What defines a ‘sound political environment’? According to Encyclopedia Britannica, a stable political system survives through crises without internal warfare. In other words, a country has a sound political environment when the government can maintain, if not increase, its legitimacy of rule.

Like many in the developed world, we take a sound political environment for granted. While a stable and competent government should be an aspiration every country should strive towards, this remains a privilege as a result of historial luck coupled with great leaders and a sensible populace that accords many benefits.

The soundness of a country’s governance provides seemingly unrelated benefits. In the aggregate, one of them is a healthy real estate market. Even so, there are some exceptions to this idea.

The Singaporean Political Environment

Proponents of the idea that a sound political environment is correlated to a healthy real estate market often quote Singapore. After all, Singapore’s ruling party, the People’s Action Party (PAP), has enjoyed 63 years as the ruling party (and counting!) since its first electoral victory in 1959.

Image courtesy PAP Facebook

However, the PAP’s political longevity was not handed to them on a platter. Practical policy-making, especially in delivering law and order and economic growth, allowed them to create stability in Singapore’s independence years, marked by internal strife and overpopulation.

Through subsequent threats to political legitimacy, the government continued to see through following threats, such as the oil crises of the 1970s and, later on, the Asian Financial Crisis in 1997, winning 83 out of 93 contested seats in the recent 2020 elections.

What this means for Singapore’s Real Estate Market?

Singaporean real estate is a hallmark of stability in Southeast Asia.

Even with high government regulations and taxes, which usually do more harm than good by repelling prospective investment capital, it has done quite the opposite here in Singapore. Singapore remains one of the most attractive real estate market destinations over the long term.

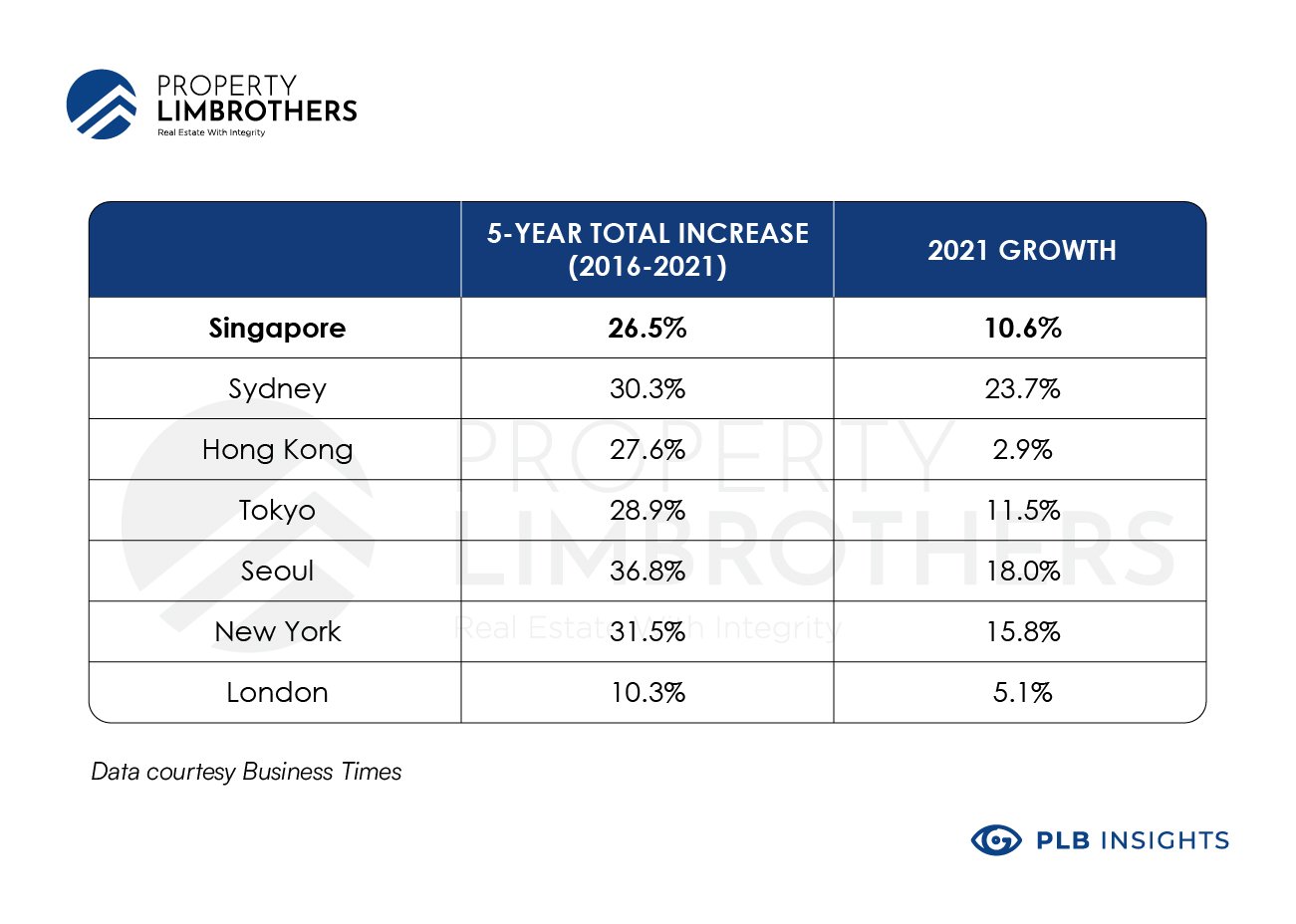

Why is this so, even with statistics showing that Singapore’s private property market is not the top performer when compared to other gateway markets? The keyword here is stability.

Singapore remains an attractive real estate destination due to its low corruption and pragmatic economic directives – pointing again to sound governance. Although a mature economy, Singapore has vast growth potential this decade, even growing 7.2% last year amid the global pandemic slump.

The Chinese Political Environment

If you need another excellent example of political longevity, look no further than East Asia.

China’s Chinese Communist Party (CCP) has been in power for much longer than the PAP – came to power in 1949 and continued to govern a country of over 1.4 billion as of writing (April 2022).

A nation as large as China comes with equally significant social and economic issues. It is no secret that the CCP has had to maintain its rule by exercising an sizeable grip on power in what’s known as a civilization state, an entity consisting of many diverse communities and ways of living dating back to the Roman Empire.

Image courtesy Real Instituto Elcano

How’s Chinese Real Estate?

China’s real estate market growth remains very much integral to China. As recent as 2019, total sales in Chinese real estate have reached almost 16 trillion yuan (2.5 trillion USD), accounting for nearly 10 per cent of China’s GDP.

Yet, at the moment, the Chinese real estate market is currently facing its own set of challenges.

First and foremost, while real estate growth remains a primary objective even at the local level, this seeming laser focus on this growth has turned out to be tunnel vision.

China is currently facing a property market bubble so worrying that prices quadrupled within the last two decades.

Chinese public housing policies have much room for improvement. For more information on Chinese public housing, read our previous article, Is Public Housing Important to a Real Estate Market? Exploring the Differences Between China and Singapore’s Public Housing Policy.

The Australian Political Environment

Australia is known for its ‘revolving door’ of prime ministers. Since 2010, it has experienced leadership change on five separate occasions: once in 2010, twice in 2013, and once in 2015 and 2018.

Why is this so? There are frequent conflicts of interest between party interests and civil society. The centre-left Labour Party and the centre-right Liberal-National Coalition have attempted (unsuccessfully) to fix these conflicts by calling for leadership spills as short-term solutions.

How’s Australian Real Estate?

With seemingly frequent political instability (thankfully not to a militant degree), does this mean Australian real estate may not be as attractive?

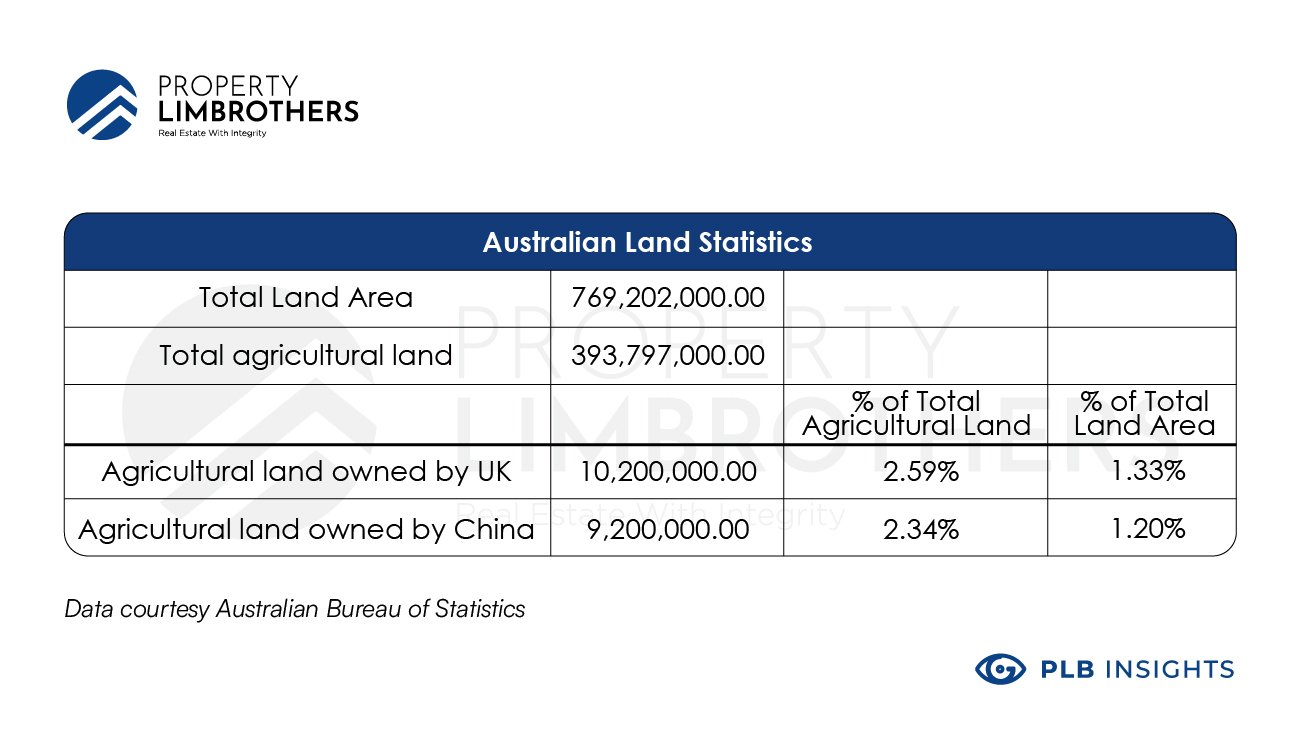

While foreign investors have made up only 3.7% of new home sales and 2.2% of established homes in March 2021, foreign investors are also taking a slice of pie out of Australian farmland.

As of May 2020, the United Kingdom owns as many as 10.2 million hectares, followed by China at 9.2 million hectares. These statistics mean that despite changes in political leadership, foreign investment in Australian real estate remains robust.

However, renowned investors like Scott Pape have reservations about investing in Australian property, saying that such a market is a ‘bubble ready to burst, especially amid rising interest rates, so always do your due diligence before investing anywhere!

Political environment ain’t enough

Assessing the health of a country’s real estate market should not be confined to one factor for reference. While a sound political environment may contribute generously to the performance of a country’s real estate market, it is not the primary contributor.

Singapore may seem to be a great example of a good relationship between political longevity and a healthy real estate market, yet China appears to break this notion. On the other hand, Australia enjoys a robust flow of foreign direct investment into its real estate despite frequent leadership changes.

It would be wise to measure your risk appetite when considering which country’s political environment fit in your grandiose retirement plans. However let it not be the only factor when investing internationally.

Need more guidance on planning your real estate investment plans? Feel free to reach out to our team. Click here to contact us now!