Buying your first property is a huge milestone in your life. It is an achievement. Something to be proud of. To couples who have been long waiting to live together, the BTO flat could be a special and sentimental place. Filled with memories of building their first nest together. The process of homeownership is arduous.

For couples getting their first BTO, the application, paperwork, and decisions that need to be made can be time consuming and exhausting. This is completely understandable. Especially since it is likely the biggest ever purchase in their lives. One of the big decisions is choosing which loan to take. Are you going to go with a bank or HDB loan?

This topic has been covered extensively. However, recent developments in the global interest rate environment have pushed banks to raise interest rates on mortgage loans. With fixed rate bank loans now having higher interest rates than HDB loans, which one would you pick?

In this article, we cover the general considerations when considering a home loan for your BTO or Resale HDB. Thereafter, we will discuss how the interest rate changes would affect the decision on which loan to get. We will highlight factors for individuals to consider if their personal situation makes one loan more suitable over another.

What should I consider when taking a home loan?

There’s more to loans than just interest rates. You have to know the ins and outs of the application process, the required documents, and the terms of the loan contract. When you are making the decision to take up a home loan, you have to remember that the decision is time sensitive as the loan eligibility and approval process takes time. And you would need these documents prior to signing the Option-to-Purchase (OTP) for your HDB flat. Having a solid timeline is vital.

Rushing to get all the paperwork done on time can be very stressful and overwhelming. So to avoid those nerve-wrecking circumstances, it would be good to already know what decisions you will make ahead of time. The bottom line is that the approval for the loan should be settled one month before the purchase. You might want to decide what loan you are going for even before you confirm which property to buy. That way, you can focus on the application without the need to deliberate whether or not you are making the right choice.

Application Timing

For HDB loans, you would need to have a Home Loan Eligibility (HLE) before you can sign the OTP. The HLE application will take approximately two weeks and will be valid for a period of six months. Because the validity period is long, it might be a good idea to get the HLE early to avoid trouble and unexpected delays down the road. Here is the link of the HDB website that gives more information on the HLE eligibility.

Bank loans are considerably more flexible in terms of their application timing. The in-principle-approval (IPA) can be ready within a working day if you have all the documents prepared in advance. This IPA is valid for a period of one month, which means you have a month to sign the OTP after you have obtained the IPA. Otherwise, you would have to repeat the process to get another IPA in order to get the loan offer from the bank. For your easy reference, here are some links from DBS, OCBC, and UOB on the required documents.

Refinancing Concerns

Refinancing is a common decision made by home buyers who wish to switch a loan provider. This is typically done around the 5-year period when the property hits MOP (for BTO) or when Resale Private Property is past its Seller’s Stamp Duty penalty period. Refinancing is usually done to go for loans with lower interest rates to save some money. While you can easily refinance with bank loans, the decision to refinance on HDB loans is extremely tricky.

You may refinance a HDB loan with a Bank loan but not the other way around. Given this constraint, home buyers should think very carefully about the purpose of refinancing. If it is to optimise on interest rates, you have to look which loan the macroeconomic trend favours. Currently the interest rates are rising due to monetary tightening. This could last all the way into late 2023. However, most home loans have a fixed rate period for at least 2 years. By then, interest rates might have eased off a little.

Property Ownership History

Believe it or not, your property ownership history matters when it comes to considering a loan. If your previous property purchase was a private property, there is a 30 month waiting period before you can apply for a HDB loan or a BTO. You can still go ahead to buy a Resale HDB though. An important note here is that you can only take two HDB loans in one lifetime. However, a third loan is possible under extraordinary circumstances at the discretion of HDB.b

Basically, HDB loans favours buyers with a history of purchasing HDBs. If you have purchased a private property prior and wish to move to a HDB, you will either have to face the 30 month waiting period (where will you stay after selling the property?) or take up a bank loan for your resale HDB.

Age and Remaining Lease on Property

An important condition in both HDB and Bank loans would be your age and the remaining lease on the property. HDB is concerned about the property not being able to meet your housing needs when you reach your golden years. On the other hand, the remaining lease of the property is also a concern as that limits the ability to use the property as collateral against your loan.

Your new home should be able to cover the youngest buyer to the age of 95. If the remaining lease is insufficient, the HDB loan and CPF withdrawals will be hit with some limitations. Bank loans would likely lower your LTV to a lower level if the remaining lease is less than 60 years. If the remaining lease is less than 30 years, it might be extremely difficult to get a loan for the property. Basically, the older the HDB is, the more cash is required to make the purchase due to lower LTV and limits on CPF usage. Here’s a link on the CPF usage for more information.

Loan Quantum

A crucial consideration you must have is the loan quantum. The loan quantum may vary by a large margin because of the restrictions of the HDB loan and the way the quantum is calculated. First your CPF must be emptied or used till there is 20K remaining. If you are purchasing a resale HDB, 50% of cash proceeds from your previous HDB sale must be used for the payment. This is the Right-Sizing policy. Basically, to take a 2nd hdb loan.

The buyer must put in 50% of their cash proceeds from the sale of their first HDB property into the 2nd HDB property with HDB loan. The loan will cover the remaining amount. HDB loans have a maximum Loan-to-Valuation (LTV) of 85% with no minimum cash component. For buyers of resale HDBs, note that there might be a resale levy and the need to refund the CPF principal used with accrued interest back into the CPF OA. This is the downside of taking a 2nd round of HDB loan. Thus, households usually go for bank loans on their second HDB so that they can keep more cash from the sales of the first home.

For HDB Transactions it could go 2 ways in general.

1. You complete the sale transaction first, then wait 1 month for the CPF monies to be refunded back into your account and you get to bank in the cash proceeds etc. Then you complete the transaction for purchase. Assuming you are buying and selling between HDBs. This would involve you going to HDB 2 times, 1st time to give the keys, 2nd time to collect keys.

2. You can complete both Sale and Purchase transactions on the same day where the money does not leave HDBs “account” and they will write off each transaction based on the relative monies. Hence the term “Contra”. While this process seems more intuitive. There are a few regulations that render this process more complicated.

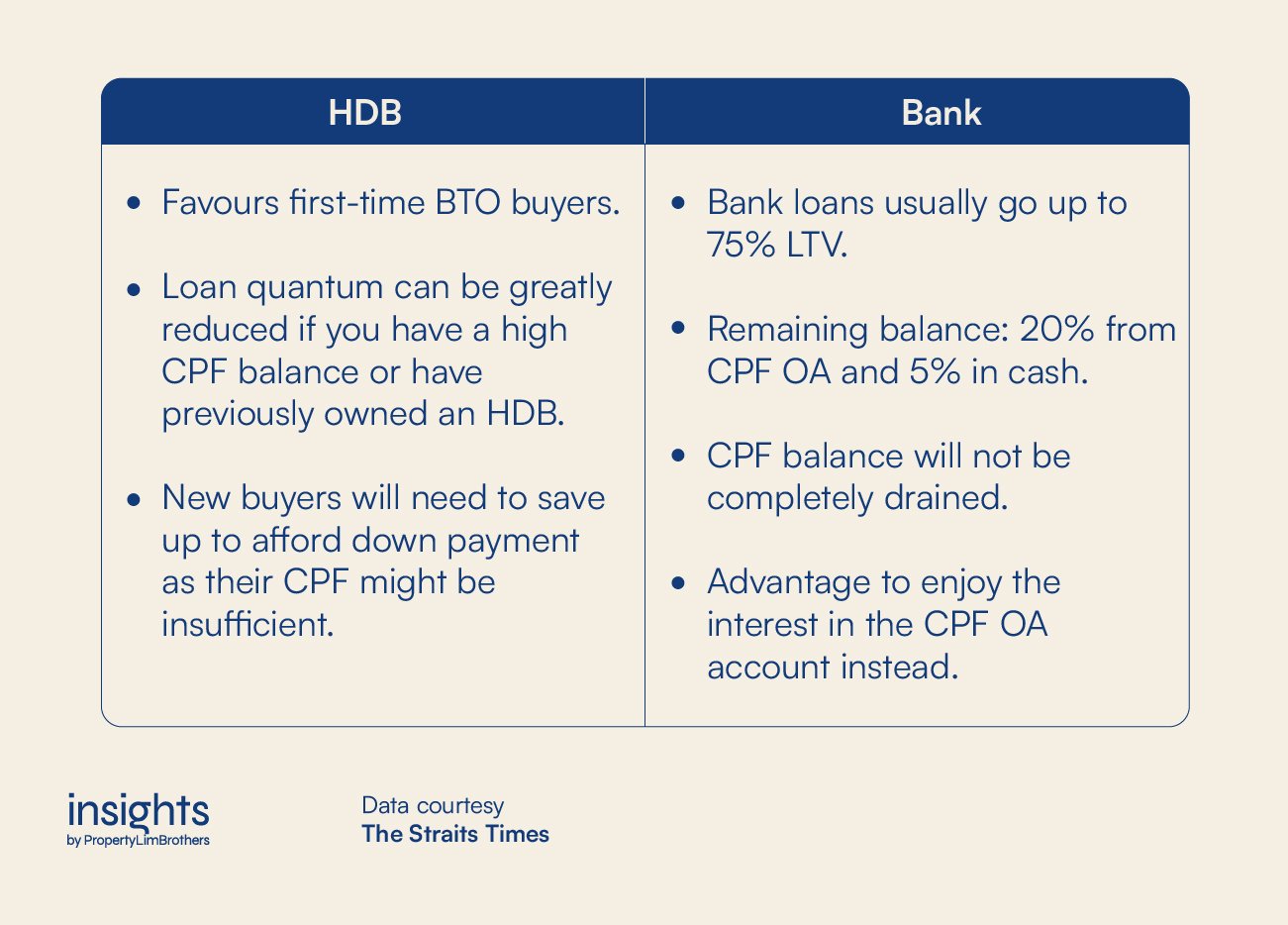

Generally, people wish to take advantage of higher loan quantums in order to enjoy the capital gains on the property with leverage. HDB loans have a limitation on this aspect. Loan quantums can be greatly reduced if you have a high CPF balance or have previously owned a HDB. This points to HDB loans favouring first time BTO buyers the most. Especially young couples who have yet to build up their CPF balance. The main challenge for this group of buyers would be to save up enough capital to afford the down payment on the HDB.

On the other hand, bank loans have a straightforward approach to loan quantum. With income level permitting, the bank loans usually go up to 75% LTV. The remaining 25% is usually paid with 20% from CPF OA and 5% in cash. A perk here is that your CPF balance will not be completely drained. It will be able to enjoy the interest in the CPF OA account instead. Subsequently, you would not have to worry about refunding the CPF principal used with interest (which is a normal source of “heart-pain” when going through the sales process).

Interest Rates Changes — How are things different?

HDB loans have a fixed interest rate of 2.6%, pegged at the CPF OA rate +0.10%. While the interest rates are rising globally, we do not expect the HDB loan interest rate to change. As doing so would require the government to increase the CPF OA rate or change the interest peg rule. Given that the priority of HDB loans is to ensure that public properties are affordable, there is reasonable doubt that HDB loans will increase the interest rates.

In our previous articles, we have described the differences between fixed and floating rates, as well as covered the different types of mortgage loans. To summarise the big points, fixed interest rates tend to be a little bit higher than floating rates upon application. Floating rates are usually based on the 3 month average SORA. With a rising interest rate environment pushing banks in Singapore to increase the mortgage interest rates, home buyers should make choices while taking into account this increase in loan interest rates.

With bank loans starting to exceed the 2.6% interest rate mark, and expectations of even higher interest rates, it will not be long before we see 3% as the norm. With DBS scrapping their 5-year fixed rate HDB package, even the banks are being conservative about the situation. These macro factors currently favour fixed rate mortgage rates. Unless you are confident that the higher interest rates will not be in play for a long time, you might consider going for a floating rate instead. Either way, it would seem that HDB loans would provide a better interest rate in the near term.

We monitor the interest rate changes closely. Since mortgage rates closely affect the general public’s ability to afford housing, there is an urgent need to make sure that we are aware of the interest rate hikes made by central banks such as the one in the U.S. Due to the inflationary issues faced by economies all over the world, it is very likely that higher interest rates would persist over the next year. At least until the issue of inflation is resolved, or if the financial markets get hit by an economic crisis.

Interest rates are only one of the many considerations that one should have when considering which home loan to take. In order to make an optimised and informed decision on this, you would need to have a deep grasp of your own personal circumstances and the pros and cons of each loan type. You should pick the one that suits you best.

Personal Circumstances and the Loan Decision

Income, credit history, future plans for housing, current financial situation. These four factors are very important in the loan decision process. Ultimately, these factors of your personal situation will shape which decision you might end up making. Having a certain financial background would make one loan more beneficial for you than the other. Knowing how your individual situation falls in place with the loan decision will help you make the right decision.

HDB loans have an income ceiling for applicants. If your average gross monthly income is more than S$14,000, you would not be eligible for the HDB loan. This amount is S$21,000 for extended families and S$7,000 for singles buying under the Single Singapore Citizen Scheme. If you face affordability concerns now or in the future, you might want to consider the HDB loan over the bank loan. If you are confident in the stability and level of income, bank loans might give you a more desirable loan quantum.

Credit history is equally important to both HDB and banks. The important part here is managing your repayments and making sure that you stay solvent. Cash flow management would be a vital skill here as you would need to control your expenses such that you can meet your debt obligations for the housing loan. Between the bank and the HDB, the government agency is more forgiving in terms of considering special cases on compassionate grounds. If you are unable to meet your debt obligations, the bank is entitled to take back your property as a collateral. HDB on the other hand goes through a case-by-case basis. If your appeal falls through, your property will still be taken back and put on the market as a Sale of Balance flat.

Your future plans for your HDB matter. Are you planning to upgrade immediately after 5 years? Or are you looking at a prolonged period of stay? People who are looking for a quick exit might find bank loans more attractive. Less CPF is used, and the refund would not be as painful. On top of that, you would likely enjoy a higher loan quantum if you have substantial CPF savings. On the other hand, if you are in it for the long run, you might want to consider the HDB loan. It offers better affordability and cash management, and better interest rates in the short term.

Ultimately, your current financial situation would immediately help you in making the right decision. For instance, if you are a first time buyer with not much CPF savings, the HDB loan might be a good choice for you. Especially given the current interest rate environment. If you are a repeat HDB buyer (looking at resale) and intend to upgrade to private property in five years, a bank loan might grant you the flexibility you need while only costing slightly more due to the rising interest rates.

Closing Thoughts

While the interest rate increase might influence some to choose a particular type of loan, it is mostly still motivated by personal situation and future plans. Having a good grasp of the advantages and disadvantages of the different types of loans and how it complements your personal situation will help you come out on top.

Interest rates might make people with high loan quantums feel the pinch of the rising cost of borrowing. Nonetheless, a major part of the loan decision is motivated by the role of CPF and the amount of loan quantum desired. These two aspects are arguably more important than interest rate concerns.

The issue of optimising on the loan decision is not simple. Careful deliberation is needed, especially if the situation is more complex. If you need help or advice in arriving at a decision for loan choice, feel free to approach any of our experts here.