Decoupling is a concept that has taken Singapore by storm since the turn of the century. It is a simple yet elegant idea. Sell your existing home, be it a condo or HDB. Use the proceeds to foot the downpayment for two new private condos, one under each spouse’s name. One for your own stay (typically bigger), and the other for investment or rental income (shoebox unit). This was a very attractive idea to the middle-income population looking to grow their own property portfolio, whether for legacy or retirement purposes.

Real estate in the 2000s felt to most people as a “sure-win” method to investing. A low risk, high leverage way to increase their net worth. This heated obsession with property buying led to euphoric, speculative buying of property. Pushing prices further up, before the bubble popped together with the Global Financial Crisis in 2008. There were many factors contributing to this “property-fever” in the late 2000s. Are we witnessing a similar craziness in the property markets today?

In this article, we revisit the idea of decoupling and probe if it is still a viable property investment strategy in the current regulatory and economic environment. We explore why decoupling made so much sense to investors in the 2014s, and why it might not make that much sense to today’s investor. To build on the idea of decoupling and its successors, we offer a few perspectives on how we should make sense of decoupling in the current investment climate.

The Wild Property Market Before Decoupling was a Thing

Before the rapid implementation of cooling measures from 2009-2013, property buying was a phenomenon of its own. You might have heard stories of condominiums selling out at launch, units going out to buyers like hot cakes. Investors run to the showroom with their chequebooks, ready to sign and pay for the down payment for multiple units on the same day of the launch. These are imageries of a by-gone era. Yet, it still runs vibrant in the minds of experienced property investors and realtors.

There are three key difficulties in building a property portfolio. First, was the issue of down payment for the subsequent properties without liquidating existing ones. Next, it was the cash flow issue of servicing two or more property loans. Finally, it was the exit opportunities and the ease of selling the property. The regulations in the real estate industry before the Global Financial Crisis were rather easy-going in some sense. The three key difficulties in accumulating real estate were not as difficult as now.

In the past, there was 90% Loan-To-Valuation for private properties, Interest Only Housing Loans & Interest Absorption Schemes (both outlawed), and low transaction costs for flipping properties (before the introduction of SSD and ABSD). These made it a lot easier for the public to participate in the real estate market, and sometimes speculative. We will focus on the two aspects of affordability: reduced down payment & cash flow aids.

First, the down payment required for private properties before 2008 was 10% of the property value. Banks before the Global Financial Crisis were more than happy to offer a 90% LTV. After all, that means more people will be able to afford to buy a property and more interest payments from them. Sounds like a win-win right? What really sweetened the deal was that CPF OA could be used to pay for half of the cash down payment (5% of property value) after July 2005. This was a tremendous benefit for buyers. Imagine buying a one million dollar Condo. All you needed for the down payment was 50k in cash and 50k in CPF OA. Of course, some additional cash is needed for legal fees and buyer’s stamp duty.

Second, the next hurdle after the down payment was to be able to service a huge 90% LTV loan. Could middle-income earners do it all by themselves? Surely, it would have been too strenuous on personal finances to foot such a heavy mortgage. Two key schemes as forms of cash flow aid enabled them to afford such a loan. The Interest only Housing Loan (IOL) and the Interest Absorption Scheme (IAS). The IOL allowed loanees to pay only the interest payments without paying back the principal amount. This greatly reduced the mortgage payable each month (sometimes almost as much as half). The IAS, on the other hand, was a scheme offered by developers to absorb the interest payments of the loan until the construction was done.

With these two pillars in place, it became easier for members of the public to afford real estate to a degree where it was possible to speculate in the market. It became feasible for middle-income families to work their way into owning multiple properties. However, the Global Financial Crisis in 2008 rocked the boat hard. Financial institutions in the U.S. experienced a rude wake up call with defaults from irresponsible lending. This subprime mortgage crisis caused the global financial system to go into a tailspin.

In a bid to prevent such a disaster from happening in Singapore, regulators here have learnt to tighten up on the real estate market. Making it less prone to speculation, and stabilising it to make sure that financial institutions are not exposed to too much risk from bad debt. As a result, IOL and IAS were outlawed in 2009. LTV was lowered, and ABSD was added. Our previous article on Cooling Measures covers part of this history.

How and Why did Decoupling took off

As the Cooling Measures started to stack up from 2009 to 2014, people’s dreams of owning multiple properties were dashed — at least temporarily. The introduction of decoupling, enabled people to embrace the ABSD rules and was a strategy emphasising the legal flexibility of homeownership in order to build a property portfolio. Decoupling has nothing to do with divorce, by the way. But it does have something to do with how spouses legally arrange themselves for homeownership.

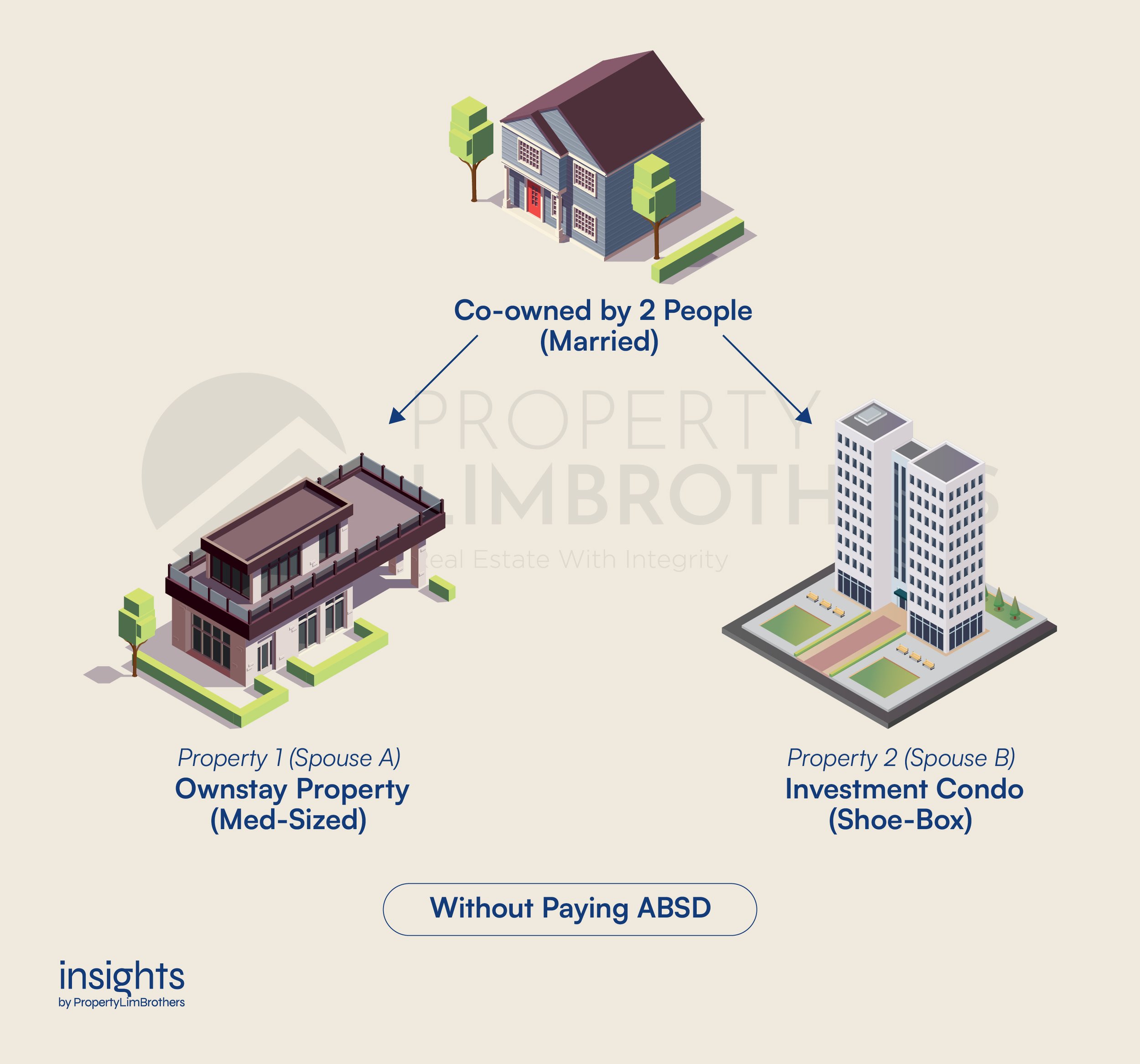

The concept was simple. Instead of owning one property with two names, each spouse can potentially own one property without having to pay the ABSD. This makes owning two homes possible without paying for ABSD. A divorce is not necessary. The buying process simply has to state only one of the spouses as the legal owner of the property. While this avoids the additional ABSD costs, property buyers still had to deal with lower LTVs (which means higher down payments and higher mortgage payments).

The hurdles of having a cash pile to foot the down payments for two properties, and having sufficient income to support the loans for two homes are substantially difficult. In order to overcome the first challenge of the down payment, prospective homeowners would be advised to ideally get a BTO flat first. The profits from the sale of the BTO upon MOP, accompanied by the savings throughout the entire period would help to build the financial base to afford the down payments for the two properties. While there is a general consensus that BTOs do earn some profits, its ultimate purpose is still to provide affordable public housing. And people should remember that. To further reduce the down payment amount for multiple properties, it was most popular among HDB upgraders to purchase a mid-sized private condo for their own stay (typically two to three bedrooms) along with a small shoebox apartment for the investment property (typically studio or one bedroom).

This strategy was immensely popular during the mid-2010s as it played on the hopes of owning multiple properties for legacy and retirement purposes. Whilst it is more difficult to do so during this period, the decoupling strategy offered HDB upgraders (which were the biggest group of consumers for the condo mass market) a dream that is tempting and tough to refuse. Even though the decoupling strategy was considered feasible, it sometimes put families at risk of a precarious financial position. Cash reserves might have been spent dry simply to afford a second property. Families might be overleveraged and put themselves at risk of default if there’s a property market downturn or retrenchment exercise.

These middle-income families were dual-income in nature. Both spouses are working hard at the rat race to be able to continue servicing the property loan, stretching their debt servicing ratios to the limit. This leaves little room for discretionary and emergency expenses. To help decouplers deal with the cash flow issue, the decoupling strategy was more effective with new launch condominiums. The Progressive Payment Scheme helped with the mortgage at the earlier stages when the property was still being built. The mortgage is only effective on the capital disbursed to developers upon completing specific milestones in the construction of the condo. After the property is completed, the investment property can be rented out to assist with the mortgage payments. Alternatively, it can be sold for a profit if there is a handsome capital appreciation on the investment.

As you can see, many considered the decoupling strategy to be rather clever. Using multiple pieces of the puzzle to make owning two properties possible for middle-income families. It is not easy to pull off this decoupling strategy well. There is bound to be a high level of financial stress involved in such a huge investment move. However, we have to acknowledge that decoupling has helped many families start working on their property portfolio dream. Is such a strategy still feasible or efficient in helping families get to that property collection vision now?

Does Decoupling Still Work in Today’s World?

If decoupling on its own wasn’t tough enough, it is now even harder to execute than in the mid-2010s (at the peak of its popularity). Primarily, the LTV is even lower than before (75% or below). TDSR was also reduced (55% currently). Both are big hits to the ability for people to afford private property, let alone buy multiple ones. With regulators gradually scaling up the cooling measures on private property, will decoupling still work with tighter housing loan requirements? ABSD might be less of an issue now than LTV and TDSR for the middle-income property investors.

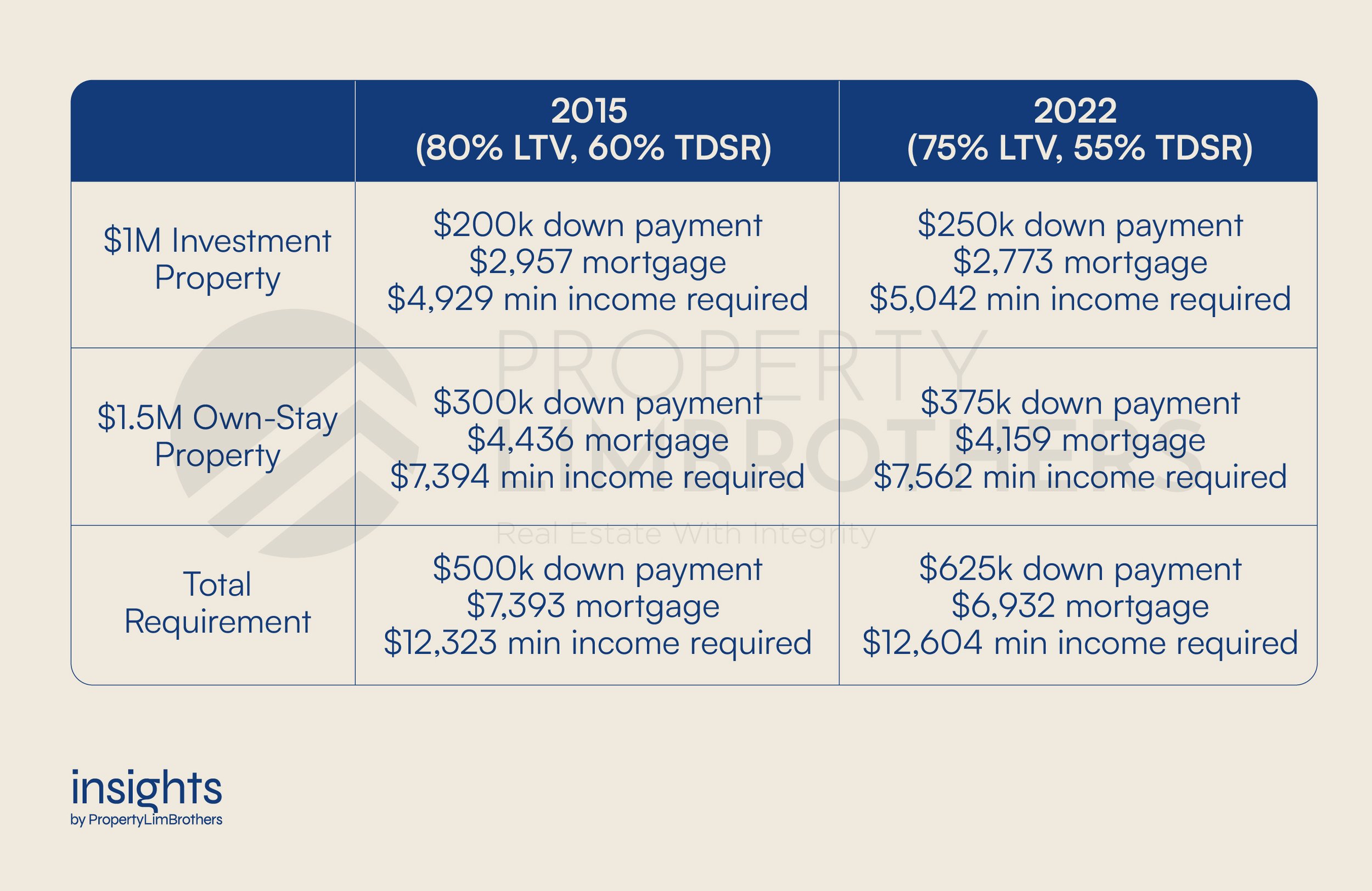

Let’s take a look at how the tighter debt requirements affect the viability of decoupling? Comparing 2015 and the present, we look at how much income individuals would need to afford a $1 million investment condo and a $1.5 million own-stay condo. Assuming that the tenure of the loan is 30 years at an interest rate of 2% (estimated mid-to-long term average rate), we round mortgage payments to the next dollar. We calculate the theoretical minimum income required based on the TDSR ratio (banks might or might not offer loans based on credit scores and TDSR guidelines). This is the bare minimum, the advisable income level would be much higher, preferably within the 30% Mortgage Servicing Ratio (MSR).

Looking at the table above, we can see that the down payment required based on the current rules is much higher (by $125k in fact). This is no small matter. Even if each spouse saves $1,000 each month, it will take the couple 5 years and 3 months before they can accomplish this goal. The minimum income required may not look like a huge difference, but it will matter more when we factor in car loans and other forms of debt.

Decoupling today may still be feasible but it takes considerably more money and time to execute. It is far from being an efficient strategy for families to build wealth. What is the way forward? Is there a better way for people to build a property portfolio? How should they go about their first steps? One alternative is to go for growth. Just because you own multiple properties, doesn’t mean your portfolio will automatically perform. Instead, re-prioritising high-growth potential properties might be a better choice for middle-income families to grow their capital before they move on to purchase multiple properties.

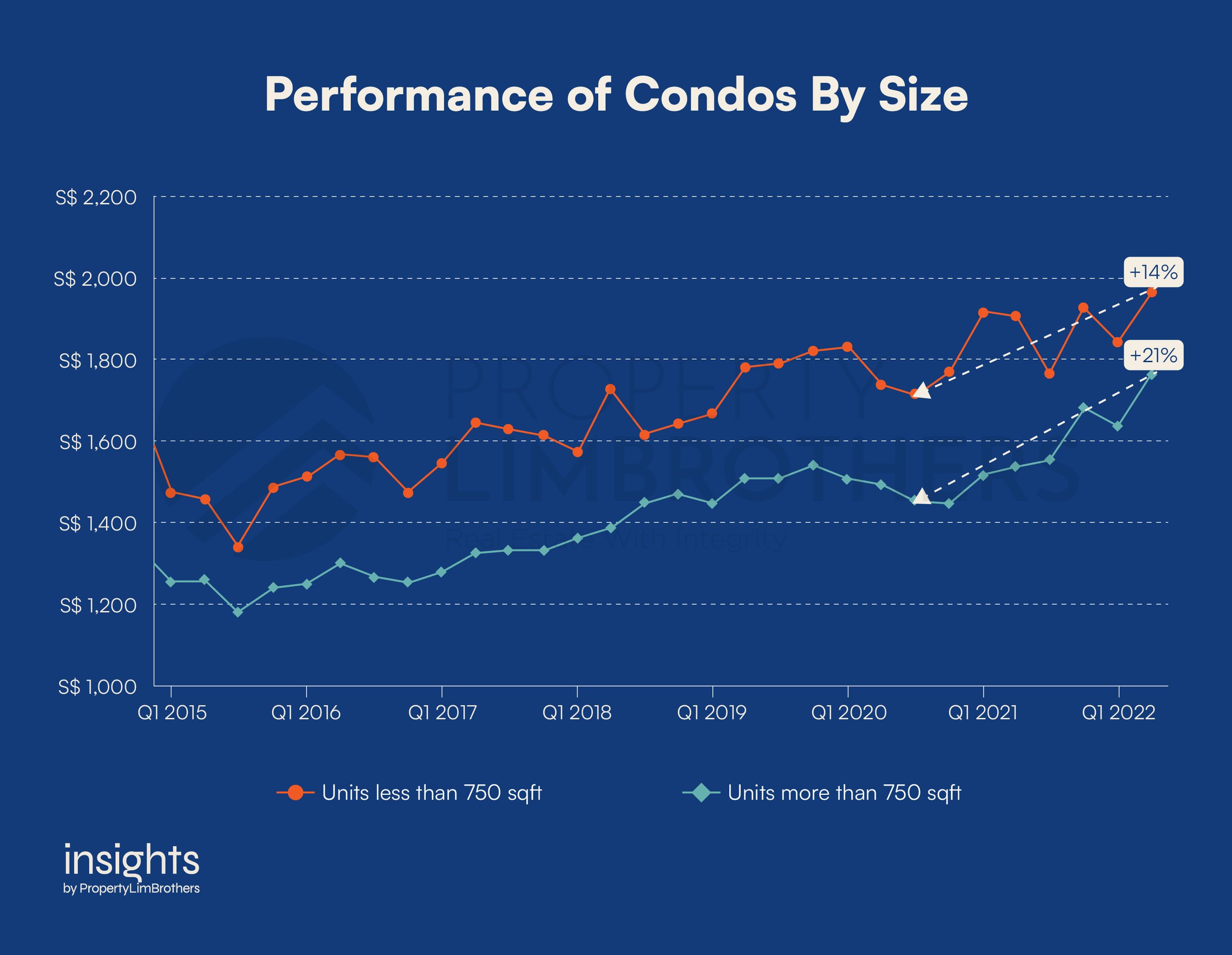

Less is more. When it comes to capital appreciation, banking on a single, larger apartment might do better than a decoupled combination (mid-sized + small sized). Although rental income is likely not applicable for the single larger apartment, it could probably do better on the capital appreciation front. Our previous articles have talked about how the future of work has pushed a preference for larger homes forward. Even with people going back to the office, it would seem that the desire for bigger living spaces remains strong.

Over the past 7 years, smaller apartments have been priced at a higher psf but have a lower growth rate (33%) as compared to larger apartments (41%). In more recent history, from the pandemic in 2020Q3, large apartments still outperform smaller apartments by a margin of 6%. Smaller apartments only grew 14% in the span of 7 quarters while larger ones grew 21%. Going back to our focus on capital gains, less properties may help you achieve better capital returns if you select the right property.

Closing Thoughts

Decoupling may lose out to more efficient capital appreciation strategies that focus on growing wealth and capital rather than the count of properties in the portfolio. Such a performance based focus will help families achieve their larger long term goals, be it legacy for their children, living in landed property, or having a property portfolio for retirement.

If you wish to know more about decoupling strategies and capital appreciation strategies for property portfolios, reach out to our experts here. How we buy, sell, and select homes are catered to each individual’s needs. Goals will be different. Financial situations will be different. The ideal strategy will be different. Does decoupling still make sense for you? Talk to us to find out more!