It used to be uncommon for a property owner to think about selling when purchasing a property as it is a traditional idea to live in the same house until our ripe old age. This is for several reasons such as the hassle of moving, emotional attachment, familiar neighbourhood, and the idea of not wanting to pay any more mortgages if the property is already fully paid.

As years go by, it gets very common for a property owner with the high intention of wanting to sell their property and move on to the next one.

So what changes property owners’ minds to move away from the traditional view of living in the same house until a ripe old age? We found several common traits such as moving closer to preferred primary school zone, closer to parents, closer to the CBD or town area, moving into prestigious districts, and buying into higher asset class property.

In this episode of Seller Series, we will be exploring the topic of “Who are you selling your home to? Demographics and implications.

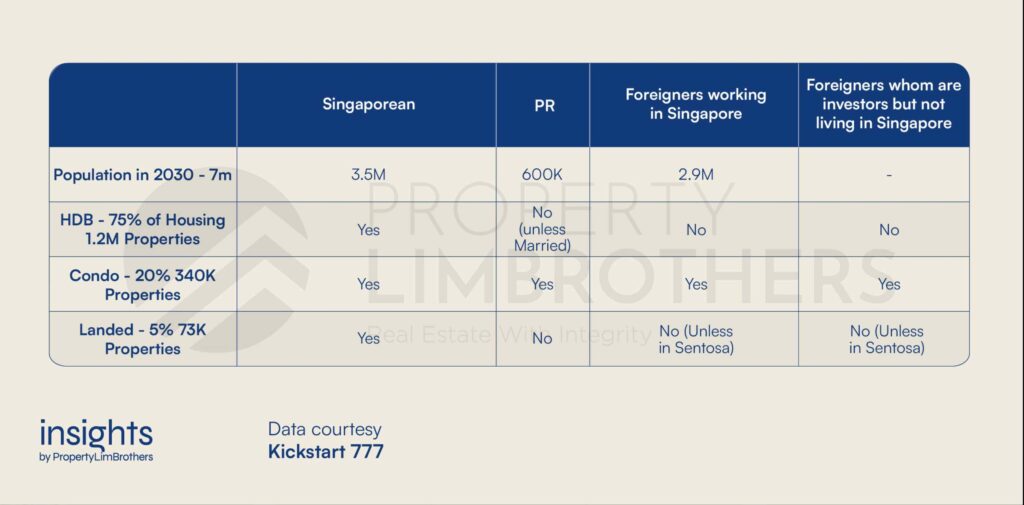

The different asset types and who’s eligible to buy what?

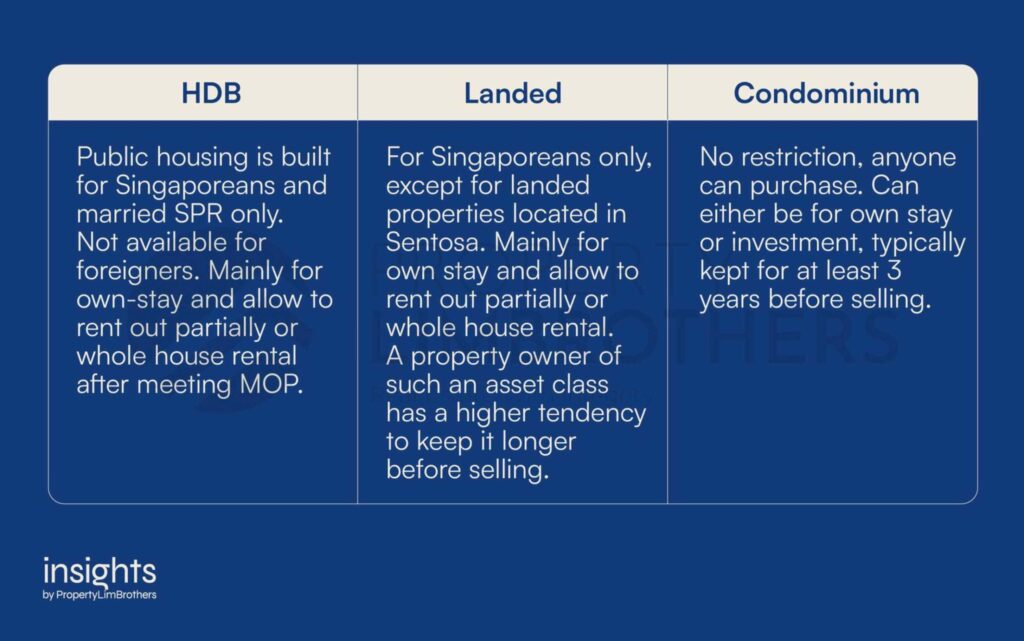

In Singapore, the most common housing we will see is HDB, followed by condominiums, and lastly landed. Owning any of these different asset types will mean different flexibility to whom we can sell our property to when you have reached your MOP (minimum occupation period) which is a typical 5-year period or when you have served out your 3 years SSD (seller stamp duty).

Here’s a quick overview of who is eligible to buy into these different asset classes, starting with the least flexibility.

Case Reference for future buyer demographic

Case Study 1:

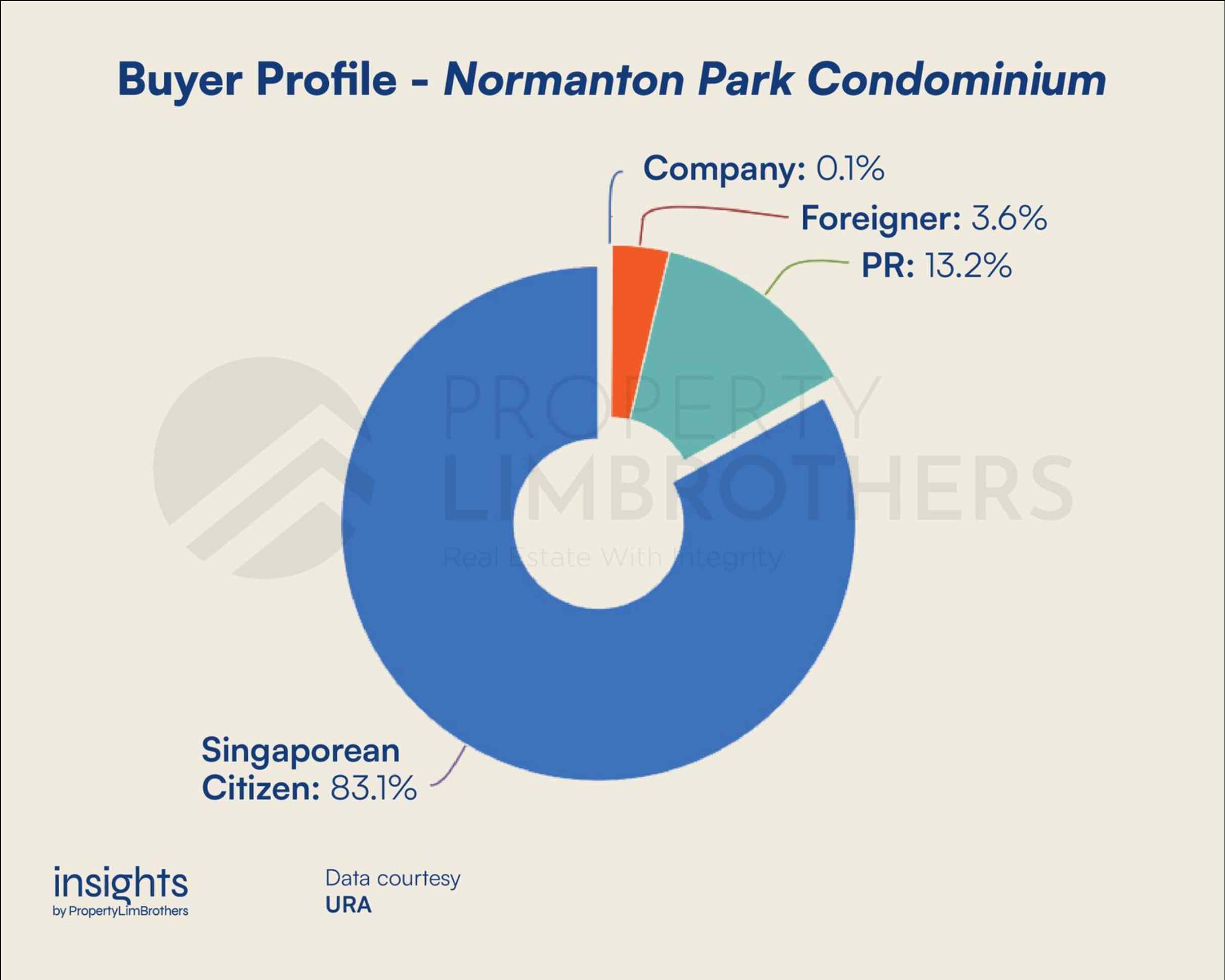

If you are an owner of Normanton Park Condominium:

– Located at D5, RCR (Rest of Central Region), West region, 99 years tenure

Who will be your future potential buyer?

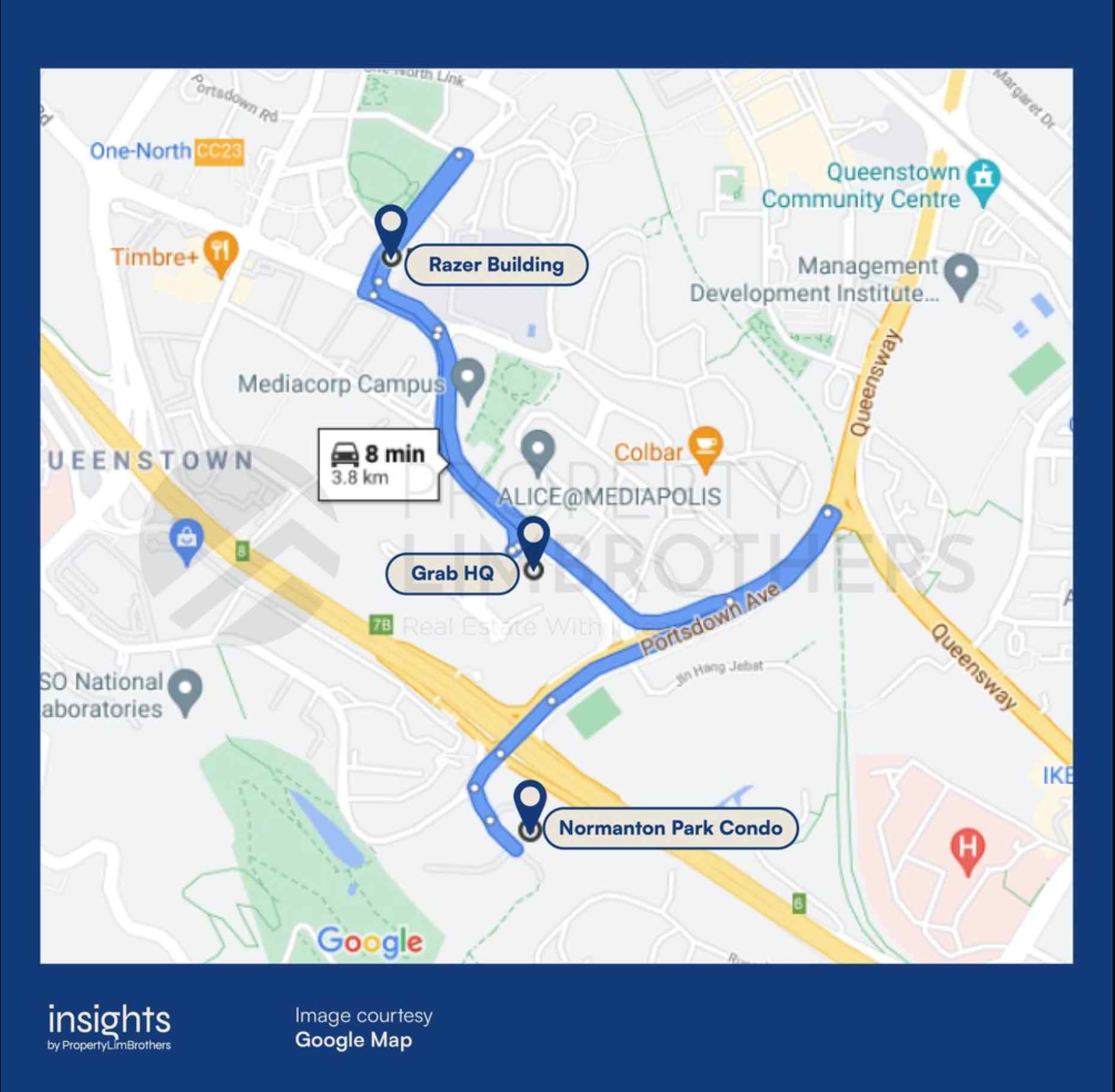

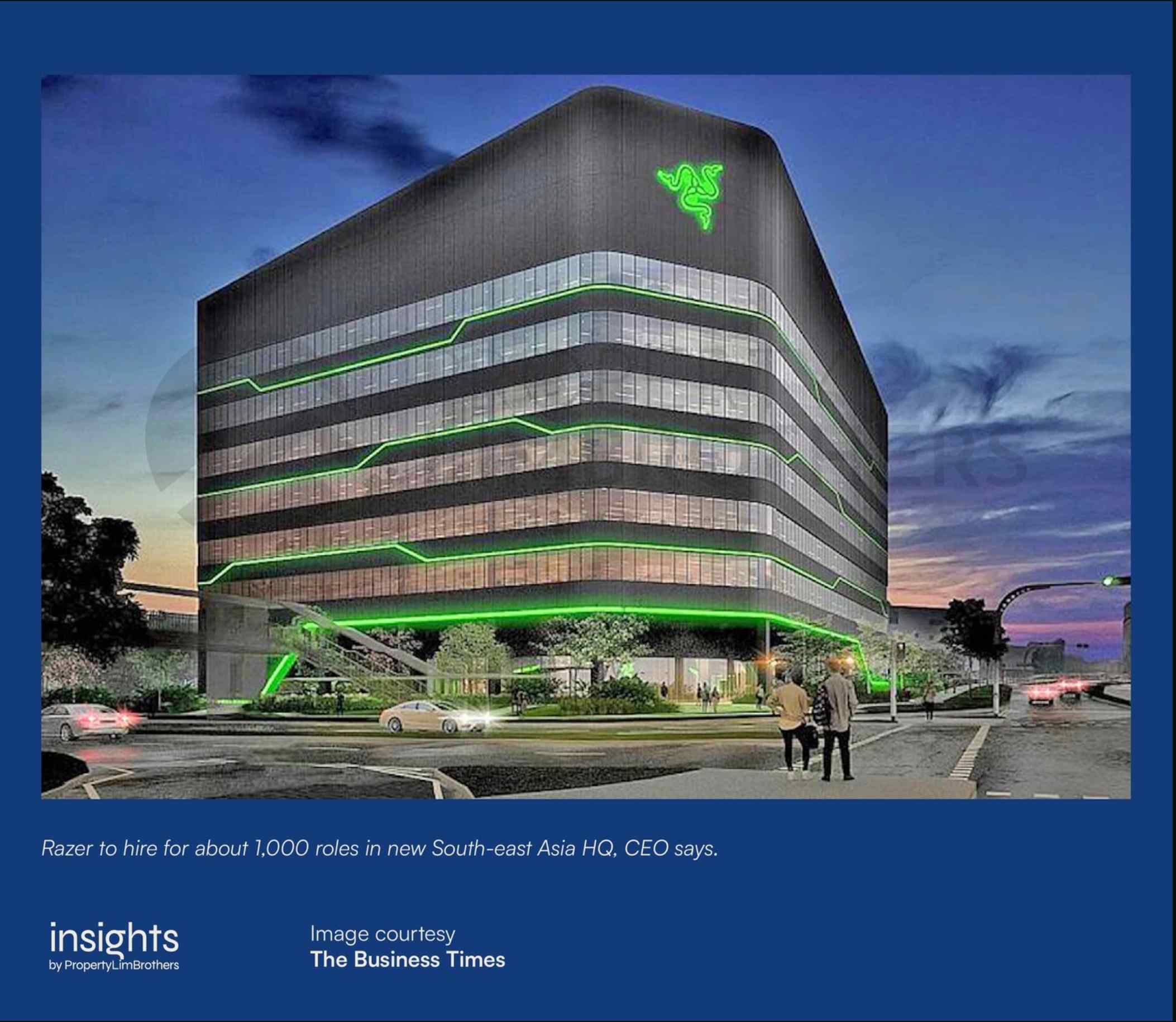

Potential buyers can come from any of these places ranging from hospitals to science parks, be it local or foreign expats. They can also come from listed companies such as Grab and Razer which have their headquarters built nearby this district.

The expansion of these giant tech firms also means having potentially higher purchase and/or rental demand for the surrounding areas. This means that investors are highly likely to purchase Normanton Park to rent it out or buyers from any of these companies will purchase it for their own stay.

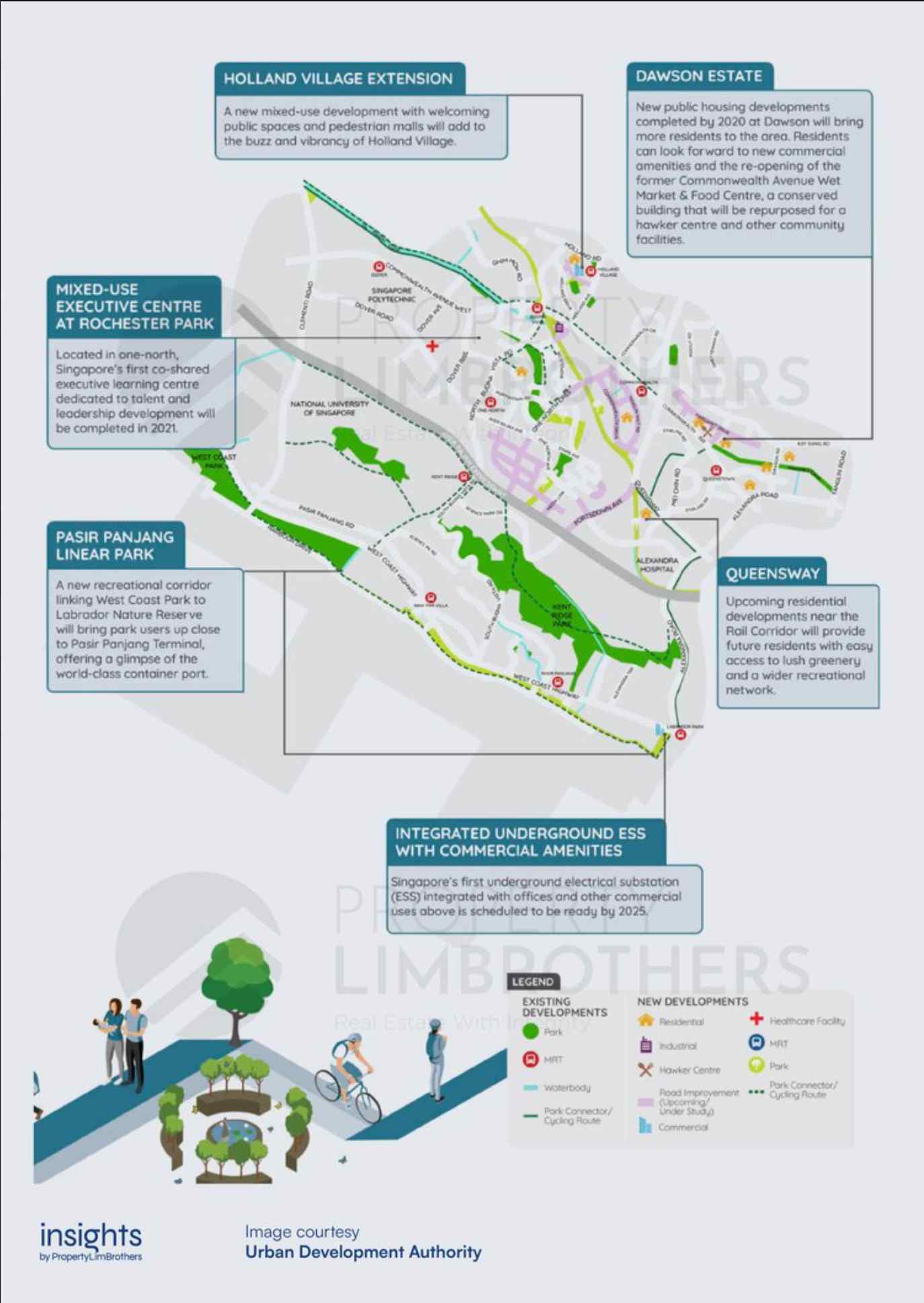

In addition to that, URA Master plan further announced Singapore’s first underground electrical substation (ESS) integrated with offices and other commercial uses scheduled to be ready by 2025. This development further increases buyers’ demand.

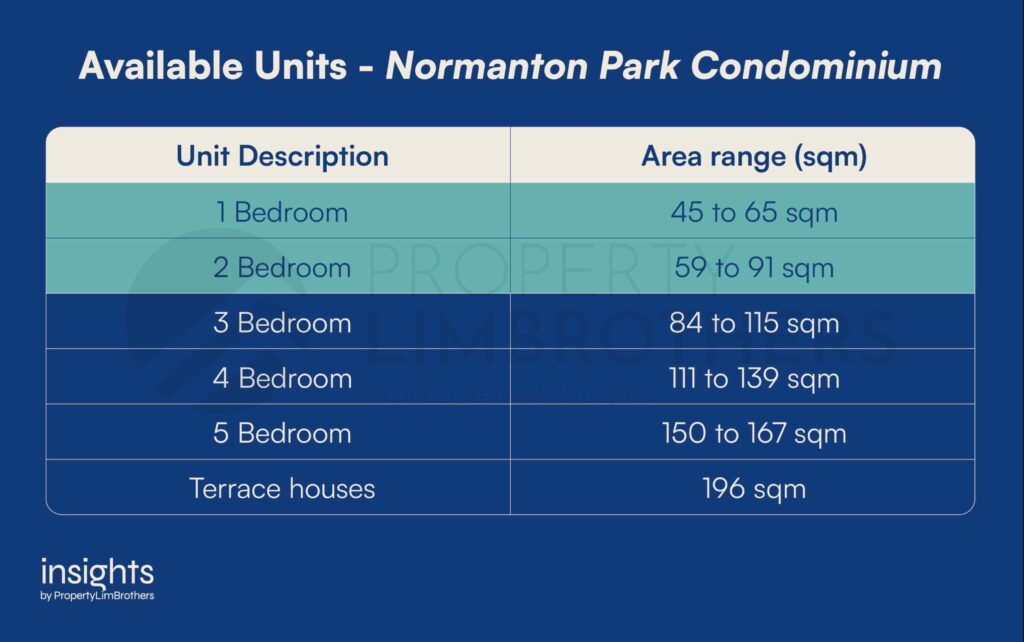

Apart from researching the type of demographic for your future potential buyer through location analysis, we can also analyse the number of unit-type built within the project as part of the determinant.

For Normanton Park, up to 38.1% of 1,840 units are 2-bedroom and 16% are 3-bedroom, which make up 792 units and 333 units respectively. Based on this data plus the location analysis, one can boldly assume that their potential future buyer will be either a single expat or an expat of a small family size. So should you not consider such data and buy the wrong unit for this project, you may face challenges to sell in the future because my unit may not fit the majority of potential buyers in this district.

Case Study 2:

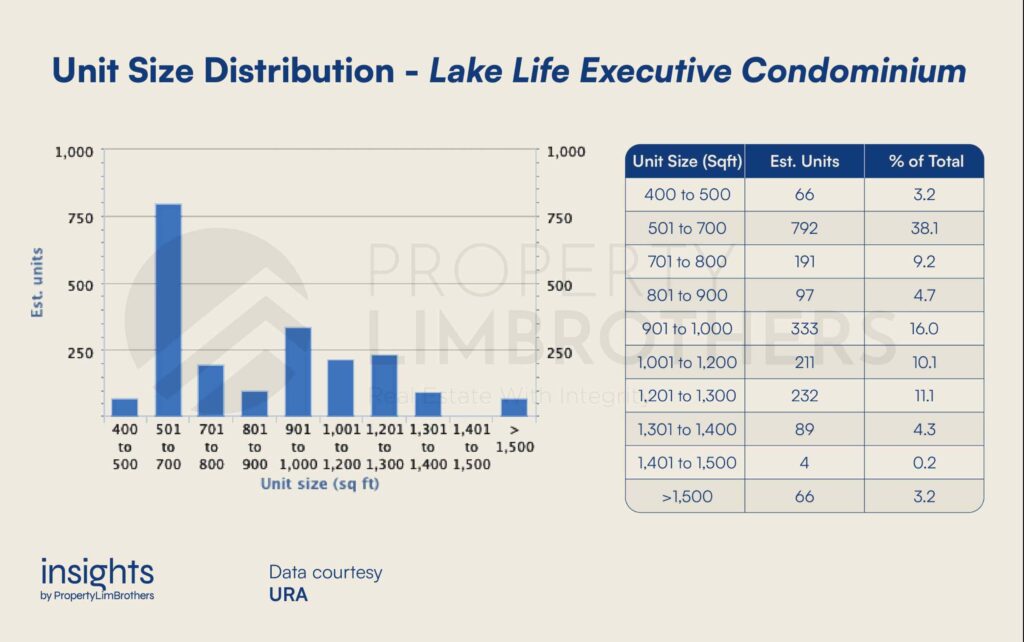

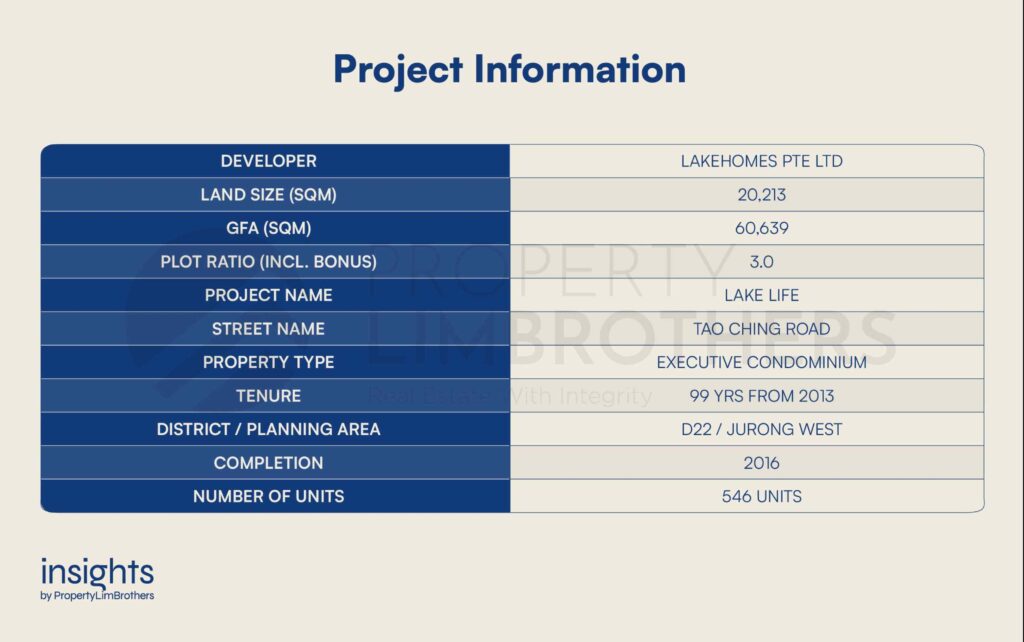

If you are an owner of Lake Life Executive Condominium:

– Located at D22, OCR (Outside of Central Region), West region, 99 years tenure

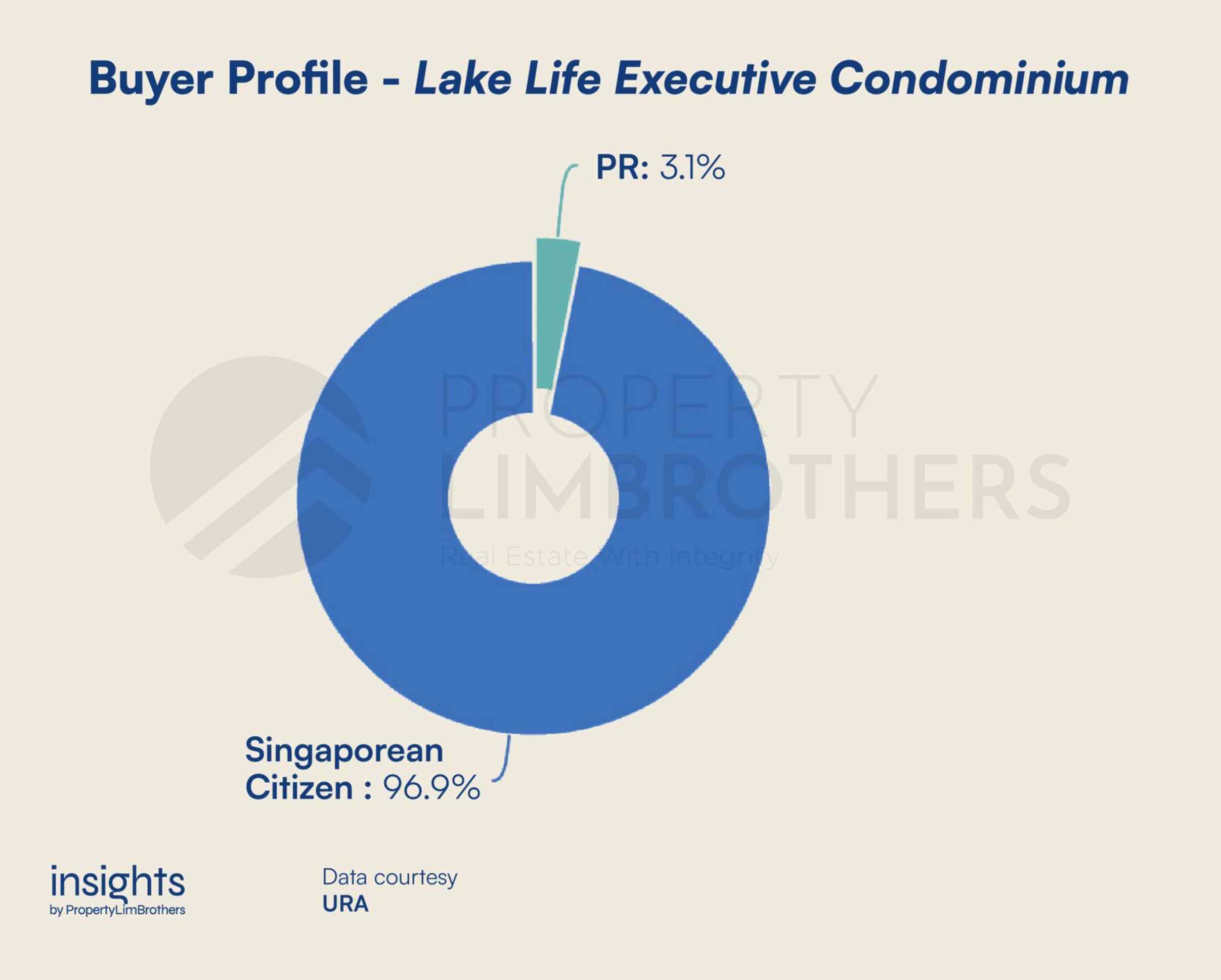

Using the same principle of what we have used in case study 1, which is location analysis and the numbers of unit-type built within the project, let’s find out the demographic for your future buyers for this project development.

So, based on the numbers of unit-type built for Lakelife EC, the majority of the unit-type built are 3 & 4 bedrooms, mostly for the family profile. Now let’s look into the location analysis to find out who these family profiles are.

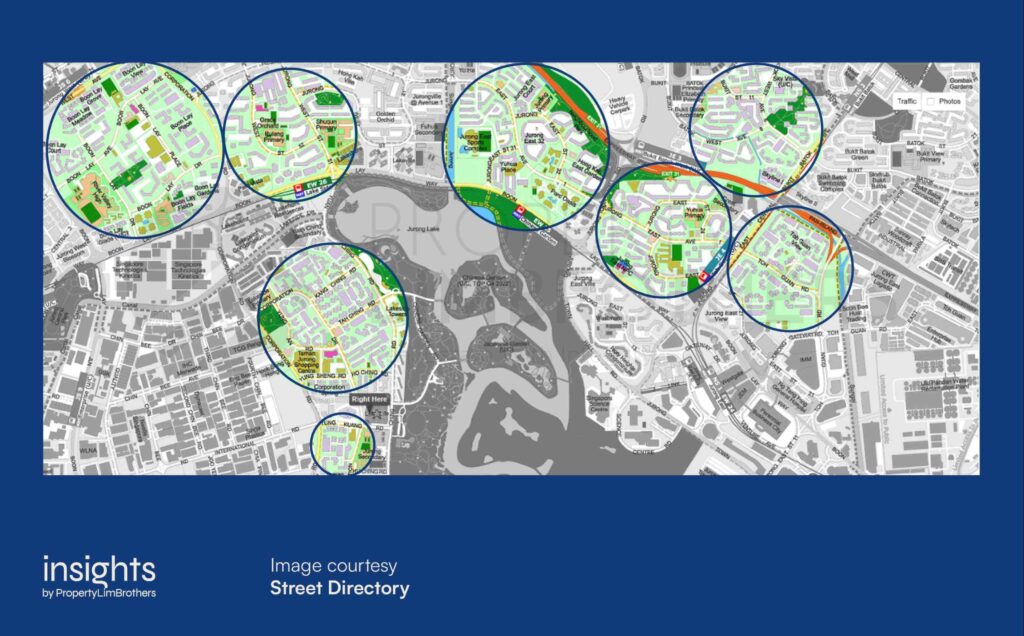

Based on this map, potentially most of the future buyers are HDB upgraders of 4 to 5 pax family profiles within the Boon Lay, Taman Jurong, Jurong East/ West, and Bukit Batok regions that may look into buying Lakelife EC. So, assuming you own a 2 bedroom in Lakelife and planning to sell, then you may face challenges in selling or simply require a longer time frame to find a suitable buyer.

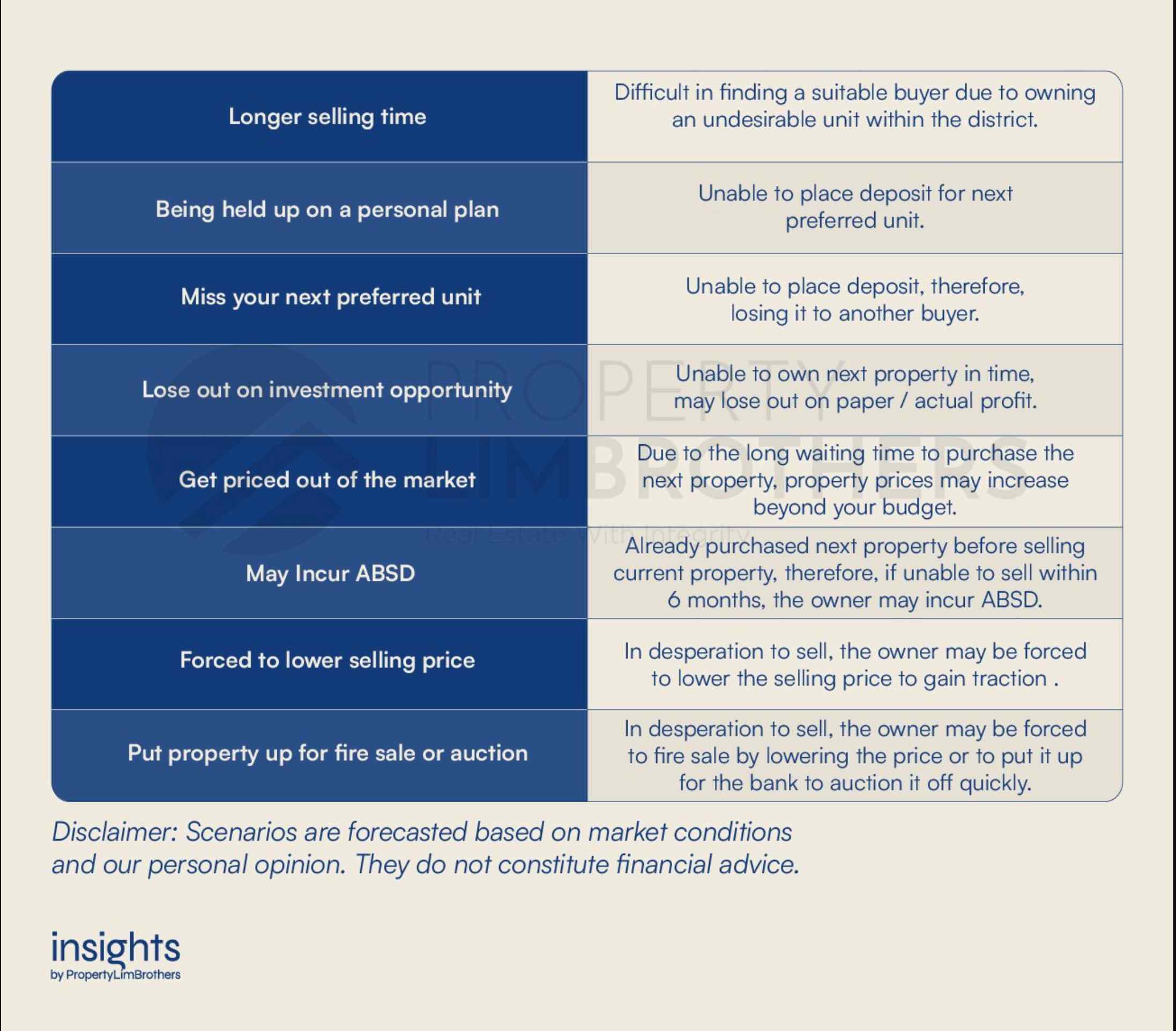

Implications of not planning for future exit

For a property owner who prefers to move once every few years or to realise the Singaporean dream by owning multiple properties, it is then important to plan for the future exit even before buying into a project development, without doing so, several implications may potentially happen.

Rounding it up

We should recognize that not all property owners plan to sell their property, there are owners who prefer to stay in it until their golden years and that’s perfectly fine. For this group of owners, it is then important to prioritise an individual property’s needs and wants over the exit plan.

To sum up this topic, before buying into any project it is important to consider the determinant factors below:

– Location analysis

– Number of unit-type built

– Assume the profile of the future potential buyer

By considering these 3 factors, you will get a good idea of buyer demographics and face way lesser implications when selling in the future simply because you have bought into the correct unit type.