The holy grail of investment is the ability to read the future. Is this investment going to make me money? Is it going down the drain? Every investor’s desire is to have this crystal ball that tells them if the market is going to go up or down the next day. While this doesn’t really exist in reality, it hasn’t stopped people from trying to make the mythical palantir.

In Singapore, a property purchase would easily become the largest asset in your portfolio. If people are already concerned and getting jittery with how their stock portfolios are doing in today’s turbulent market, shouldn’t they be concerned about where their property values are going? The gains or losses you make on a property purchase is likely leveraged (due to bank loans) at a high quantum, and can easily outweigh the performance of an everyday Joe’s portfolio.

This is an introductory article to a series on PropertyLimBrothers’s MOAT Analysis. In the following weeks we will cover the different aspects of the MOAT Analysis, why they matter, and how we can use them to their full potential.

What is MOAT Analysis about?

Inspired by mediaeval times, a moat is a defensive trench built around important towns and castles. The deep and wide structure of the moats are to prevent and deter a prolonged siege of the city, making the location more defensible for its inhabitants.

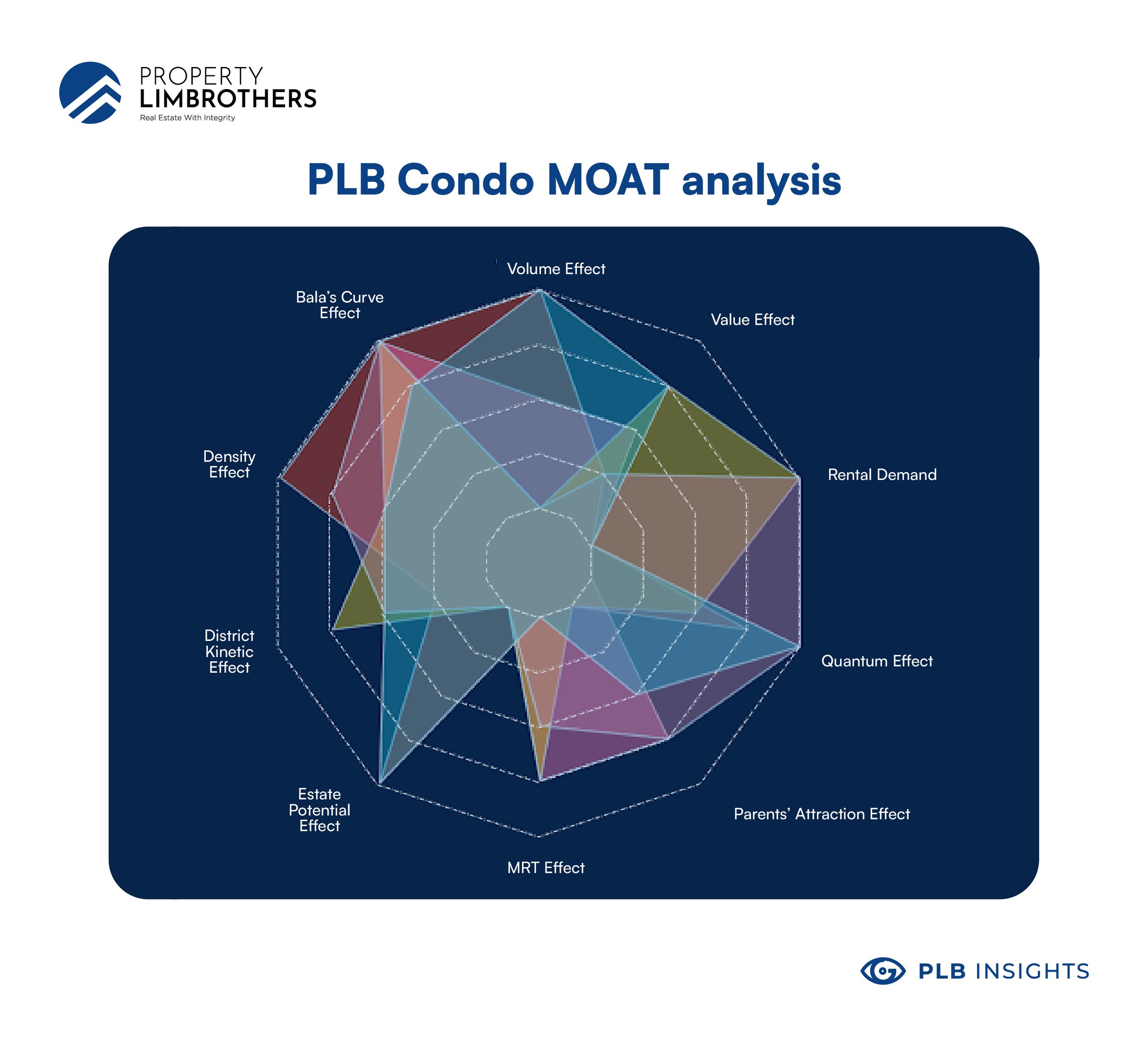

Likewise, in PLB’s MOAT Analysis, we identified 10 factors that contribute to the defences of property value over time. The objective of the analysis is to find out how likely a property is to retain its value and appreciate over time. The 10 factors that we identified are correlated to the price performance of properties and help to indicate the desirability of the property in the eyes of future buyers.

Ultimately, MOAT Analysis is a decision making tool to help you compare options that you have shortlisted, based on objective factors. The intention is to give you a bird’s eye view of the investment outlook of your future purchase. We call these factors “objective” because it doesn’t change no matter who is looking at it, nor the opinions of the user.

For instance, the number of past transactions don’t change whether or not you like the property. The distance of the property from an MRT or nearby schools also doesn’t change whether or not there’s a hundred or a thousand people eyeing the property.

MOAT Analysis is our attempt to provide a less biassed (if not unbiased) outlook of the property at hand. Whether we are in love with the property or for whatever reason dislike it, MOAT Analysis can provide objective insights that you might not have considered from your own point of view. The MOAT Analysis also helps us be objective and impartial in our analysis of the property’s attributes. Especially so if you wanna increase your future buyer audience pool.

How is MOAT Analysis designed?

So what are the 10 factors we have included?

In the MOAT Analysis we pay attention to:

-

Volume Effect

-

Value Effect

-

Rental Demand

-

Quantum Effect

-

Parents’ Attraction Effect

-

MRT Effect

-

Estate Potential Effect

-

District Kinetic Effect

-

Density Effect

-

Bala’s Curve Effect

We will not cover what these factors mean and the objective data they use in this introductory article. Over the course of the next few weeks and months, we will dedicate articles to each of these factors and take a deep dive into why they matter. Before we move on, we have to throw out a disclaimer that we’re on a constant journey to improve the MOAT Analysis. We periodically review whether factors are still relevant and significantly impact prices. If you’re attentive enough, you might see some factors get added, removed, or changed over time. At the end of the day, we want to only consider the objective data that matter in affecting the value of the property.

In terms of how we have designed the MOAT Analysis, we take into account factors that are relevant to price movement or specific buyer profiles. We include factors from traditional property analysis, buyer’s criteria from the ground, and different demographics and investor profiles. An example would be how rental, quantum, transaction volume, and lease are a part of traditional property analysis. We look at those core factors. However, we also look at distance to certain neighbourhoods, MRTs, or schools. This way, the MOAT Analysis has a broad enough scope to catch all the main relevant factors for price movement.

We have also designed the MOAT Analysis to be a dynamic decision making tool. It is dynamic in the sense that it uses live data from government bodies. This means that over the years, you might see the MOAT profile of properties change over time. When a new MRT is built or when Rental demand is up, it will be reflected in the analysis, giving us an updated picture of the property in the here-and-now.

In a sense, that beats relying on quarterly performance data from URA, or personal research and consolidating it all on your own. This tool is meant to help us easily visualise the winning points of the property and why we should or should not be buying it. To some seasoned players, this decagon might remind them of video game characters having certain “traits” they are exceptionally excellent or weak at. That is one way you can think of PLB’s MOAT.

Our scoring system ranks each component on its own, and then aggregates them for an overall score for the property. The higher the MOAT score, the more likely the value is defensible in the future. We get a holistic view of the price performance from these components, allowing us to better position our purchases for exit to specific target buyers in the not so distant future.

How do we use MOAT Analysis to its full potential?

There are many ways to use our MOAT Analysis. Strictly speaking, there is no right or wrong way to use it. The score or analysis simply shows us what a property has, and what it is lacking. Most people who use it often already have some projects that they are fond of, and want to know if they have made a wise choice based on the indicator.

An important thing to consider when using the MOAT Analysis is to account for the purpose of purchasing a new property. Is it your next residential home? Or a pure investment property? This can have vastly different results. Your purpose for buying a property determines whether or not you care about these 10 factors. It is rather uncommon for own-stay buyers to look at all 10 factors with the intention of maximising the score. If you’re an own-stay buyer, you’ll need to balance this out with the needs and wants of your family.

Rather, they look at their specific goal (perhaps near a school for their child), or their favourite neighbourhood that they’ve wanted to stay in. The same goes for investors. Some focus on rental demand to maximise rental yields, others might focus on capital appreciation. Either way, pairing the MOAT Analysis with your own purpose for buying will help give you the information you need at a glance.

We also use the MOAT Analysis to compare properties with nearby or similar projects. This will help us to find the better deal. While no two properties are the same, sometimes, a better deal presents itself around the corner for the attentive and hard-working buyer who has done all the research. The harder you work, the luckier you get. That is how the world works sometimes. Opportunities present themselves to those who are ready.

The MOAT Analysis is also useful for ad-hoc analysis to identify disparity gaps, policy impacts, and value chasms on different types of property classes. A few select factors can be used to compare apples with oranges. As strange as that may sound, coupling objective geographic factors with performance data helps us find areas which can be locations of interest. Value can be found if we pay attention to price-leaders and their followers. If a long trailing gap is not justified based on the MOAT Analysis, that should set off potential buy signals.

Who do I go to for MOAT Analysis advice?

We do in-depth and dedicated analysis for our clients. That includes detailed MOAT Analysis on the properties being considered for investment or own-stay purposes. While this is a tool mainly for buyers, we can also use it for the seller-side to gain more insight into how to position your property on the market so that it meets the right audience. Our Inside Sales Team (PLB IST) are all trained to use the MOAT tool and we’ve received great feedback from our clients on how useful it is.

There are a few different ways you can reach out to us to get MOAT Analysis advice for your specific situation. You want to consider:

-

Contact any PLB IST member for a consult (they all have cool instas)

-

Contact us via email or call

On the other hand, if you wish to just learn more about our MOAT Analysis system you can:

-

Go to our YouTube channel for more information and free educational videos

-

Upcoming PLB Insights articles that will cover each factor in detail

Until next time!