Picking an investment might be “easy” in some cases. See potential in Electric Vehicle brands like Tesla? Buy. See the potential in the future of E-Commerce platforms like Shopee? Buy. The decision becomes increasingly difficult when you’re dealing with a large sum of money or investments with less public information available. This is understandable. A large part of investing is managing human psychology. Tempering its impulses: fear and euphoria.

How should you select the right Shophouse to invest in? How should we go about choosing our criteria? Where should we start? In our previous article, we talked about the administrative steps you can take to purchase an investment Shophouse. But are you picking the right one that suits your investment needs?

This article focuses on how you can select an investment Shophouse to suit your needs. We bring up some key questions you should consider in order to make an informed and optimised decision.

-

Research & Due Diligence

-

Quantum or PSF Play

-

Capital Growth or Rental Yield

-

Deciding between D7/8 or D1/2

-

Conservation or Non-Conservation Shophouse

-

Be Prepared for a Mid-Term Holding Strategy to Observe Appreciation

1. Research & Due Diligence

Image courtesy Corporate Finance Institute

Doing your own research and due diligence is important to make sure that your investment really matches your needs. No one knows you better than yourself. Putting in the time and effort to make sure that your hard earned money is not thrown off carelessly is important. We understand that this is a lengthy and potentially painful process. So we’ll lend a hand.

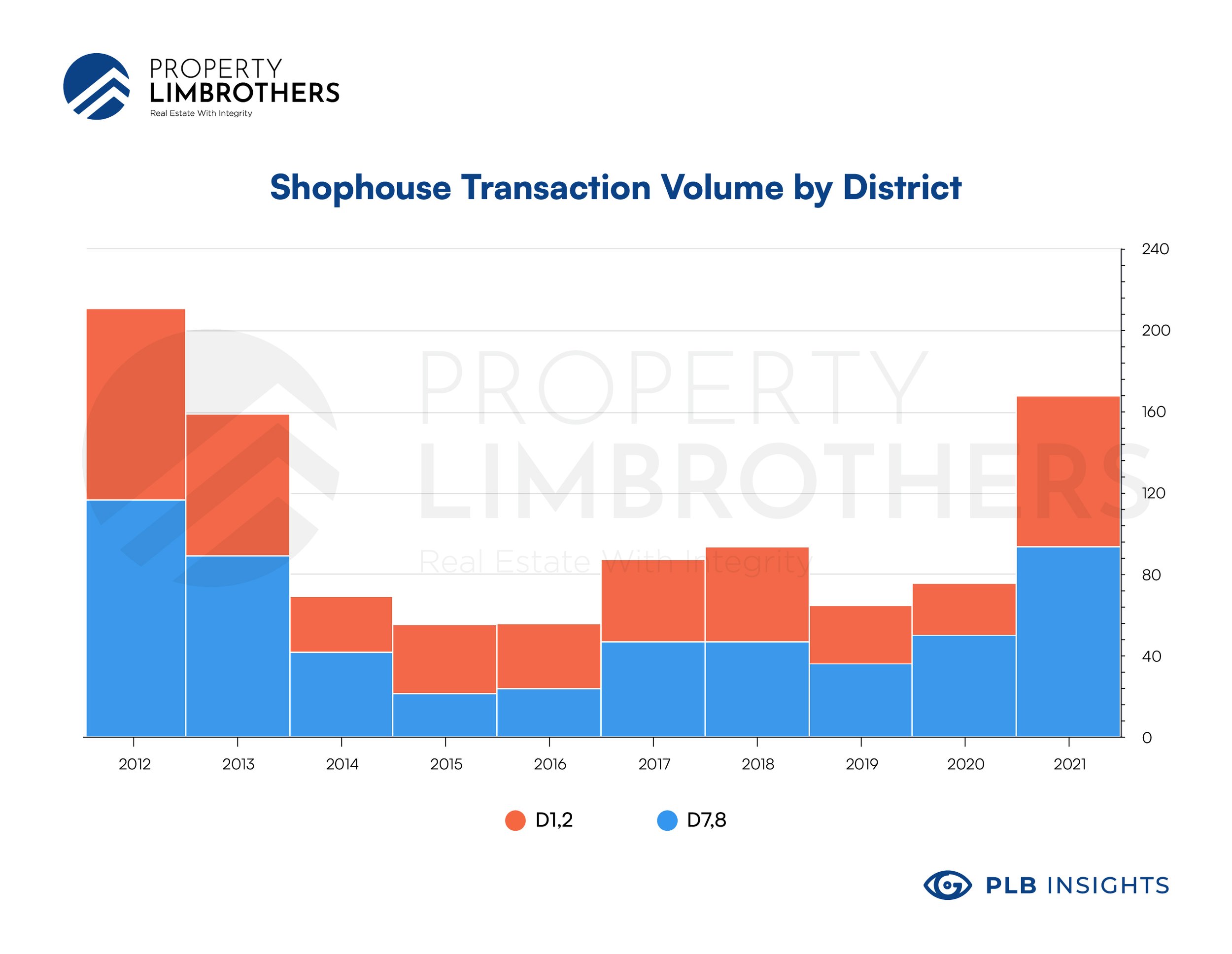

Pay attention to the past transactions of the investment Shophouse. How many other transactions happened over the past few quarters? How does this compare to Shophouse clusters in other districts? Generally, we are looking for a higher volume of transactions. This gives the banks an easier time to give a fair valuation of the property, which will be valuable in assisting you with obtaining the loan of the appropriate size. Higher transactions would also mean more information available on the market. This will give you a better understanding of the demand and supply situation in that area. A high volume of transactions usually tell us that it’s a healthy market.

That being said, here are a few caveats. A high volume of transactions does not guarantee stable valuations even in the same district. Each Shophouse is unique. The number of Shophouses are in very limited supply. The valuation might also vastly differ from bank to bank. Due to the supply issue, Shophouse pricing may also not follow the bank valuations.

The next important thing to look out for is checking for other comparables that are up for sale. This might take a bit of time as you have to look through listings or consult your real estate broker on finding similar Shophouses that can be used to make a fair comparison. Having more Shophouses shortlisted means opening up more opportunities and options for yourself. This would translate to less pressuring negotiations and viewings as you have more alternatives to look to if the deal is unfavourable or goes south. Looking at the current market for its offerings might also provide you with good deals and information from time to time.

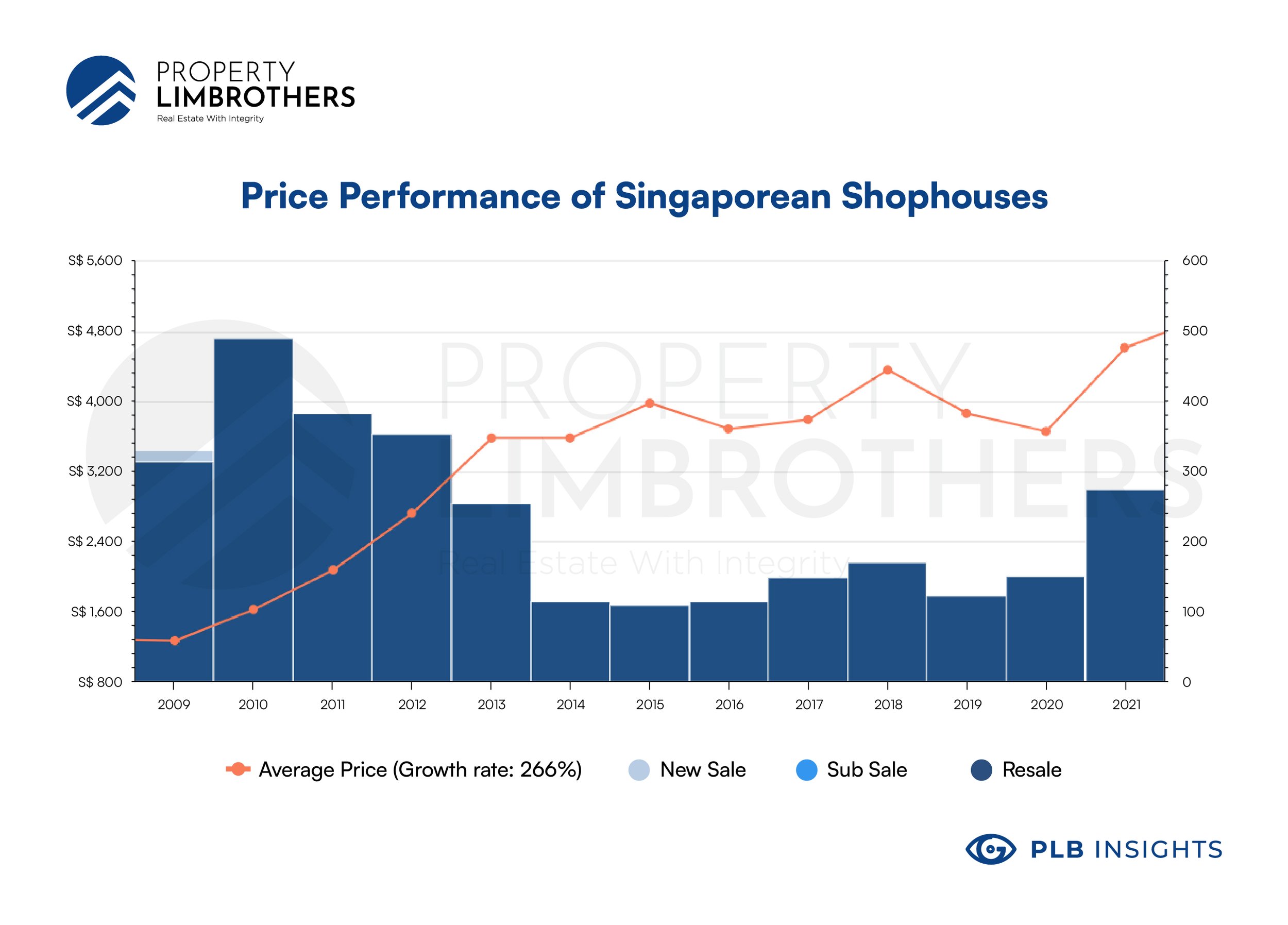

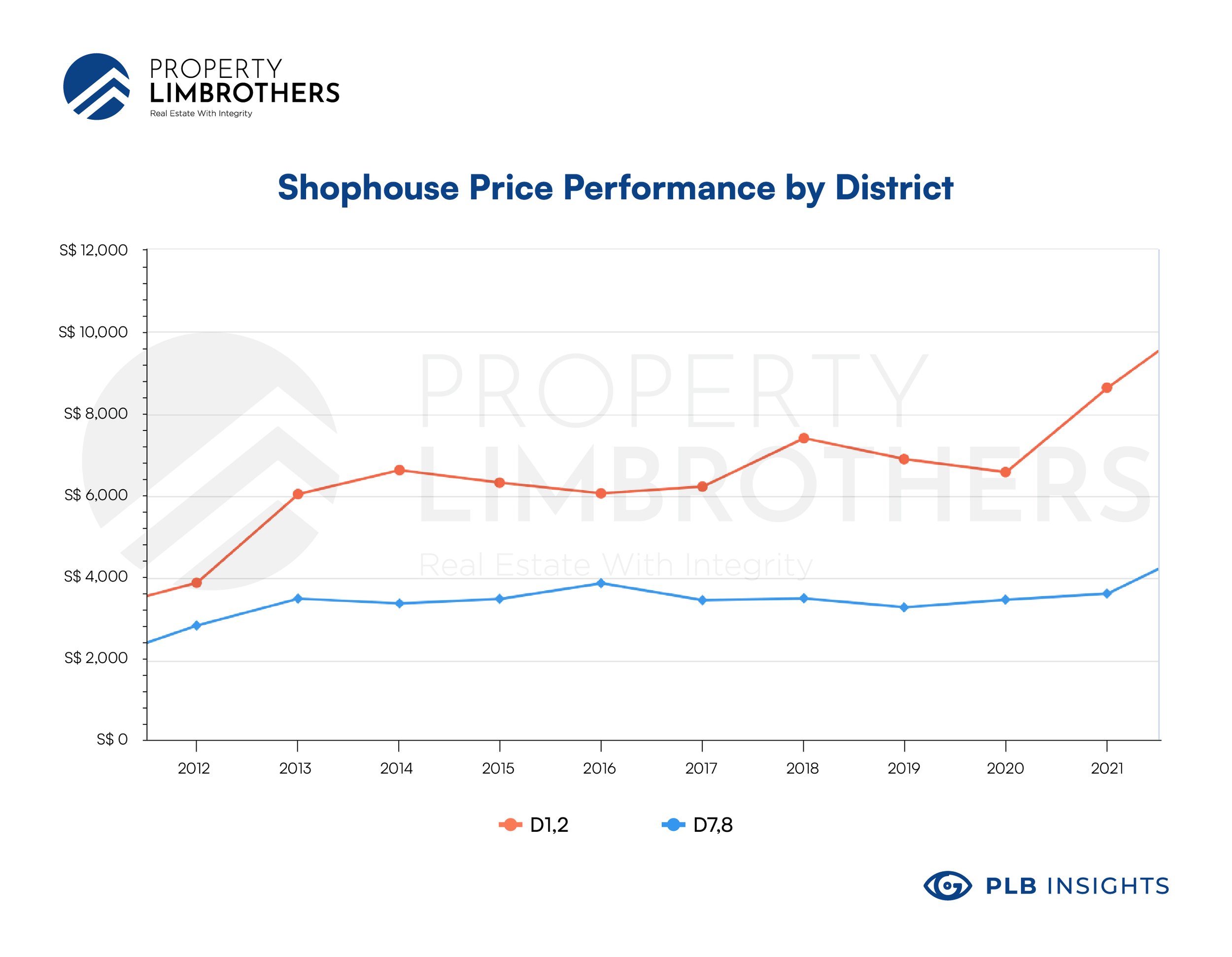

This point is rather intuitive. Price performance. Of course, you would like to know how your shortlisted Shophouses have been performing in the recent few years. A good way to do this is to go from macro to micro. The big picture comes first, followed by the exact Shophouse that you are looking at. You can start with the performance of the entire Shophouse population, followed by districts, then the specific project. This will give you an idea of how your selection fits within the general trend. Is it over or under performing the market? Then you can start to wonder why this is so.

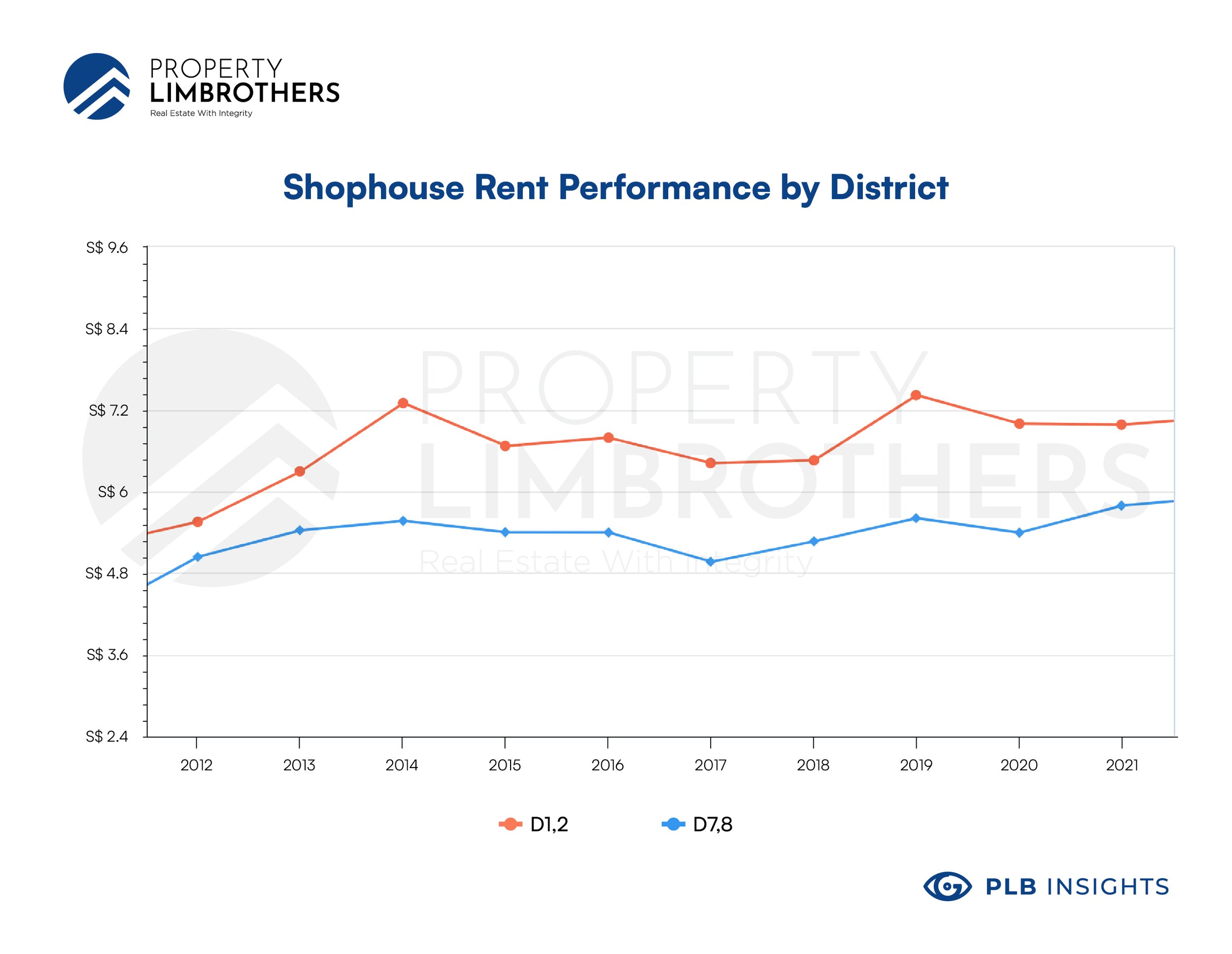

Similar to the previous point, rental yield is also a number you want to look at. Especially when it is an investment Shophouse, your primary means of generating income is through rent. This is basically the returns from the capital you have invested. The previous point on price performance is more on the capital appreciation. Looking at the rental yield will tell you how efficient the property is at generating income. It will also offer hints as to the popularity of the Shophouse for businesses. Depending on the Shophouse cluster, specific businesses may want to rent from you. Do pay attention to this before you decide to buy a Shophouse in a specific location.

2. Quantum or PSF play

Once you have decided to go for the Shophouse as a mode of Real Estate investment, you should ask yourself if you are focusing on affordability or value. We understand that Shophouses are no small investment. The holding company probably pools together a group of investors keen on buying and gaining exposure to specific Shophouses. So this decision is key to setting the tone. Go for affordability (Quantum play) to gain entry into the market or go for value (PSF play) to get a larger place or an undervalued purchase.

A caveat here is that PSF plays do not equate to value all the time. We know this. PSF can be lower for specific reasons. Such as, districts further from amenities or the city centre, larger sized properties, desperate sellers looking for buyers by offering a discount. Understanding what is driving the PSF would tell us what kind of value we are getting from the PSF play.

Between the two options, it is clear that you need to know yourself well. The number of investors being involved also matters in deciding between the Quantum or PSF play. Generally speaking, quantum plays might make more sense if you are primarily capital-constrained but want to gain entry into the Shophouse segment. If you foresee issues obtaining a large bank loan for commercial Shophouse purchases, you might want to consider going for a quantum play too. This might be the case if your holding company is young or has insufficient cash flows or credit history to warrant a large loan for commercial property.

If there are less capital constraints in your investment decision, you might want to consider going for the PSF play. This typically involves going for higher quantum Shophouses with more floor space. In exchange for lower PSF and larger space, these properties would likely be of a higher quantum or less central location. Do note that the capital requirement is non-trivial. The holding company used to make these purchases should be GST registered and have sufficient cash flows to support the large loan on high quantum Shophouses. Alternatively, having multiple investors with similar investment goals would help you execute this strategy. Remember that if these investors hold shares of the holding company, they will also own a stake in the other subsidiaries through these shares.

With Shophouses being a fast growing segment of commercial real estate, we foresee more investors trying to gain access and compete for the limited supply. The prices of more affordable Shophouses would likely be propped up by these new entrants. As a result, quantum plays would get more expensive over the next few years. Early entrants might end up gaining handsome appreciation following investors piling into this segment. On the other hand, PSF plays might look more attractive over the long term for investors with access to large sums of capital. We expect larger quantum Shophouses to have their price and growth driven by smaller-sized comparables.

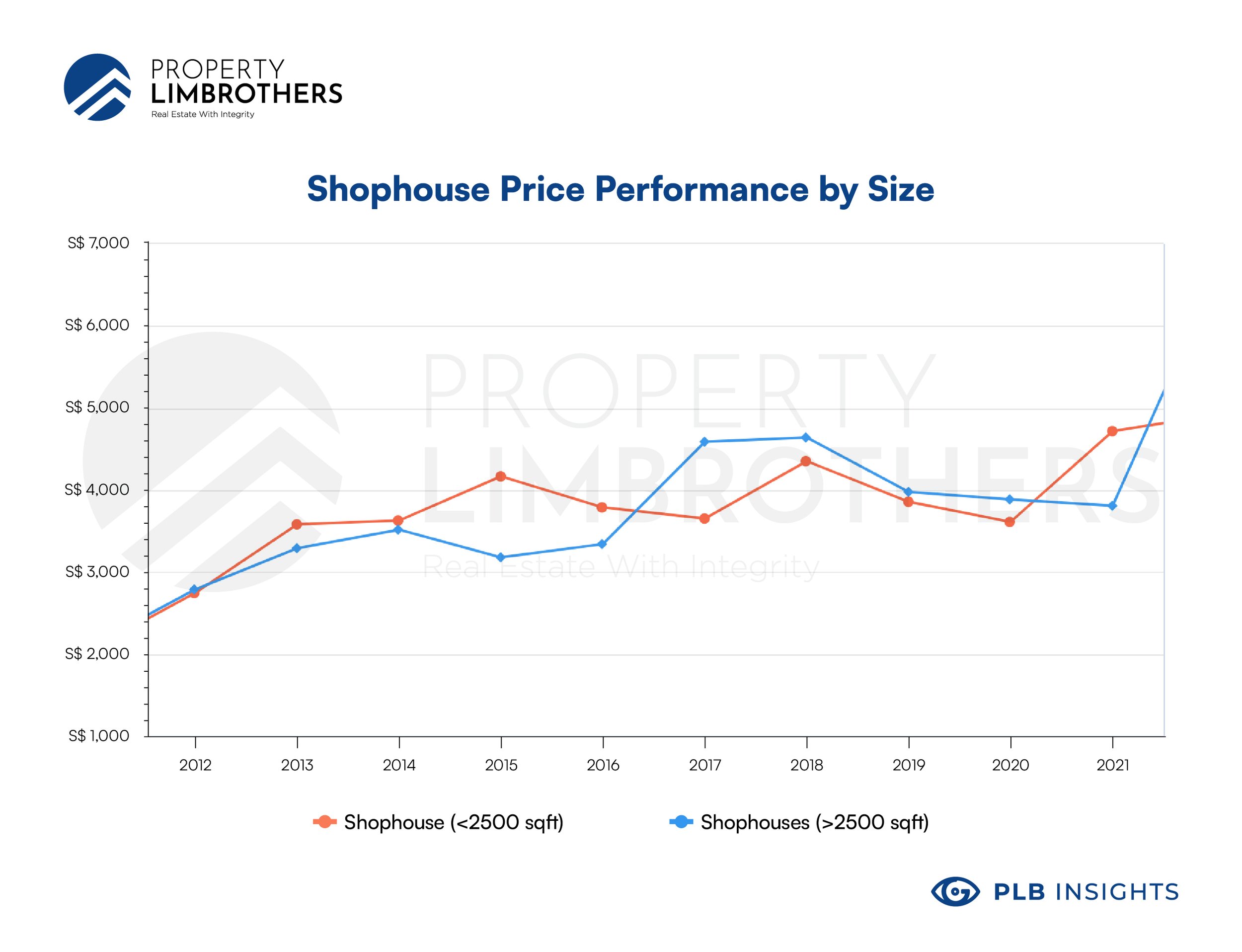

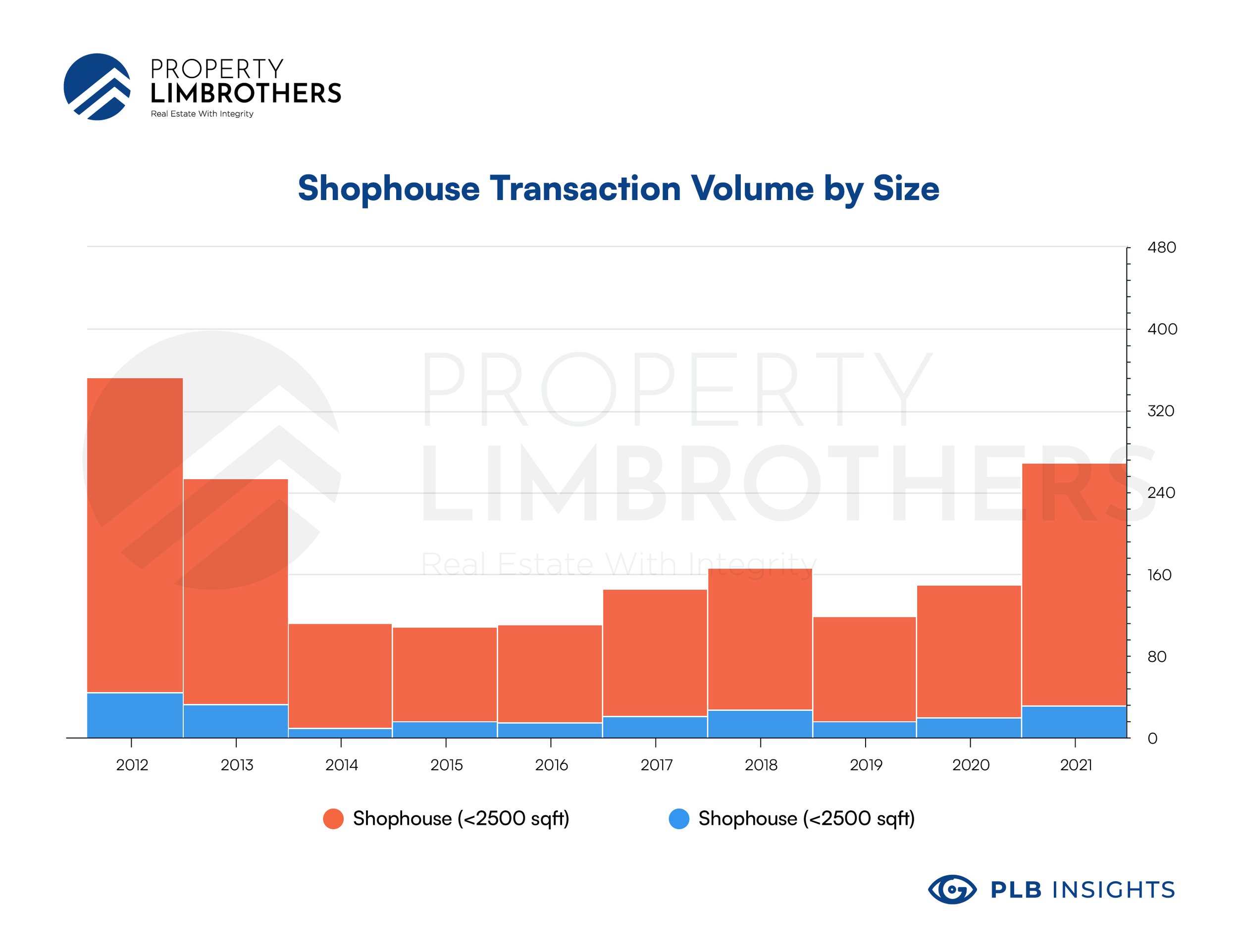

To put some data to visualise what we mean, the orange line demonstrates a quantum play for Shophouses (<2,500 sqft) and the blue line represents Shophouses (>2,500 sqft). The PSF stated here refers to the build-up space. Notice that the lines oscillate, each line takes time to be on top of the other. Generally, larger Shophouses present the opportunity for PSF plays. These Shophouses have larger variance in PSF due to its low transaction volume. Sometimes, a deal presents itself in the form of lower relative performance to smaller Shophouses as seen in 2015 and 2021. On the other hand in years like 2017 and 2018, investors of larger Shophouses might wish to realise their gains by letting go of the property at a higher relative PSF than smaller Shophouses.

We understand that timing the market is difficult. Nonetheless, it is important to realise the trends and patterns in price action of the property class you are looking at. Based on the price action patterns in Shophouses, a “buy low, sell high” approach is definitely feasible. The higher price variance in larger Shophouses presents this opportunity to time the market.

3. Capital Growth or Rental Yield

Going for the Quantum or PSF play is related to whether your investment objectives are predominantly Capital Growth or Rental Yield. Capital Growth strategies focus on investing in assets for the purposes of Capital Appreciation. Since most of the gains will be realised upon sale, being able to time the market and having a great exit plan is key. Shophouses that fall within this category would tend to be either undervalued or lagging behind its comparables in terms of price performance. This signals a disparity gap and more room for capital growth. Thus, the investment selection of the Shophouse would primarily be focused on finding the “ugly duckling” among a cluster of already well-performing Shophouses. The key point is seeing the value before other investors do. Others see the ugly duckling but you already see the beautiful swan, even before it grows up to be one.

Rental Yield strategies focus on Shophouses with the highest level of rental yield ($/PSF). This is a longer term strategy aimed to generate a stream of income rather than looking purely to profit from a sale in the Mid-Long term. The great thing about this strategy is that there is less pressure to sell. Since the stream of revenue can help support both the mortgage, and the income statements of the holding company. We foresee the Shophouse performance to maintain a strong relative performance going into 2023 and 2024. Its strong cultural and heritage factors play in with its unique traits to make a truly special class of property in Singapore.

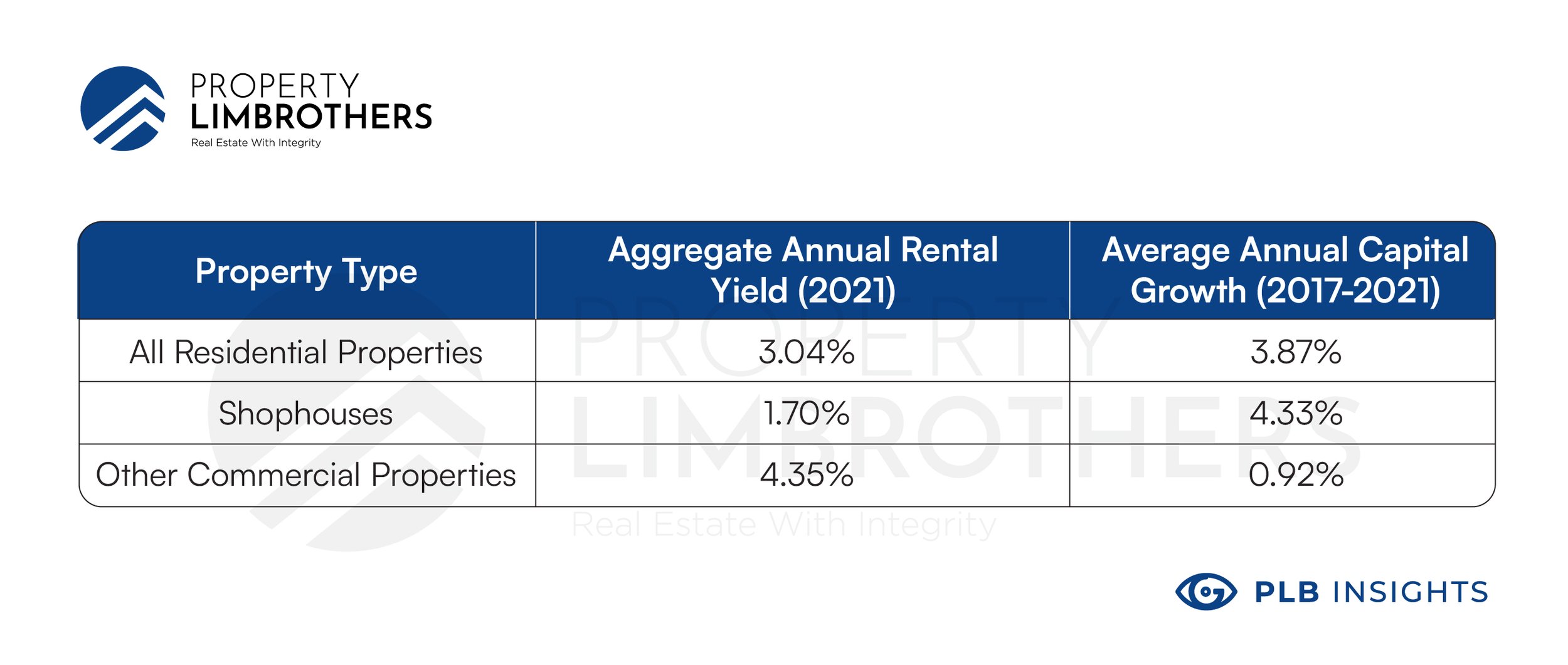

On the aggregate level, Shophouses align more with Capital Growth strategies than Rental Yield strategies. This is not to say that you can’t do it for rental yields. If you do intend to go with the rental yield strategy, make sure that you are picking the right outliers that have much better yields than the average Shophouse. Overall, Shophouses outperformed Residential and other Commercial properties in terms of capital growth over the past 5 years on aggregate. Though the Rental Yield of Shophouses are the lowest of the three categories, it is trending upwards. Whereas other commercial properties are in a downwards trend for rental yield. This might be driven by the Covid Pandemic or Work-From-Home Trends.

4. Deciding between D1,2 or D7,8

The next consideration would be location. We compare two groups of districts (D1,2 vs. D7,8). Generally, this consideration is between the middle of CCR (D1,2) and the border between CCR and RCR (D7,8).

Comparing the price performance between the two different groups, Shophouses in D1,2 jointly outperforms D7,8. In some sense, we can deduce that the larger capital growth trends for Shophouses might be driven more by Shophouses in D1,2 than other districts. While this might be the case, the high prices in the CCR might act as an entry barrier for most investors. If that is the case, investing jointly in D1,2 using a holding company or going for a quantum play in D7,8 is the way to go.

The interesting observation that goes with the better price performance for D1,2 is the transaction volume. Usually in a case where price performance is better, we notice a much higher transaction volume. For Shophouses in D1,2 we have a counter-intuitive discovery. The transaction volume for D1,2 is comparable if not lower than D7,8 with the exception of the 2015-2016 period. From this, we can perhaps infer that there are “stronger hands” in the D1,2 Shophouse segment. Less willing sellers for an already small pool of Shophouses mean that prices are bound to inflate with a growing pool of prospective investors. If you are going for D1,2 Shophouses, you might want to consider if you have diamond hands.

Next, when comparing between D1,2 and D7,8, we look at rental yields. Even though we know from the earlier section that Shophouse investments are more in line with Capital Growth strategies, rental yield should not be neglected as they go towards repaying the mortgage. Rental performance is better for D1,2 as expected. There is more upside volatility during good years such as 2014 and 2019 for D1,2. In comparison, D7,8 rentals are rather stable.

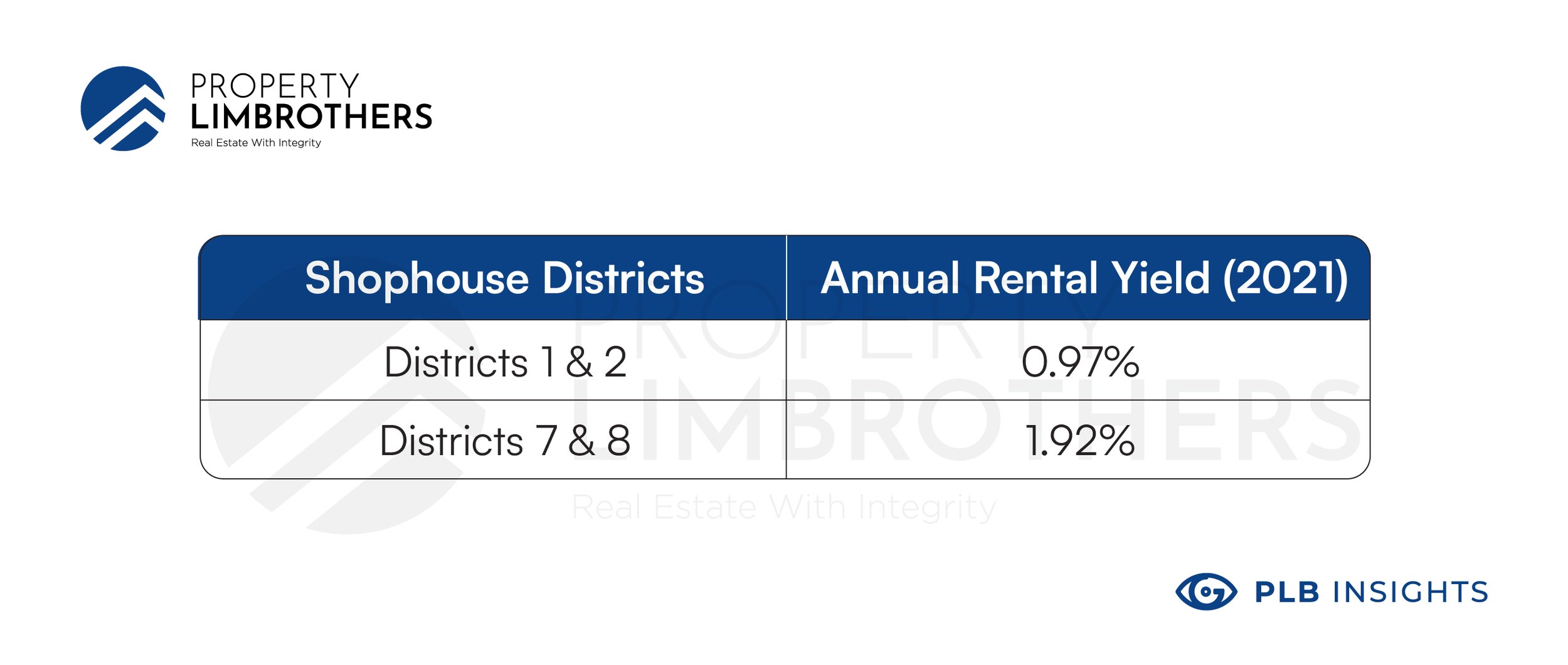

The rental yields for D7,8 are almost double that of D1,2. This is the main trade-off for D1,2 Shophouse investors. Although Capital Growth is better, Rental Yields are poorer. The opposite is true for D7,8. In this case, D7,8 makes the case as a more affordable entry for investors with higher rental yields and lower quantum. There is also much less volatility and variance in price. Volatility itself is not a bad thing. With volatility comes opportunity, but also risk. In this section, investors are reminded of their risk tolerance for property investments. We would recommend those with a higher risk tolerance to seek opportunities that D1,2 presents. For investors with a moderate risk tolerance, D7,8 presents a more palatable option.

5. Selecting Conservation or Non-Conservation Shophouse

Choosing either a Conservation or Non-Conservation Shophouse is more than a matter of taste. It affects regulations pertaining to how you can renovate the space. It also has intrinsic value as a piece of history. In our previous Shophouse article, being a conservation Shophouse can be a cultural asset that gives businesses its much needed boost. If it works in tandem with the brands of businesses looking to use the space, it could be a great boost to image.

Conservation Shophouses might have constraints on renovations and how the building must be maintained. We take this as a good thing, not a bad thing. These constraints help keep tenants in line when it comes to modifications of interiors and exteriors. It also adds to the rustic charm of being a Conserved building. Either way, when selecting between the two, take note of what kinds of businesses you would like to rent to. If you are operating in the Shophouse with your own business, ask yourself if being a Conservation Shophouse would add value to your brand.

Lastly, Conservation Shophouses are unique and historically significant. There aren’t going to be more Shophouses of the same age and quality unless you go back in time to build more. This adds a chip to the negotiation table when you eventually look to exit. While it might be a value-add in terms of rarity, do take note that the pool of investors that see this value might also be slightly smaller.

6. Be Prepared for a Mid-Term Holding Strategy to Observe Appreciation

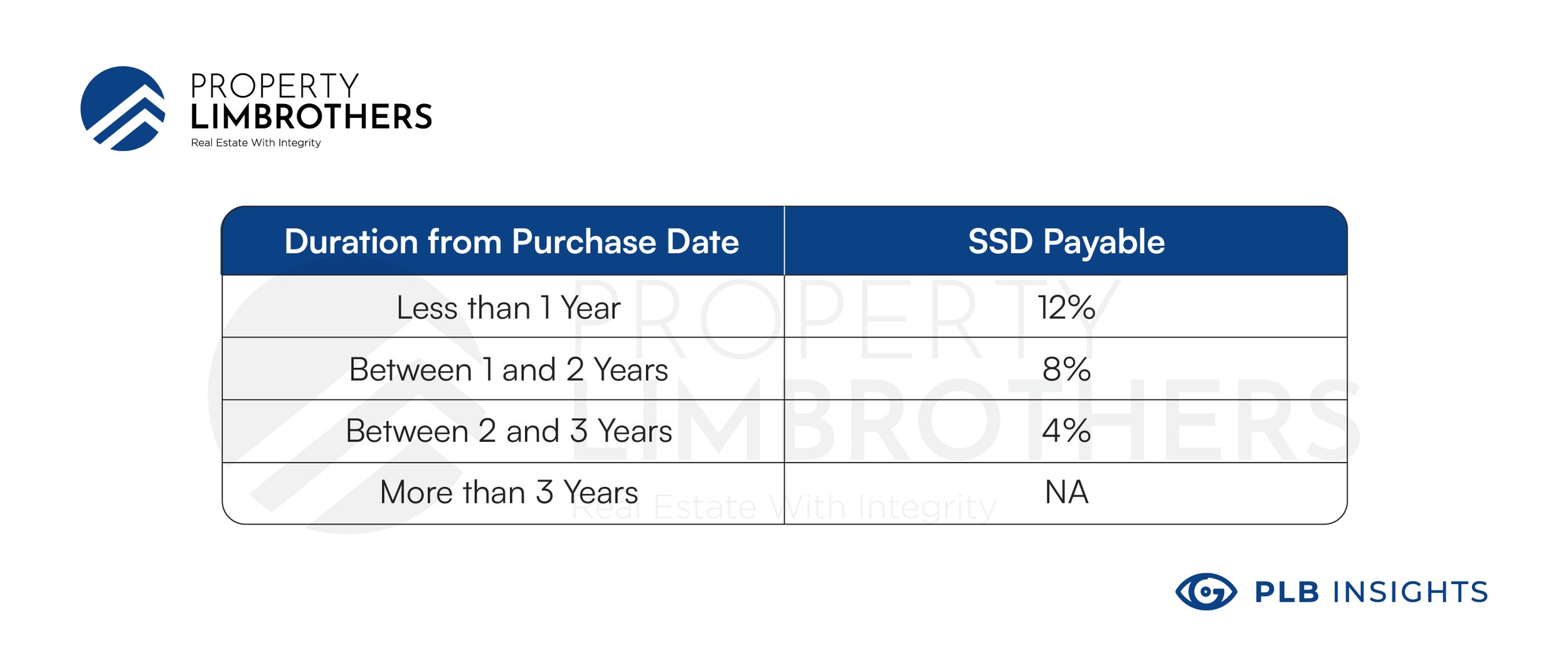

We mentioned earlier about having diamond hands when it comes to specific Shophouse investments. Having the holding power to wait and observe the capital appreciation will take time. While ABSD does not apply for Commercial Shophouses, SSD still does for Shophouses that have a residential component or is an industrial property. You will have to pay SSD if you sell the property within 3 years of purchasing it.

In order to make sure you sell your investment into strength, having a minimum holding period of 5 to 7 years would be good. This would give you enough time to ride out any economic downturn or monetary tightening (as we are seeing now). When you decide to make an investment in a commercial Shophouse, make sure that you are not overleveraged, and have the holding power to not panic sell when the price performance is poor.

Closing Thoughts

We have covered a lot in this article. Here’s a checklist of the main points of our discussion.

-

Research & Due Diligence

-

Quantum or PSF Play

-

Capital Growth or Rental Yield

-

Deciding between D1/2 or D7/8

-

Conservation or Non-Conservation Shophouse

-

Be Prepared for a Mid-Term Holding Strategy to Observe Appreciation

The key takeaway is that commercial Shophouses are generally more in line with the Capital Growth strategy than purely for Rental Yield. Between the Districts, D1/2 have better capital appreciation but much poorer rental yields. The barriers of entry are high but present greater upside with a mid-long term holding period. On the other hand, D7/8 offers better rental yields with still decent levels of capital appreciation over time. It presents a more affordable entry point into the commercial Shophouse Segment.

If you want to know more about the Shophouses that personally suit you more, reach out to us here to have a detailed discussion.