Singapore’s real estate market has been known for its resilience and stability, but with the upcoming redevelopment of Paya Lebar Airbase (PLAB), the equilibrium in the market is likely to be disrupted. The government’s decision to transform the former military airbase into a commercial and residential hub will definitely spark a flurry of interest from developers and investors, but what does this mean for the future of Singapore’s real estate market?

In this opinion piece, we will explore the potential impact of this massive supply shock on the market equilibrium and the various factors that could shape the future of real estate in Singapore. We will cover the information provided in the URA’s Long Term Plan Review and how the future development of the PLAB estate will impact the rest of Singapore.

What are the current plans for PLAB?

The relocation of the airbase is set to begin in the 2030s, which is around 7 years from now. This is a considerable amount of time, and much could change in terms of the plans the government has for the PLAB estate. For a new estate of this size, it would probably take a few years to develop the infrastructure into and around PLAB. This refers to the infrastructure that is required to turn the military base into an estate with vibrant commercial, retail, and residential functions.

Transportation infrastructure, power lines, water and sewage systems, are examples of the kinds of infrastructure that would need to be in place before we even think about our HDBs and Condos. Not to mention the relocation of military assets, we can only speculate how long it will take to turn PLAB into a seedbed for real estate development.

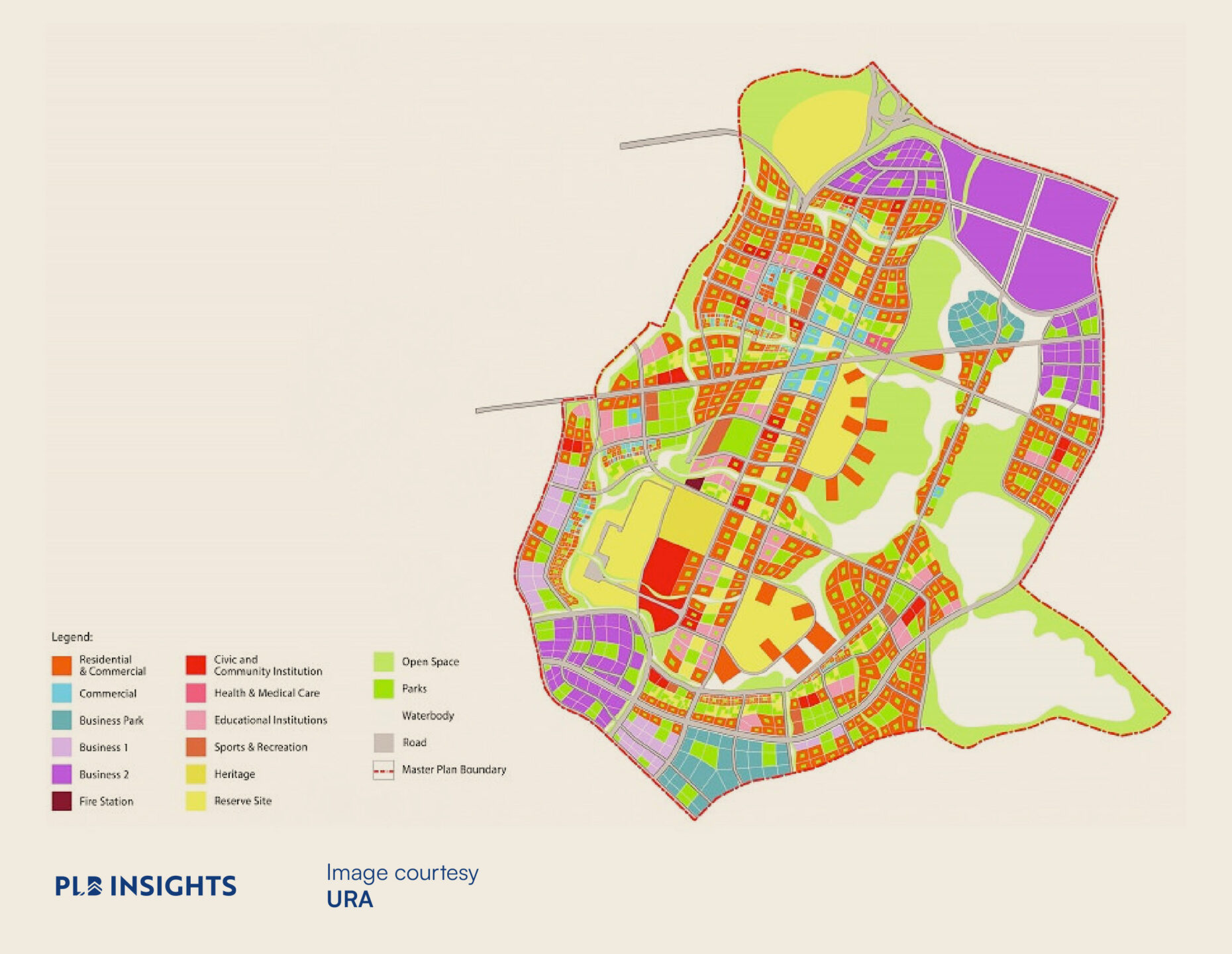

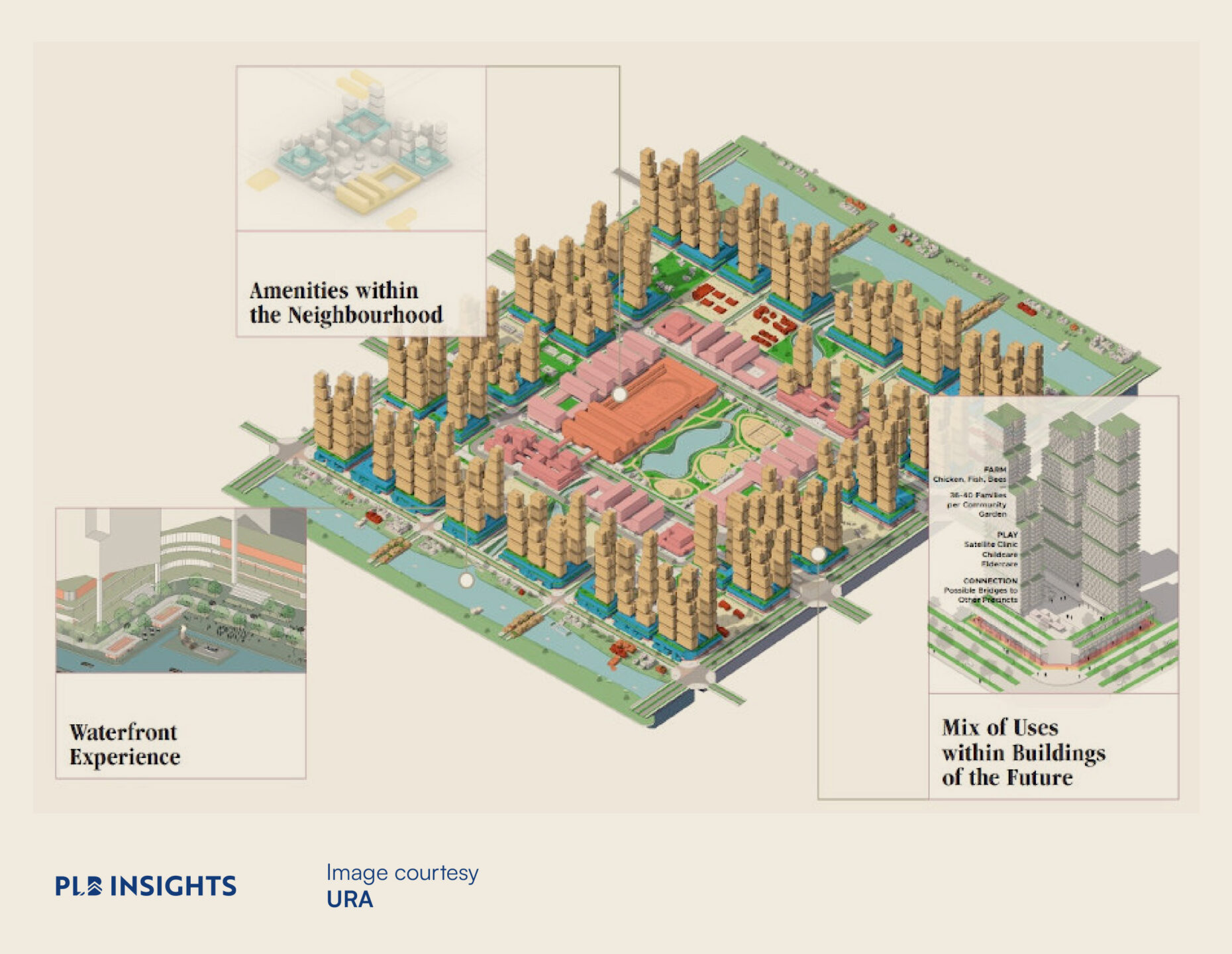

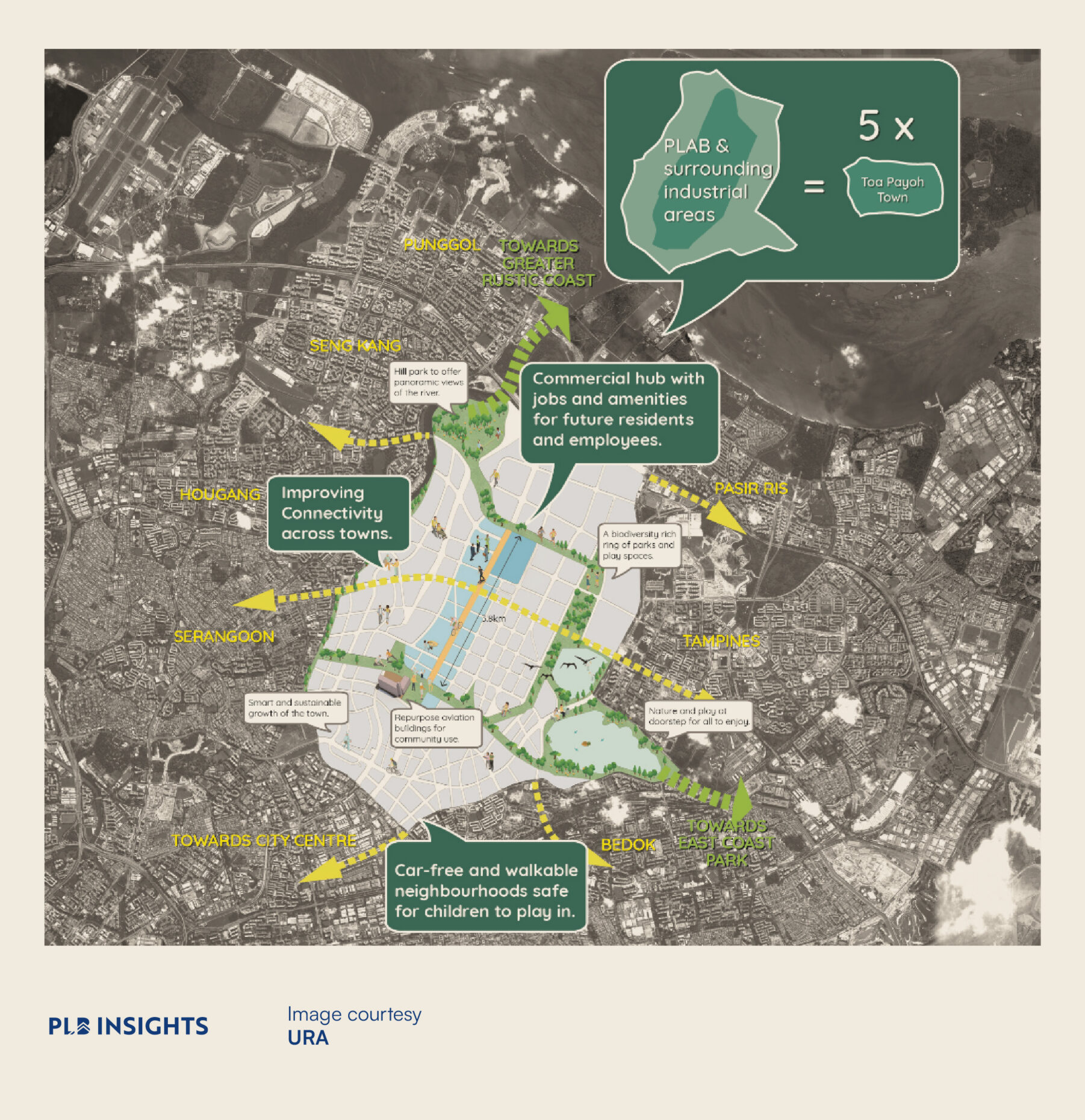

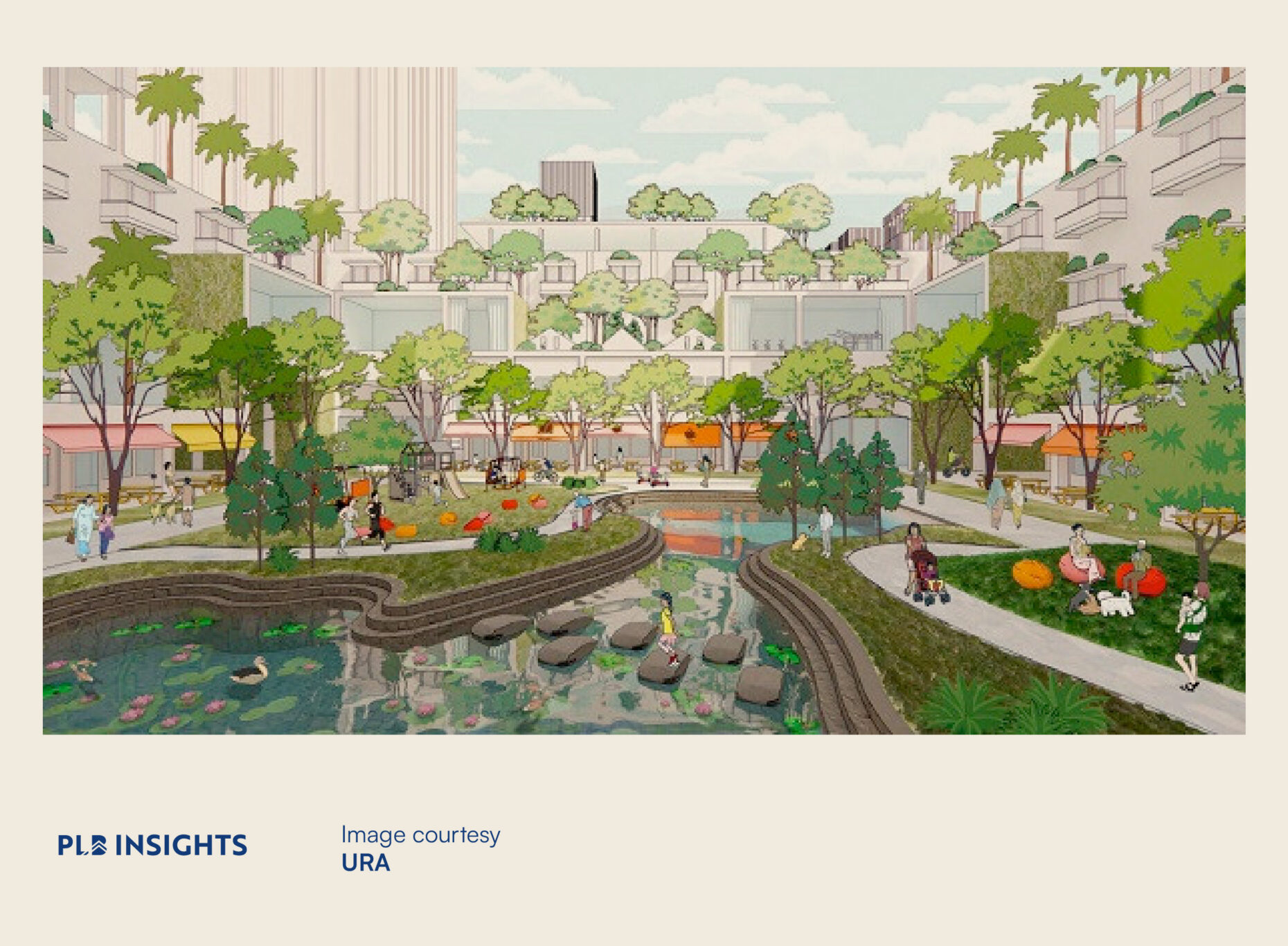

Assuming that it would take around 3 to 5 years to complete the infrastructure required for the new estate and another 3 to 5 years to actually construct the commercial, retail, and residential real estate of PLAB, we might only get to see the estate come to fruition in the late 2030s or early 2040s. This long wait is not without its rewards. The new estate (as of now) is promised to have a vibrant community, work, and living conditions. The current draft plans revolve around having a strong balance of natural spaces, along with mixed-use residential spaces and business & industrial parks along the fringes.

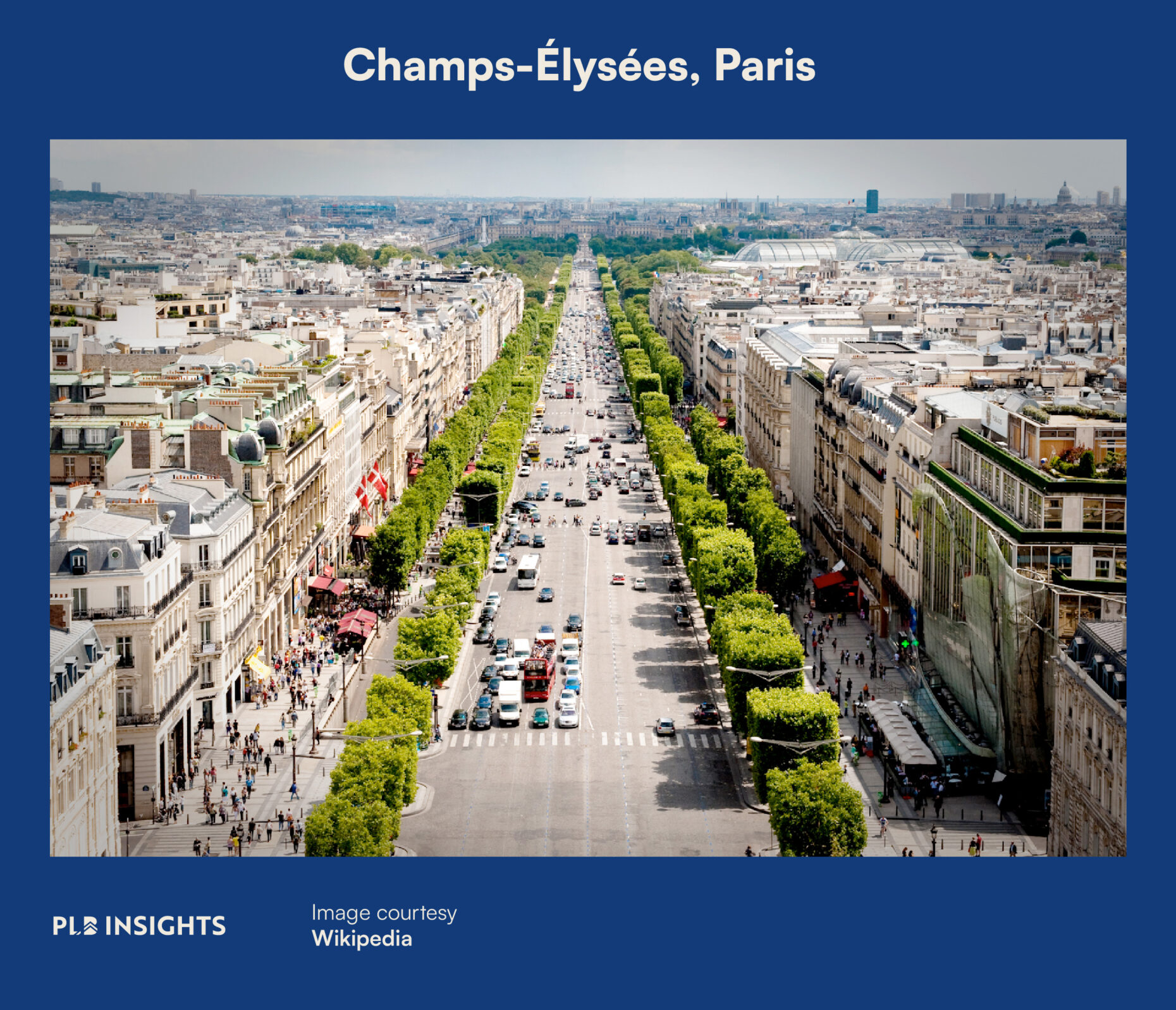

Vital amenities like educational institutions, fire stations, heritage sites, and medical facilities, etc are also planned to give PLAB the design and feel of a city from the future (as it should be). The long boulevard design might have high-rise mixed-use residential spaces, giving the central part of PLAB a feeling like Champs-Élysées (Paris), Broadway (New York) or even Las Vegas Boulevard. Needless to say, a high-rise residential space along the boulevard would be easily deemed as prime real estate.

Some designs found on the URA site also feature a look that resembles Central Park in New York. PLAB does seem to have its sights on embodying compelling aesthetics, modernity, and livability as key characteristics that would define the estate. The boulevard and central park designs are visually appealing, and would yield residences with stunning views should it turn out as imagined. The mixed-use nature of such residences would also be a boon in pushing up demand.

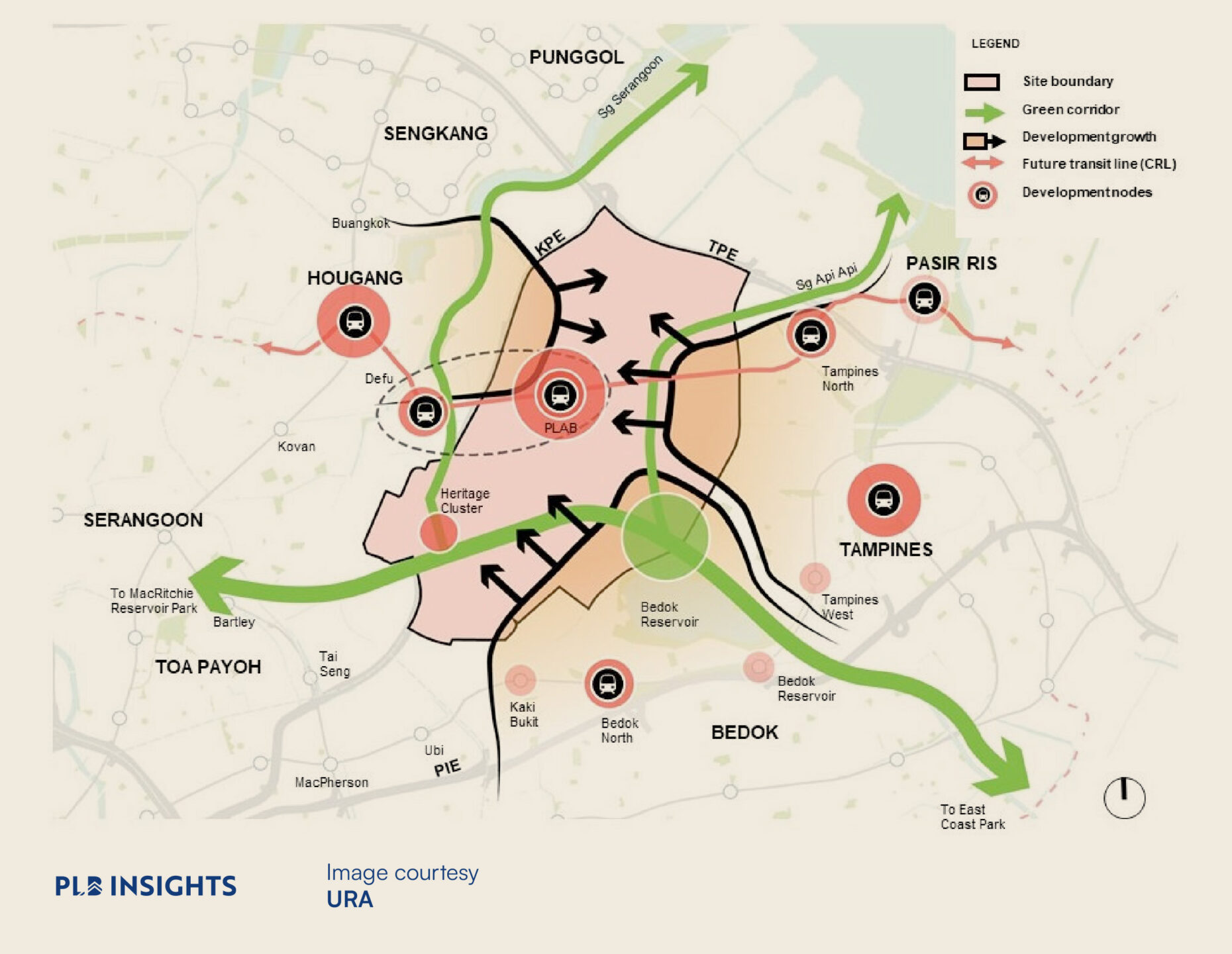

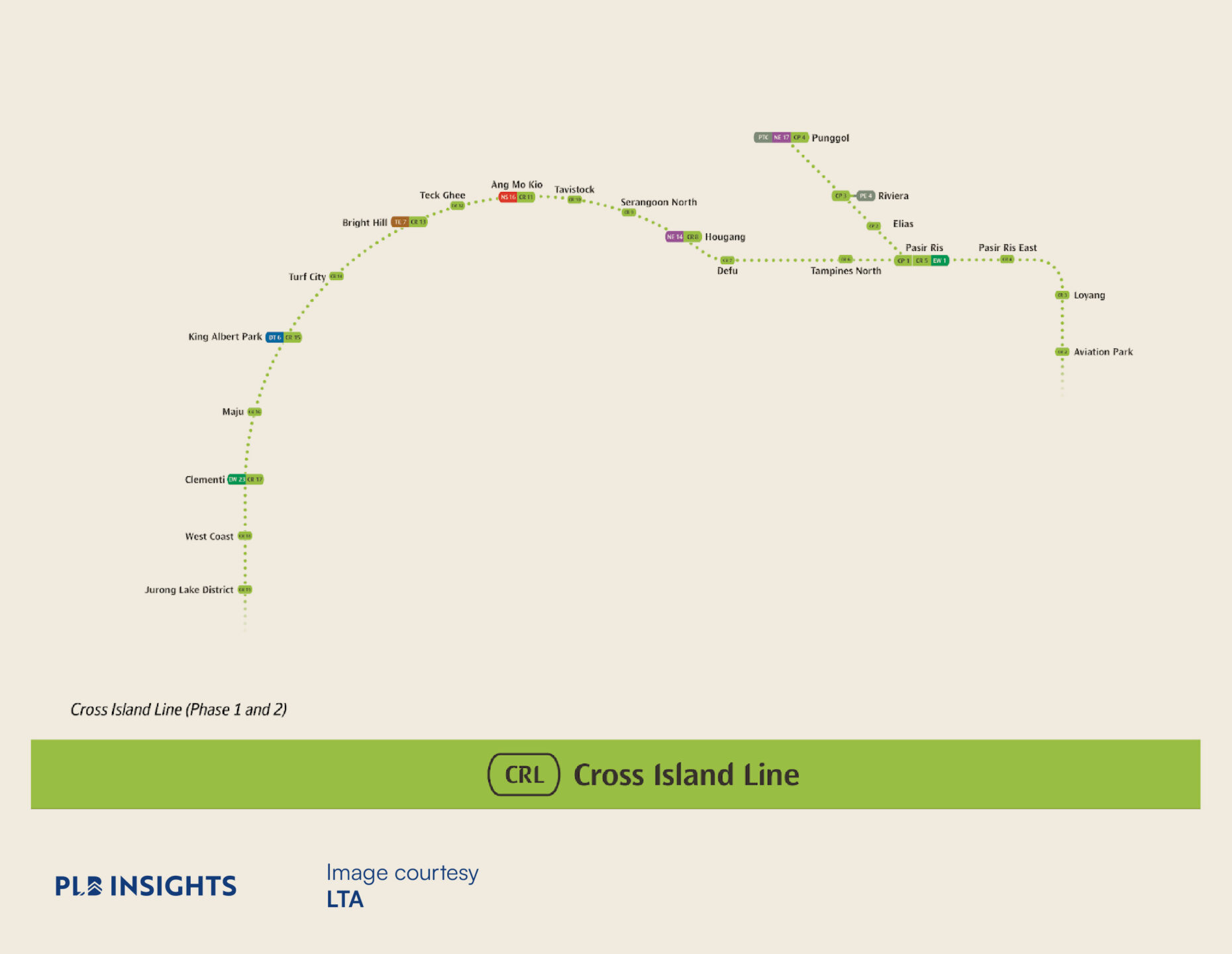

Having excellent connectivity is going to be a necessity for PLAB to be an in-demand estate. The future transit line demarcated on the map below refers to the upcoming Cross Island Line (CRL) which will be cutting through the PLAB estate. There is a planned development node between Defu and Tampines North MRT Stations on the CRL. An important note here is that the CRL is planned to complete phase 2 by 2032, which is near the start of the PLAB development. It might take a much longer time (late 2030s, early 2040s) before we see new additions to the CRL as PLAB is not reflected in the MRT map as of now.

There is a large focus on green corridors connecting the PLAB estate to Punggol, Pasir Ris, Bedok Reservoir, MacRitchie Reservoir Park and East Coast Park. This would give PLAB a connectivity boost as well as great outdoor options for residents of this new estate. The development growth of PLAB is not going to rely solely on the central boulevard itself. The expansion of Hougang, Tampines (North-West), and Bedok, will aid the development of the fringes of the PLAB estate.

The PLAB estate might also have some futuristic features, such as car-free zones. It is far enough into the future (10 to 20 years) that perhaps we can’t rule out having flying taxis. PLAB may be a testbed for new transport possibilities such as driverless, drone, and aerial transportation-delivery systems.

Speculation aside, the existing plans for PLAB are there to set it up as a city of the future. While there may be many more details and changes to come as the development starts to take shape in the 2030s, we can only hope to see what exciting new developments PLAB will bring to Singapore.

Why should we even care about PLAB?

We should pay special attention to PLAB now, even though the development might only manifest 10 to 20 years from now. The size of the PLAB is significantly large, and is 5 times bigger than Toa Payoh Town if you include the surrounding industrial areas. The amount of residential and commercial real estate supply that PLAB will be introducing into Singapore’s market is going to be huge. It is understandable that such a large development is likely to gradually develop and release the supply into the market, so as to not have an adverse impact on market prices.

If you currently own a property in an estate that neighbours PLAB, you might want to be on alert as well. With this much new residential and commercial supply being added, properties in neighbouring estates will also be affected. Properties on the fringes might benefit from the infrastructure and commercial developments in PLAB, while also facing added competition from new residences that will emerge in PLAB. Although we cannot say for sure whether the impact on the surrounding estate will be a net positive or negative. Owners of properties located in Pasir Ris, Tampines, Bedok, Serangoon, Hougang, Sengkang, Punggol, might want to take a closer look at how their property may or may not be affected.

The PLAB development is estimated to yield approximately 150,000 residential units. This is a large supply that could possibly alleviate concerns about insufficient housing options for residents or skyrocketing rentals. However, stable rising land prices and development costs do not bring the economics in favour of alleviating those concerns. One can speculate on the affordability of the abovementioned 150,000 residential units and who would be staying in them.

With Singapore’s ageing population, it is difficult to say whether our demographics can support the development of a new estate like PLAB. Not only in terms of occupying the residential units, but also to sustain the commercial and retail activities in the area. This brings up the question of whether we have sufficient population growth to support the continued development of new towns across Singapore and not just PLAB in the coming decades. There either needs to be a change in the birth rate situation of Singapore, or Population White Paper implications in the near future.

As for the possible prices of new residential launches in PLAB. There is a chance that rising land and development costs might push residential developments here into a presently unimaginable range. Due to the effects of compounding growth, the home prices we are experiencing now for new launches ($2,000 PSF range) may have been unimaginable 10 to 20 years ago (ask your parents if you don’t believe us).

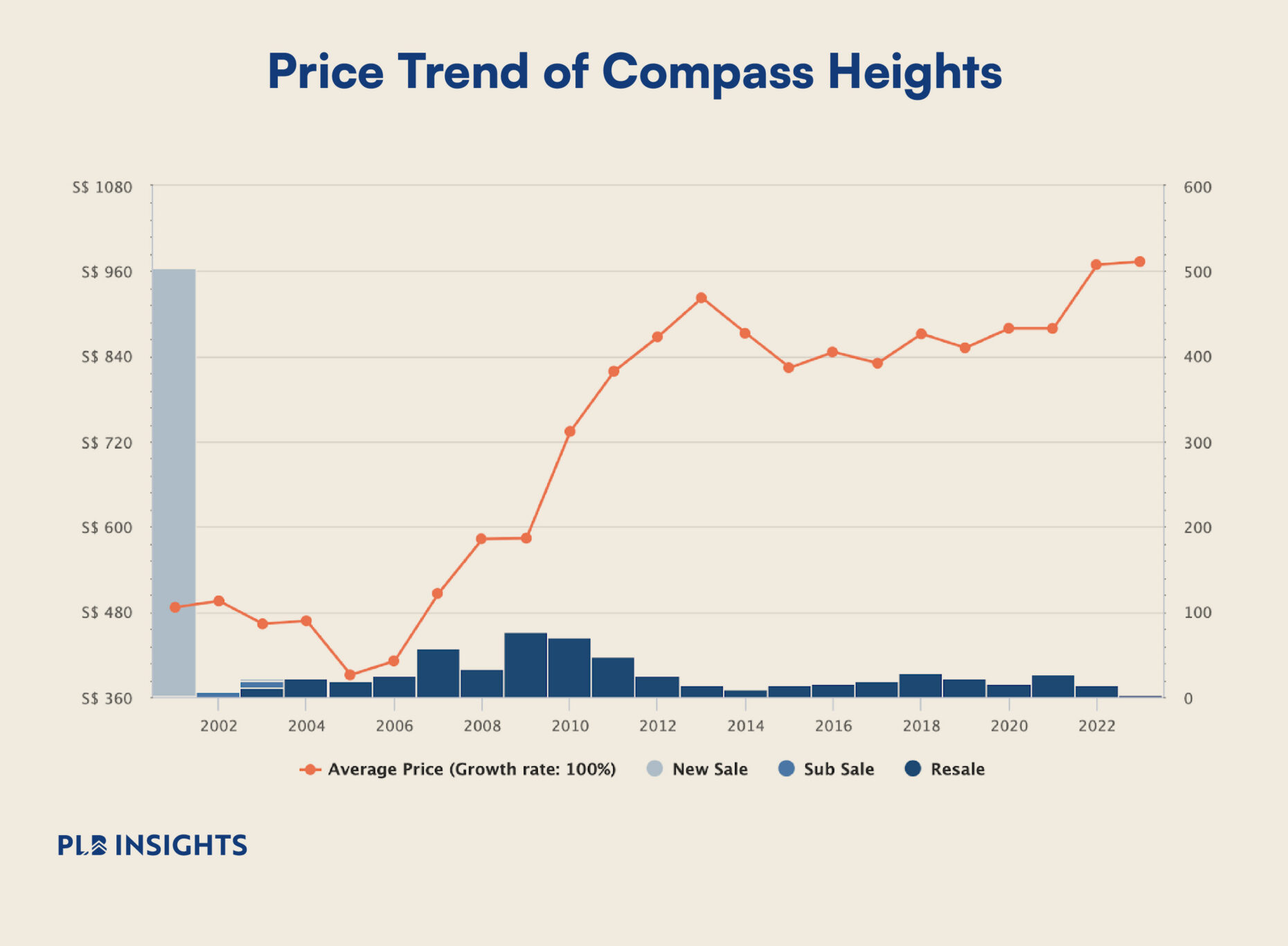

Just as an illustration, let’s look at Compass Heights which was completed around 2002. Its average PSF in 2003 (20 years ago) was only $463 PSF. Do note that this is an integrated leasehold development that is located right above Compass One (previously Compass Point) and Sengkang MRT. If you had bought it at the initial launch, the current price is approximately double of what it was back then.

Abstracting this illustration to the whole of Singapore, we observe a 4.63% compound annual growth rate (CAGR) for new sales between 1995 and 2022. This is a 27-year average growth number. Assuming that Singapore keeps up with this trajectory for new sale prices in residential real estate, new launches in PLAB around 2040 would have an estimated PSF of $5,373. How much would an individual or family need to earn to afford a property like this? That is what you would have said if you were in the market 20 years ago and saw today’s new launch prices.

Comparing this inflationary pressure on real estate against a food item, a bowl of Fishball Noodle used to cost around $1.50 in 1995 and has risen to around $5.00. This is more than a 3-fold increase. The CAGR for a bowl of Fishball Noodle in this example is 4.56%, which is only marginally lower than the CAGR for new launches over the same period. This example illustrates the power of compounding, which can be either a negative or positive effect depending on whether it is an expense or an asset that you are holding.

Closing Thoughts

Do not be disheartened by the astronomical estimated prices and do not let this affect your family planning. At the end of the day, what determines equilibrium prices on the market is the balancing act between demand and supply. The high estimates for new launches in PLAB are due to the compounding effects of inflationary pressures, and would be mitigated (to some extent) by rising wages over time albeit at a lower rate.

In summary, while it’s uncertain whether the completion of PLAB alone will cause an oversupply of residential units in the Singapore market two decades from now, it’s possible that real estate prices would not be as high as estimated if such a scenario does occur. Despite this uncertainty, the real estate market has shown a positive trend over the past few decades, and significant macro-environmental upheavals would be required to reverse this trend. As PLAB continues its development, we may gradually ride the positive trend up to that price point, and any price changes would likely occur gradually rather than suddenly. In the end, only time will tell what effect PLAB will have on Singapore’s real estate market.