As a foreigner in Singapore, the decision of whether to buy or rent a property can be a complex one. There are a number of factors to consider when making this choice, including the cost of living in Singapore, the cost of purchasing or renting a property, and the length of your stay in the country. Whether you are an expat looking to live in Singapore for a few years or an individual looking to invest in property, it is important to weigh the pros and cons of each option to determine which is the best fit for your needs. In this article, we will take a closer look at the factors that you should consider when making your decision, as well as the benefits and drawbacks of buying versus renting a property in Singapore as a foreigner.

It is also important to keep in mind the regulations for foreign ownership of property in Singapore. There are restrictions on the types of properties that foreign individuals and corporations can purchase, as well as restrictions on the amount of property that can be owned by a single foreign entity. In addition, there are additional taxes and fees that must be paid when purchasing property in Singapore as a foreigner. These regulations can significantly impact the cost of buying property in Singapore and should be carefully considered when making your decision. Whether you are looking to purchase a property for personal use or for investment purposes, it is essential to thoroughly research the regulations and requirements for foreign ownership in Singapore before making a final decision.

This article provides a comprehensive overview of the pros and cons of both renting and buying property in Singapore for foreigners. This guide breaks down the key factors that impact the decision, including cost, flexibility, tax implications, and long-term financial planning. By examining each of these factors in detail, the article provides a clear and informative guide for anyone who is trying to decide whether to rent or buy property in Singapore as a foreigner. Whether you are an expat looking to live in Singapore for a few years or an individual looking to invest in property, this guide will help you make an informed decision that is best for your unique situation and needs.

Breaking down the Rent or Buy Decision

1. Cost

The cost of living in Singapore is high, and the cost of purchasing or renting a property is no exception. When considering the cost of renting, it is important to factor in monthly rent, utility bills, and other associated costs such as furniture rental or parking fees. On the other hand, the cost of buying a property includes the down payment, monthly mortgage payments, property taxes, and maintenance costs such as repairs and renovations. It is also important to consider the costs associated with purchasing a property in Singapore, such as stamp duty, legal fees, and valuation fees.

While the monthly cost of renting may be lower initially, it is important to keep in mind that renting does not provide the opportunity for building equity or taking advantage of long-term appreciation in property values. On the other hand, owning a property allows you to build equity over time, but requires a substantial initial investment in the form of a down payment. It is important to carefully consider your budget and financial situation when making your decision.

2. Flexibility

Renting provides a higher degree of flexibility compared to owning a property. If you are an expat who may be moving to a different country in the near future, renting allows you to move without the hassle of selling a property. Additionally, if you decide to move to a different location within Singapore, it is much easier to find a new rental property than it is to sell your current home and purchase another. This can be especially useful for individuals who are uncertain about the length of their stay in Singapore, as it allows for a more flexible living arrangement.

However, it is important to keep in mind that rental agreements typically have a minimum term, and breaking a lease early can result in significant financial penalties. Additionally, rental prices can increase over time, which may impact your monthly budget. When considering the flexibility of renting, it is important to weigh the benefits against the potential drawbacks and make an informed decision.

3. Tax implications and Regulations

When deciding whether to rent or buy property in Singapore, it is important to consider the tax implications of each option. Foreign individuals and corporations are subject to additional taxes and fees when purchasing property in Singapore, including stamp duty and the additional buyer’s stamp duty (ABSD). While it typically depends on the number of properties you own and your residency status, the ABSD for foreign buyers of property in Singapore is 30% of the property purchase price. However, there are ABSD remissions for Nationals and Permanent Residents of Iceland, Liechtenstein, Norway or Switzerland, as well as Nationals of the United States of America.

In addition to the ABSD, foreign buyers may also be subject to the seller’s stamp duty (SSD), which is a tax imposed on the sale of property within a specified period after the purchase date. The SSD ranges from 4-12% of the selling price and is designed to discourage speculative buying and selling of property. The SSD is not applicable after 3 years from purchase. In recent years, the government of Singapore has implemented a number of cooling measures aimed at reducing the demand for property and controlling price growth. These measures include restrictions on loan-to-value ratios, higher stamp duties, and higher property taxes. Note that there are strict regulations on the foreign ownership of landed property in Singapore, and prior approval from SLA is required. There are also strict prohibitions from asking Singaporeans to purchase a property in your interest, or to set up a trust to do so.

4. Long-term Financial Planning

Finally, it is important to consider the long-term financial implications of your decision. Renting provides no opportunity for building equity or taking advantage of long-term appreciation in property values. On the other hand, purchasing a property allows you to build equity and potentially see a return on your investment through appreciation in property values over time. Additionally, owning a property can provide a sense of stability and security that renting may not offer.

It is important to consider your long-term financial goals when making your decision, and to weigh the benefits and drawbacks of both options in light of your unique financial situation and goals. Whether you are an expat looking to live in Singapore for a few years or an individual looking to invest in property, it is essential to thoroughly research the regulations and requirements for foreign ownership in Singapore and make an informed decision that is best for your unique situation and needs.

The Case for Renting

One of the key advantages of renting property in Singapore for foreigners is the flexibility it offers. Renting eliminates the commitment to long-term ownership, allowing individuals to move from one property to another with relative ease. This can be particularly important for foreigners who may not have a clear understanding of their long-term residency plans in Singapore or who may need to relocate frequently for work or other reasons. By renting, individuals are not locked into a specific property or location and can adjust their housing arrangements as their needs change.

Another advantage of renting property in Singapore is affordability. Renting is often more affordable than purchasing, especially for foreigners who may be subject to additional taxes and fees when buying property. Renting eliminates the need for a large down payment and ongoing maintenance costs, making it a more accessible option for those who are not yet in a financial position to buy. This can allow individuals to save more of their income and direct their financial resources towards other investments or purchases.

When renting property, the responsibility for maintenance and repairs falls on the landlord, not the tenant. This can provide peace of mind for foreigners who may not be familiar with the local property market and who may not have the knowledge or experience to handle property maintenance and repairs. Renting also eliminates the need to worry about property insurance, which is typically the responsibility of the landlord. This can be a significant relief for foreigners who are new to Singapore and who may not be familiar with the insurance options available in the market.

Finally, renting property in Singapore can provide individuals with an opportunity to save. By eliminating the need for a substantial down payment and ongoing costs associated with homeownership, individuals are able to save more of their income. This can be particularly attractive for foreigners who are looking to save for future investments or purchases. Additionally, renting can also provide individuals with the opportunity to invest their money in other asset classes, which are more liquid and have the potential to offer higher returns over time.

Renting property in Singapore offers a number of advantages for foreigners, including greater flexibility, affordability, reduced responsibility, and the opportunity to save. While purchasing property can also be a viable option, renting provides a more accessible and low-commitment option for those who are not yet in a financial or residency position to buy. By considering the benefits of renting, individuals can make an informed decision about their housing options in Singapore.

The Case for Buying

One of the biggest advantages of buying property in Singapore is that it provides a long-term investment that can yield stable and appreciable returns. For foreigners who plan to reside in the country for an extended period of time, buying a property can be a wise financial decision. The property market in Singapore has a solid track record of steady growth, and this trend is expected to continue in the future. This stability and growth make buying a property in Singapore an attractive investment option for foreigners.

In addition to being a long-term investment, owning property in Singapore can also provide tax benefits. Foreigners who purchase property in the country may be eligible for deductions for mortgage interest and property tax, which can significantly reduce the cost of homeownership. Moreover, owning property in Singapore can also provide individuals with the opportunity to take advantage of favourable tax laws, such as capital gains tax exemptions and property tax rebates, further increasing their return on investment.

In addition to these benefits, it’s important to note that there are ABSD remissions for certain foreign nationals. Nationals and Permanent Residents of Iceland, Liechtenstein, Norway, or Switzerland, as well as Nationals of the United States of America, may be eligible for ABSD remissions when purchasing property in Singapore. This can significantly reduce the upfront costs associated with buying property and make it a more attractive option for these individuals.

By taking advantage of these remissions, foreign nationals from these countries can enjoy many of the benefits of owning property in Singapore, including a long-term investment, tax benefits, personalisation, pride of ownership, and greater flexibility and control, without incurring the full ABSD costs. This makes buying property in Singapore a more viable option for these individuals and can help to ensure that they make a smart financial decision.

One of the key benefits of buying property is the ability to personalise living spaces to suit individual preferences and tastes. Unlike renting, where individuals are subject to restrictions on modifications and renovations, homeowners have the freedom to make changes to their property. For foreigners who have relocated to Singapore and are looking to create a comfortable and familiar living environment, this can be particularly important. Whether it’s customising cabinetry, adding a home office, or undergoing a complete renovation, owning a property provides individuals with the freedom to make their living space truly their own.

Owning property in Singapore can also provide a sense of pride and accomplishment. For many people, owning property is a symbol of stability, success, and financial security, and can be a source of pride and satisfaction. Furthermore, owning a property in Singapore can also provide a sense of belonging and roots, which can be especially important for those who have relocated from another country.

Finally, purchasing property in Singapore provides individuals with greater flexibility and control over their living situation. With the ability to choose the location, size, and type of property, as well as the option to rent it out or sell it as needed, individuals who buy property in Singapore can make decisions that suit their specific needs and circumstances. This added control over their living situation provides individuals with the freedom to tailor their housing arrangements to meet their unique needs and goals.

In conclusion, buying property in Singapore can offer numerous benefits for foreigners, including a long-term investment, tax benefits, personalisation, pride of ownership, and greater flexibility and control. With its strong property market, favourable tax laws, and high quality of life, Singapore is an attractive destination for individuals who are looking to purchase property and secure their financial future. By considering these benefits, foreigners can make an informed decision about their housing options in Singapore.

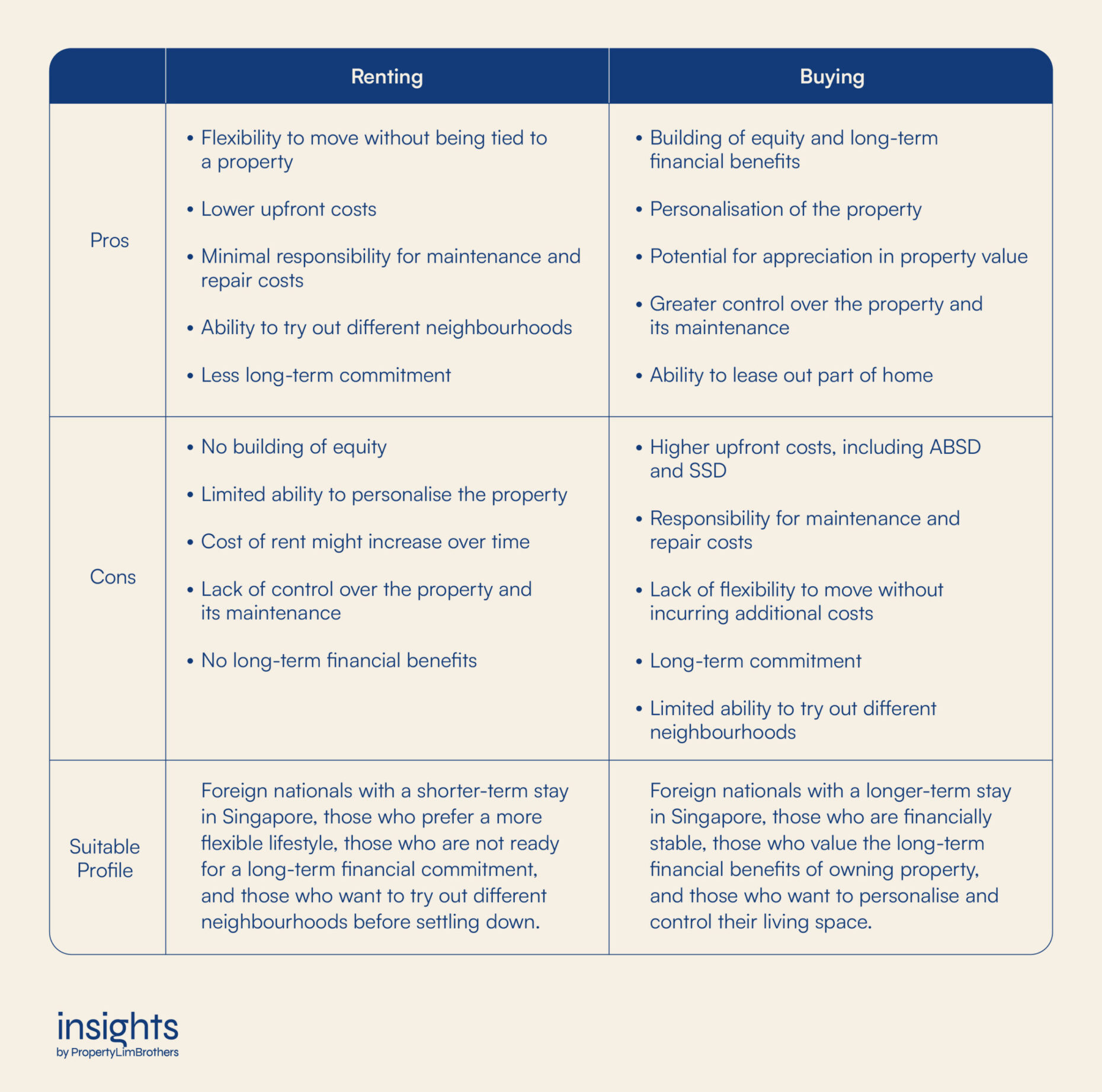

Overall Pros and Cons of Renting vs Buying

Making the decision to rent or buy property in Singapore as a foreigner can be a complex and challenging process. To help simplify the decision-making process, we have created a table that outlines the pros and cons of both options. The table provides a comprehensive comparison of the key benefits and drawbacks of each option, as well as the customer profile that each option is best suited for. By considering both the advantages and disadvantages of renting and buying, you can make an informed decision that aligns with your individual needs and circumstances.

Closing Thoughts

In conclusion, whether to rent or buy property in Singapore as a foreigner is a complex decision that requires careful consideration of several factors. While renting offers the flexibility and ease of not having to worry about the costs and responsibilities of property ownership, buying offers the long-term financial benefits of building equity and securing a valuable asset.

Ultimately, the decision between renting and buying will depend on individual circumstances and priorities, such as financial stability, career plans, and lifestyle preferences. It is advisable to seek advice from a financial advisor or property professional to gain a better understanding of the potential costs, benefits, and risks associated with each option.

This article aims to provide a comprehensive guide to help foreign nationals make an informed decision on whether to rent or buy property in Singapore. We hope that by considering the arguments presented here, foreign nationals will be better equipped to make a decision that meets their needs and helps them achieve their financial and lifestyle goals in Singapore.

If you’re still unsure about whether renting or buying is the right choice for you, we invite you to attend one of our upcoming webinars on this topic. Our expert property advisors will be on hand to answer your questions and provide tailored advice based on your individual circumstances.

Additionally, you can access our latest Q4 report on the Singapore property market, which includes insights into the current market trends and the impact of various government policies. By downloading this report, you will have access to valuable information that can help inform your property decision.

Don’t let the process of renting or buying property in Singapore be a daunting one. With the right information and support, you can make a confident, informed decision that will put you on the path to achieving your financial and lifestyle goals in this vibrant, cosmopolitan city.