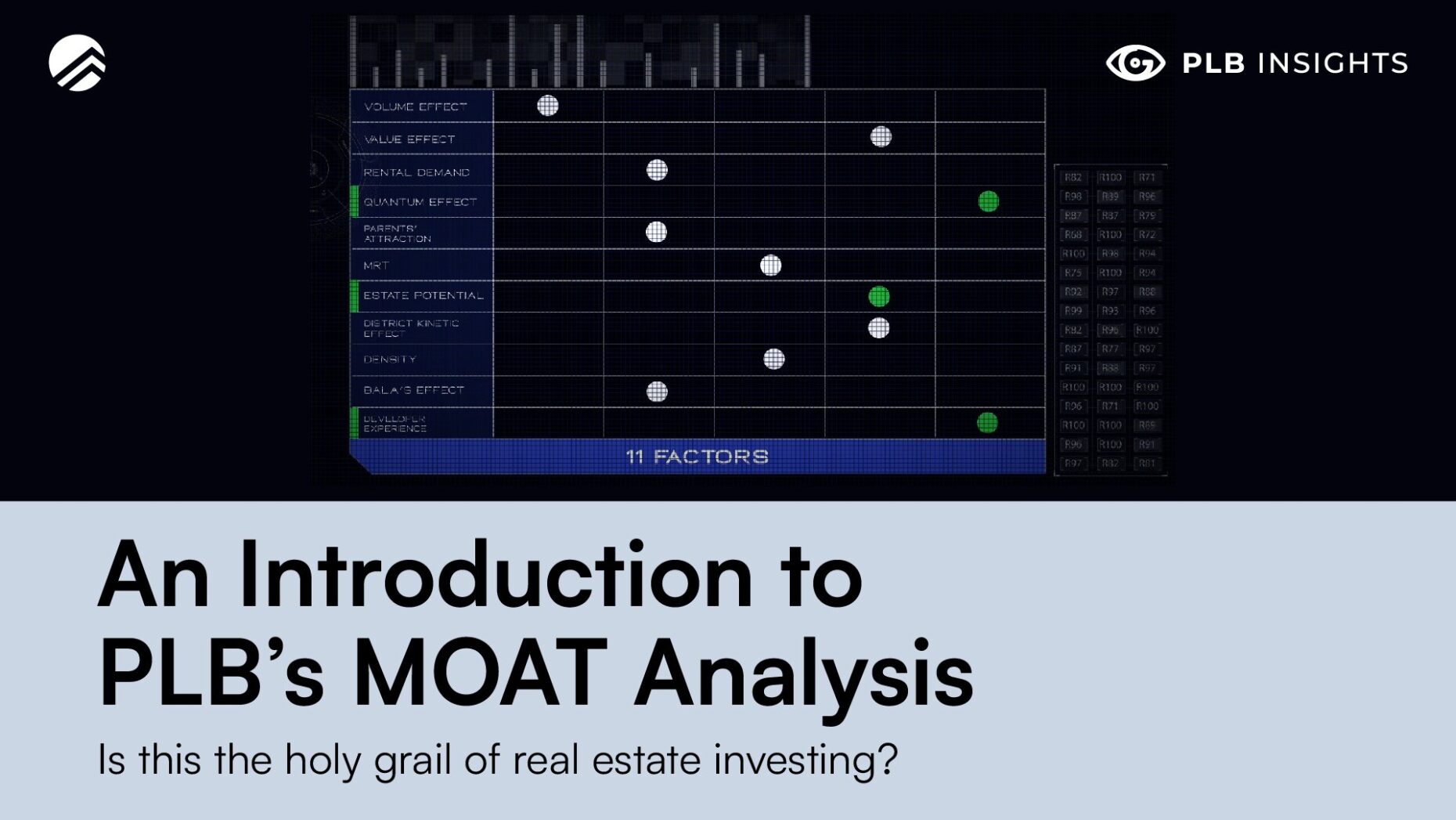

The PLB MOAT Analysis serves to give buyers an in-depth understanding of the property they are eyeing with just a glance. If you have read our previous articles you would know that the main strength of the MOAT Analysis is to compare across multiple properties and multiple traits.

If you have played some of the Final Fantasy games, it is like comparing the “stats” of the characters to see what they are good at and what they aren’t. This helps gamers decide whether characters are complimenting each other and if they make a better team.

Following this same logic, the MOAT Analysis aims to find out if the property complements your needs and wants in a property. By measuring multiple traits of the property, buyers can find out if the property suits them in their current phase of life and financial situation.

The MOAT Analysis is most useful for buyers who know themselves well in terms of their own situation and what they want. Even if you don’t feel certain about what you’re looking for in a property, the MOAT Analysis gives you suggestions on what to pay attention to. You can slowly pick up on what really matters to you over time.

Previously, we have covered the Volume Effect (transaction flow within the project), Value Effect (whether you are getting a “good deal”), and Bala’s Curve (effect of remaining lease). We have also covered MOAT Analysis in an introductory article so that you get the big picture. In this article, we cover the effect of MRT distance on the price of the property.

The MRT Effect — What is it?

The MRT Effect is essentially covering how the distance from an MRT station affects the price of property. To make sure that we capture the essence of convenience, we look at whether the property has a MRT station that is within walking distance.

Of course, walking distance is debatable. If you go on a holiday overseas, what might be walking distance in Shanghai or Melbourne might end up being a 30 minute hike. This might come as a shock to Singaporeans.

It is not that Singaporeans do not have the patience to walk long distances. In fact, some might be avid hobbyists when it comes to walking. Just that in Singapore, our weather might be too swelteringly hot, or way too stormy and wet to be exposed to the elements for anything more than 15 minutes.

We get you. The MRT Effect captures the walkability of the property to existing and upcoming MRT stations to make sure that you won’t be finding yourself too drenched in sweat or rain. When it comes to walking distance to an MRT station, less than 5 minutes will clock you 5 points on the MRT Effect. Anything close to a 15 minute walk would have only 1 point on this component.

Upcoming MRTs are included too, this would make sure that we “future proof” our analysis. We expect a bulk of the price effect of MRTs to be when they are publicly announced. Thus, a high point on the MRT Effect doesn’t necessarily mean you currently have an MRT near you. But it certainly means that there will be one in the future if not already present.

In some sense, it captures the future value of the property due to MRT accessibility. Because when you are buying a property. It should not be just for the here and now. Like any other investment, it is all about the future value. Ideally, you want to acquire assets that will be worth more in the future and not depreciate over time.

With the MRT Effect, you can now identify and compare the difference in the future value of accessibility for the properties in question. We also factor in the presence of interchanges and multiple stations nearby.

Why does the MRT Effect matter?

MRT stations are a special type of amenity. Overtime, the addition of new lines has increased the level of accessibility across Singapore. It benefits the working-class in Singapore the most. With people gradually going back to the office, the value of having an MRT station near where you live will be most salient.

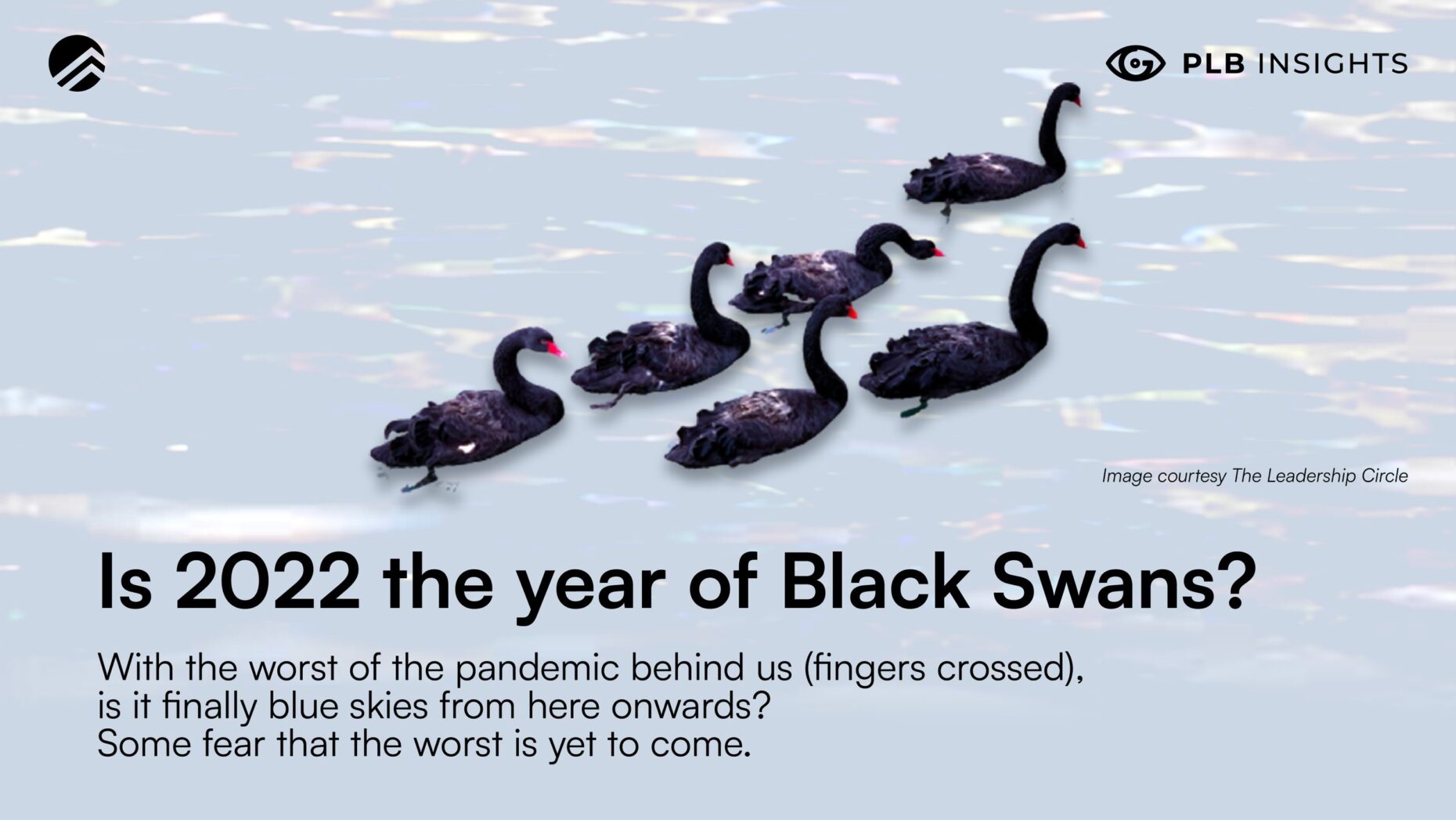

Unless you’re working in some sort of digital nomad job, you should be mentally prepared to go back to the old normal. Many companies such as J.P. Morgan and Goldman Sachs are taking a more aggressive stance on convincing people to return to office. However, there are some pockets of resistance. An IPS survey has shown that workers still want flexibility in the way they work.

Depending on your company, your boss, and the role you are in, work-from-home may cease to be the new normal. To mentally prepare ourselves, we should probably expect a newer normal of going back to the office with some degree of flexibility to work remotely. That being said, we need to brace ourselves for what will come back with the back-to-office crowd.

Peak-hour traffic jams. Squeezy MRT rides and crazy crowds at stations.

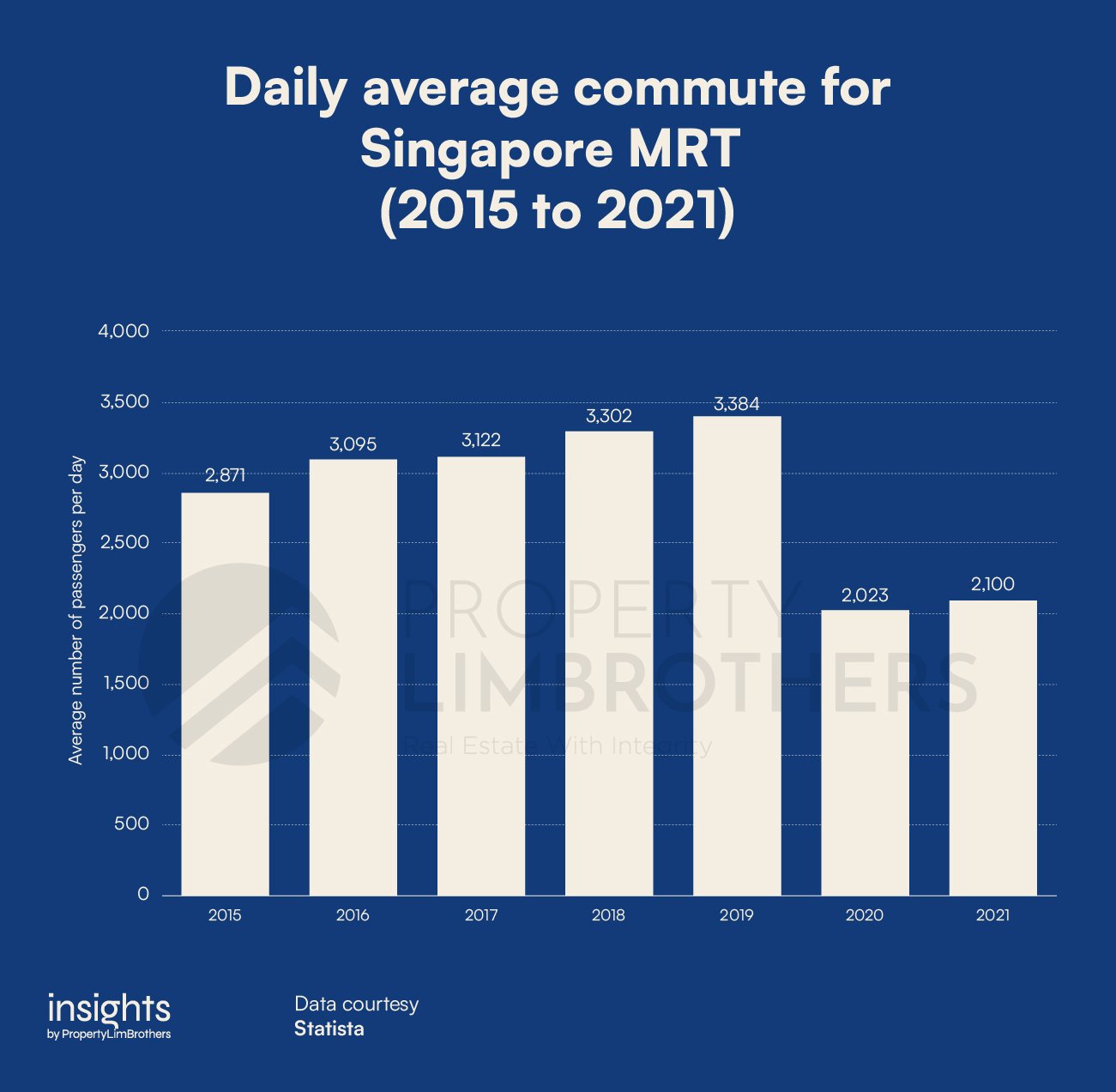

The number of people taking MRT back to work is slowly climbing back up to pre-pandemic norms. Although we are still around 78% of the pre-pandemic ridership, we would soon reach that level again soon. A silver lining to all of this is that the economy would kick back into full gear. At least for commercial and retail spaces, we expect the pace to pick up from here.

If this year were to make a V-shaped recovery to pre-pandemic ridership levels, we are expecting a rise of approximately 61% compared to 2021. Going from 2.1 million riders back to almost 3.4 million is going to be tough to get used to again. Nonetheless, we should expect this level of crowding moving forwards.

Going back to our point, why does the MRT Effect matter at all? If remote work is not here to stay for a majority of working adults, accessibility options will become more important. This will affect the value of property as people would want to buy or rent a home that is close to affordable means for transportation.

Even if you have the luxury to own a car or take a taxi to wherever you need to be, it doesn’t change the fact that investors are still looking for generally more accessible locations. Buyers are looking for the best deal not only for themselves, but also a place that future buyers will also see the value in.

How do we use it in the MOAT Analysis?

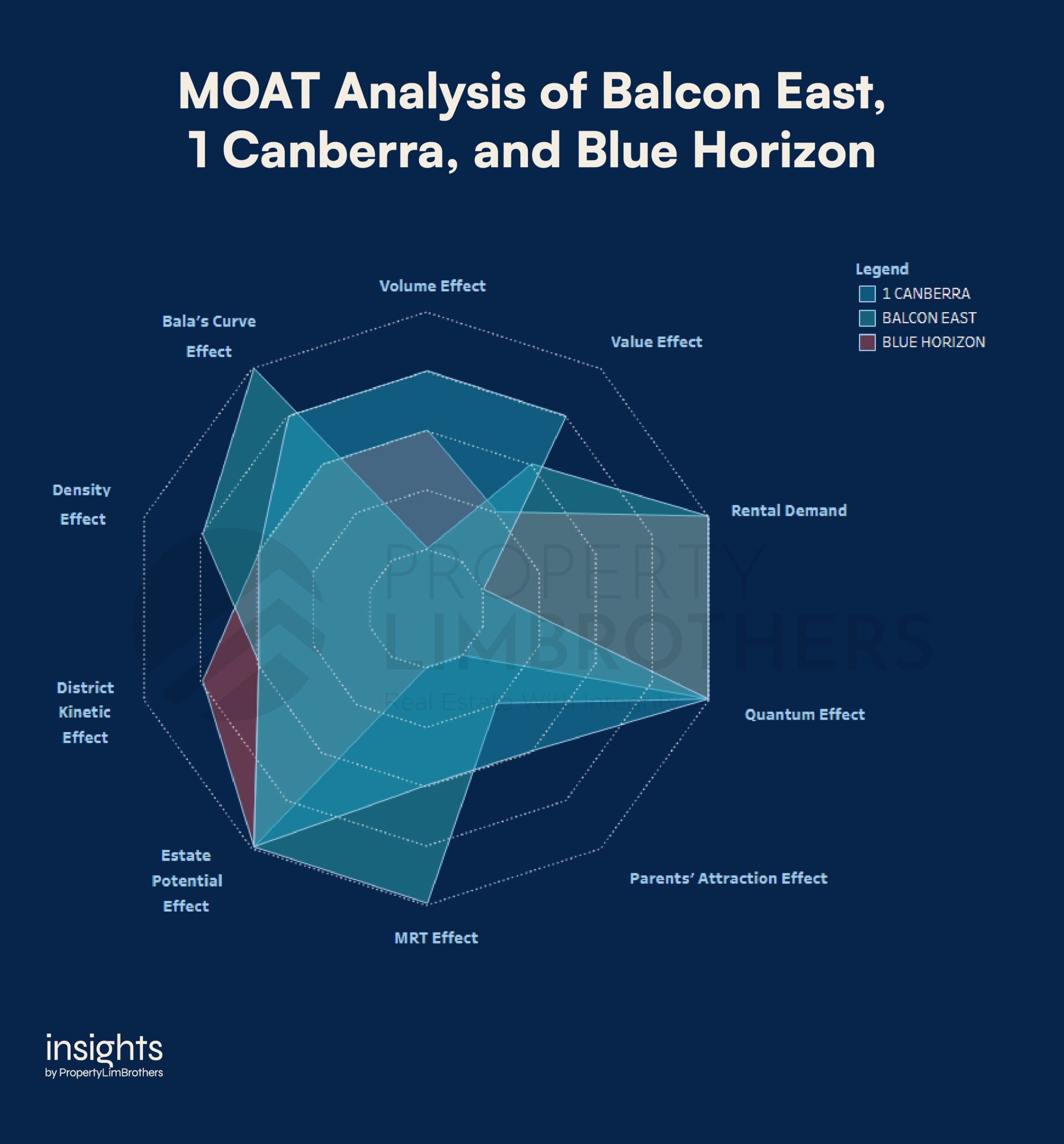

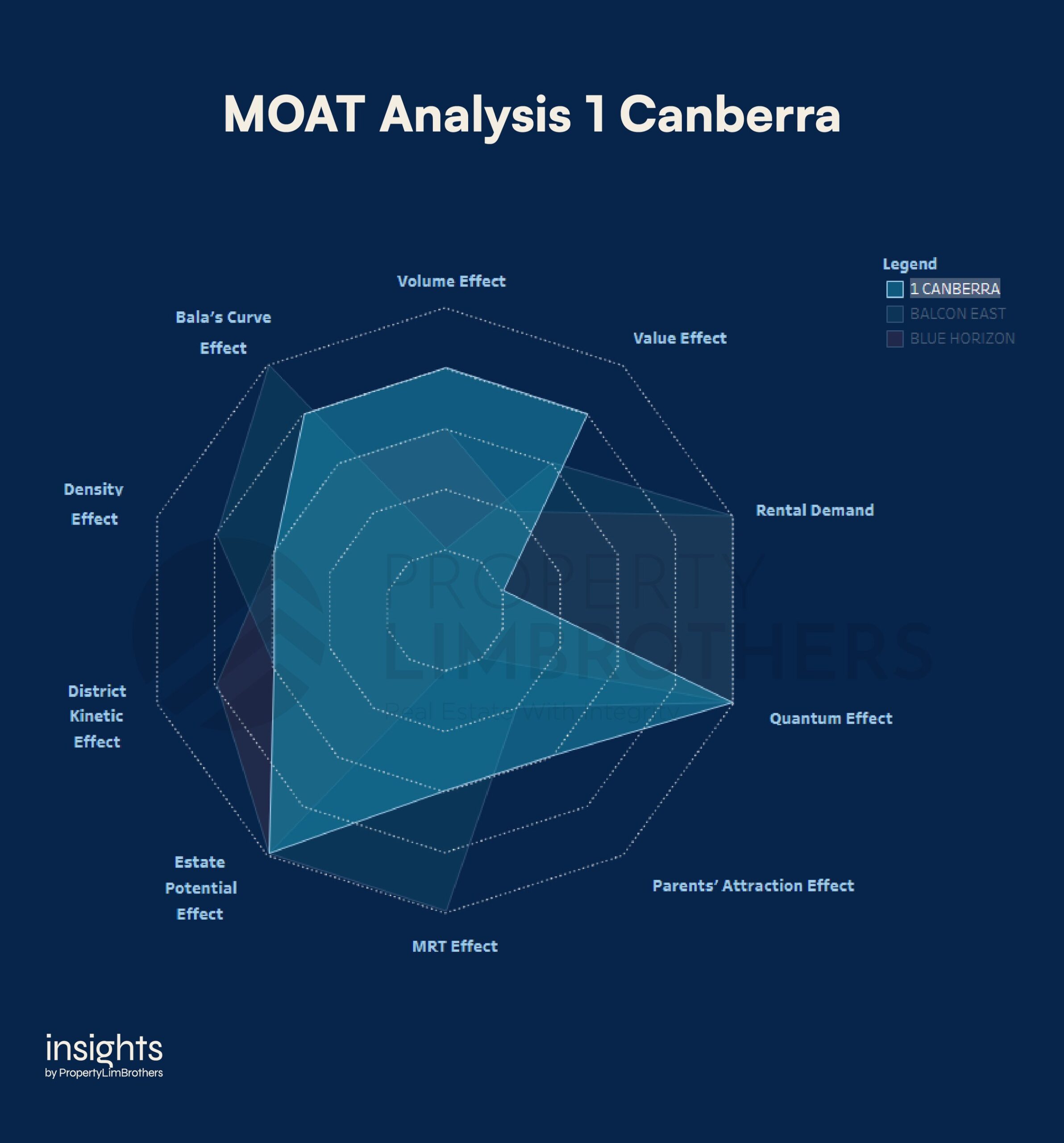

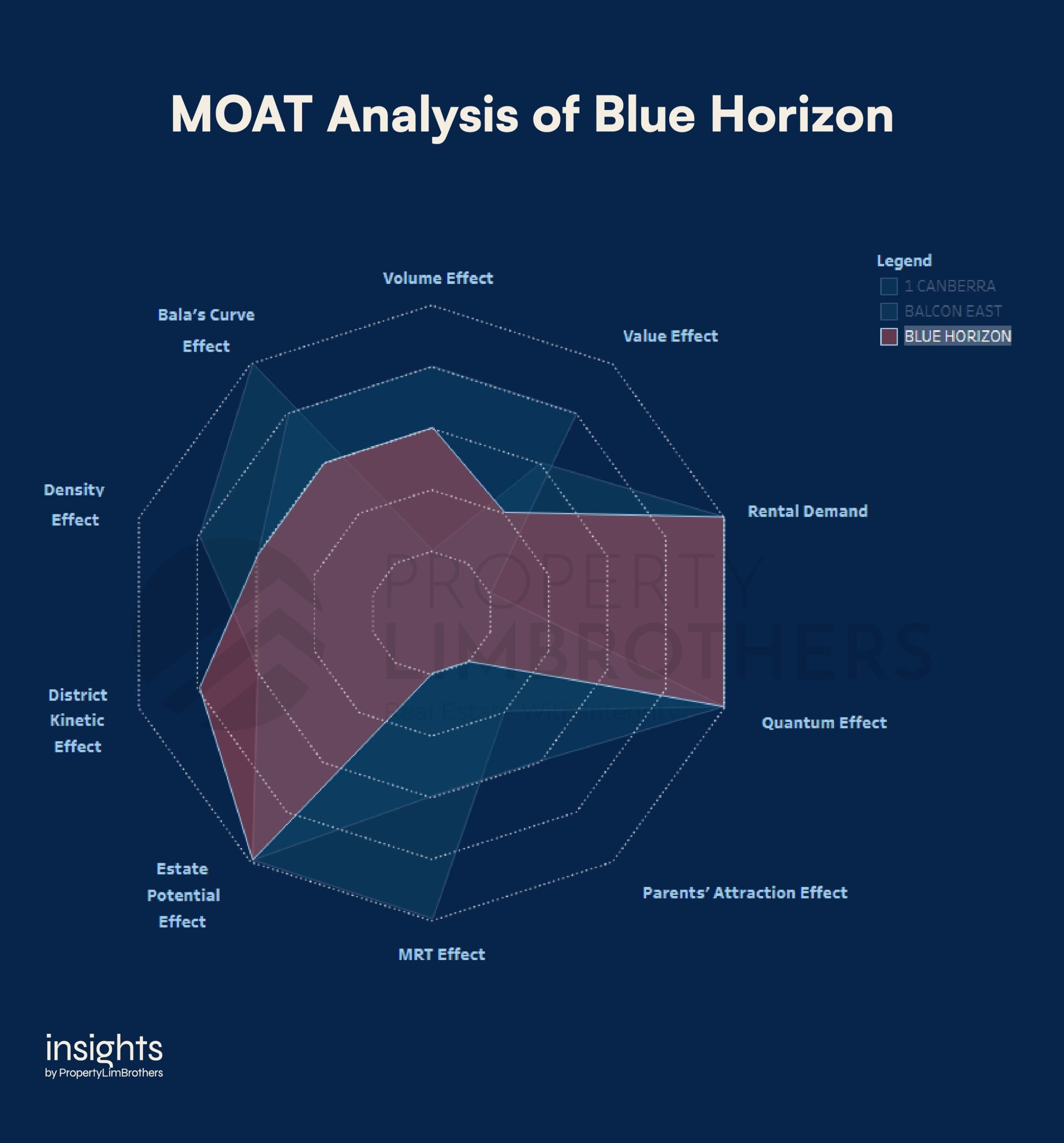

As with all our other MOAT Analysis articles, the MRT Effect does not work in isolation. They are most useful in conjunction with other aspects of the analysis when comparing properties. For this article, we will make a simple comparison between Balcon East, 1 Canberra, and Blue Horizon. This is just to demonstrate the MRT Effect on the MOAT Analysis. We will not go into an in-depth review of the properties but will just compare the locations of the condos and the nearby stations.

Before we dive into the analysis proper, we would like to highlight that the MRT Effect would be naturally correlated to some of the other aspects of the MOAT Analysis. However, this correlation might not be that obvious by eyeballing just a few comparisons.

First, properties near MRT stations tend to be valued higher on average than properties further away. There might be a negative correlation between MRT Effect and Value Effect. Those closer to MRT stations might be valued much higher than its peers and hence would be less discounted as compared to other properties in the same district.

Second, properties near MRT stations should receive more attention from potential tenants, hence pushing up rental demand. However, this relationship is dependent on the neighbourhood and the district. Due to the effect of higher prices, tenants might be priced out to consider other properties or locations that are more value for money. With the rental market heating up, we might see more movement for rental demand over the next few quarters.

At this point, it would be important to add that the MOAT Analysis is dynamic. We draw live data from APIs to make sure that we draw as accurate a picture as possible and capture the ever changing cityscape of Singapore. The changes in rental demand in the current market will be reflected as changes in the MOAT Analysis over time.

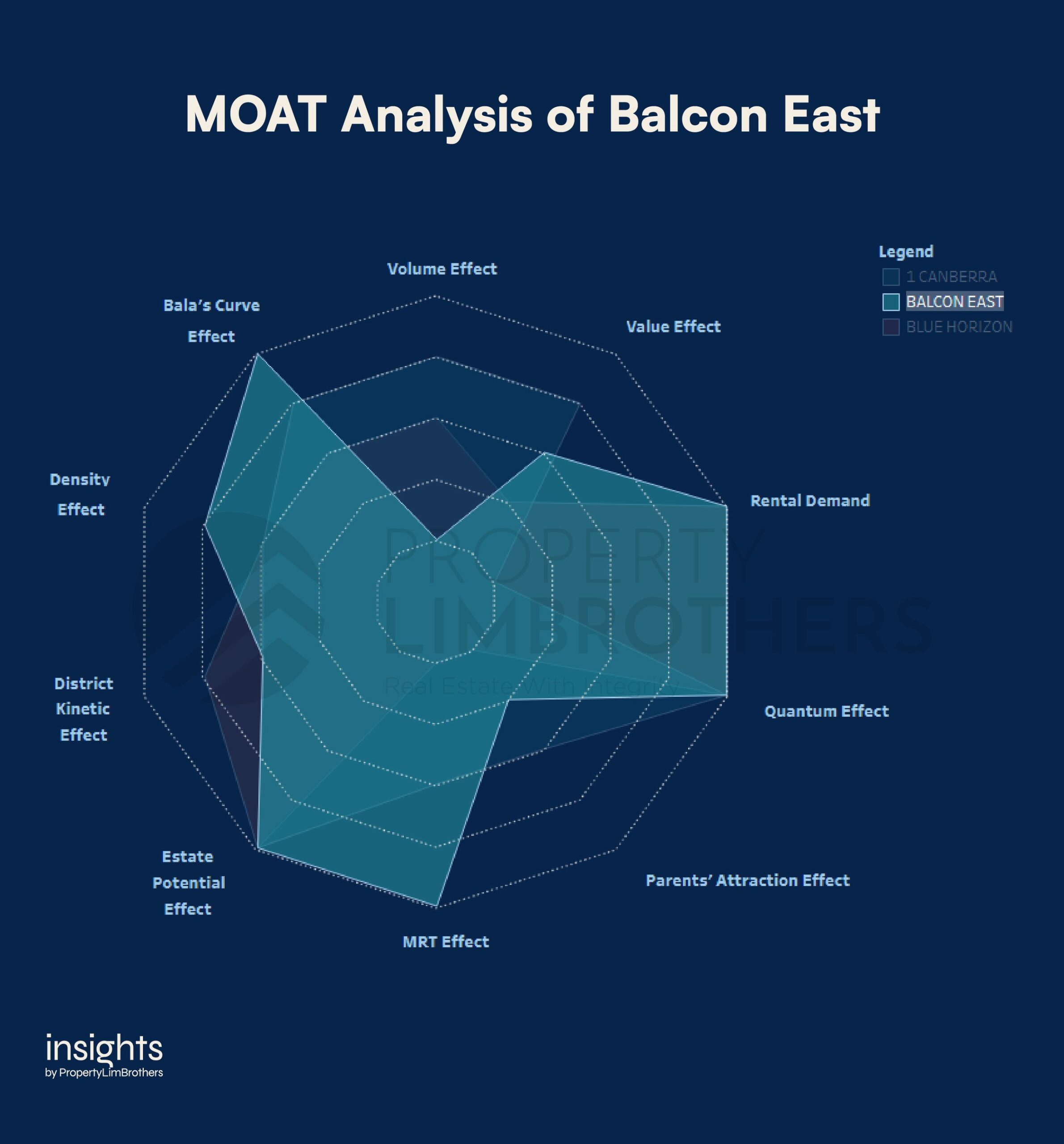

Balcon East is an example benefitting from the MRT Effect including new stations, scoring a full 5 points on MRT Effect. The nearest MRT station is Bayshore (179m away). It is slated to open in less than two years, around March 2024. Balcon East is a freehold property completed around 2012 and has a total of 37 units. As you can see from the chart above, Bala’s Curve and Volume Effect captures those immediately obvious information in visual form that can be easily used for comparison.

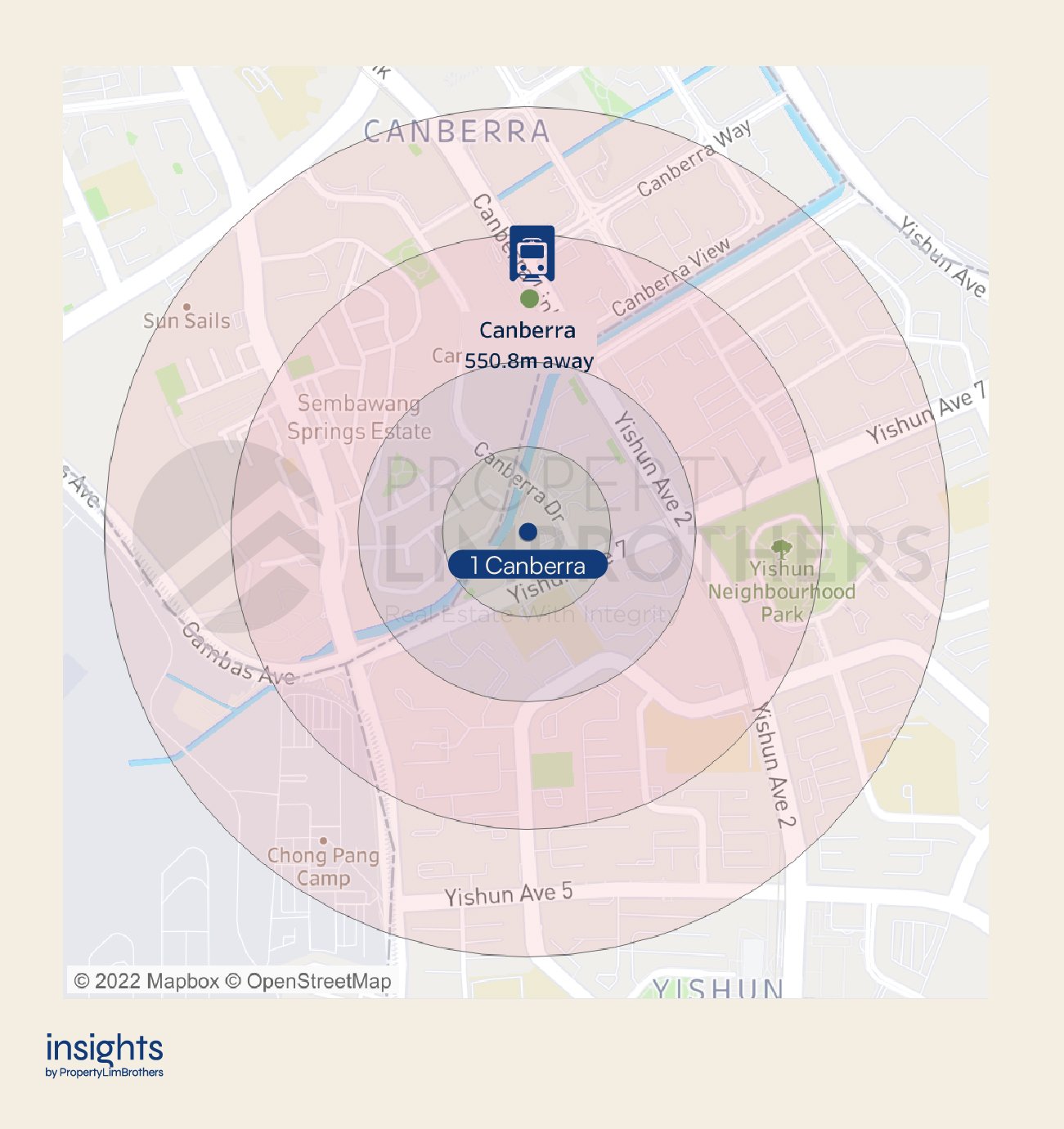

The next property we are looking at is 1 Canberra, a 99-leasehold EC completed around 2015 with a total of 665 units. It scores a 3 on MRT Effect with the nearest station being Canberra, which is around 550m away. Even though this property does not get much love from rental demand, it does rather well for Bala’s Curve and Value Effect. The distance from the MRT might be enough to deter renters who really want convenience being really near the MRT (score of 4 or 5).

Another reason could be that not all MRT stations are born equal. For heartland areas and city areas, we expect to see slightly different patterns. MRT stations should be more important as we move closer to the heart of economic activity, which does not always have to be located in the city centre itself. This includes other work hubs where we see offices and malls cluster together (such as Jurong East).

Last but not least, we look at Blue Horizon to the west. It is a 99-year leasehold condominium completed around 2005 with a total of 616 units. It scores a 1 on the MRT Effect as there are no MRT stations in sight. However, it is near west coast park and NUS, which may be why the rental demand is so strong.

An important thing to note here is that the Value Effect score is low. Signalling a potentially overvalued property, with a price above peers in the district. To add, something that stands out is the moderate Volume Effect score despite having 616 units. This might signal slower transactions which might mean that less people are willing to sell their units here, or that it is potentially harder to exit.

Closing Thoughts

In our comparison of the three different properties, note how the MRT Effect is not entirely definitive of the performance of the property. While the MRT Effect is important, and it does matter to buyers, it is not the entire story.

“There is an audience for every home.”

Use the other aspects of the MOAT Analysis to give you a more complete picture on if the property is for you. Ultimately, each different buyer profile is looking for different things in a property. The MOAT Analysis is a match-making process to find the most suitable properties for the buyer’s tastes and preferences.

If you would like to explore more on how you can use this tool for your property search, reach out to our Inside Sales Team here or drop your favourite member a message on their socials. They are all trained to be experts in MOAT Analysis, feel free to tap on their expertise to aid you on your property journey.