In case you missed it, the Housing and Development Board (HDB) will launch more than 9,500 Build-to-Order (BTO) flats in the November 2022 sales exercise, with three projects falling under the Prime Location Housing (PLH) model. The application window opens on 23 November 2022 (Wednesday) and will last for one week, ending at 11:59 pm on 1 December 2022 (Thursday).

The Sale of Balance (SBF) exercise will be happening concurrently with the BTO launch. Applicants can access the HDB flat portal to view the projects and units available and apply for the flat type and estate that suits their housing needs.

Since BTO season is officially upon us, we take this opportunity to cover some of the most-asked questions Singaporeans have about the BTO and SBF launches. Let’s jump right into it!

1. Can I apply for both the BTO and SBF exercises?

No, you can only apply for either the BTO or the SBF exercise, not both. If you are considering applying for this launch, carefully review both exercises and weigh your options before applying. Take note of the estimated waiting time and completion date for BTO projects and the remaining lease for some of the SBF units available.

2. How does the SBF process work?

As the name suggests, SBF stands for the sale of balance flats that were unsold during past sales launches or were repossessed by HDB for various reasons. This means that some of the units offered in the SBF exercise will have depleted leases, but the upside is that you will be able to collect the keys since the project is already completed.

When the SBF exercise begins, available units and projects will be listed on the HDB flat portal for applicants. You will only be able to apply for the estate and flat type you want — for example, a 5-room flat in Punggol. And in Punggol, there may be five different projects offering 5-room flats. Applicants who applied for the same estate and flat type will participate in a ballot for a queue number for flat selection. If you successfully get a queue number within the number of units available, you will be able to choose a unit from any of the five projects offering a 5-room flat.

3. Will I be considered a second-timer if I forfeit my queue number?

Sometimes, unforeseen circumstances such as cash flow difficulties leave you no choice but to forfeit your queue number and reject the chance to select a flat. It happens.

If you get a queue number and are invited to select a flat but do not, there will be consequences. For the first time, additional chances you accumulated from previous unsuccessful applications (in non-mature estates) will be reset. But you will still get first-timer priority for your next application.

However, if you reject a second chance to select a flat, your first-timer priority will be suspended for a year – meaning you will be considered a second-timer if you apply during this year.

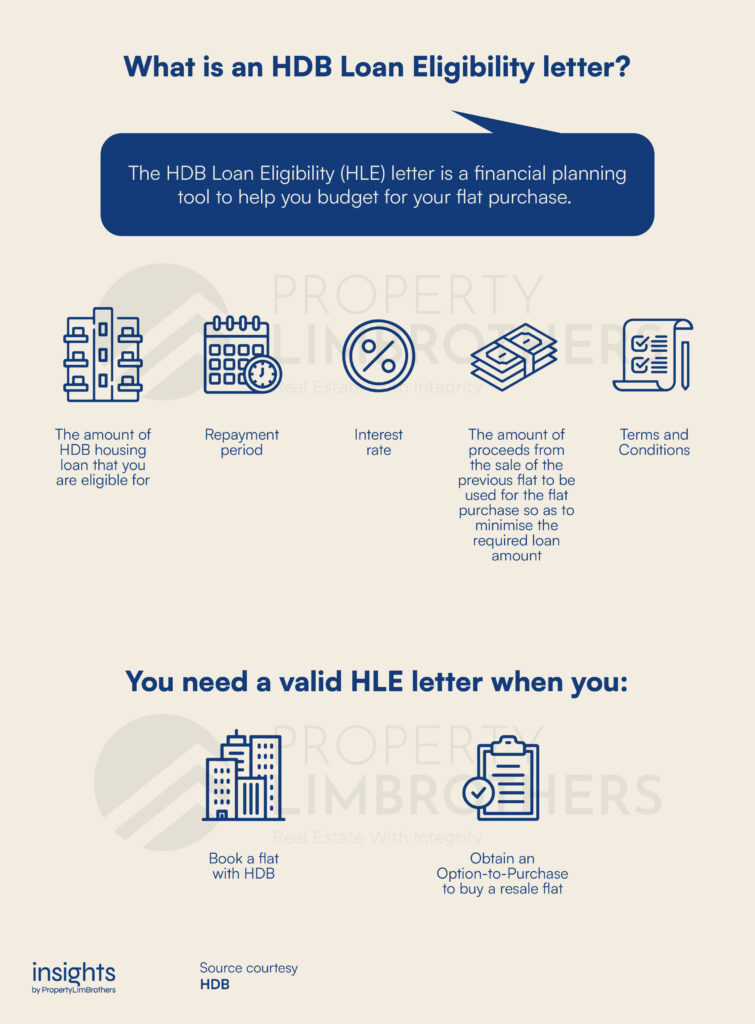

4. Do I need a valid HLE letter before applying for a BTO?

You will only need a valid HDB Loan Eligibility (HLE) letter when going for your flat selection appointment, so you will not need one during the application stage of BTO – but it is good to have one to work out your budget and finances. HDB also takes up to two full weeks to get back with your HLE letter, so getting it early when applying for a flat will be helpful. An HLE letter is valid for six months from the date of issue, provided that there are no drastic changes to the applicants’ details and income.

5. I am an NSF applying with my partner, who is currently a student. Will we be able to get an HDB loan and grants since we do not have income?

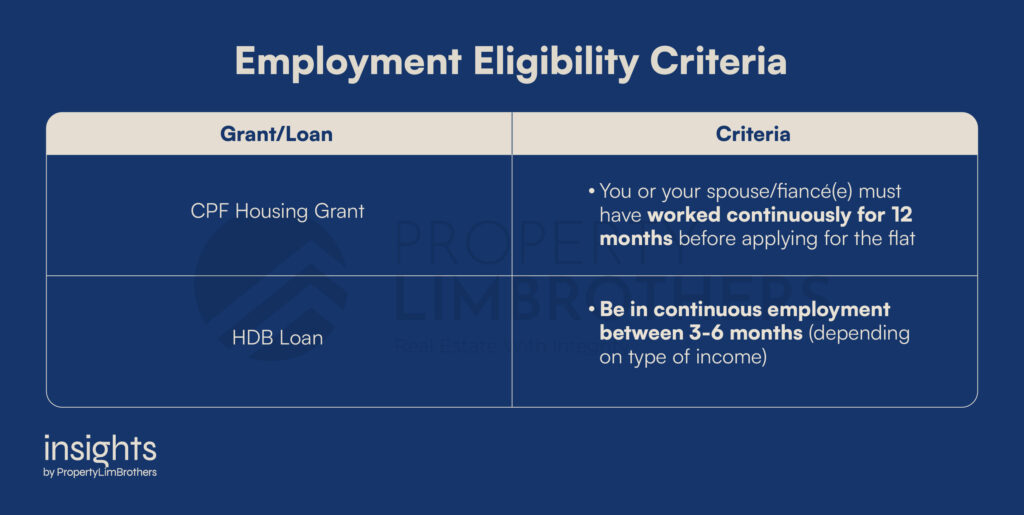

To be eligible for CPF Housing Grants, one of you must have worked continuously for 12 months before applying for the flat. And to qualify for an HDB loan, one of you must be in continuous employment between 3-6 months (depending on the type of income).

The Deferred Income Assessment scheme comes into play for young couples with no current income. It allows you to apply for a flat first, deferring the income assessment until three months before flat completion. But this does not affect the downpayment. You will still be required to pay your downpayment during the lease signing.

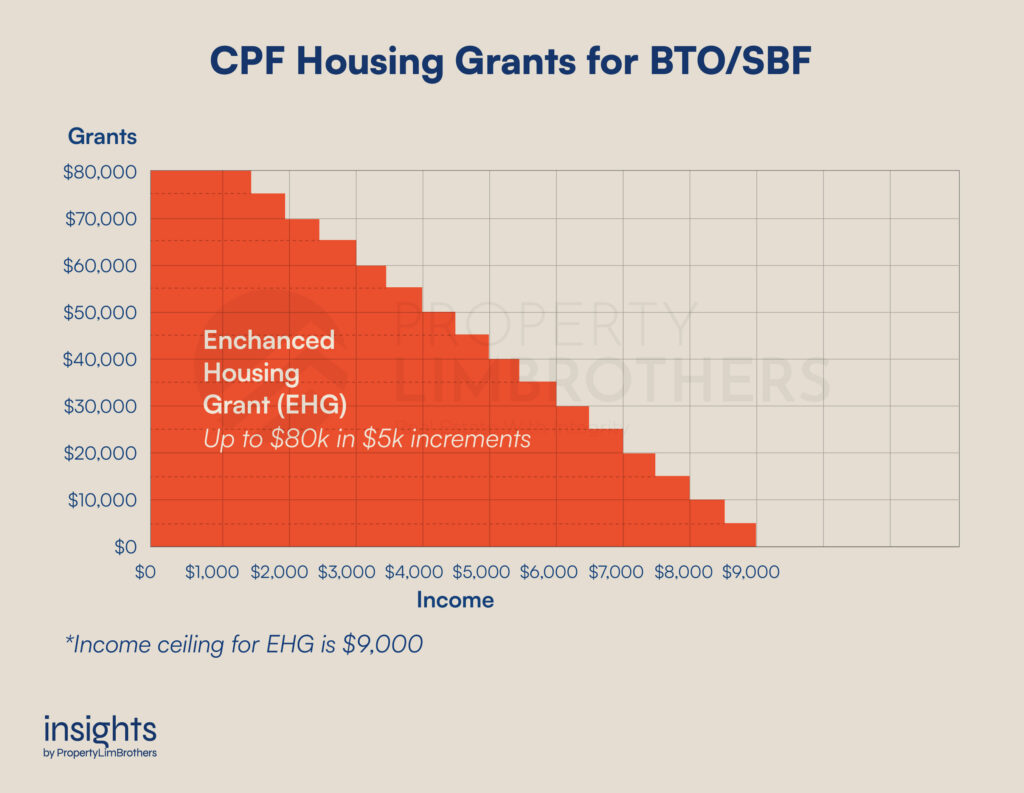

However, there are some implications. Since your income assessment is deferred until three months before flat completion, you will need to ensure that you meet the employment criteria by then. Ensure that at least one of you has worked continuously for a year when your income is assessed. Otherwise, you will still be ineligible for the Housing Grants and HDB loan. Take note of the $9,000 income ceiling for the Enhanced Housing Grant (EHG), and $14,000 for HDB loans.

6. If my income rises closer to BTO key collection, will I become ineligible for grants?

The first income assessment during the flat booking appointment determines your eligibility and grants. You will still be eligible and entitled to the same grants if your income rises later.

7. What if I don’t have the funds for the full 20%* downpayment?

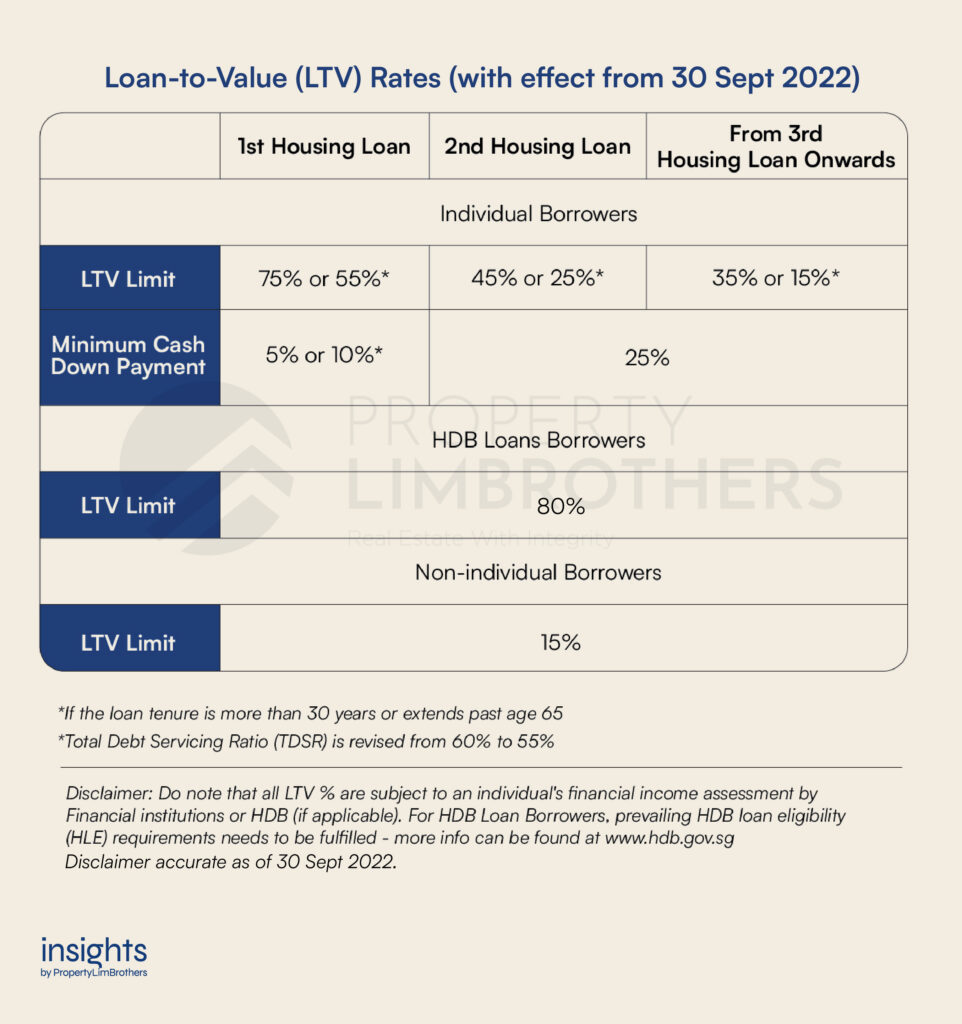

After the 30 September cooling measures, the Loan-to-Value (LTV) ratio for HDB loans has been further reduced from 85% to 80%. This means you will have to fork out 5% more for your downpayment, as HDB can only loan you a maximum of 80%.

However, BTO applicants can apply for the staggered downpayment scheme, which allows you to pay 5% upfront during the signing of lease and the remaining 15% upon key collection.

You may also use the CPF Housing Grants credited to your CPF OA to pay the downpayment.

8. How do BTOs that fall under the Prime Location Housing (PLH) model differ from normal BTO flats?

We have previously covered some of the major ripple effects of the PLH model. BTO flats that fall under the PLH model have a Minimum Occupation Period (MOP) of 10 years instead of the usual 5-year MOP. Owners are only allowed to rent out bedrooms, not the whole flat, even after fulfilling the 10-year MOP. Furthermore, there is a percentage clawback of the resale price or valuation (whichever is higher) when owners finally sell it after ten years.

It also remains to be seen if the current owners will pass on these restrictions to the next buyer.

9. Can I buy a BTO if my parents just sold a private property under my name?

No, you will be considered an ex-private property owner (ex-PPO) and will have to wait 30 months before you can apply for a BTO.

10. What’s the difference between applying for a BTO as co-owners and as owner-occupier?

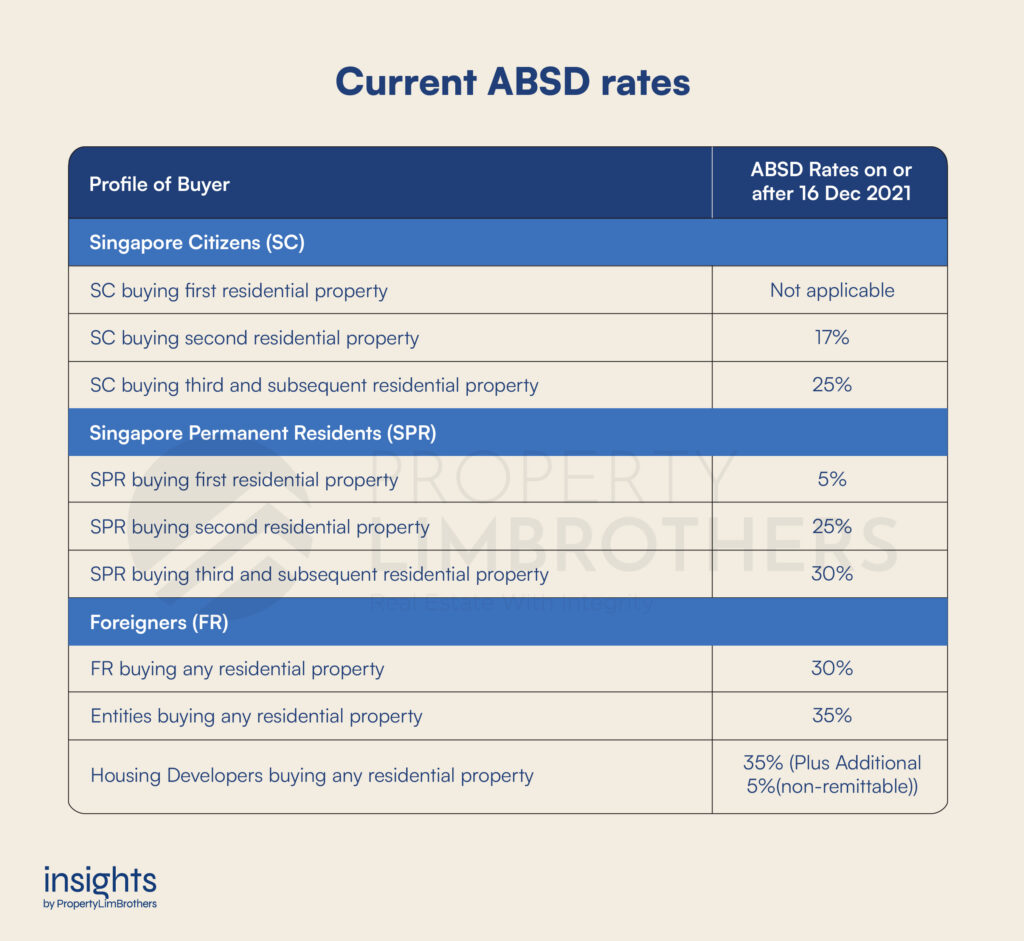

Applying as co-owners allows your and your partner’s income to be considered for loan and grant assessment. You will also be able to use both of your CPF OAs to pay your downpayment, mortgage, and other housing fees. In this case, the right of survivorship applies – meaning if one of you passes on, the property goes to the surviving HDB owner. It also means that if one (or both) of you buys a private property, you will incur a hefty 17%* Additional Buyer’s Stamp Duty (ABSD).

Only the owner’s income will be considered for loan assessment if you apply as owner-occupier. Similarly, only the owner’s CPF OA can be used to pay downpayment, mortgage, and other housing fees. However, HDB will still assess both of your incomes for grants. Therefore, it is crucial that the owner’s income can hold the entire loan. The advantage here is that after the 5-year MOP, the occupier can purchase a private property without incurring any ABSD. This allows you as a couple to diversify your property portfolio and own two properties.

Closing Comments

We hope this clarifies some of the doubts you may have regarding BTO and SBF. If you need clarification on any terms covered in this article and what they mean, do check out our guide to real estate terms in Singapore.

One final tip from us: BTO and SBF ballots are not first-come-first-served, so you may want to consider monitoring the application rates and apply to the project with the lowest application rate to increase your chances.

For those applying for this November 2022 BTO or SBF launch, we wish you good luck and may the odds be in your favour. If you have more enquiries or want a second opinion about your property options, do not hesitate to contact us. Until next time.

*Based on latest cooling measures (w.e.f 30 September 2022)