Singapore’s land is scarce and will always be at a premium. To meet all the needs of a growing and thriving metropolis, the Urban Redevelopment Authority of Singapore is serious about maximising land usage. It is for this reason that we see taller skyscrapers and HDB flats, and the long escalator rides down into deeper MRT tunnels.

For real estate enthusiasts and investors, the Master Plan provides clues to understand how Singapore’s urban landscape is balanced and the potential changes in the future.

Here at PLB, we use the Master Plan to guide our analysis. Let’s take a glimpse as to how we use the Master Plan, and how you can apply these skills in your real estate purchases or investments.

History of Master Planning in Singapore

Before we dive into the technicals, here is some brief history of Singapore’s master planning.

The Singapore Improvement Trust completed the statutory master plan in 1955 which was later approved in 1958. In this first iteration, the government already used land-use zoning and plot ratios for strategic planning, while reserving land for infrastructural uses, community facilities and open spaces to balance other needs of the city-state.

Later on in 1989, URA took over as the leading authority for planning and conservation activities. Focused on creating a “tropical city of excellence”, the 1998 Master Plan improved the quality of life, variety of housing and leisure facilities, and more greenery in the intensifying urban jungle.

Master Plans today provide detailed instructions on zoning and density parameters. It guides Singapore’s land use planning and development over the next 10-15 years. Although they tend to not be changed, the public is consulted during the Master Plan review process.

Starting from 2014, the Master Plan focuses on creating “inclusive, highly liveable, economically vibrant and green environment” in six domains: housing, transport, economy, recreation, identity and public spaces. This spilled over into the current 2019 Master Plan that regulates Singapore’s urban developments.

Applications of Master Plan

Understanding the broad developments in the area

URA’s website consolidates the broad themes, highlights and transformations that guide overall and regional development strategies. In recent times, the URA has adopted a closed loop ecosystem in its decentralised town models to ensure that citizens can live, work and play in their towns.

This is where understanding urban transformations are also important.

Notable transformations include the highly anticipated Greater Southern Waterfront and the technologically advanced Punggol Digital District. One of the key transformations to look out for is also the transformation of Paya Lebar Air Base. Comparing the Master Plan to the transformation plan, there are plots of business areas and reserve sites still undergoing detailed planning. For “car-free and walkable neighbourhoods”, the initial plan provides evidence to understand which plots may be closer to public transportation.

Masterplan developments of the Paya Lebar Airbase

Estimating properties using plot ratios

1. Estimating future developments

Based on the announcement by GuocoLand, the plot of land at Lentor Central will be developed into a mixed-use development with three 25-storey towers of 600 residential units and double-volume sky terraces. Using the plot ratio as an estimate for building height, this new development should be at least 36 storeys. But being adjacent to the MRT tracks, the proximity may have inhibited deeper foundations and affected the overall height of the development.

For more information on the relationship between plot ratio and height restrictions, check out our previous article.

GuocoLand Development in red with a plot ratio of 3.5. Lentor MRT is indicated by the blue marker.

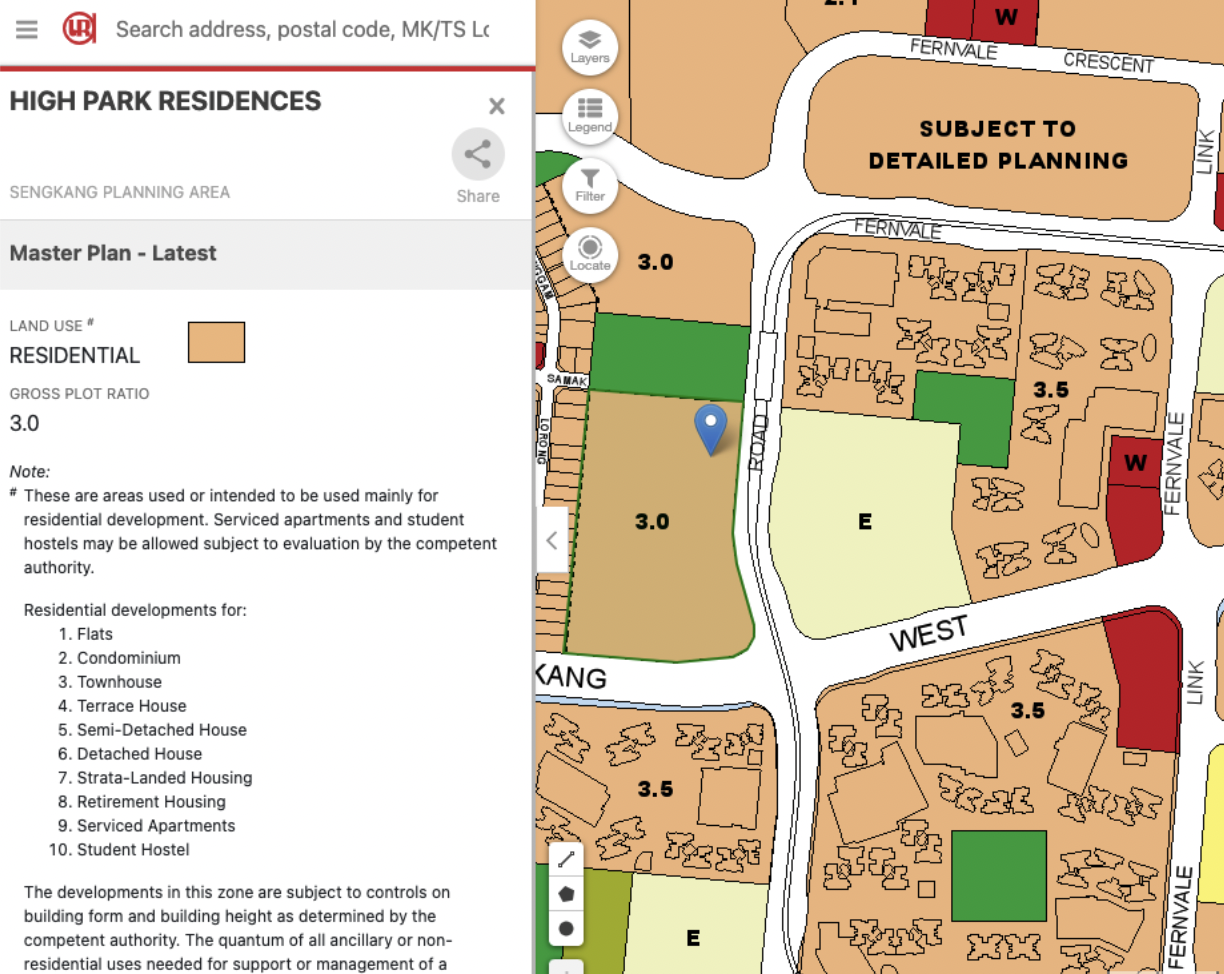

2. Estimating changes in the neighbourhood

Looking at plot ratios helps homebuyers to future proof their housing needs. The Master Plan legend dictates what developments can take place in certain land parcels. For undeveloped areas, the Master Plan can help homebuyers make more informed choices. Take a look at one of our previous listings at High Park Residences. Our unit faces south and overlooks an undeveloped plot of land. The Master Plan tells us that this land is reserved for educational institutions. A mid-to-high floor unit will retain its view even after developments take place, so homebuyers can rest assured that their views and housing value will remain largely unaffected.

3. Estimating en bloc potential

There are also investors who speculate the en bloc potential of the Tiong Bahru post-war SIT flats. Using the URA Master Plan, the gross plot ratio of 2.8 suggests that the maximum height of developments is around 36 storeys. Moreover, the architectural style is preserved by the now-conserved neighbouring SIT flats. Taken as a whole, the Master Plan provides clues for investors to identify which land parcels are underutilised and could be prime candidates for the SERS or VERS en bloc schemes.

Strategies documented in the Master Plan rarely change. But do remember to periodically check Amendments to Master Plan to find out if plot ratios or plot zonings have been changed.

Understanding the colours

How to read the legend/colours

Moh Guan Terrace. Image courtesy 99.co

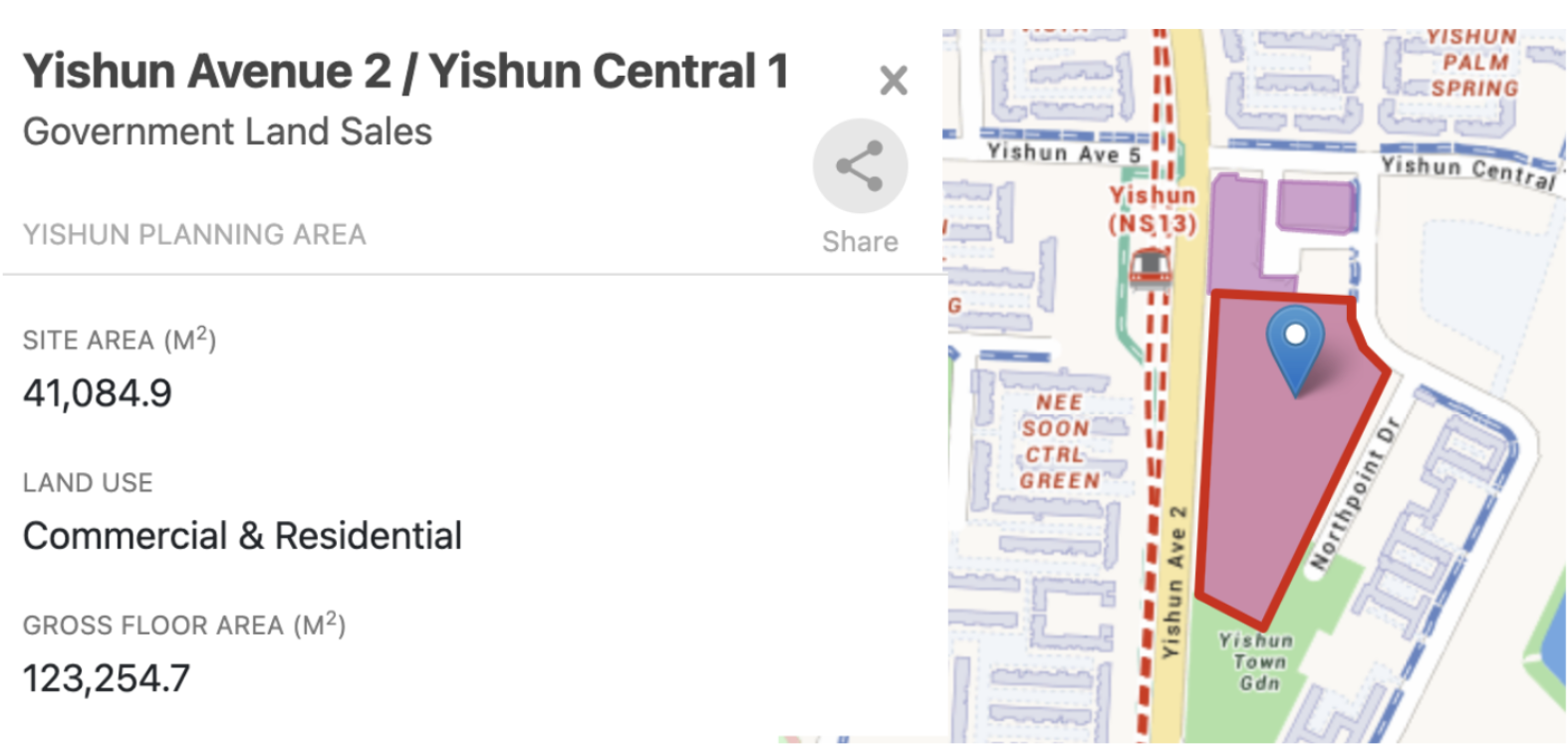

For example, as Singapore expands its decentralised township model, Mixed-use developments comprising commercial and residential properties are to be expected.

Looking deeper at the Master Plan Written Statement, it states that “the total quantum of commercial and related uses shall not… exceed 40% of the maximum allowable floor area”.

In the case of North Park Residences, using the Master Plan guidelines, the estimated number of units can be calculated to be 1056.

In 2019, the average size of dwelling units has been changed to 85 sqm to limit the number of shoebox units being built. The recalculated number of units is 870 and closer to the actual number of units at North Park residences.

With this knowledge, the total number of units in future developments can be estimated using Government Land Sales data.

White Sites (White)

White sites are the blank cheques for urban development. They have the potential to be developed into commercial, hotel, residential, sports and recreational spaces, or become integrated or mixed-use developments of higher value.

The coveted Pasir Ris 8 that sold 85% of units over launch weekend is one example of a white site. Why was it so favourable? We did a deep dive into this residential development.

Business Parks (Cerulean blue)

Business Parks are generally favourable zones to be near to. They attract PMETs from the region and they contribute to the tenant pool.

One cannot forget the Punggol Digital District when it comes to Business Parks. Estimated to host 28,000 employees when fully operational in 2024, the Punggol Digital District will be Singapore’s prime district for artificial intelligence, blockchain, 5G and next-generation internet-of-things technologies.

Take a look at a previous article where we used the Master Plan to analyse potential developments in the area.

Business 1 (Lilac) Light/Heavy Industries

Business 1 sites house companies which do not have disturbance buffers of 50m imposed upon them. These light industries typically include computer software development, printing and publishing, and do not affect property prices as significantly as Business 2 sites.

Business 2 (Magenta)

On the other hand, Business 2 sites are the heavy industries. Manufacture of industrial machinery, shipbuilding and repairs attract heavy trucks. These areas face increased levels of noise pollution and traffic congestions, and are not viewed favourably by tenants and buyers. Fortunately, they are usually placed in areas far away from major towns such as Jurong and Tai Seng.

Places of Worship (Red with a “W”)

Whether it is weekly prayers or annual rituals, places of worship may bring about some noise and traffic disruption. Buyers will have to take this into consideration when doing their planning.

For the superstitious, engaging a fengshui master may be something to consider if your properties are in close proximity to places of worship.

Health and Medical Care (Red with an “H”)

The type of healthcare institute depends on the size of the plot. Smaller sites usually indicate senior care homes, while larger sites are more likely to be hospitals or polyclinics.

Do consider that Singaporeans increasingly prefer to “age in place”, whereby older folks continue to live in their existing mature estates. Statistics from CNA show an increasing preference for domestic care and independent living.

Multi-generational families and independent elderly may want to factor in their proximity to healthcare facilities to minimise inconveniences and safeguard against emergencies.

Reserve sites (Yellow)

Reserve sites are the wild cards in the zone. Although they are yet to be determined, understanding the themes, highlights and transformations can provide some clues as to what future developments may take place.

For more details on how properties are classified, check out the detailed explanations in the Master Plan Written Statement.

Bonus: Concept Plan

For getting this far, here’s a little bonus.

Singapore is known to be prudent and adopts long-term strategies. The operations in Master Plans are based on Concept Plans.

Concept Plans are broader in nature, focusing on longer term developments over the next 40-50 years. It ensures that Singapore’s scarce land supports “long-term population and economic growth while maintaining a good living environment”. It is at this stage that stakeholders and members of the public are consulted, and amendments to the Master Plan are made.

To remain relevant, the Concept Plan is reviewed every 10 years. In particular, the 1991 Concept Plan was the most crucial. It separated Singapore into the Woodlands, Tampines, Seletar and Jurong East regional centres, and allocated Marina South as the new downtown.

Just as the authorities use long term planning, for the far-sighted and patient out there, the Concept Plan can help you to identify trends, potential deals and investment opportunities. Lately, the “Biophilic Town” model is used to meet the needs of all Singaporeans while taking care of the environment. The various spokes in this model help us here at PLB identify how high quality living environments may look like in future developments.

The Long-term Planning Review 2021 is one such review of the Concept Plan. The onset of COVID-19 has forced URA to rethink urban developments.

Conclusion

There you go. That’s a broad summary on how we here at PLB consider the Master Plan in our research process.

If you’re interested to hear more about our thoughts on future developments or investment opportunities, subscribe to our newsletter to keep posted on the latest PLB Insights.