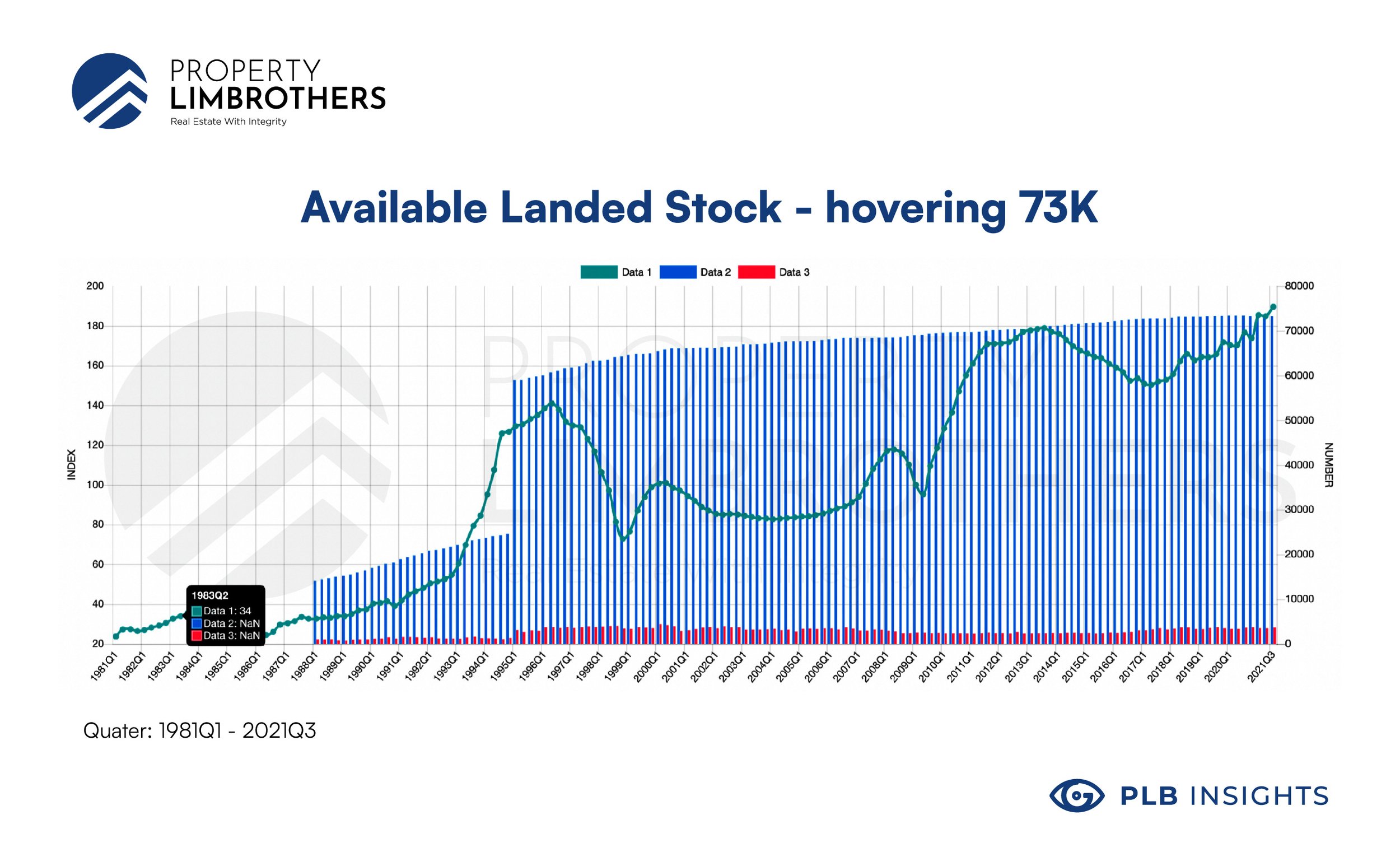

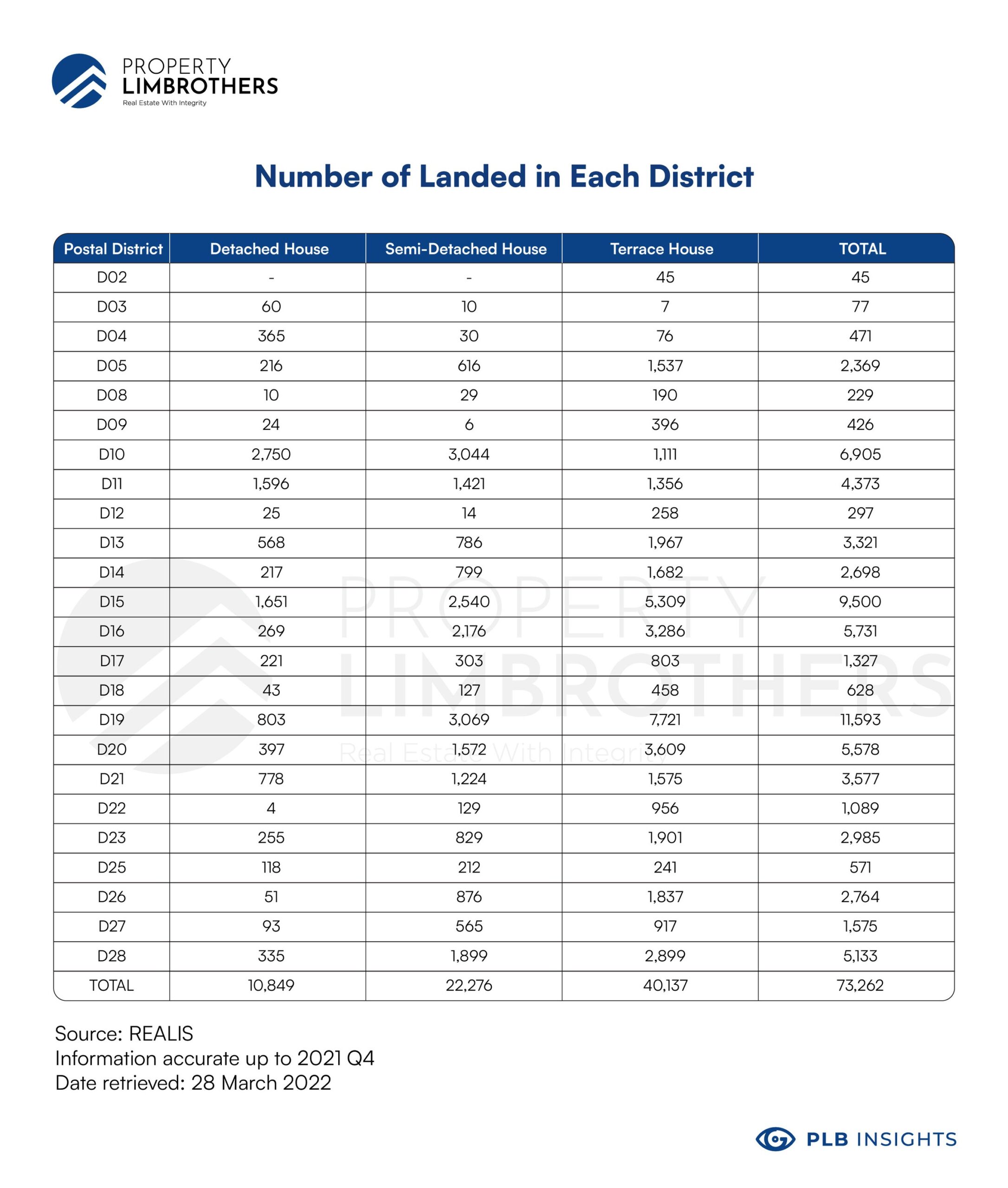

Owning a pure landed property in land-scarce Singapore, which refers to both freehold and 999-years in nature, is considered a dream to many. With only about 73,000 landed properties currently available in the market, which makes up about 4.9% of the entire housing supply, this unequivocally makes them a scarce and valuable class asset of real estate in Singapore.

Hence, there is no surprise why pure landed properties are highly sought-after. While we recognise its high demand, it is paramount, as a landed buyer, to understand and identify exactly which kind of landed home is fitting based on your preferences and motivation.

In this article, we categorise the whole landed landscape into four main, distinctive segments and deduce that brand new landed properties drive the entry prices of the landed market upwards. We also take a broader perspective on the pricing trends of the landed market to identify the Chasm Gap between landed and non-landed private residential property prices and evaluate why landed properties will become a class of its own. We also analyse what this means for you as a landed buyer and share some perspectives to consider when searching for your next landed home.

The 4 Different Segments of the Landed Market

Segment 1: Older, Suitable for Rebuild

This landed segment refers to landed properties that are predominantly old, single-storey structures aged about 30 years or more. These landed homes usually are meant for a full-on rebuilding project to maximise the potential plot ratio of the total land size. Essentially, you are purchasing the land as a blank canvas to tear down, rebuild and redesign your home based on your preferences and your very own lifestyle. This is, of course, following the requirements based on the envelope control guidelines and the URA landed zonings. The whole rebuilding process may take about 18 to 24 months, so if you have a longer time horizon and are not in a rush to move in, this will undoubtedly be a suitable option. Take note that due to the COVID-19 pandemic pushing up construction costs in terms of both manpower and resources, one can expect rebuilding costs to rise to about $350 to $450 PSF for Terraces and Semi-Detached homes, and about $400 to $500 PSF for Detached homes based on land builders’ advice and consensus. So, do be prepared to expect your total rebuilding costs to be in the range of about $1.5M to $2M, depending on the type of landed home and the built-up size.

Segment 2: 20 to 30 years old, Suitable for A&A Works

Landed homes in this segment are generally about 20 to 30 years old. They still have a good, solid building structure, perfect for some Addition and Alteration (A&A) or major renovation works once you buy them over. Based on builders’ estimates, you can expect about $200 to $250 PSF of A&A costs, depending on the type of landed home and the additional built-up size, which can tally to about $800K to $1M worth of A&A works. These works may require about 6 to 16 months of waiting time before you can fully move in.

Segment 3: Newer Landed Properties, Suitable for Minor Renovation Works

The third segment is, by and large, newer landed homes developed within the past 10 to 15 years. These homes are predominantly built-up to their maximum potential floor size and are relatively well-maintained.

Renovations here include electrical wiring, plumbing work, flooring and adding more storage space as well. As with the increase in material and shipping costs, you can expect the total renovations to cost about $200K to $300K, or at about $160 PSF, to freshen up the entire home. It could also exceed this range depending on the extensiveness of the renovations done to suit your taste and preferences. These landed homes are suitable for buyers who require a shorter time horizon to move in, as the renovations will take about 6 to 9 months, depending on the amount of work done.

Segment 4: Brand New Landed Redeveloped by Developers

The fourth and final segment is the brand new types of landed homes that were previously old land acquired by developers which were then rebuilt and sold out in the market. These newly built homes save lots of time and effort because you can purchase and move in right away with no renovations needed. Of course, with a brand new product, you are paying a more premium price for a ready-made home that saves you the opportunity cost of time.

You can watch our PLB Landed Home Tours to understand how we utilise the segmentation of landed properties in our pricing analysis.

Brand New Landed Properties (Segment 4) are the Main Drivers that Lead the Market Prices Upwards

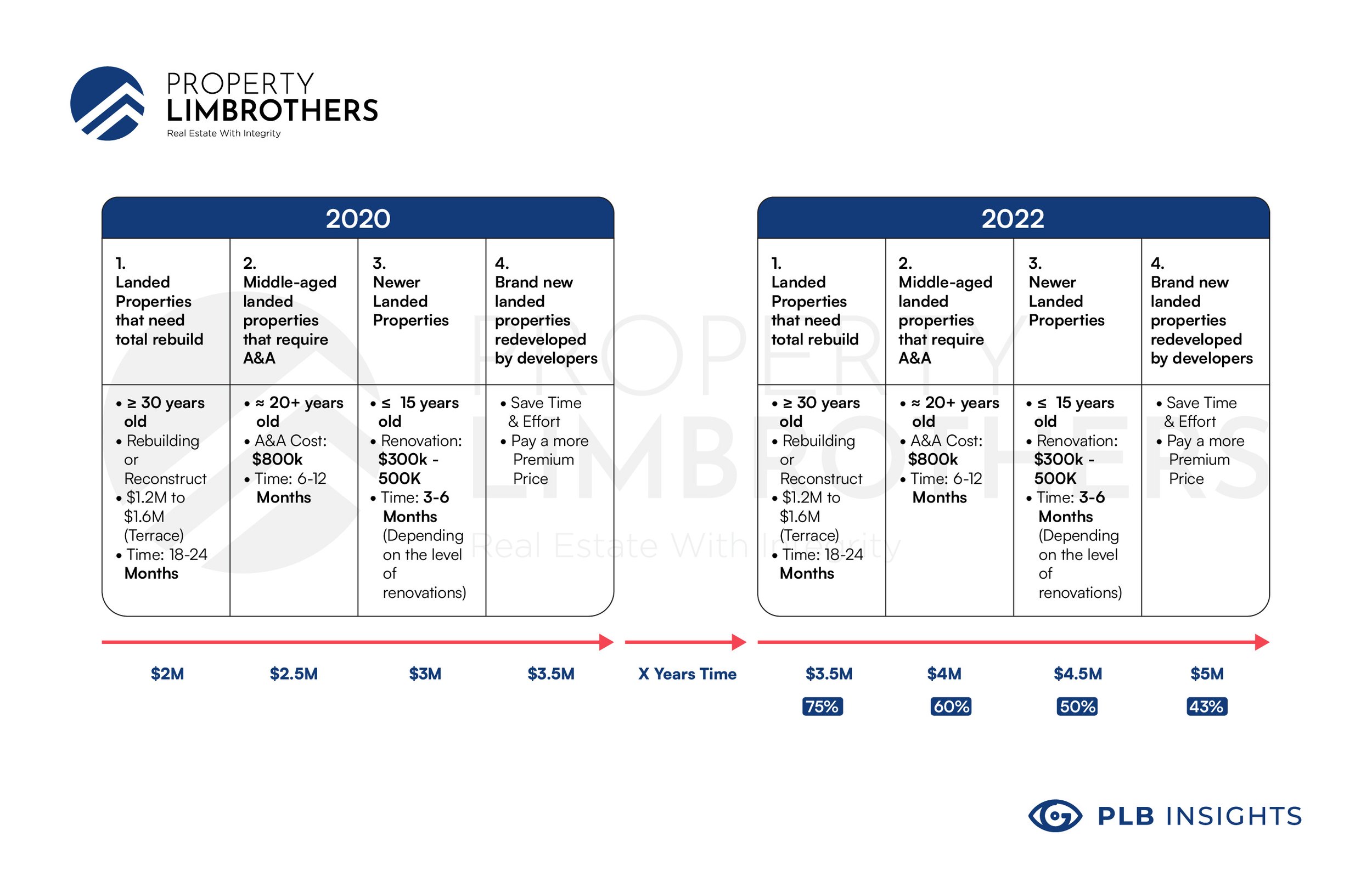

Unquestionably, we acknowledge that there are several distinctive micro-segments within the landed market itself with varying benchmark entry prices. For instance, different streets within the same district have different pricing variations. However, to examine the benchmark pricing mechanism of each segment, let’s compare the benchmark quantum prices for each of the four segments using the current average asking prices on the ground.

The table above shows the entry pricing of the pure inter-terraces within Districts 14, 15 and 19 as of Q1 2020 and Q1 2022 respectively. As you can see, landed entry prices have escalated over the past two years. Looking at this steep increase in value appreciation, which segment is driving the landed market upwards?

The fundamental trend to note here is that brand new landed properties (Segment 4) are the main drivers that lead the market upwards. Developers acquire old landed properties and undertake rebuilding projects to redevelop them into brand new landed homes before releasing them into the market in 18 to 24 months’ time. This will cause the current benchmark pricing to push upwards, considering their returns margin on top of their breakeven pricing and rising construction costs. This segment then establishes a new benchmark pricing, resulting in a ripple effect where the 3rd, 2nd and 1st segments will also follow suit upwards, thereby inducing a new, higher benchmark entry pricing for each respective segment.

Perspectives to Consider to Make Sense of the Segments of the Landed Market

Now that we have distinguished the four different segments and their benchmark pricing within the landed properties, there are a few balanced perspectives for you to consider when outlining your entry and future exit strategies.

If you are looking for something that is relatively more palatable in terms of its percentage increment over the past two years, you may consider going for the brand new types of landed homes (Segment 4). The benchmark pricing for brand new landed homes has generally increased by 43% from Q1 2020 to Q1 2022, the lowest percentage increment of the four segments, while older land meant for a rebuild (Segment 1) has surged by 75%. From this perspective, you will still be getting into a brand new inter-terrace that is fully rebuilt for you and has no waiting time to move in with your family, compared to waiting for 18 to 24 months should you purchase old land to rebuild. Hence, if going for a brand new landed with a 43% increment in value is a more comfortable approach than going for an old landed that has greatly appreciated by 75%, then perhaps this is one perspective you may want to consider.

Suppose you have a longer time horizon and substantial holding power, and you are keen on rebuilding an older land (Segment 1) even if it has seen a considerable 75% increment. You can choose to enter the landed market first and hold for a year or two when prices have further appreciated before considering an equity term loan or a construction loan to rebuild your new home. You may want to explore this perspective because the entry price is the lowest, and so you will be getting into the pure landed market at the lowest quantum of $3.5M. This is also applicable for Segment 2 landed properties that require A&A works. One thing to note is that factoring in your construction costs of about $1.2M to $1.5M for an inter-terrace rebuild, your total cost might eventually add up to an overall amount similar or more as compared to purchasing a brand new one initially.

Consider Your Opportunity Cost of Time and Rebuilding Costs

To decide which perspective is best suited for you boils down to your opportunity cost of time and whether you have a long enough time horizon to invest into rebuilding your own dream home. Otherwise, it might make more sense to move in immediately into a brand new one. Another factor to consider is the surge in construction costs due to the manpower crunch and soaring raw material prices caused by the global pandemic, as well as rising inflation rates. As construction costs increase, this may swell your overall rebuilding costs past the point where you might eventually be spending more to reconstruct your own home as compared to buying a ready-made brand new one.

The Chasm Gap of Landed versus Non-Landed Private Residential Property Prices

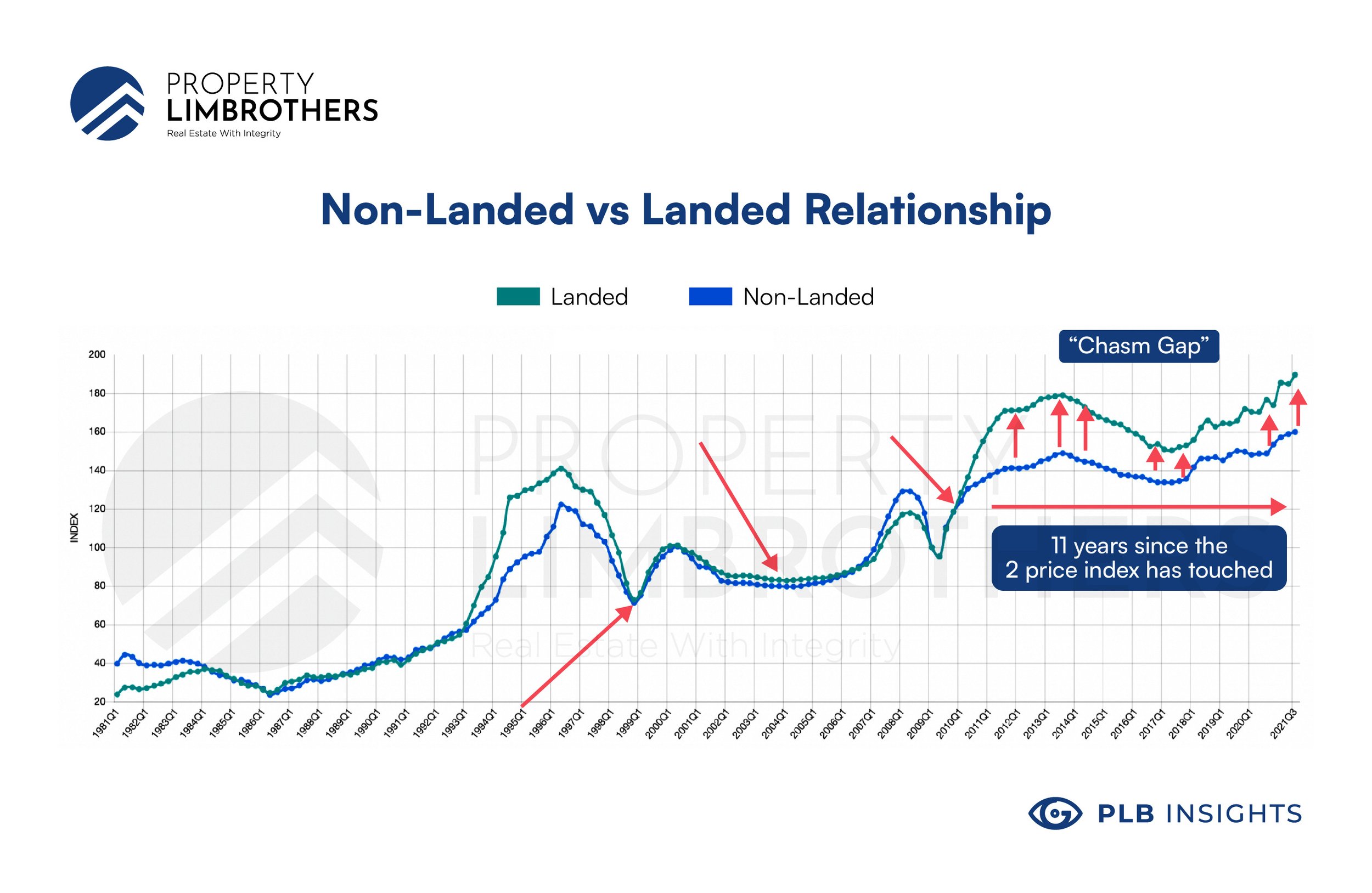

Let’s delve deeper into the Property Price Index of both the landed and non-landed prices in the private residential market over the past decade to examine how the Chasm Gap reinforces the notion that landed properties will become a class of its own, and what this then means for you as a landed buyer.

Before cooling measures were first introduced in 2010, landed and non-landed prices generally moved in tandem. Since then, however, we have noticed that landed prices have started to deviate from non-landed prices, creating a gap. This divergence between the price movements of both the landed and non-landed prices is what we refer to as the Chasm Gap. In truth, this gap has consistently prevailed for the past eleven years and is showing no signs of diminishing.

You can read our previous article where we discuss the Chasm Gap in detail here.

Limited Availability of Landed Stock

For the past 26 years, the available landed stock has been hovering around 73,000 to 75,000 and is barely increasing. The entire supply of landed homes in total is inherently still sitting on the same amount of land plot sizes across Singapore, no matter how many subdivisions of land happen. Landed stock is limited because land reserved by the government for pure landed developments is scarce. Instead, the government might release specific plots of land, albeit rarely, for strata landed or 99-year landed projects such as the sale of Lorong 1 Realty Park in 2017 and the upcoming Pollen Collection, a 99-year leasehold development with 132 landed homes. Besides the landbanks of a few major developers, most of the brand new landed properties come from developers that acquired old houses, subdivided the land and rebuilt brand new ones. Therefore, developers’ new batches of landed enclaves are rare, while most landed transactions occur in the resale market. This lack of new supply will likely persist in 2022, so be prepared to pay a higher premium for brand new landed homes due to higher labour and raw material costs.

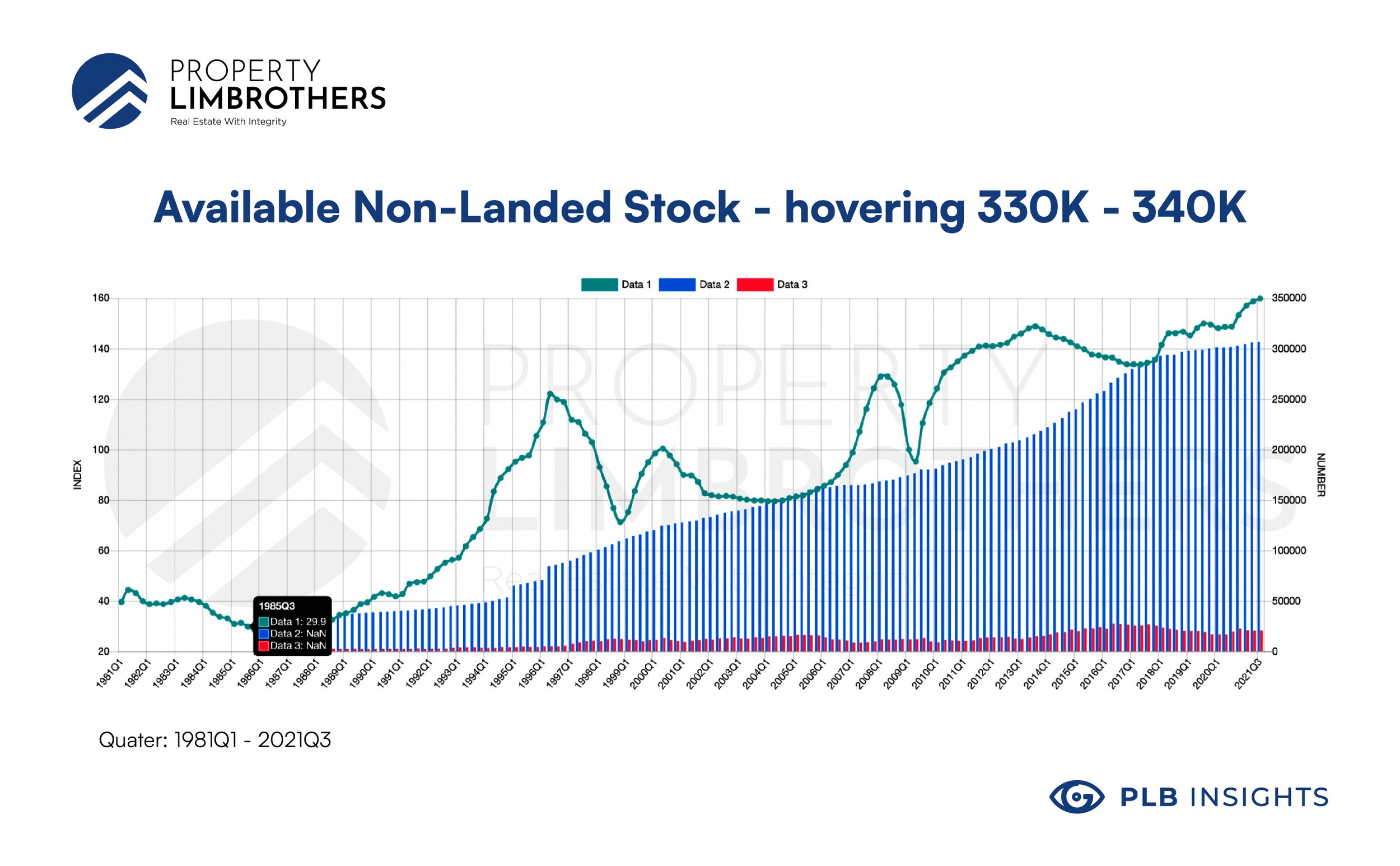

Conversely, the available non-landed stock, which refers to private condominiums and apartments, is currently hovering at about 330,000 to 340,000. It continues to increase at a much more stable rate than landed supply. With each round of Government Land Sales (GLS) and en blocs, more units will be developed on the same land plot size. In particular, GLS land is released sparingly, as seen in its controlled supply over the past 2 to 3 years. Nonetheless, there have been new launches almost every quarter. This difference in supply is a critical factor that leads to the chasm gap between the landed and non-landed prices.

In contrast to private residential properties, the HDB market has the most extensive available stock, with almost 1.2 million HDB apartments. And with a further 23,000 more Build-To-Order (BTO) apartments set to be launched each year in 2022 and 2023, the stock for HDB properties is rapidly increasing to meet the strong demand for public housing.

Changing Market Conditions Further Reduce Landed Stock

Additionally, changing market conditions further reduces the supply of available landed properties. As landed prices rise and the landed market strengthens over the past few years, current landed owners might not be motivated to sell because they expect prices to appreciate further. With a strong holding power, owners will be less likely to negotiate on the asking prices since they expect a higher value from the surge in demand for landed homes. Even if they were to sell, they are likely to continue staying within the landed market unless they are, for instance, approaching retirement and are looking to cash out and right size down to a single-level residential unit.

Moreover, as the current global pandemic continues to disrupt the global supply chain and cause construction costs to increase, this creates a higher barrier to entry into the landed market. It becomes more prohibitive and costly to build landed properties, and thus, as developers release brand new landed supply back into the market, they will be priced at a higher premium due to increased construction costs.

So, what does this mean for landed prices moving forward? Two possible outcomes may happen: Firstly, the non-landed price forms a benchmark support level where the landed price does not fall below it. Second, land prices may push higher and widen the gap even further, thereby eventually solidifying landed properties as a class of its own.

As the Chasm Gap Widens, Landed Properties Become a Class of Its Own

With the Chasm Gap likely to persist in the next 5 to 10 years, it provides a favourable opportunity for landed buyers to capitalise on the current landed market. As landed prices continue to appreciate, this leads to a more significant deviation away from non-landed prices, further widening the Chasm Gap. Therefore, as the Chasm Gap widens, this will reinforce landed properties to become a class of its own because they now become a better store of value.

Using Non-Landed Prices as the Base Support Level for Landed Prices

If you have the buying power to purchase a landed property, we recommend monitoring the support level of the non-landed price trend (i.e. the blue line). If the non-landed price trend is increasing at a stable pace, then landed prices might continue to go on a gradual upward trend as well.

In the wake of the latest cooling measures and rising interest rates, non-landed prices have pulled back slightly by 0.6% in Q1 2022. However, with the easing in safe management measures and the reopening of Singapore’s borders, we can expect a boost in demand for private residential properties. In addition, with the rising inflation and construction costs, we can anticipate new launch prices to remain firm as more projects launch for sale. Similar to the landed market, new launches are the drivers of the non-landed market, so we can expect non-landed prices to hold steady and possibly increase gradually.

Therefore, we can foresee demand for private homes from genuine homebuyers to remain strong, providing the support for landed and non-landed prices to continue their gradual upward trend in 2022.

Conclusion

Navigating through the landed landscape might seem disconcerting, and you might feel uncertain of making the right decisions. Ultimately, it is most important to do your due diligence and future-proof your exit. Consider your opportunity costs and work out a feasible timeline that you are comfortable with.

If you are searching for your next landed home or need any other real estate advice, feel free to reach out to us here at PropertyLimBrothers and we will be happy to assist you.

Our PLB Research and Data Analytics Team has also developed a new analytics tool with live-feed data from URA Realis to help you make sense of the broad-based market trends using the Property Transaction Volume and Property Price Indexes. This tool will be available on our PropertyLimBrothers website soon, so stay tuned.