The new launch condominium market in Singapore is increasingly grabbing the limelight in the real estate sector. Beyond their reputation as contemporary architectural marvels, these new developments offer prospective buyers a myriad of advantages, including cutting-edge amenities, strategic locations, and a unique potential for capital appreciation. Their rising prominence is reshaping the contours of Singapore’s residential property market, setting trends that are likely to influence the trajectory of the industry in the coming years.

The convergence of factors such as evolving consumer preferences, flexible financing options, the nation’s robust economic recovery, and foresighted urban planning, have all coalesced to create an ecosystem ripe for the growth of the new launch condo market. In this article, we take a look at the balance of new launch condo inventory in 2023 and explore some factors influencing the meteoric rise of this market segment in Singapore’s real estate industry.

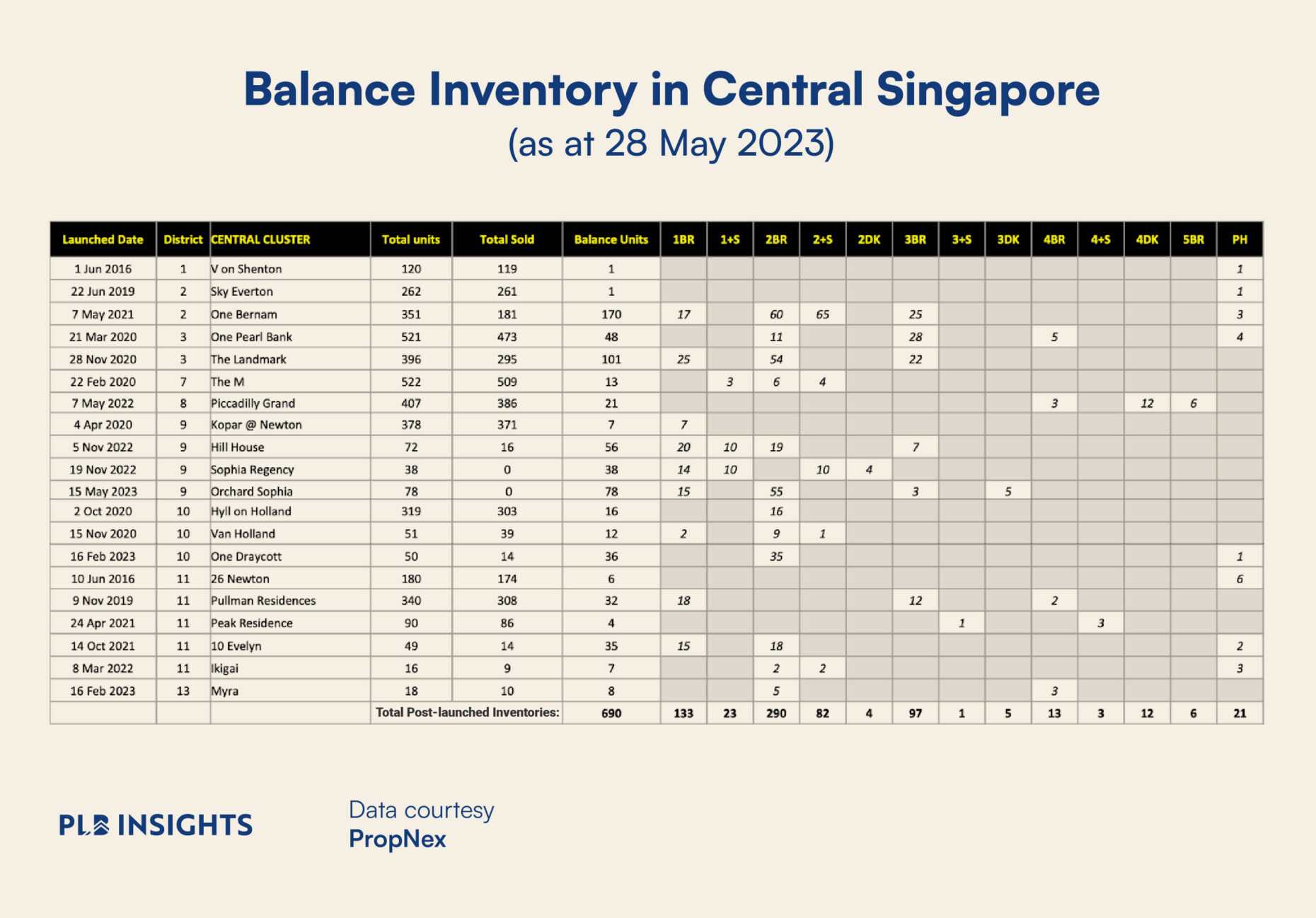

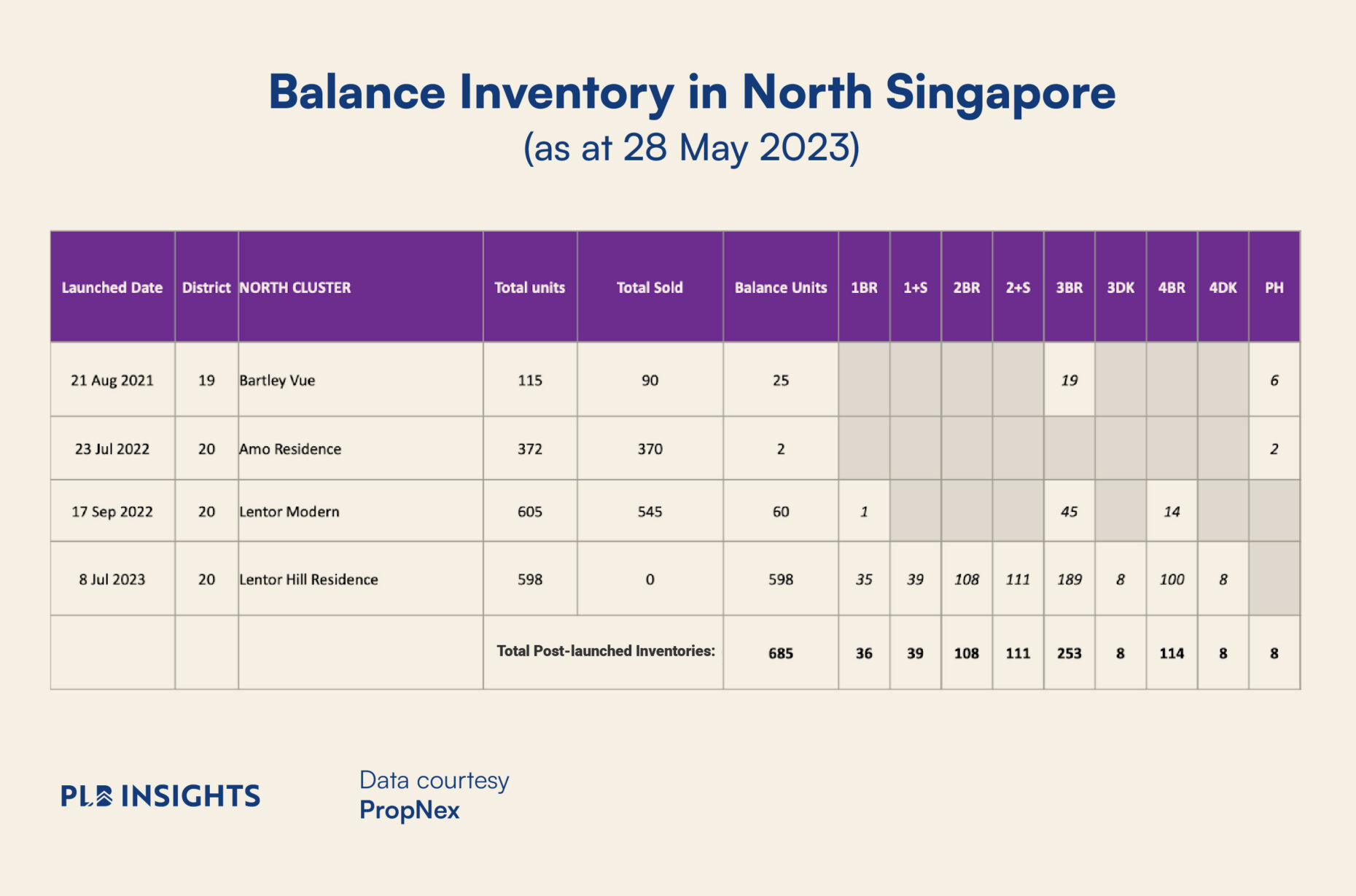

*Balance Inventory is accurate as at 28 May 2023

New Launch Balance Inventory by Region

Western Singapore

The Western region of Singapore has seen a couple of hot launches over the past few years. Notable projects with balance inventory at the time of writing (28 May 2023) include Terra Hill, Ki Residences, The Botany @ Dairy Farm, Blossoms by the Park and The Reserve Residences.

Terra Hill is a freehold development launched earlier this year in February 2023. The project sold 102 (38%) of its 270 units on launch weekend at an average of $2,650 PSF. This includes the seven units sold from its Prestige Collection which averaged at $2,850 PSF. Looking at its remaining inventory, we see that the total units sold is down to 99 from its initial 102 units sold on launch weekend. This could mean that some of the sales fell through and the buyers forfeited their deposits. The latest balance from Terra Hill stands at 171 units, consisting of 2-Bedroom, 2-Bedroom + Study, 3-Bedroom, 4-Bedroom, and penthouse units. About 43% of the remaining units are made up of 3-bedders. And of the 54 penthouse units available, 48 remain, translating to a take-up rate of 11%.

Ki Residences is a 999-year leasehold development launched in December 2020. In its virtual launch, the project sold 22% of its 660 units and 60% of luxury collection units at an average price of $1,790 PSF. In our review, we concluded that Ki Residences would be more suitable for homebuyers rather than investors, and even among homebuyer demographics, families with older children and multi-generational living would find it a better fit. Ahead of its expected TOP in 2024, there are only 15 remaining units at the time of writing, all of which are 3-bedders. Given that it is a 999-year leasehold project, there is also the element of legacy planning involved, which is likely why the bigger units were more popular. Smaller units like 2-Bedroom and 2-Bedroom + Study were popular, likely amongst buyers looking at a lower quantum and investors going for rental play without the risk of lease decay.

The Botany @ Dairy Farm is a 99-year leasehold development launched earlier this year in March 2023. The project sold 187 (48%) of its 386 units on launch day at an average of $2,070 PSF. This reflects the demand for mass market homes, especially considering the limited availability of unsold new launches in the Outside Central Region (OCR). All 36 of the project’s 1-Bedroom units were sold at the launch, along with 93% of the project’s 104 2-Bedroom units. This is likely due to investors trying to capitalise on the rental demand from the international school in the vicinity. Given the high interest rate environment at the time of the launch, bigger units are taking longer to sell as owner-occupiers might be taking their time to explore their options in the market and to review their finances before committing to the purchase.

Blossoms by the Park is a 99-year leasehold development launched last month in April 2023. It had a stellar performance, achieving 73% sales at the launch despite the ABSD cooling measures introduced just two days before. The average prices of units sold was $2,423 PSF, with all the 1 and 2-Bedroom units (excluding 2-Bedroom penthouse) being snapped up. Sales accounted for over 70% of the 3-Bedroom and 3-Bedroom dual-key units, starting at $2.3 million ($2,183 PSF) and $2.1 million ($2,276 PSF) respectively. Approximately a third of the 4-Bedroom units, with starting prices of $2.9 million ($2,243 PSF), were also sold. This is the highest first-day sales of any new launch development in 2023, and according to the developers, 96% of the buyers were Singaporeans and Permanent Residents (PRs). This shows that the latest cooling measures were designed to dampen foreign investor interest but have not significantly impacted Singaporeans and PRs buying for own-stay purposes.

Lastly, The Reserve Residences is a 99-year leasehold mixed-use integrated development, the latest project launched on 27 May 2023. It achieved 71% sales (520 of the initial 635 units released) on launch weekend at an average price of $2,460 PSF, making it the best-performing launch by unit sales in 2023. At the time of writing, 526 units have been sold as at 28 May 2023. The development is directly connected to Bukit V shopping mall and a transport hub – with Beauty World MRT station on the Downtown Line (DTL) and an air-conditioned bus interchange on the second level of the mall. With a total of 732 units, The Reserve Residences would inject a sizable supply of private residential units into the area and serve as part of the rejuvenation of the Beauty World area.

Central Singapore

The private non-landed residential supply in Central Singapore is one of the lowest compared to the rest of the regions. That is partly due to the number of boutique and small developments pumped into this region. Notable projects with balance inventory at the time of writing (21st May 2023) include Piccadilly Grand, Pullman Residences, and Myra.

Piccadilly Grand is a 99-year leasehold development launched in May 2022. It had a phenomenal launch, selling 77% of its units on launch weekend and setting a new benchmark at $2,150 PSF at that time. As a mixed-use development boasting direct access to Farrer Park MRT station and a city-fringe location, 315 out of its 407 units available were snapped up almost immediately. 90% of the buyers were Singaporeans, with the remaining 10% being PRs and foreigners from China, Hong Kong, India, Indonesia, Malaysia, and the USA. An interesting fact is that priority was given to multiple-unit buyers (immediate family members buying to stay together), with 48 units sold to this group before balloting for the remaining units began. At the time of writing, only bigger units such as 4-Bedroom, 4-Bedroom Dual-Key, and 5-Bedroom units remain.

Pullman Residences is a freehold development launched in November 2019. It recently made the headlines for fetching a record high $3,515 PSF for a 2-Bedroom unit. As a branded residence, its residents will enjoy a unique living experience with facilities and concierge services like the ones you will enjoy at a premium hotel. That, along with its freehold status and central location, are huge factors why its units have been breaking the $3,000 PSF mark. The most expensive unit in the project was a 4-bedder standing at 1,378 sqft which was sold at $4.25 million ($3,083 PSF). At the time of writing, only 1-Bedroom, 3-Bedroom, and 4-Bedroom units remain at Pullman Residences.

Lastly, Myra is a freehold development relaunched in February 2023 earlier this year. It was originally launched in September 2020, which saw 17 out of its 85 units sold on launch weekend at an average price of $2,000 to $2,100 PSF. Since then, almost 80% of its units have been sold. The developers relaunched the remaining 18 unsold units this year, and only 8 remain at the time of writing. Of the 8 remaining units, 5 are 2-Bedroom units and 3 are 4-Bedroom units. With the recent announcement that the Bidadari estate is nearing its completion, prospective buyers will be buying into a newly rejuvenated estate with high potential for appreciation as the surrounding plots of BTO projects form a healthy pool of exit audience for Myra.

Northern Singapore

Northern Singapore has seen a slew of highly successful new launches especially last year. Notable projects with balance inventory at the time of writing (21st May 2023) include AMO Residence and Lentor Modern, both developments that caused a stir in the new launch market.

AMO Residence is a 99-year leasehold development launched in July 2022 last year. It was one of the best new launches in recent years, selling 98% of its 372 units on the first day of launch at an average price of $2,100 PSF. We examined the reasons behind AMO Residence’s overwhelming success and found that there is still a high demand in the market for mature estates in the OCR. Besides its central location, its strategic unit distribution and palatable quantum were also extremely attractive factors to families looking to upgrade from their HDBs. At the time of writing, only 2 penthouse units remain at AMO Residence.

Lentor Modern is a 99-year leasehold development launched in September 2022 last year. Following the success of AMO Residence, Lentor Modern also had an outstanding performance, selling 84% of its 605 units on launch day at an average price of $2,122 PSF. Since it had more units than AMO Residence, the performance of Lentor Modern made it the best-selling project of 2022. As the development will be sitting atop a retail mall with direct access to Lentor MRT station, many families were drawn to the lifestyle presented by the integrated development and the perks of an up-and-coming estate like Lentor. At the time of writing, 60 units remain, of which 45 are 3-bedders. With integrated developments getting more attention in 2023, Lentor Modern presents a good opportunity for homebuyers and investors to capitalise on the potential of the estate.

Upcoming new launch projects to look out for in the area would include Lentor Hill Residences, which will be injecting a total of 598 residential units into the neighbourhood. This development could see high demand when it is launched as there is a potential spillover demand from homebuyers who missed out on AMO Residence and Lentor Modern, who are still seeking a good unit in this area.

Eastern Singapore

The eastern part of Singapore includes coveted residential addresses like Tanjong Katong and Marine Parade, and has always been lauded as one of the best areas to live in. In the past few years, we have seen a good supply of new launch developments being introduced to this area. Notable projects with balance inventory at the time of writing (21st May 2023) include Sky Eden @ Bedok, Sceneca Residence, Tembusu Grand, and The Continuum.

Sky Eden @ Bedok is a 99-year leasehold development launched in September 2022 last year. It is the first new launch in the Bedok estate in more than a decade, and achieved 75% sales of its 158 units on the first day of launch at an average price of $2,100 PSF. As a mixed-use development with 12 commercial units on the ground floor on top of its location right beside amenities like Bedok MRT station, Bedok Mall, and Bedok 85 Market, residents get unparalleled convenience right at their doorsteps. This further solidifies the increasing demand in mass market homes in the OCR, especially in more mature estates like Bedok. At the time of writing, 28 units at Sky Eden @ Bedok remain, of which 19 are 3-bedders and 9 are 4-bedders. With future developments in Paya Lebar and Changi, its proximity to these economic hubs could be something to consider for those looking for a home in the OCR.

Sceneca Residence is a 99-year leasehold development launched in January 2023 earlier this year. As the first new launch development to be launched this year, it sold 60% of its 268 units on launch day at an average price of $2,072 PSF. This was in spite of it being the first major private residential project to be launched after the September 30 cooling measures, where stress test interest rates were increased to encourage prudent borrowing. Located right next to Tanah Merah MRT with a sheltered walkway linking them, Sceneca Residence boasts good connectivity to a myriad of amenities as well as business hubs in the east. At the time of writing, 100 units remain, of which 73 are 3-bedders and 23 are 4-bedders. There are also a 2-Bedroom unit and 3 penthouse units available.

Tembusu Grand is a 99-year leasehold development launched in April 2023 earlier this year. Being the first in the pipeline of new launches in the Katong area this year, it sold 53% of its 638 units on launch weekend at an average price of $2,465 PSF. The development boasts a close proximity to the upcoming Tanjong Katong MRT station on the Thomson-East Coast Line (TEL), and managed to draw a diverse group of buyer profiles. Families with school-going children were also attracted to the project given the number of reputable schools in the area. At the time of writing, 281 units remain, with almost all bedroom types still available including 2 penthouse units.

Lastly, The Continuum is a freehold development launched in May 2023 earlier this month. It is one of the biggest freehold developments in District 15, injecting a total of 816 freehold private residential units into the region. It managed to sell 26.5% of its units over launch weekend at an average price of $2,732 PSF, which is a rather robust performance considering the government’s recent attempts to cool the market and the uncertain economic forecast. Larger units were favoured amongst homebuyers, with 2-Bedroom types making up 62% of the units sold and 3-Bedroom units making up 29%. 15 of the 4-Bedroom units were sold as well, at prices exceeding $3.3 million. As a freehold development, The Continuum appeals strongly to upgraders and owner-occupiers looking to right-size or are seeking a legacy property.

Upcoming developments in the region to look out for would include Grand Dunman, which will be located right next to Dakota MRT station. Furthermore, as a mega development with slightly over 1,000 units, Grand Dunman will likely attract a lot of attention from prospective buyers and investors. If you are interested in District 15 new launches, we recently discussed the trio of new launches (Tembusu Grand, The Continuum, Grand Dunman) in the vicinity and did a quantum comparison, so be sure to check that out.

Closing Thoughts

It is evident that the new launch market segment stands at a fascinating crossroads. The surge in demand for modern and innovative homes, buoyed by a mix of economic resilience, favourable financing options, and shifting consumer preferences, paints a promising picture for the future.

In the face of the ongoing global uncertainties, new launch condos have proven their mettle, offering a compelling blend of investment potential and contemporary living standards. It’s not just about owning a home, but a piece of the future – a statement of a modern lifestyle that many aspire to. As we approach the halfway point of 2023, one thing is clear: the new launch condo market in Singapore remains an exciting space to watch, full of opportunities and potential for both investors and homeowners alike.

If you are exploring your options in the property market and would like some guidance or a second opinion, feel free to reach out to us here. Our team of knowledgeable and experienced consultants will be glad to walk you through the process and offer tailored recommendations based on your needs. PropertyLimBrothers, always happy to show you the place.