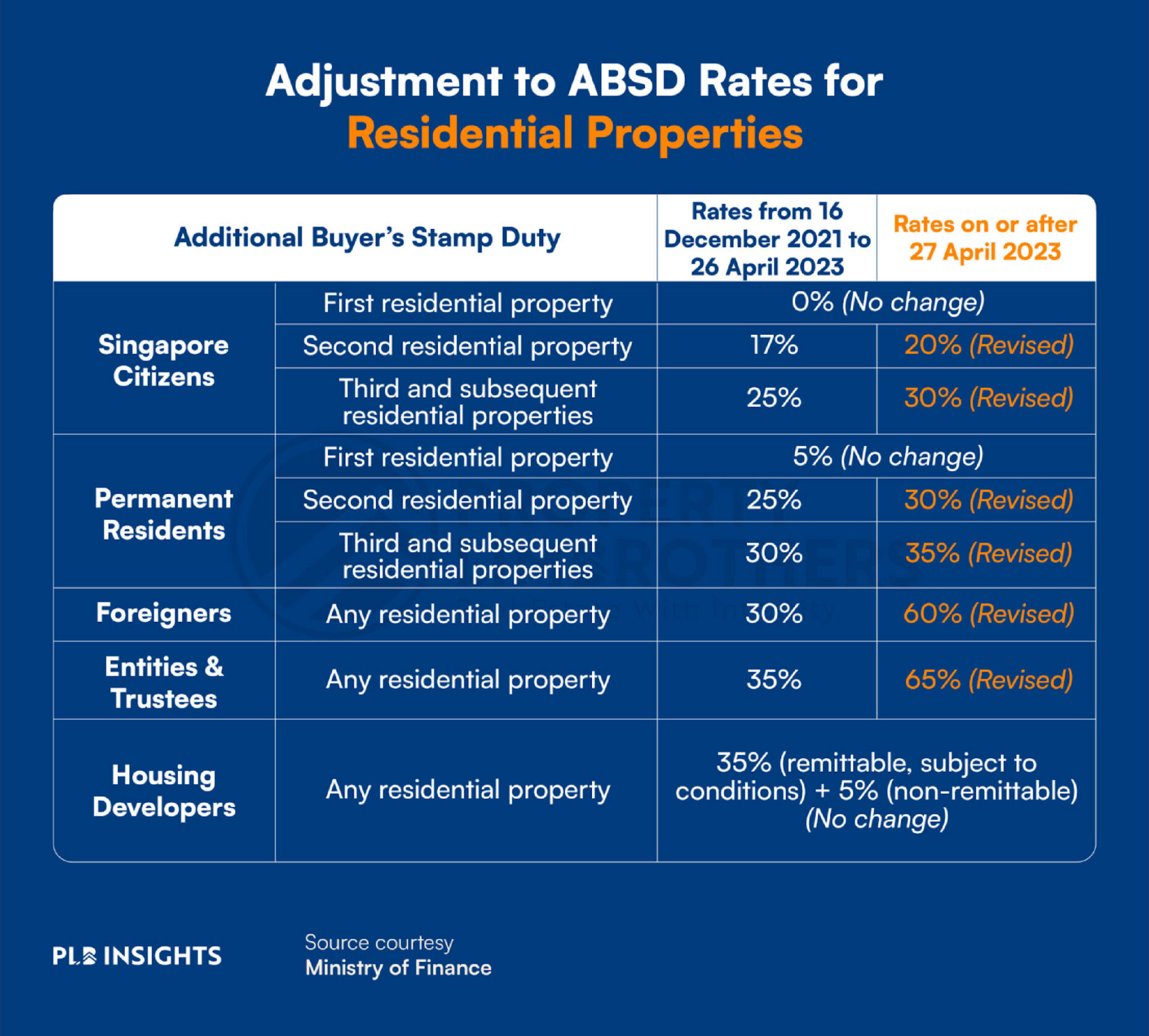

The Singapore government recently introduced a fresh round of cooling measures on 27 April 2023 aimed to deter foreign investment given the spate of luxury property purchases by foreign buyers in the past year. The most significant measure made was the revision of Additional Buyer’s Stamp Duty (ABSD) rate for foreign buyers from 30% to 60% – the largest increment so far. Before this, the last time we saw a revision of ABSD rates was in the cooling measures introduced on 15 December 2021, where ABSD rate for foreign buyers was increased from 20% to 30%.

In this article, we will explore whether this latest ABSD revision will be effective in deterring foreign buyers from investing in Singapore real estate, taking a look at property cooling measures around the world. Read on as we dive into what and where foreign investors are buying in Singapore in the past two years, and whether this trend will continue in spite of the cooling measures.

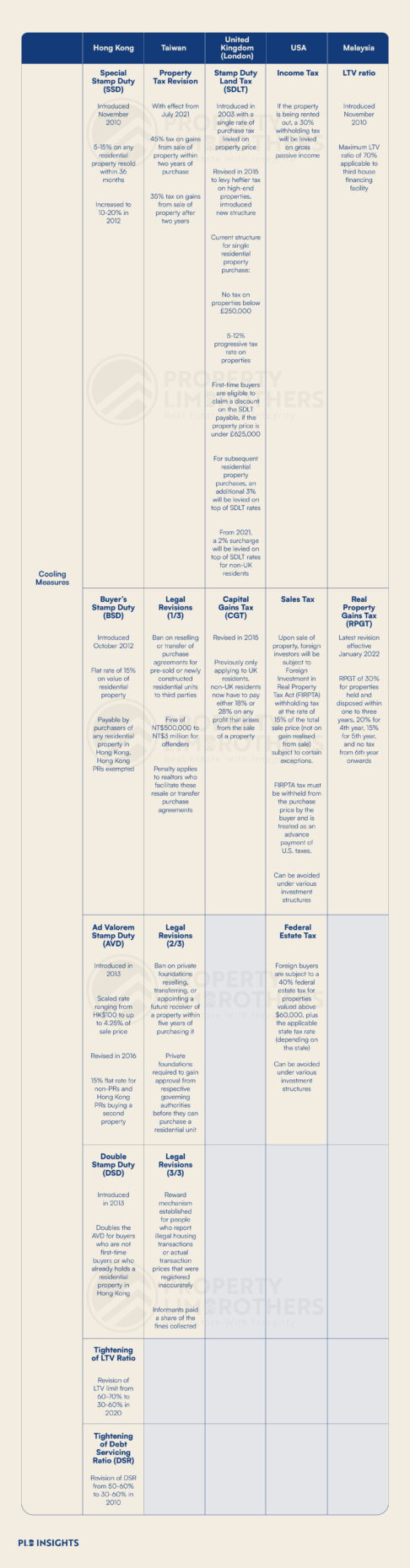

A Look at Property Cooling Measures Around the World

Cooling measures are not a new concept, nor is it unique to Singapore’s real estate market. In a world that has become increasingly connected, international markets are heavily dependent on global political and economic trends, as well as foreign investment.

It is crucial to have cooling measures in place as they can adapt to the fluctuations of the real estate industry and regulate it. These measures promote sensible financial decision-making when it comes to buying a home, and ensure a sustainable property market. Cooling measures generally have a significant impact on consumer spending habits and market outcomes.

We take a look at residential property cooling measures around the world to compare how other countries are regulating their real estate market, specifically in managing foreign investor interest.

At a glance, most of the property cooling measures around the world come in the form of stamp duties on the sale and purchase of residential properties as well as taxes, particularly on income generated from the property or capital gains when selling the property. Some even take the form of legal legislation to curb speculative moves and market manipulation.

In general, Hong Kong’s property cooling measures are the most similar to Singapore’s, with various stamp duties and the regulation of borrowing limits to encourage financial prudence. Now let us look at the restrictions and cooling measures in place to manage foreign property investment in Singapore.

Singapore’s Restrictions on Foreign Buyers Purchasing Private Residential Properties

For the purpose of this article, since we are focusing on foreign investors, we will be covering only the private residential segment of the market. For a complete guide on the types of properties that foreigners are eligible to buy in Singapore, do refer to this article that we have written previously.

Private properties in Singapore can take the form of condominiums, apartments, landed houses, and executive condominiums (ECs) that have passed its 10th year. Foreign buyers purchasing private properties here are not restricted by location and flat type, unlike public housing. Private properties are also not subjected to any Minimum Occupation Period (MOP) before renting out or selling. However, the residency status and nationality of foreign buyers can affect the amount of ABSD they have to pay.

At the time of writing, under the Free Trade Agreement (FTA), Nationals or Permanent Residents of Iceland, Liechtenstein, Norway, Switzerland, and Nationals of the United States of America are accorded the same stamp duty treatment as Singapore Citizens. This means that foreign buyers that fall into these categories are not required to pay ABSD for their first residential property in Singapore.

Aside from ABSD, other cooling measures aimed at managing foreign investor interest include the revision of Loan-to-Value (LTV) and Total Debt Servicing Ratio (TDSR), which tightened borrowing limits.

Foreign investors who are interested in purchasing landed properties in Singapore must get approval from the Land Dealings Approval Unit (LDAU) of the Singapore Land Authority (SLA). The table below summarises the types of private residential properties that foreign buyers are eligible to purchase.

The evaluation process for approving applications for landed properties takes into account a variety of factors such as the applicant’s permanent residency status in Singapore for a minimum of five years and their economic contributions to the country, including their employment income that is taxable in Singapore. The only way to purchase a landed property while avoiding this process is by purchasing a leasehold landed property with a remaining lease of seven years or less, which does not require approval from the SLA.

Foreign buyers who wish to buy a landed residential property are limited to properties that do not exceed 15,000 sqft and are not situated within a good class bungalow area. Those who wish to purchase such properties will be subjected to stricter eligibility criteria.

In contrast, the criteria for buying properties in Sentosa Cove are less strict, but still require approval from the LDAU. Foreign buyers must use the property only as a dwelling house for themselves and their family members, and not for rental or any other purpose. The only limitation is that the property must not be larger than 1,800 sqm.

What and Where Foreign Investors are Buying in Singapore

Since foreign investors do not need to seek approval from the relevant authorities before buying non-landed residential properties such as condominiums and apartments, naturally most of the foreign transactions happen in the non-landed segment.

Although landed residential properties are often lauded as the best store of wealth because of its huge land size in contrast to Singapore’s land scarcity, non-landed residential properties have been performing exceedingly well in recent years. The average PSF of condominiums (both in the resale and new launch segment) has been on an upward trend since 2021, despite or perhaps because of the impact of the COVID-19 pandemic. This makes non-landed residential properties even more appealing to foreign buyers as an investment vehicle.

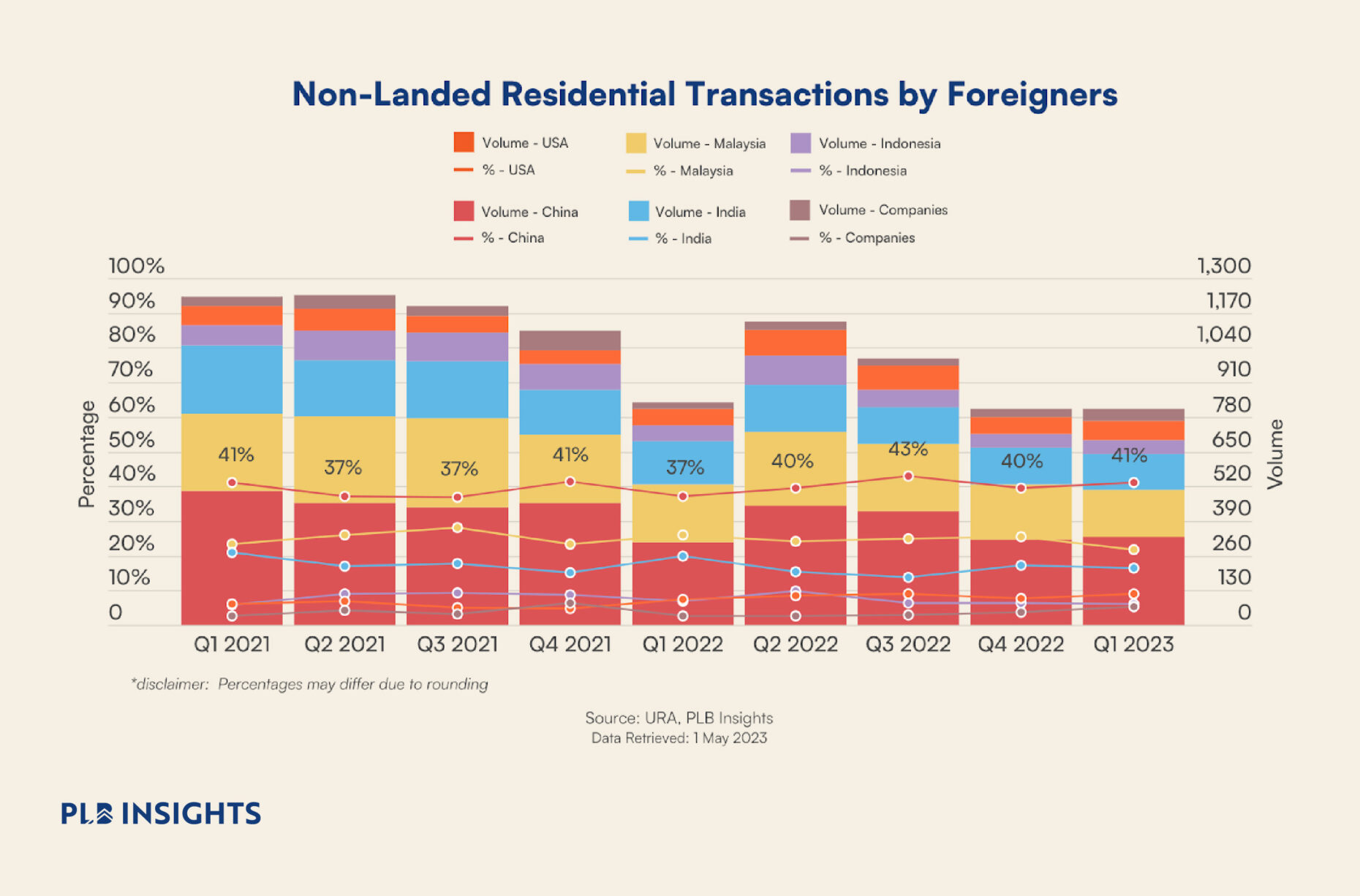

Breaking it down by nationality, we see that Singapore Citizens contribute to 82.75% (30,965) of non-landed residential transactions in 2021 and 80.25% (20,195) in 2022. Q1 2023 saw a significant drop in the percentage of non-landed residential transactions by Singapore Citizens to 75% (down from 80% the previous quarter).

The rest of the transactions are made by companies and foreign buyers from China, Malaysia, India, Indonesia, and USA.

Of the non-landed residential transactions made by foreign buyers, 39% (1,863) in 2021, 40% (1,509) in 2022, and 41% (332) in Q1 2023 were from China. Even though the transaction volume of China buyers dipped slightly between 2021 and 2022, investor interest seems to be going strong and undeterred by the ABSD hike in 2021.

Total transaction volume only dropped for the first quarter of 2022, but bounced back strongly in Q2 and Q3 2022. This is likely one of the key factors contributing to the government’s aggressive move to double the ABSD rate for foreign buyers in the latest round of cooling measures.

Aside from China buyers, the next two biggest contributors are Malaysian and Indian buyers. 25% of non-landed residential transactions by foreign buyers in 2021 and 2022 were Malaysian, and 18% in 2021 and 16% in 2022 were Indian.

Companies and buyers from Indonesia and USA made up less than 10% of transactions each.

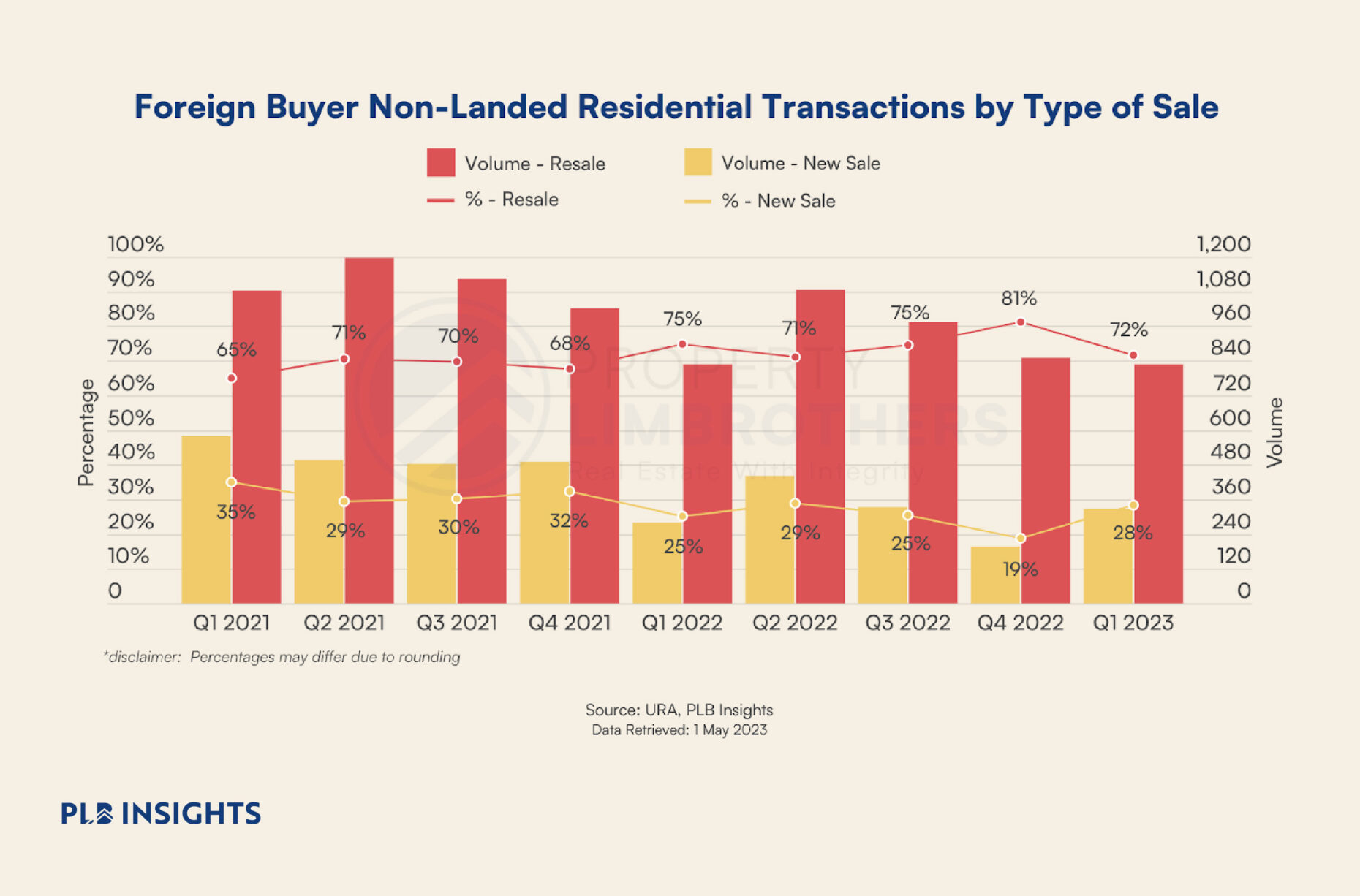

In 2021, 68.5% (4,424) of foreign buyer non-landed residential transactions were resale transactions and 31.5% (2,053) were new sale transactions. In contrast, 75.5% (3,738) were resale transactions and 24.5% (1,253) were new sale transactions in 2022.

Even though the overall volume has dropped because of the ABSD increment in December 2021, a larger percentage of transactions now favour resale non-landed residential properties over new launches. Entering 2023, the percentage of resale transactions remained strong at 72% in Q1. This trend indicates that resale non-landed residential properties have become more appealing to foreign buyers, perhaps because of appreciation potential, easier access, and availability as compared to new launches.

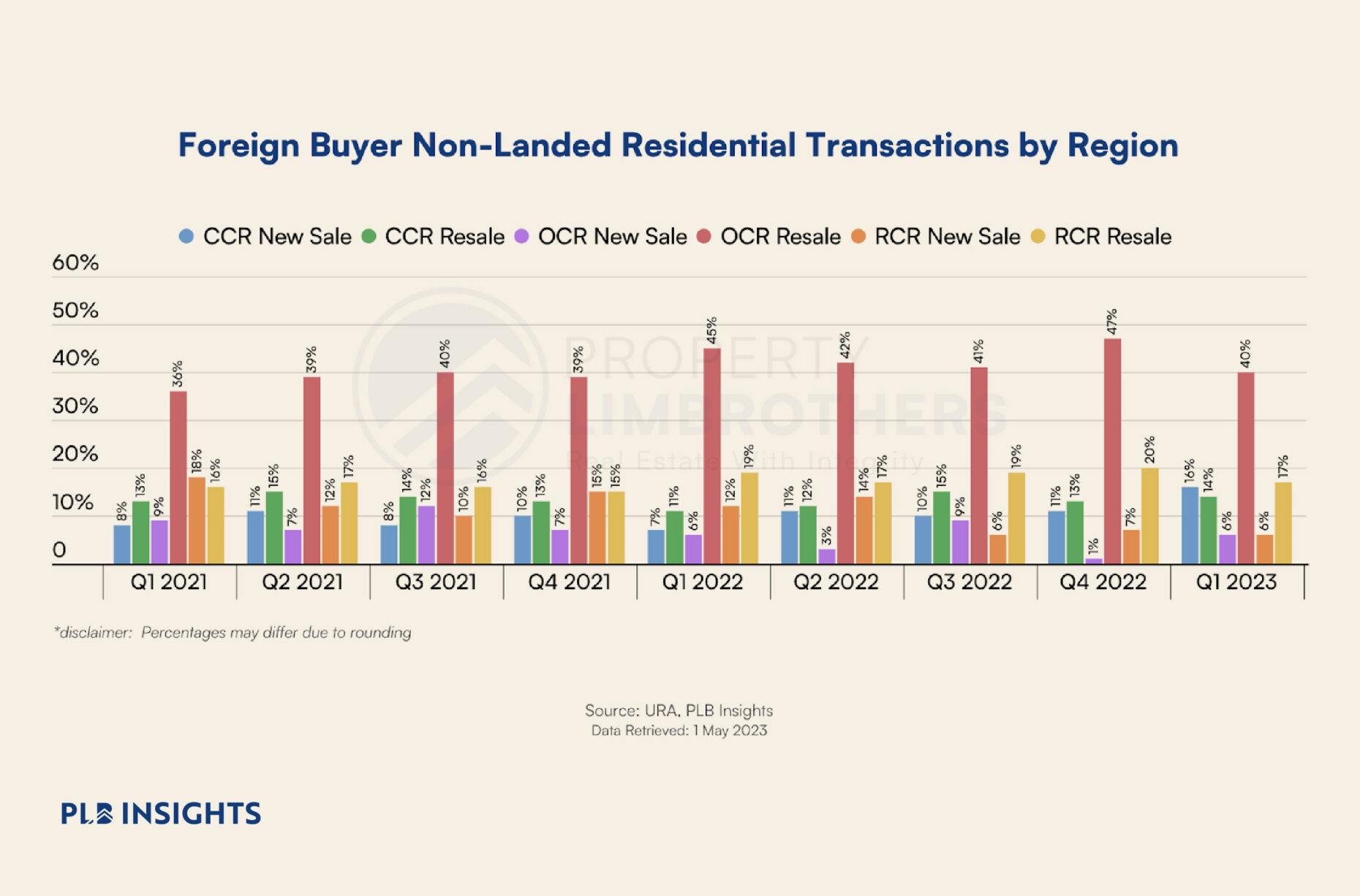

Unsurprisingly, the majority of foreign buyer non-landed residential transactions are in the Outside Central Region (OCR). The OCR spans around three-quarters of Singapore and is the largest market segment, and is generally where you can find more affordable properties at lower quantum prices. Most of the transactions belong to the OCR resale segment, which makes up about 40% of all foreign buyer non-landed residential transactions.

The resale segment generally outperforms the new launch segment in terms of transaction volume as it is more accessible and takes significantly less time to acquire the property, but hot new launches can sometimes flip the numbers because of factors like appreciation potential and palatable price quantums. This can be seen in Q1 2021 for the Rest of Central Region (RCR) segment and Q1 2023 for the Core Central Region (CCR) segment.

The next biggest segment in terms of transaction volume is the RCR resale segment, which makes up about 16-20% of all transactions. RCR properties have always been popular because of their proximity to the Central Business District (CBD). However, because of the government’s effort to decentralise the CBD by creating more regional hubs in areas like Woodlands, Punggol, and Jurong, more attention has been syphoned off to the OCR.

An interesting thing we noticed is that the OCR new sale segment makes up the smallest segment, contributing only 5-9% of all foreign buyer non-landed residential transactions. In fact, only 1% in Q4 2022 were OCR new sale transactions. This trend shows that in terms of new launches, foreign buyers would rather invest in CCR and RCR projects than OCR projects.

Closing Thoughts

While many may regard the latest move to double ABSD rates for foreign buyers as a ‘freezing measure’ rather than a cooling measure, the larger impact on foreign transactions in Singapore remains to be seen.

Foreign buyers that fall under the FTA will continue to invest in Singapore real estate as they will not be significantly impacted, given that they enjoy the same ABSD treatment as Singapore Citizens. Ultra-High-Net-Worth Individuals (UHWIs), particularly from China that make up the highest percentage of foreign buyers in Singapore, will likely continue to invest in real estate here as long as they believe in our political stability and property climate.

To gain a deeper understanding of how cooling measures impact the housing market, you may refer to our article here. Additionally, if you have any inquiries about the recent cooling measures or require assistance in navigating the property market, please do not hesitate to get in touch with us.