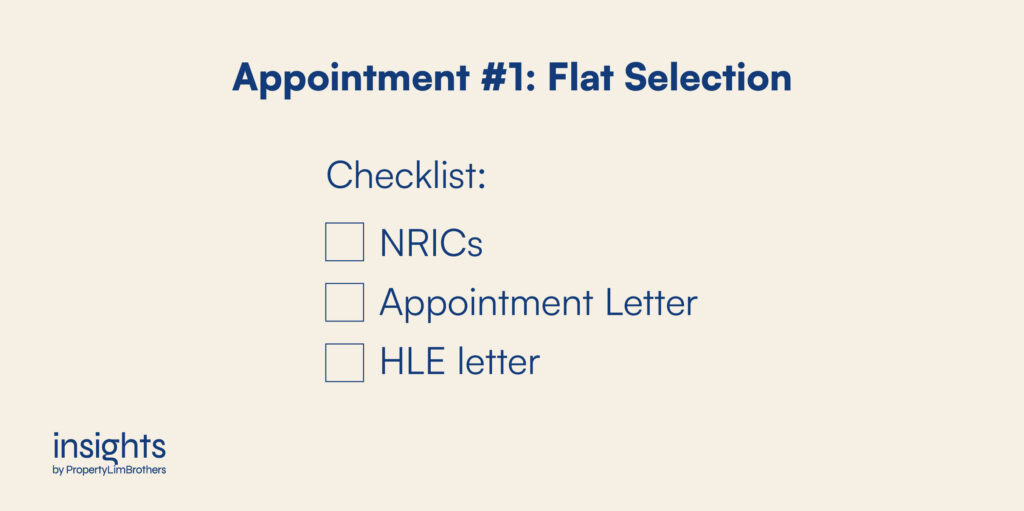

Appointment #1: Flat Selection

Big day and the moment you’ve been waiting for – it is time to select your unit and get into debt with your partner.

Bring along your NRICs, appointment letter, and HLE letter. The selection of flats strictly follows the queue number, so you might be required to wait if the couple ahead of you in the queue has not selected their unit yet. While waiting, you may want to visit the My Nice Home Gallery showflats located within HDB hub to check out the latest flat designs, as well as interior design and renovation ideas.

When it is your turn, an HDB officer will walk you through the process of selecting your flat and other administrative matters involving your grants and loan. At this point, your grant eligibility will be assessed and you will be required to submit your HLE letter if you are taking the HDB loan.

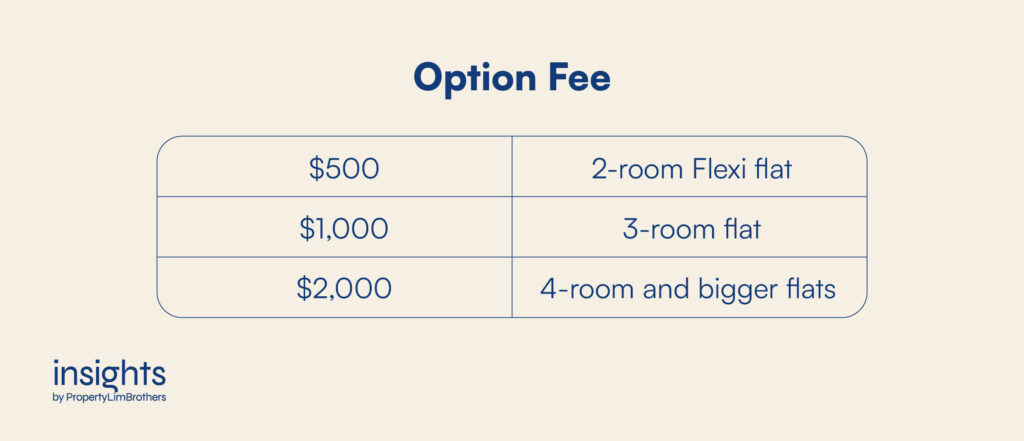

After you have selected your unit, you will be required to pay a maximum of S$2,000 in cash as the option fee. This option fee will form part of the downpayment and total cost of your flat.

And there you have it. Congratulations to those who are reaching this milestone! Don’t forget to take a photo together with your partner at the photo wall to commemorate the moment and shake on the deal.

Appointment #2: Signing of Lease & Downpayment

Prior to this second appointment, your CPF Housing Grants would have already been disbursed into both your CPF OA accounts. The good news is that you will be able to use the grants for your downpayment.

This appointment, which will be several months after the first, will be to sign the agreement of lease and to make your first downpayment, stamp duty, and legal fees. Remember to bring along your agreement of lease letter, which will specify the payment amount, when heading down to HDB hub.

During this appointment, the amount of downpayment you have to pay will depend on the type of loan you have chosen to take.

For those taking HDB Housing Loan, under the latest cooling measures, you will be required to pay a downpayment of 20% of the flat’s purchase price. However, couples who qualify for the Staggered Downpayment Scheme will be able to make the downpayment in two instalments – 5% of the flat’s purchase price during this appointment and the remaining 15% during the key collection appointment. You can use CPF OA, cash, or a combination of both to pay for your downpayment.

At this stage, if you and your partner have sufficient funds in your CPF OA after taking into account the CPF Housing Grants, you will not need to fork out any cash. However, if you have deferred your income assessment and have not received your grants, be prepared to fork out more cash.

For those opting for a bank loan, you will be required to pay a downpayment of at least 25% of the purchase price. 5% of it needs to be paid in cash while the remaining balance can be paid for using CPF OA, cash, or a combination of both.

Decide on ownership status of the flat. During this appointment, you will also be asked to choose between Joint-Tenancy or Tenancy-In-Common. The former will allow both owners to have an equal stake in the flat, no matter how much each party contributed to buy the flat. For the latter, each party will hold a separate share of the flat.

And that sums up the second appointment! Now the waiting begins. Look for Facebook or Telegram groups that provide and share regular updates for your BTO project. You may even get to know some of your future neighbours through these groups.

For those who have more urgent housing needs while waiting for your BTO flat to be built, you may wish to check out HDB’s Parenthood Provisional Housing Scheme (PPHS) or look towards the rental market.

Appointment #3: Key Collection

Congrats once again! Your BTO project is officially completed. This should be a few years after your first two appointments. By now, your excitement should be at its peak knowing your flat is finally ready after the long wait. Head down to HDB hub to finish the process of your BTO journey.

Before heading down for key collection, you will be asked to do a second HLE to reassess your loan eligibility based on your current income regardless of whether you have deferred your income assessment. If your combined income has increased since your first appointment (which it should have), your loan amount will be increased accordingly.

For those who opted for the Staggered Downpayment Scheme, this would also be the time to pay for the balance downpayment. You may use the funds and leftover grants (if any) in your CPF OA, cash, or a combination of both to pay for this downpayment.

After you have completed all the necessary payments and paperwork, the HDB officer will hand you a bundle of keys to your new home. Once again, you may want to take a photo at the photo wall to commemorate this milestone and special occasion.

Once all that’s done, it’s time to visit your new home! Traditionally, Chinese couples would bring along a pineapple to welcome wealth and prosperity by rolling it into the house. But over the years, we’ve seen this custom being practised by other races as well.

You might also want to start looking around for defects, or choose to engage a professional to do so.

Conclusion

We hope that this article has given you a comprehensive understanding of the whole process after getting your BTO queue number. As you begin executing your interior design plans and renovation works for your dream home, we encourage you to exercise prudence and not overspend.

For those who didn’t manage to get a queue number this time, do not lose hope! If you have more enquiries or want a second opinion about your property options, do not hesitate to contact us. See you at the next one.