TLDR: Did you know you could stay in a Ritz-Carlton branded development? Or own a St. Regis condominium and perhaps catch a glimpse of Kim Jong-Un (if he ever comes to Singapore again)? If you have always wondered why there are condominiums carrying the name of famous hoteliers, you have come to the right article.

Branded residences is not a new phenomenon, but it is so rare in Singapore (only 4 developments!) that it is understandable why this type of residence has gone under the radar.

To sum it up in a sentence – branded residences marry luxury living with personalised service. Keen to find out more? Read on below.

What are branded residences?

Branded residences are luxury homes that are affiliated to a well-known brand. They are generally a partnership between the brand (usually a hotel) and the developer, whereby the brand grants a licence to the developer to market and sell residences that will carry the name of the brand.

By being associated with a reputable brand, these developments signal a standard of service and quality that the brand stands by. This instils buyer confidence, as buyers are assured of a quality product that also promotes the same values and lifestyles they are familiar with.

Aside from the impressive design and quality of the actual product, the added value of a concierge service is the key differentiating factor of branded residences. Boasting service offerings that can sometimes even outshine hotel offerings, this concierge service acts more like a personal butler, settling the needs of busy individuals. This appeals to high net worth individuals, as well as time-poor buyers who appreciate the time saved on mundane tasks like grocery shopping.

In the case of hotel-branded residences, the facilities and concierge services are managed by the hotel, thus assuring owners of the quality and well-kept maintenance of the facilities and amenities.

Evolution of branded residences

Branded residences first appeared way back in the US in the 1920s with the Sherry-Netherland Hotel on New York’s Fifth Avenue.

Image courtesy ADP Architects

A few years later saw the opening of The Carlyle Hotel and private residences in 1929. Nothing happened in the years after that as the concept of branded residences took a while to catch on. It only became more mainstream when Four Seasons came onboard with their hotel condominiums in Boston in the mid-1980s.

Image courtesy Four Seasons

After selling out their hotel branded residences in Boston, Four Seasons realised the untapped potential in the market, and quickly expanded its portfolio of branded residences in North America. To also establish its international presence, they then integrated Asia-based Regent Hotels into their portfolio. Because of this head start, Four Seasons is one of the leading players in the branded residences scene.

Once the concept of branded residences caught on, hoteliers like Marriot, Hilton and Accor quickly entered the market, and continue to dominate the industry till today.

Today, there are more than 400 branded residences globally. That amounts to about 55,000 residential units. Majority of the branded residences are by hoteliers, accounting for 85% of the schemes.

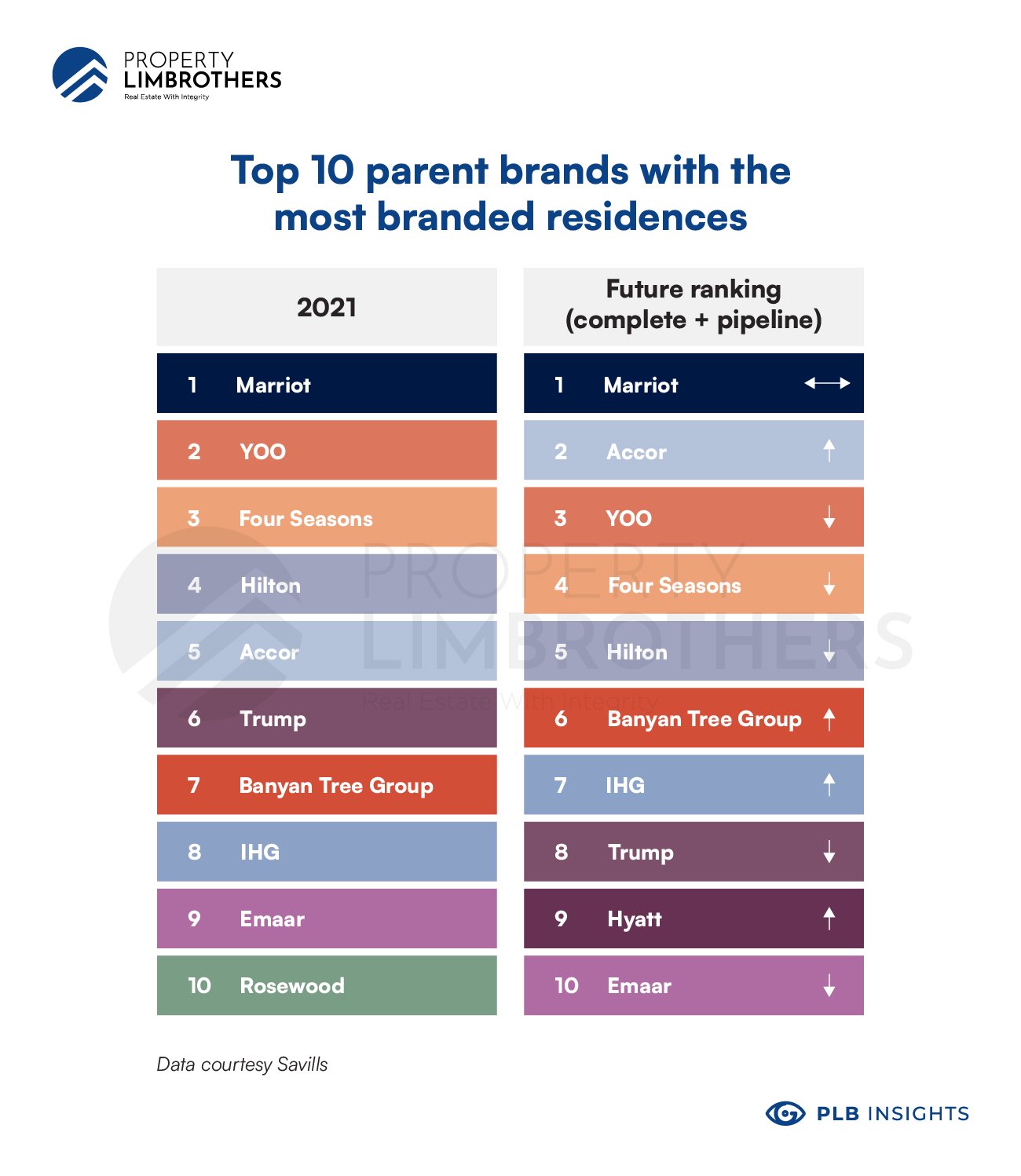

However, in recent years, non-hotel brands have jumped on the bandwagon too. Aspirational brands ranging from celebrity designers to fashion houses and even luxury cars are coming up with their own branded residences. In fact, the brand that placed second when comparing the number of branded residences schemes, is actually YOO, a design company.

Marriott is still the largest player in the market, and will defend its rank with the many projects in its pipeline. Accor, the parent brand of the upcoming Pullman Residences in Singapore will move up the ranks, placing second.

Some other interesting non hotel brands that have started their foray into the branded residences scene are

-

Luxury car brands like Porsche, Aston Martin and Bentley

-

Fashion houses like Versace and Missoni Baia

Image courtesy Bentley

Global distribution of branded residences

The US, being the birthplace of branded residences, continues to be the biggest single country market, accounting for about 32% of the schemes.

Rapid expansion of branded residences is also seen in other parts of the world, particularly in Asia Pacific and the Middle East. As the economy in these regions flourish, and domestic wealth rises, the new rich who are also brand conscious, are buying into these branded residences.

Asia Pacific accounts for 30% of the schemes, but in Singapore alone, we only have 4 branded residences – St. Regis Residences, The Ritz-Carlton Residences at Cairnhill Singapore, The Residences at W Singapore Sentosa Cove and the new Pullman Residences.

Why are hotel-branded residences growing rapidly?

As an industry, developers have been looking to shift away from the tangible (bigger pool, bigger gym etc), because these physical aspects of a development have pretty much become a given.

Developers understood that homes mean more than just the brick and mortar structure of the house. It was also important to reflect the values and desired lifestyles of the buyers.

Along came branded residences, a win-win formula, where buyers, developers and hotels all benefit.

For buyers, it is a concept that offers them the opportunity of owning a property that is associated with a luxurious hotel whose values and lifestyle they know and believe in. Branded residences also provide services that closely mirror what you get at a hotel. And that appeals to the hassle-free lifestyle desired amongst today’s time-starved population.

And developers are keen on this concept because branded residences have proved its ability to draw higher premiums when compared to non-branded developments. This is because the brand association helps to draw in buyers who are already familiar with the brand, and confident in the quality and standard of the development. Less effort is required to convince buyers, and they are willing to shell out top dollar for the perceived quality.

As for hotels, they are able to create an additional income stream from the licensing and management fees. Through branded residences, they can diversify their offerings to reach a different group of buyers who love what the brand stands for, and want to extend that into their homes rather than just hotel stays.

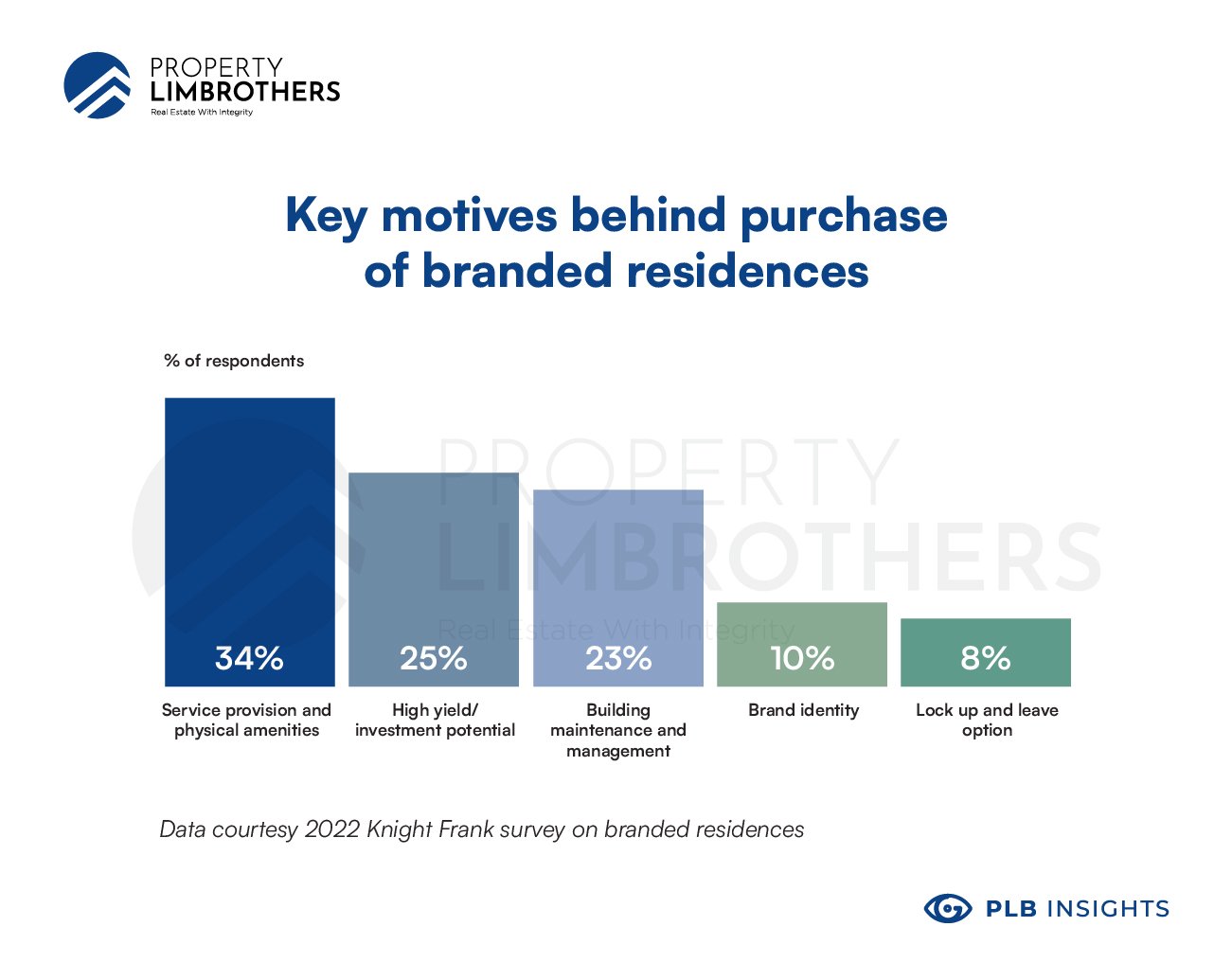

This is supported with insights from the 2022 Knight Frank survey on branded residences. When polled on the key reason why buyers would purchase branded residences, the top answer was the promise of hotel-like service and amenities. Buyers also believed in the potential for high-yield returns, in part due to the hotel management and maintenance of the building.

The promise of quality service, amenities and management differentiates branded residences from the already crowded global marketplace for luxury properties. Such a product also fills a gap in the market for time-poor consumers. This is why international buyers are willing to pay a premium for branded residences. This makes a case for developers and hotels to continue expanding into this area.

Key selling points of branded residences

Branded residences are a result of a partnership between developers and hotels. The hotel brand grants a licence to the developer, and is heavily involved in the design of the building and service offering. The developer is then in charge of the construction work, and marketing and selling the residences.

There are 3 broad types of hotel-branded residences:

-

Co-located – the branded residences are located on the same site as the hotel

-

Condo hotel – the branded residences are located within or may be integrated with the hotel building.

-

Standalone – the branded residences are located on a separate site to the hotel. An example of this in Singapore would be Pullman Residences.

All three types of branded residences anchor their selling points on the quality of the development and service offering similar to that of 5 and 6 star hotels.

In terms of the actual product, developments carrying the name of a reputable brand are typically designed with top-of-the-line fittings and based in prime locations. For example, the branded residences in Singapore are all located in prime districts 9-11, and Sentosa as well.

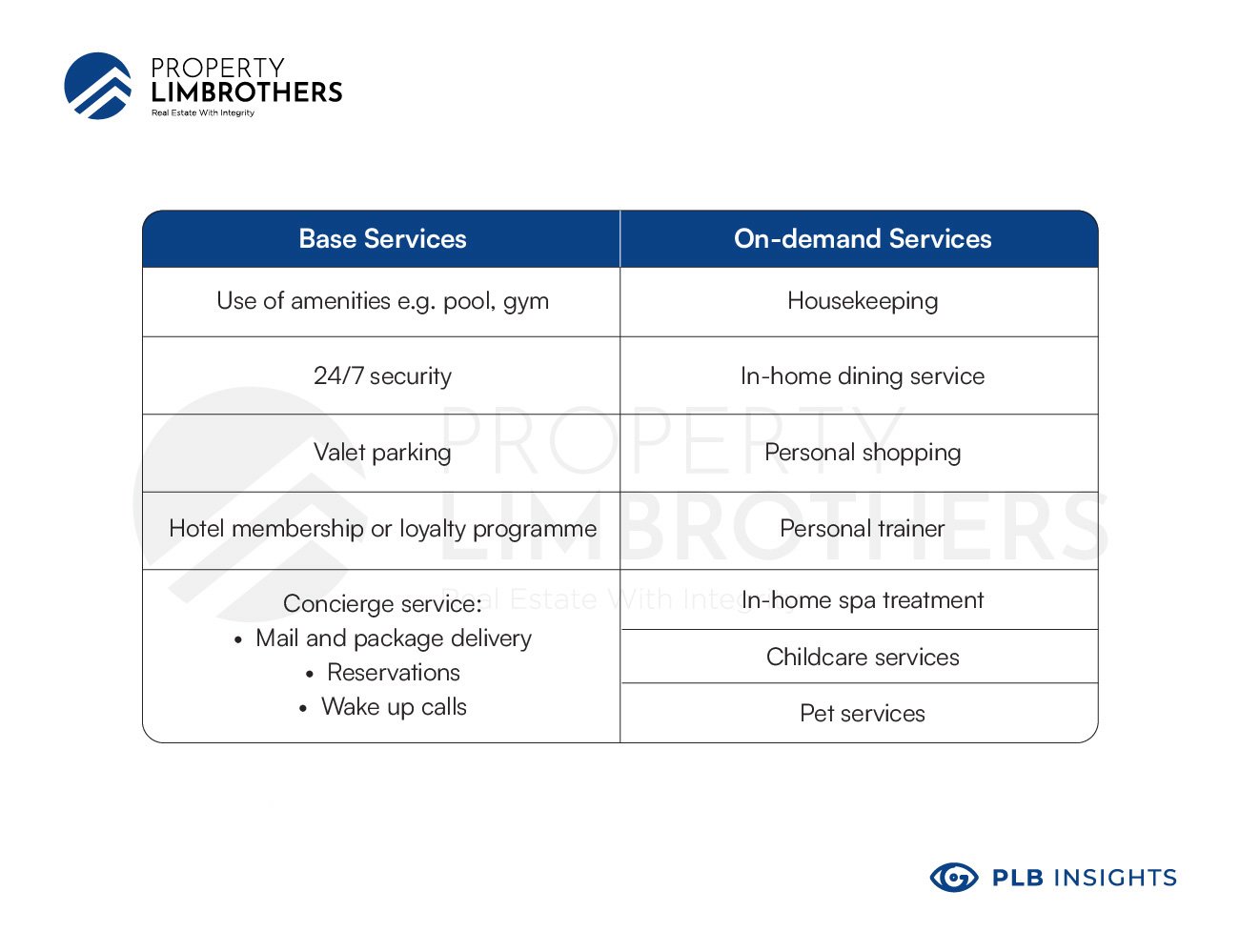

But what sets branded residences apart are the service offerings. These are usually categorised into base or core services, and ala carte or on demand services.

Base services are the usual services and amenities you would come to expect in luxury developments, such as security, concierge services and provision of WIFI. These would have been included in the service charges or monthly management fee owners have to pay.

The ala carte services are the standouts. These come at additional cost, and can range from housekeeping to dog walking, to even meals prepared by a private chef. It is basically a butler service you can opt in for, that will take care of all the mundane needs so you can focus on the more important things in life.

Here are some examples of services found in branded residences.

Buying into branded residences also comes with being upgraded to a VIP member of the hotel’s loyalty programme. Benefits include free upgrades or guaranteed rooms for when they travel. This is another major selling point, especially for the globe-trotting consumers of today.

Branded residences in Singapore

St. Regis Residences Singapore

St. Regis Residences Singapore was the first branded residence developed in Singapore. It was launched in 2008 to much fanfare and was the first project to cross the $3,000 psf threshold in Singapore. Nestled in prime District 10, St. Regis Residences is a co-located type of branded residence, as it shares the same plot as the hotel.

Developer: Richmond Hotel Pte Ltd (subsidiary of City Developments Limited)

Architect: RSP Architects Planners & Engineers Pte Ltd

District: District 10

Address: 31 & 33 Tanglin Road 247912

Property Type: Condominium

Site Area: 16,694 sqm / 179,691 sqft

Tenure: 999 years

No. of Units: 173

No. of Storeys: 23

TOP date: September 2008

Unit mix: 3 Bedrooms, 3+1 Bedrooms, 4 Bedrooms, Sky Suites & Villas

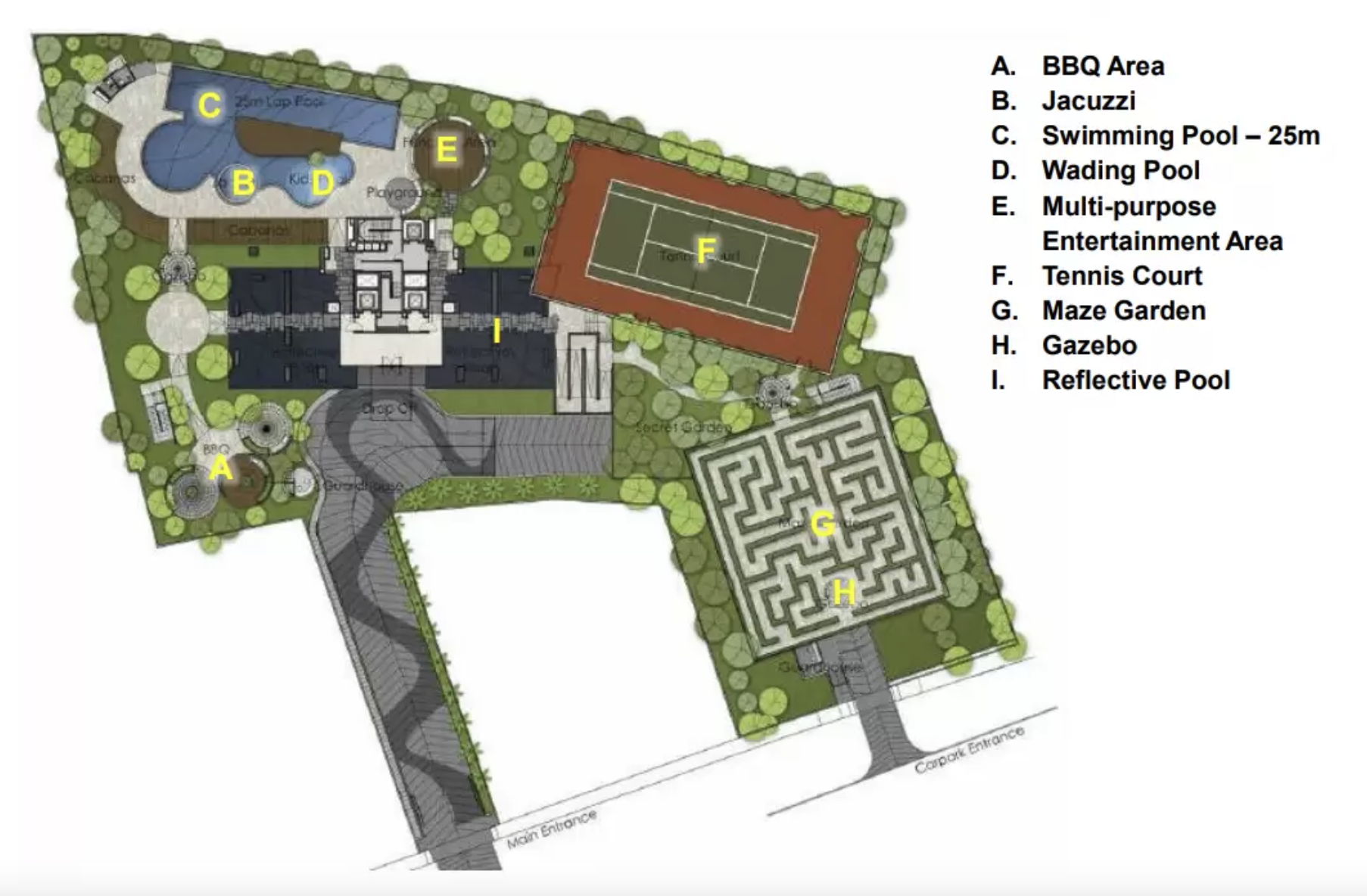

Site plan:

The Ritz-Carlton Residences @ Cairnhill Singapore

The Ritz-Carlton Residences @ Cairnhill Singapore was launched a year later in 2007, and was the first freehold branded residence development. Unlike its counterpart, the Ritz-Carlton Residences was a much smaller development, only yielding 58 units.

Developer: Hayden Properties (A subsidiary of KOP Group)

Architect: Eco-Id Design Consultancy Pte Ptd

District: District 9

Address: 65 Cairnhill Road

Property Type: Condominium

Site Area: 5,481 sqm / 59,000 sqft

Tenure: Freehold

No. of Units: 58

No. of Storeys: 36

TOP date: 2011

Unit mix: 3 Bedrooms, 4 Bedrooms, Junior Penthouse, Superior Penthouse

Site plan:

The Residences at W Singapore Sentosa Cove

The Residences at W Singapore Sentosa Cove is the only 99 year leasehold project amongst the branded residences in Singapore. The unique selling point about this branded residence is the waterfront living that none of its peers could compete on. A low rise development, The W Residences was built on a huge plot of land, amounting to 228 units, greater than the earlier two developments.

Developer: Cityview Place Holdings Pte Ltd

Architect: Eco-Id Design Consultancy Pte Ptd

District: District 4

Address: Ocean Way

Property Type: Condominium

Site Area: 23,257 sqm / 250,336 sqft

Tenure: 99 years leasehold

No. of Units: 228

No. of Storeys: 5-6 storeys

TOP date: 2011

Unit mix: 2 Bedrooms, 3 Bedrooms, 4 Bedrooms, Penthouses

Site plan:

Pullman Residences Singapore

Pullman Residences is the newest kid on the block, slated for completion in 2023. Also boasting freehold status, to date, Pullman Residences is the biggest branded residence in Singapore. It also has a wider mix of units available, ranging from 1 Bedroom to 4 Bedrooms. You can read more about our take on Pullman Residences in our next article.

Developer: EL Development (Horizon) Pte Ltd

Architect: ADDP Architects LLP

District: District 10

Address: 18 Dunearn Road Singapore 309421

Property Type: Condominium

Site Area: 8866.9 sqm / 95,443 sqft

Tenure: Freehold

No. of Units: 340

No. of Storeys: 30

Estimated TOP date: 31 Dec 2023

Unit Mix: 1 Bedroom, 2 Bedrooms, 3 Bedrooms, 3+S Bedrooms, 4 Bedrooms, Penthouse

Site plan:

Price analysis

Branded residences tend to command a premium price due to its differentiated offering of hotel-like amenities and services. Insights from a 2021 Global Buyer survey done by Knight Frank, it was revealed that 39% of residential real estate buyers are willing to pay a premium for a hotel branded property.

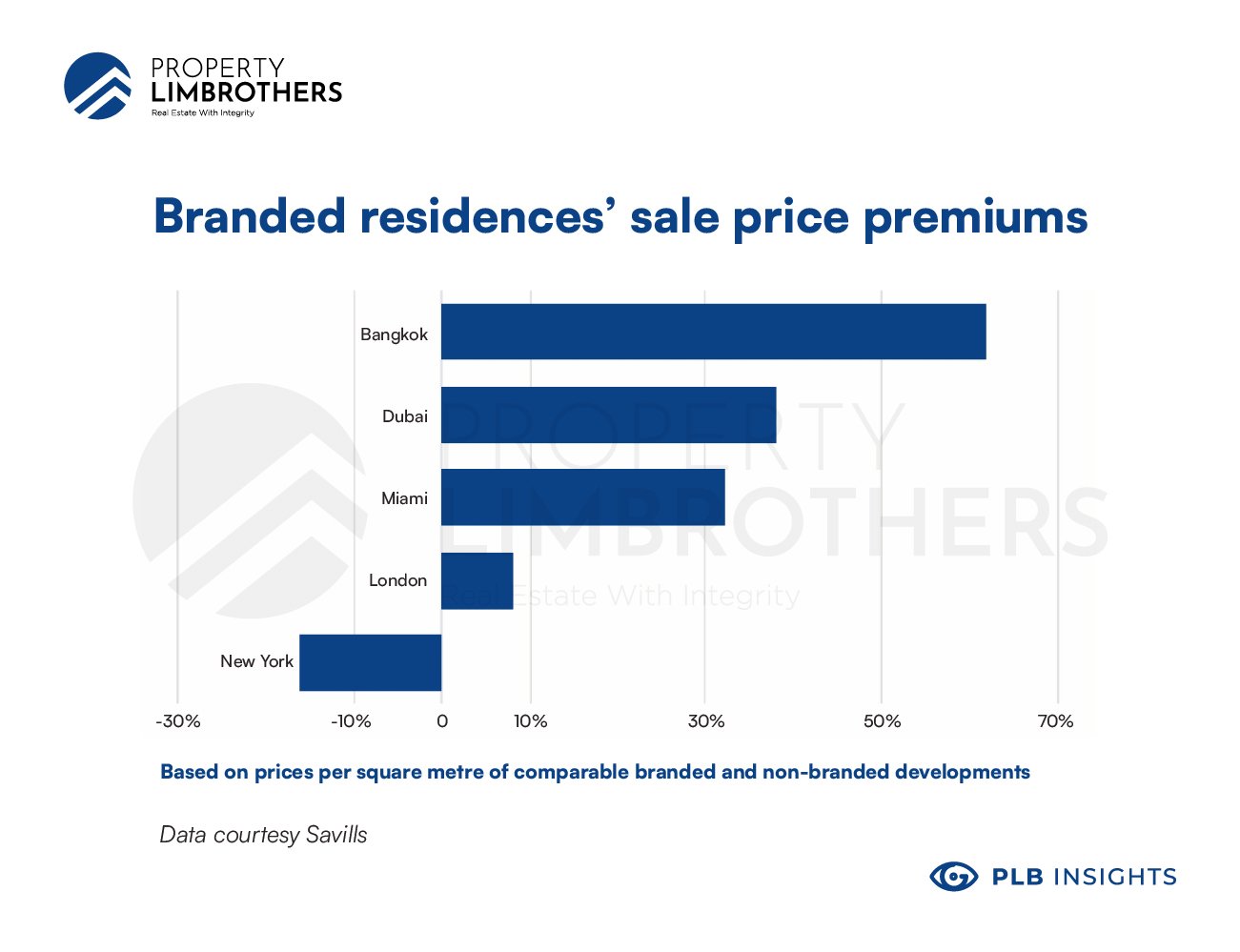

The amount of premiums that branded residences are able to fetch over non-branded developments can go up to 31%, but this varies significantly by location.

There are multiple factors that affect the branded residences’ ability to draw a premium such as the tenure, or the existence of special features like waterfront living. But more importantly, the highest premiums are usually found in emerging markets.

To the new rich in these markets, luxury brands are immensely attractive, as a way to signal their status and as long term investments. They view being able to buy into luxury products as a mark of success. The disparity in standards between the non-branded developments and branded residences may also be larger, hence, justifying the high premiums charged.

For example, the Ritz-Carlton Residences in Bangkok are asking at prices that command a premium of over 80%. In Almaty, Kazakhstan, this goes up to 150%.

In contrast, in more mature markets, luxury developments are a dime and a dozen. Existing developments already boast high standards of quality, which reduces the luxury disparity enjoyed in emerging markets. As such, the premiums in these markets tend to be lower. In cities like London and New York, premiums drops to 8%, and 15% respectively.

What about Singapore?

Being a mature market and with stiff competition from other luxury developments, branded residences in Singapore are unlikely to be able to command the kind of premiums in emerging economies.

Let’s compare the prices of Pullman Residences with other luxury developments that have been newly launched. From a glance, the pricing is on par or slightly above the prices of luxury apartments in the prime districts.

Comparing Peak Residence and Pullman Residences, both are district 11 projects with freehold status. Pullman Residences is asking at a 20% premium over Peak Residences, which is a reasonable premium to ask for, considering the luxury status of a branded residence, and the proximity to a MRT interchange. This showed clearly that Pullman Residences was careful and strategic in its pricing, and understood the market well enough to not overprice their units.

With the high premiums, are branded residences good investments?

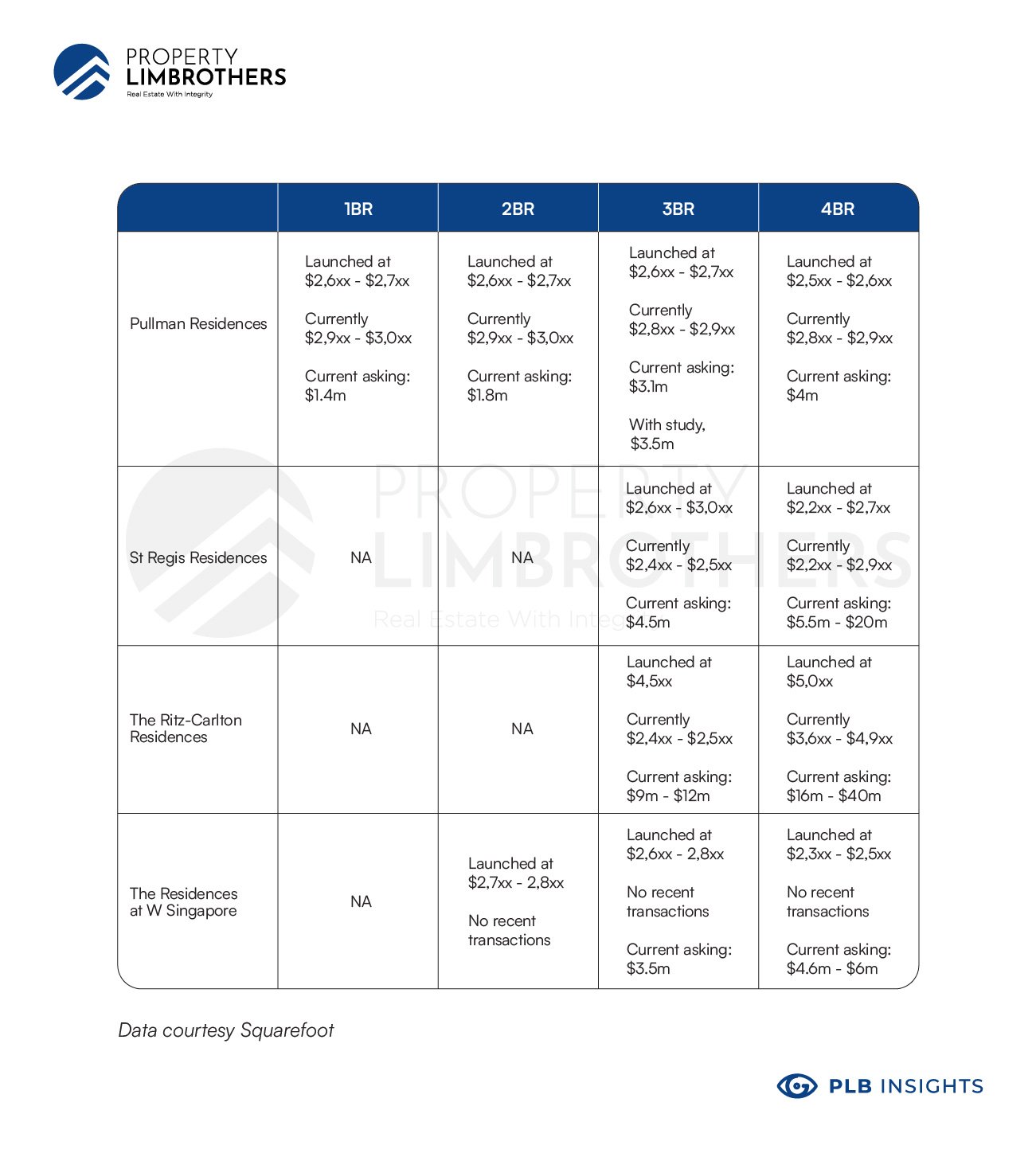

Let’s look at the price transactions of branded residences from their launch to current asking prices.

While initially well-received, the branded residences concept did not pick up as quickly in Singapore as expected from a metropolitan city-state. From the table, you might notice straight away that the prices of branded residences do not follow a linear graph of positive growth, and in fact have shown a dip in PSF as compared to their launch prices.

There are two main reasons for this:

1. High premiums

Branded residences tend to command a higher premium due to its association with a hotel brand that bears a mark of distinction, and for its unparalleled services. In other cities in Asia like Bangkok, Phuket and Kyoto, branded residences can command more than 30% than the average market prices. In markets such as Singapore, Tokyo and Hong Kong, they usually see lower premiums.

The main competitor of branded residences is other luxury developments, which are very well-established in Singapore. With the high standards of developers in Singapore, the luxury projects already set a high benchmark in areas like hotel-grade amenities and onsite management, so much so that it becomes a given for any high-end development.

The differentiating factor of branded residences becomes less compelling when buyers compare between a luxury development versus a branded residence.

When St. Regis Residences and Ritz-Carlton Residences were launched, they charged a high premium. First movers were bought in by the concept, but the general target audience of investors were not as convinced by the proposition to pay the high premium. This resulted in prices dropping in subsequent transactions.

2. Unfortunate timing

St. Regis Residences and Ritz-Carlton Residences were launched in 2006 and 2007 respectively. They were launched to great fanfare, and smashed psf records in Singapore. St. Regis Residences set a record of transactions at $3,000 psf, and Ritz-Carlton Residences later toppled that by crossing the threshold of $4,000 psf.

If you recall, since 2006, the residential property market went through two downcycles. The first being the subprime mortgage crisis that started in 2008, which crippled economies globally. Naturally, the owners of units at these two developments held onto their properties since prices were falling.

When the economy recovered, and they wanted to sell, Singapore’s property market was then hit by the cooling measures introduced by the government in 2013. This was one of the most critical rounds of cooling measures, and was the only time the cooling measures caused the property market to dip.

The Additional Buyers’ Stamp Duty (ABSD) on foreigners, PRs, and Singaporeans’ second property purchase affected investor demand. Total Debt Servicing Ratio (TDSR) was also introduced to cap the loaning power of buyers.

Like all luxury developments, the main target audience of branded residences are foreign investors, or people with more than 1 property. As such, these measures had a severe impact on the demand and prices, causing a drop between 25% and 30%.

While prices have recovered since then, they are still below their initial launch prices.

So should we still invest in branded residences?

Owners of units at branded residences have strong holding power, they are happy to wait out the down cycle because they see this as a long term investment.

Their patience has paid off as there has been a resurgence for branded residences. Transaction prices in terms of PSF have been rising steadily over the last few years, even during the Covid-19 pandemic.

This renewed interest in branded residences in the last few years is largely due to the growing population of ultra and high net worth individuals.

We expect this trajectory to continue, with reports on Singapore recording the second highest growth in the number of ultra-wealthy people in Asia, and third globally.

These affluent individuals are flocking to Singapore because of our reputation as both a tax haven and a safe haven for high profile property investments. They are discerning investors, and always on the lookout for best-in-class residential properties.

Branded residences fit the bill perfectly due to its association with a prestigious brand, and the promises of luxury and quality that defines hotel living. Such qualities tend to attract a wealthy rental pool, and in turn, generate long term returns for investors. The long term investment horizon of a branded residence is a key reason why investors are willing to pay a premium.

Adding on to that, Covid-19 has really changed the way we live and play. The property is no longer just a physical asset for homeowners. It is not just a place to rest your head at night, but a safe space for you to retreat into.

That longing for a worry-free and hassle-free sanctuary is fulfilled by a branded residence’s promise of quality, privacy and personalised service.

So we do think branded residences are here to stay, but perhaps with a few changes in the future.

Keep an eye on the future of branded residences

As the branded residences sector continues to flourish and expand rapidly, there will be more brands wanting to enter the market. Although the market is currently dominated by hoteliers, we should expect to see non hotel brands coming onboard.

We already know of luxury automotive brands like Aston Martin Residences and Bentley Residences. Starchitects would also be a key contender for branded residences with big names like Zaha Hadid Architects and Jean-Michel Gathy. We even have Walt Disney and celebrities like Pharrell Williams in discussions for their own branded residences.

But as the sector matures, more focus will be placed on creating unique experiences for homeowners. Concierge service may become a staple in all luxury developments, so branded residences will have to continue to innovate to stay ahead of the pack.

What might be really applicable to Singapore’s market is the push on culinary experience. With Singapore’s love of food, luxury residences tied to celebrity restaurants like Nobu or Wolfgang Puck may be a natural way to win consumers’ hearts. This is also backed by global research done by Savills, that shows culinary experiences ranking as the top choice among high net worth individuals.

It will be exciting to see how the world of branded residences and the luxury residential market change in the years to come.

We hope that you have enjoyed our article on Branded Residences. If you are interested to know more, feel free to reach out to our Property Consultants for an in-depth analysis and discussion. We will be thrilled to share more about our thoughts and advice. Thank you and see you next time!